A Few Old Gold Bulls Crawl Back Out of the Bunker

Momentum matters

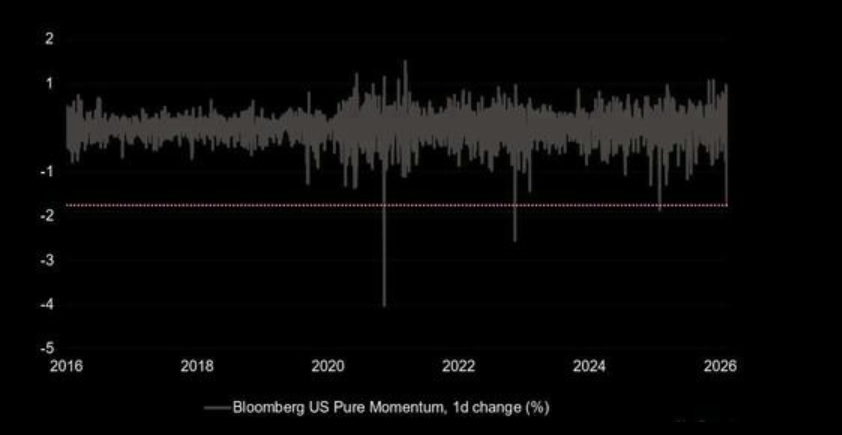

Today has been the fourth sharpest one-day sell-off in US momentum stocks over the past decade (based on the Bloomberg pure momentum dataset). Next post will explain why this potentially matters for Gold.

Source: Zero Hedge

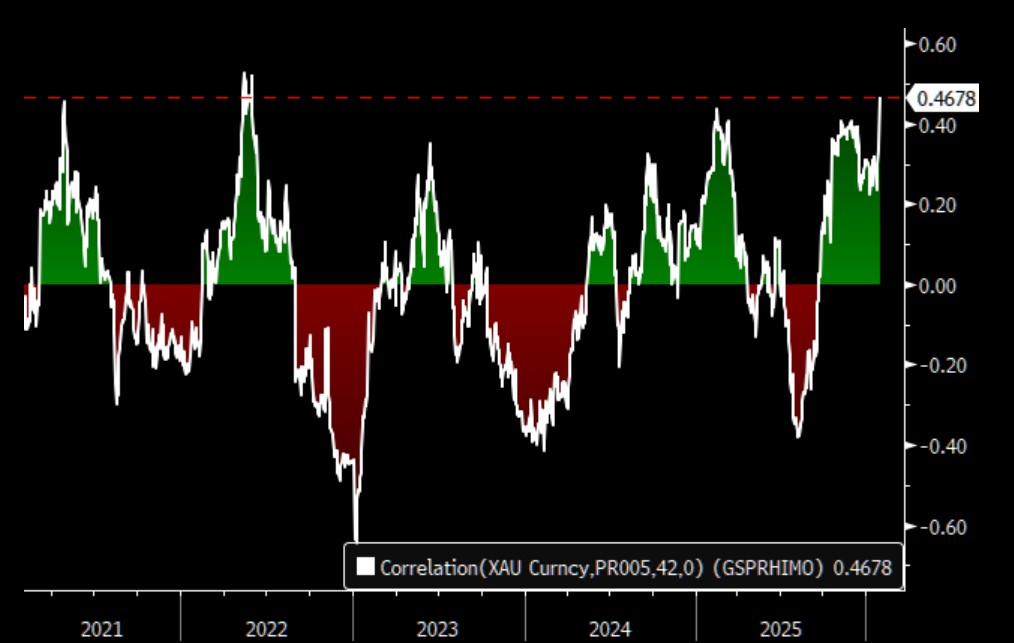

The gold / MoMo connection

Momentum and Gold are at a multi-year high correlation. More or less trade the same. Also worth noting, exposure of the factor is at the highest levels in 5+ years. This is clearly an added short-term risk to Gold here. That does however not stop old gold bulls like Goldman, BNP and Soc Gen that are out with various degrees of new bullish takes.

Source: GS

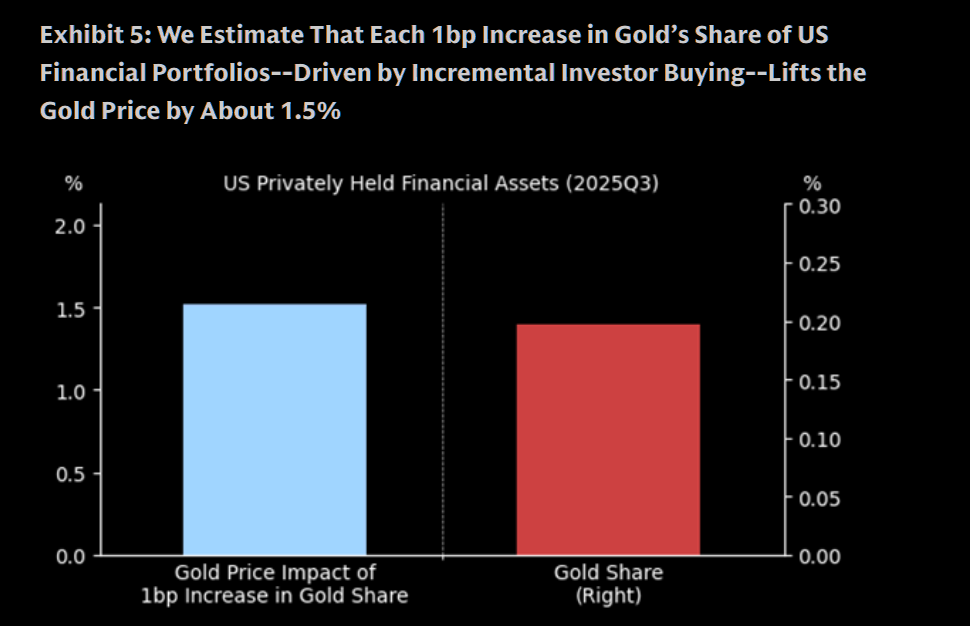

GS continues to see significant upside

"We continue to see significant upside risk to our gold forecast of $5,400/toz by Dec 2026. Our forecast incorporates two drivers: that central banks maintain their recent pace of accumulation (60 tonnes monthly average over past 12 months) and that private investors step up gold ETF purchases as the Fed cuts rates. We do not account for potential further private sector diversification --a source of additional demand that we view as a significant upside risk to the outlook, because gold allocations in Western financial portfolios remain low. Gold ETFs account for just ~0.20% of US private financial portfolios. We estimate that every 1bp increase in the gold share of US financial portfolios--driven by incremental investor purchases rather than price appreciation--raises the gold price by ~1.5%."

Source: Goldman

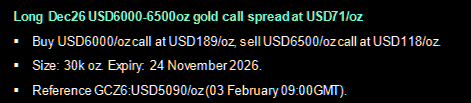

BNP: Buy the dip in gold

BNP: "We think the downwards correction has gone too far"

The desk recommends buying gold calls.

Source: BNP

Extremes to the upside

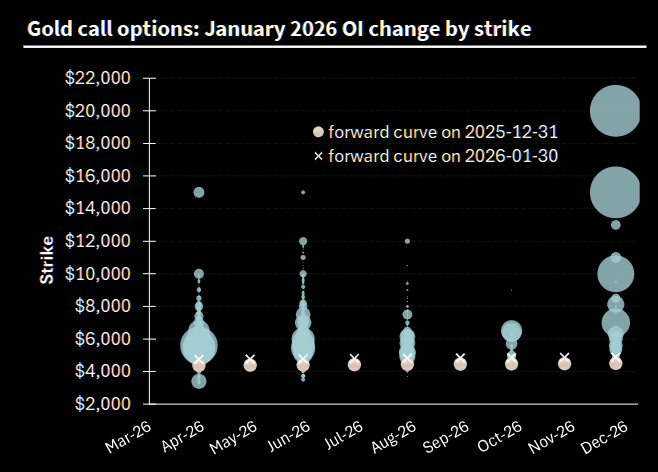

"We can see that based on the closing Friday data, the most notable build, relative to the forward curve is December 2026 with a large build in the $10,000/oz strike and an even larger one at $15,000/oz and $20,000/oz"

How to read the chart? These changes are measured from 31 December 2025 to 30 January 2026 — a period that includes Friday’s price collapse. The larger the bubble, the bigger the change in open interest.

Source: Soc Gen

Options played a central role in amplifying the rally

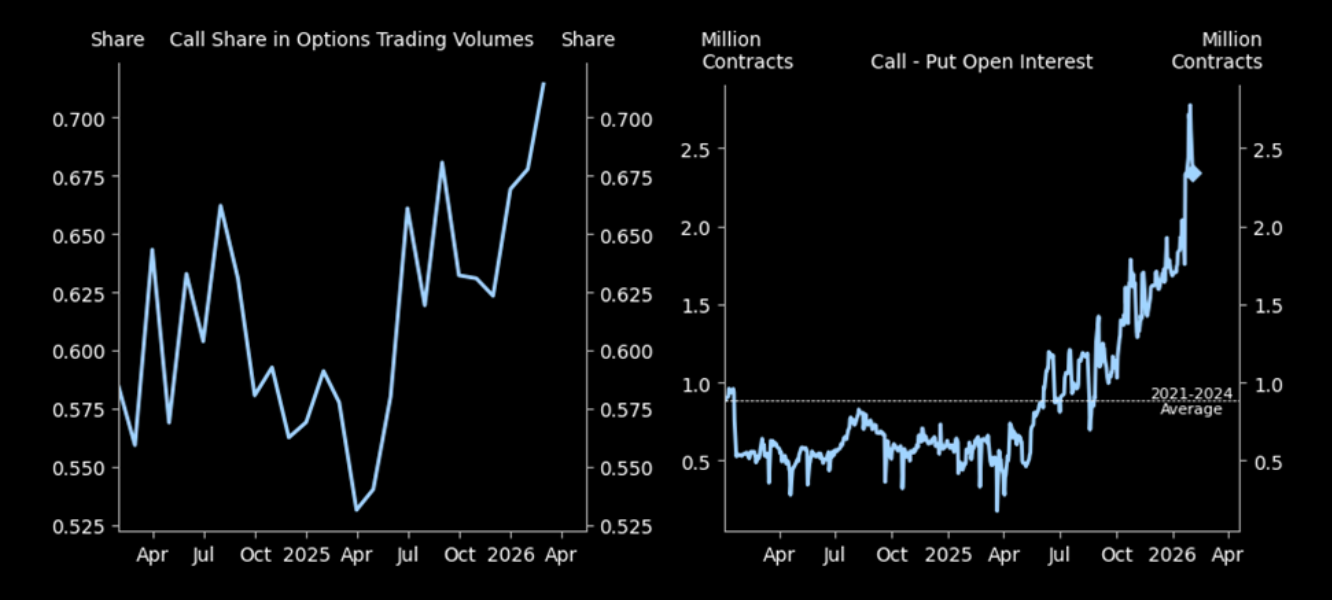

"Data suggests that Western call option structures used to hedge geopolitical and global macro policy tail risks played a central role in amplifying the rally. Following the rise in geopolitical tensions and the sharp rise in Japanese bond yields in January, option trading volumes on GLD -- the largest gold ETF-- were heavily skewed toward call options; and call open interest net of puts rose to a historical peak (about 3x the 2021-2024 average). Even this likely understated the degree of upside price pressure, as part of the exposure was routed through call‑spread structures designed to cheapen the trade and which only partially appear in open interest aggregates. As prices moved toward key strike levels, dealers who had sold these calls were forced to buy into the rally to maintain hedges, mechanically accelerating the move higher." (GS)

Heavily skewed towards calls

Option trading activity on GLD is heavily skewed towards calls; "Call Open Interest Net of Puts" reached a historic peak on 28 January — roughly 3x the 2021-2024 average.

Source: Goldman

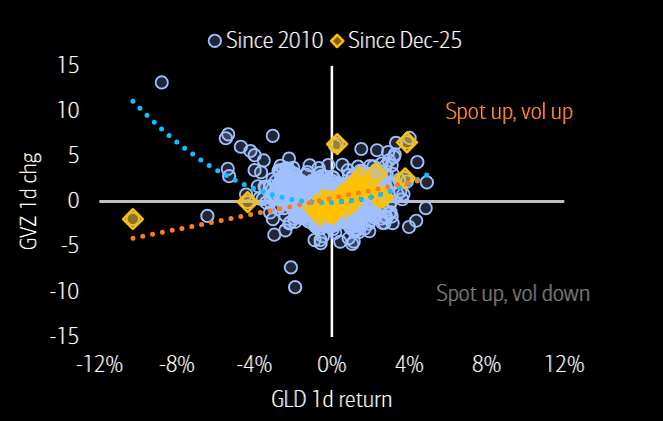

Spot up Vol up

Gold’s recent rally has shown clear spot-up, volatility-up dynamics, which has been a signature of asset bubbles historically.

Source: BofA Quant

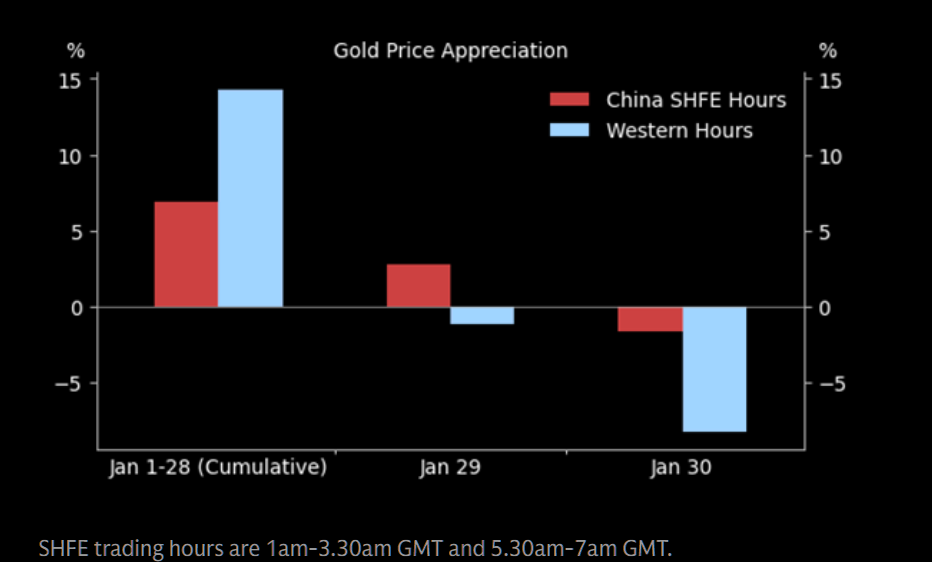

China slept

The timing suggests that Western flows rather than Chinese speculative activity drove January's volatility. Most of the buildup and unwind in gold prices occurred while SHFE—the venue for Chinese speculative futures trading—was closed.

Source: Goldman

Consolidation please

Gold bounced cleanly off the 50-day MA and the longer-term trend line. The rebound nearly retraced 50% of the large down candle (excluding shadows, roughly the maximum bounce you’d expect under a standard mean-reversion script). From here, upside gets harder, and the TME trading take is that gold needs to consolidate.