Global Growth is About to Pick Up Big Time

Fab Five

Here is our Monday series, Fab Five Fundamentals, which looks at bullish observations from the weekend. This time very much focused on the strong and re-accelerating economy.

Best of times

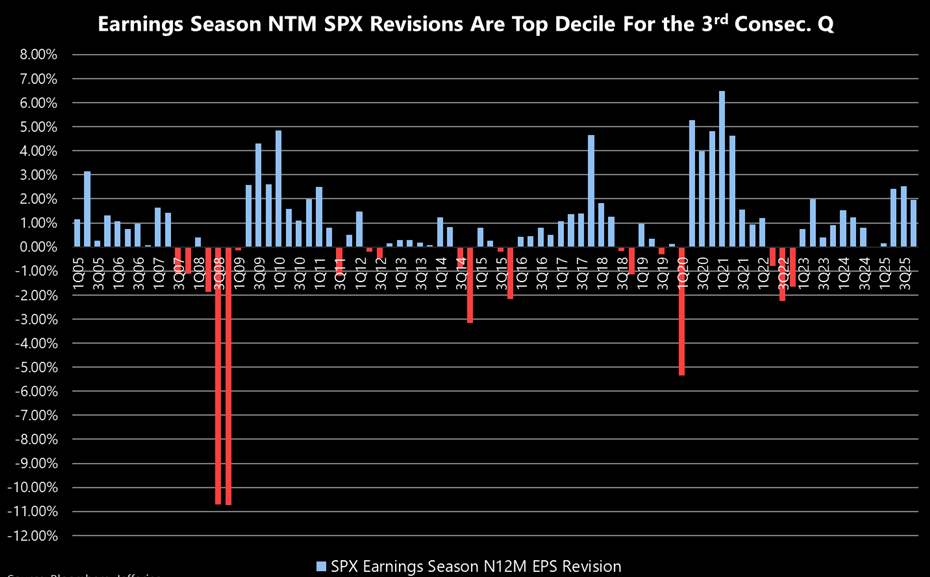

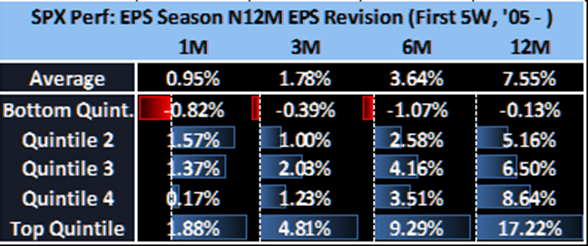

Jefferies shows that despite the dip in the beat rate, intra-earnings EPS revisions have been fairly stellar and that this bodes very well for the future performance of equities.

"The +2% markup to the SPX’s NTM EPS is good enough for top quintile looking back over the past 20Y. This is the third such Q in a row and the fourth positive Q for this earnings revision cycle. Notably, typical cycles over the past 20Y tend to last 8-10 Qs and when revisions are as good as we have seen over the past 5W, forward SPX performance tends to be stellar, +17% on a 12mo basis."

Source: Jefferies

Source: Jefferies

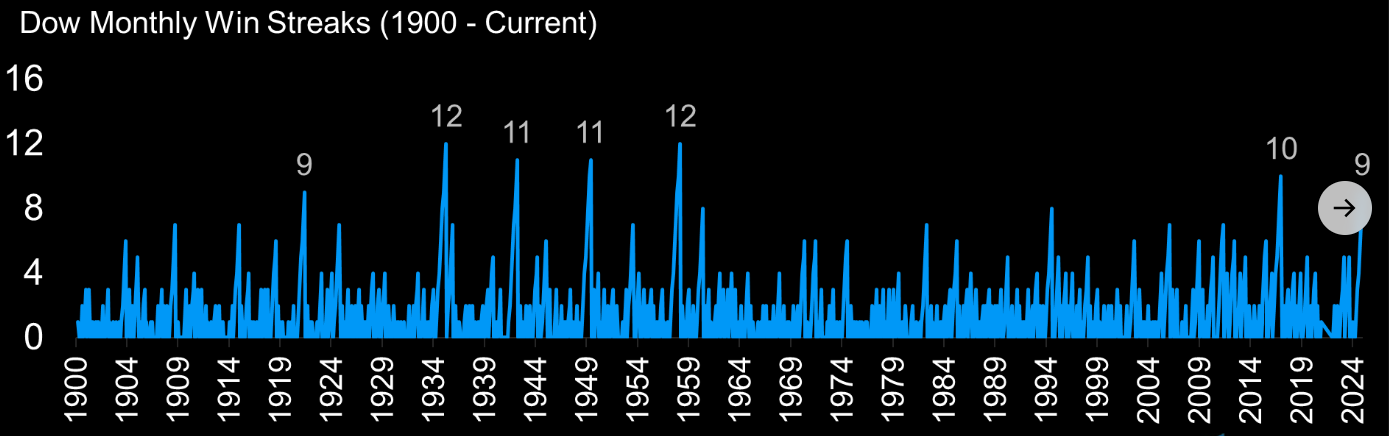

DOW

9 months in a row the DOW is higher. This just feels solid.

Source: Carson

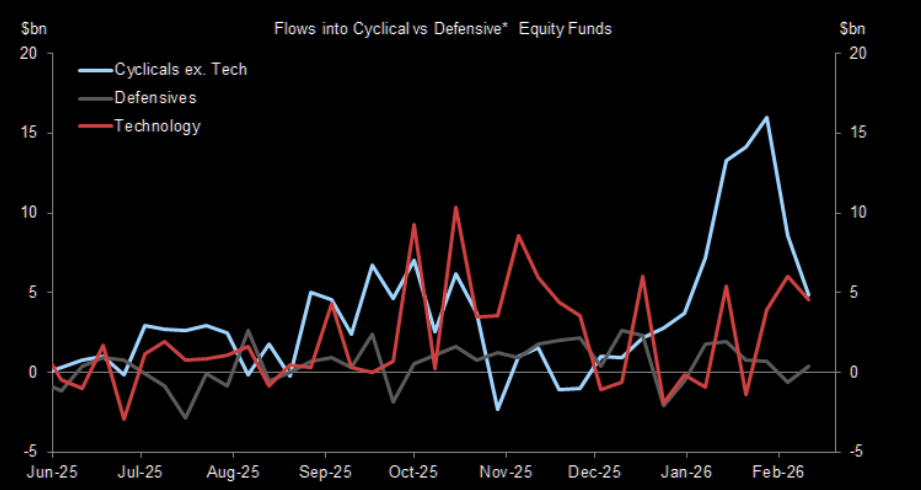

Still that cyclical bid

Despite the software selloff in recent weeks, flows into technology sector funds remain positive. Flows into cyclicals have slowed back down a little but are still positive.

Source: EPFR

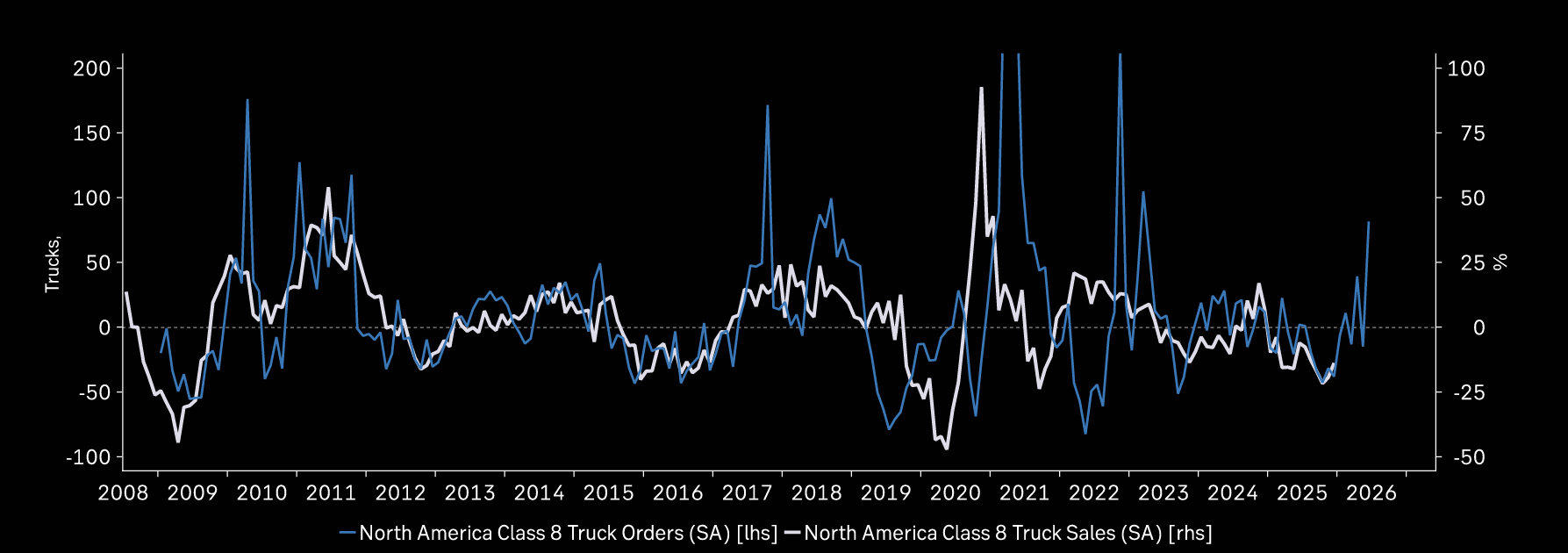

US growth picks up

US heavy truck orders are picking up sharply, this is normally an early sign of recovery.

Source: Macrobond

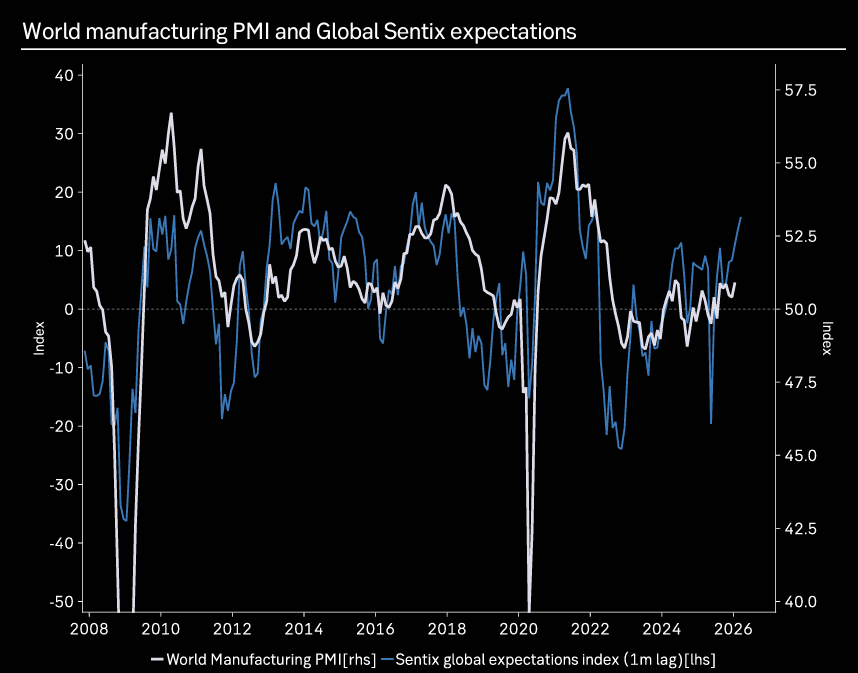

Sentix survey suggest

Sentix surveys suggest global growth is about to pick up big time after three years of stasis.