Gold: $31.5 Trillion, New Highs, And Still “Early”?

Gold groundhog day

Gold is making new highs again. Here is a collection of (not so new) charts on the “boring” asset that became impossible to ignore.

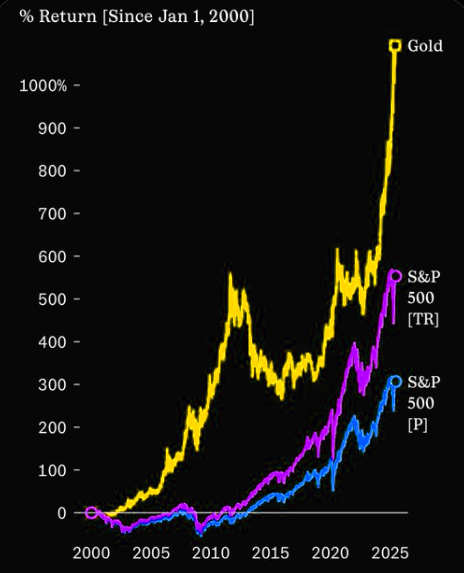

Gold crushing it

Gold has crushed the U.S. stock market over the last 25 years.

Source: Sherwood

The past 20 years

Gold vs. S&P 500 returns over the past 20 years:

1. Gold +761%

2. S&P 500 +673%

Source: Koyfin

"stores-of-value"

"while on the topic of stores-of-value, this overlays gold with BTC. as mentioned before, neither of these assets have an intrinsic value, nor do they offer any yield. therefore, they are principally driven by narratives and flows. While gold continues to be accumulated (by both speculators and reserve fund managers), BTC has been weathering a period of clear outflows"

Source: Tony P

Schiff vs. Saylor YTD

Former bro´s....

Source: Quote the Raven

7x NVDA

Gold is now a $31.5 TRILLION asset, nearly 7 TIMES larger than Nvidia.

$10.000

Gold will hit $10,000 by the end of the decade, says Ed Yardeni.

Source: Yardeni

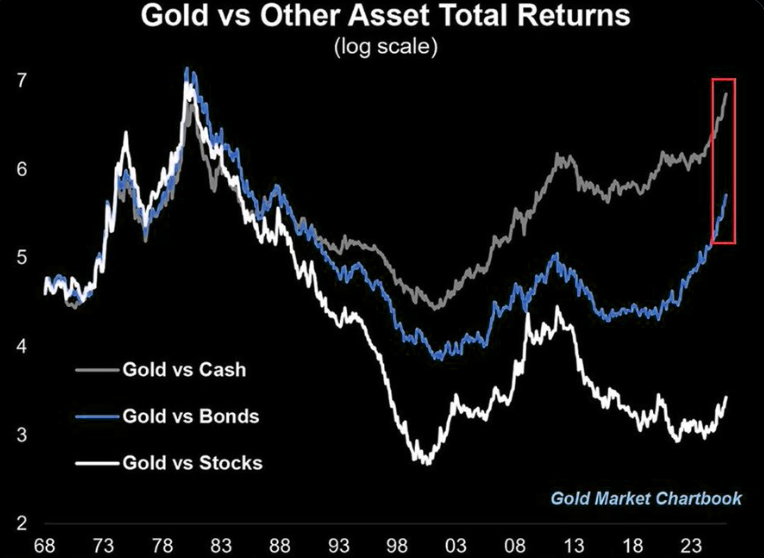

Which inning?

Gold prices relative to cash are now at their highest level since at least the 1960s, officially surpassing the 1980 peak. At the same time, gold prices relative to US government bond prices are at their highest since the late 1980s.

Gold prices relative to the S&P 500 are at the highest since the 2020 pandemic. Gold prices remain -50% and -17% below the 1980 peak relative to stocks and bonds, respectively. Gold's rally could still be early (or late...)

Source: Top Down Charts

The quants are long

The (not so ugly) cousin silver: Silver up 40% in a month while never closing below the 100-hour MAs.

Source: Spectra Markets

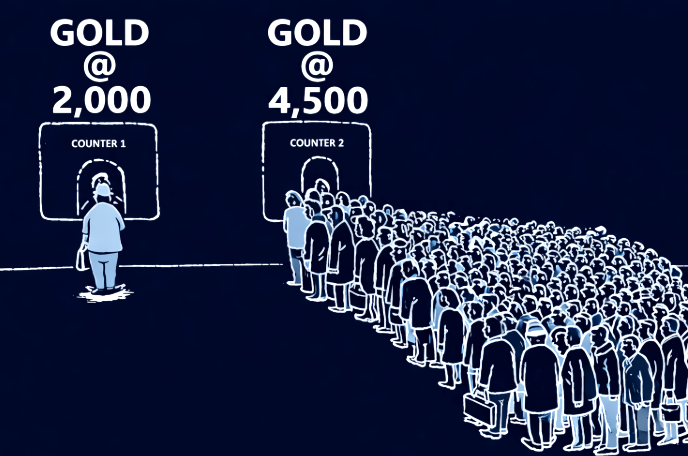

The crowd

The crowd is the crowd is the crowd and they love to buy green.