Gold: Overbought, Overvalued, Overcrowded

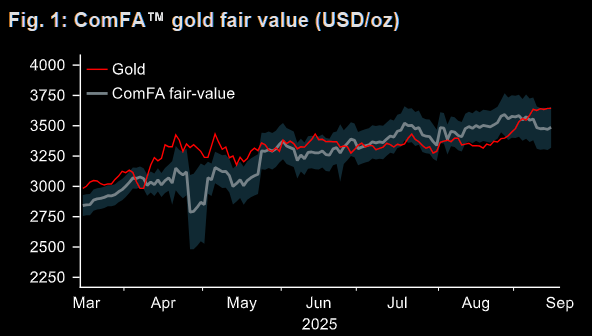

Overvalued and overbought

BNP's prop indicator showing gold as rather overbought, diverging strongly from their "fair" value.

Source: BNPP

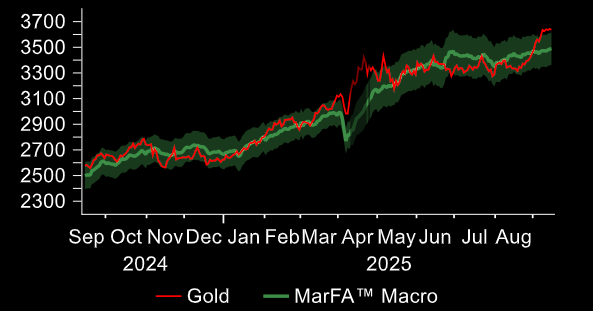

Source: BNPP

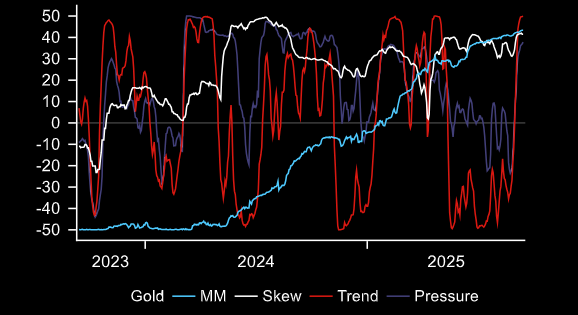

Overcrowded

"Our commodity positioning backtest suggests that when a position is overcrowded, there is scope to revert and shift to neutral". (BNP)

Source: BNPP

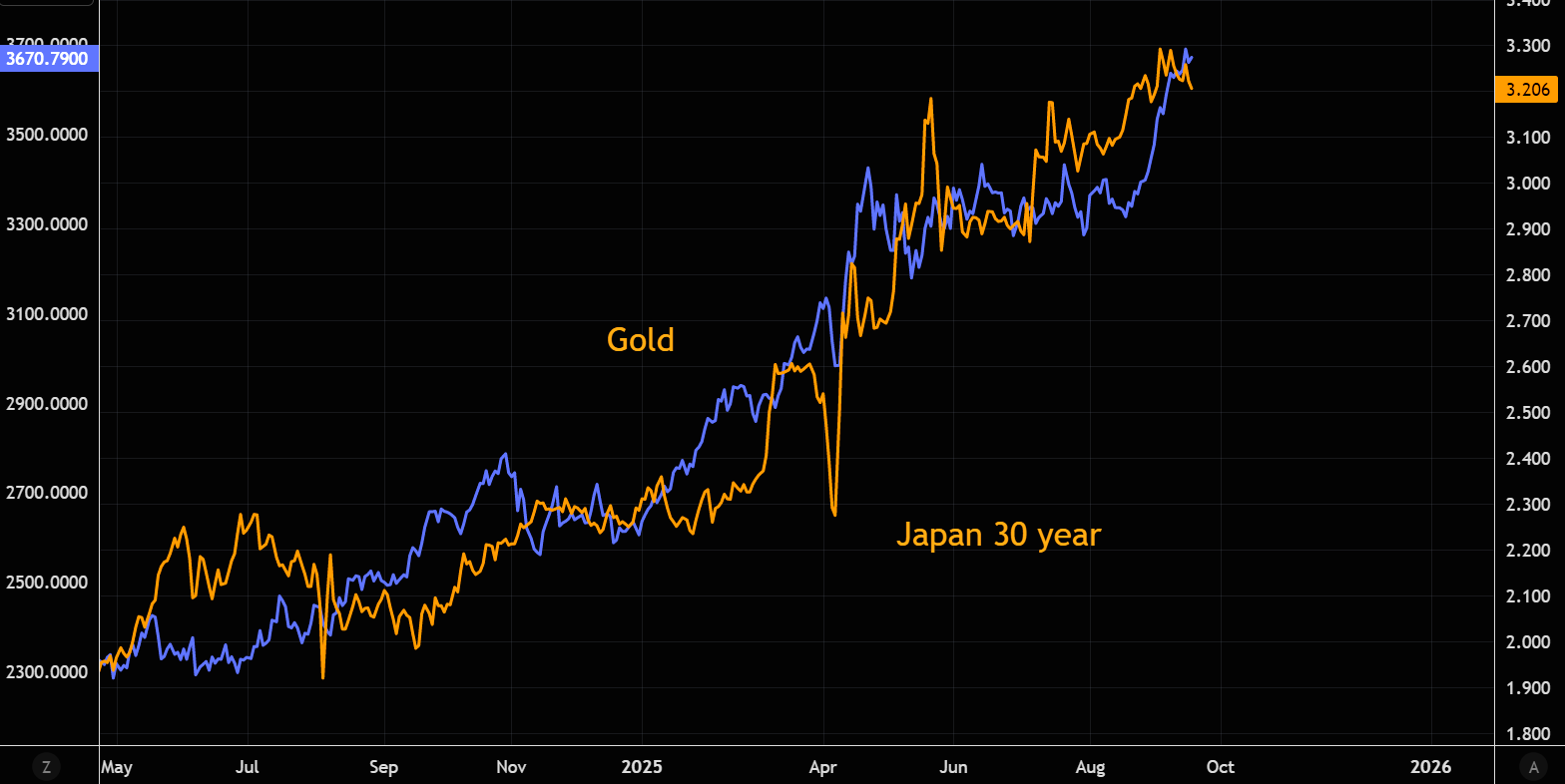

Pause?

Gold has moved in close tandem with the Japanese 30 year. Gold has now caught up to the Japanese long end, but do we see a pause, or will strong momentum drive it even higher?

Source: LSEG Workspace

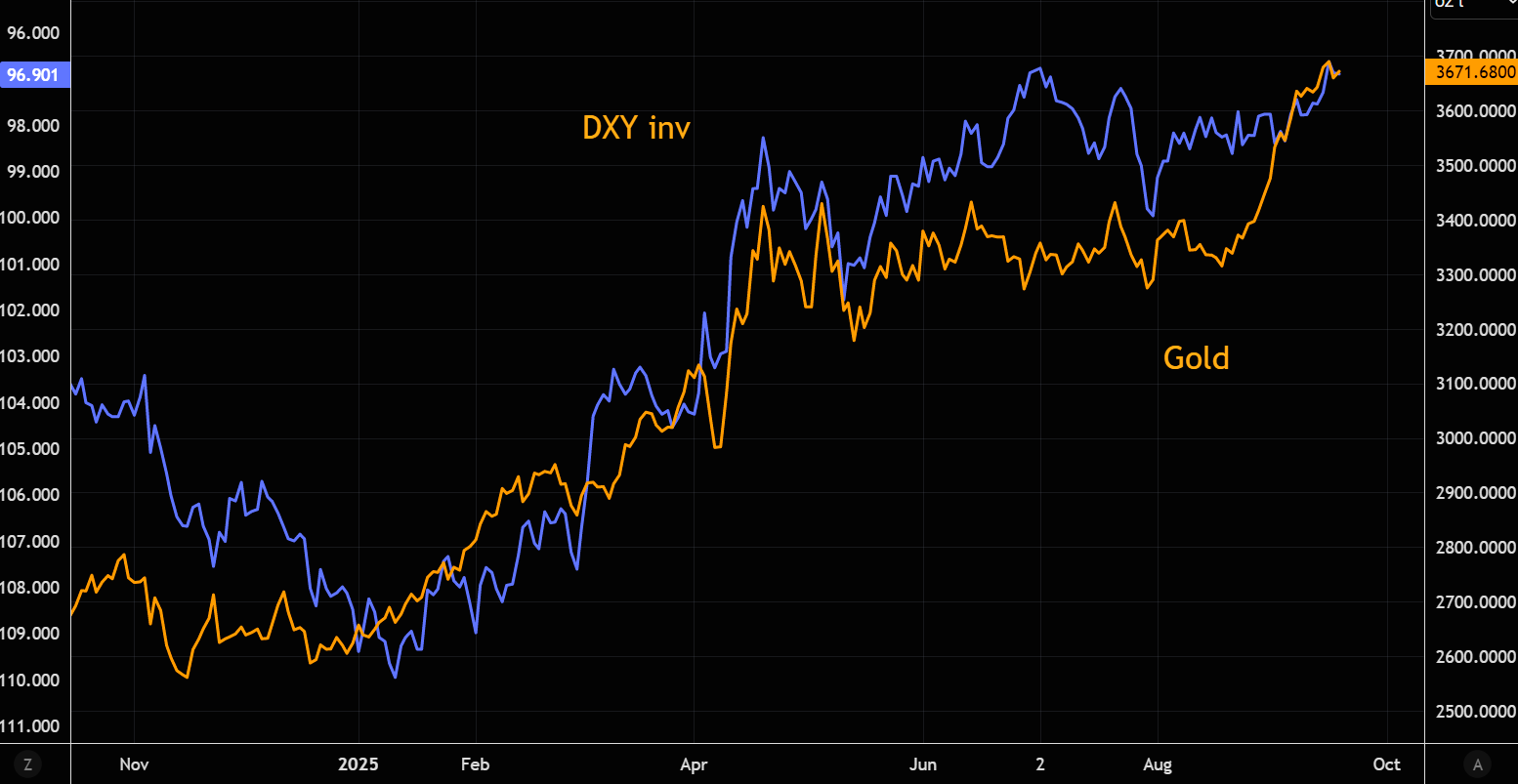

The dollar connection

Gold has "caught up" to DXY (inverted).

Source: LSEG Workspace

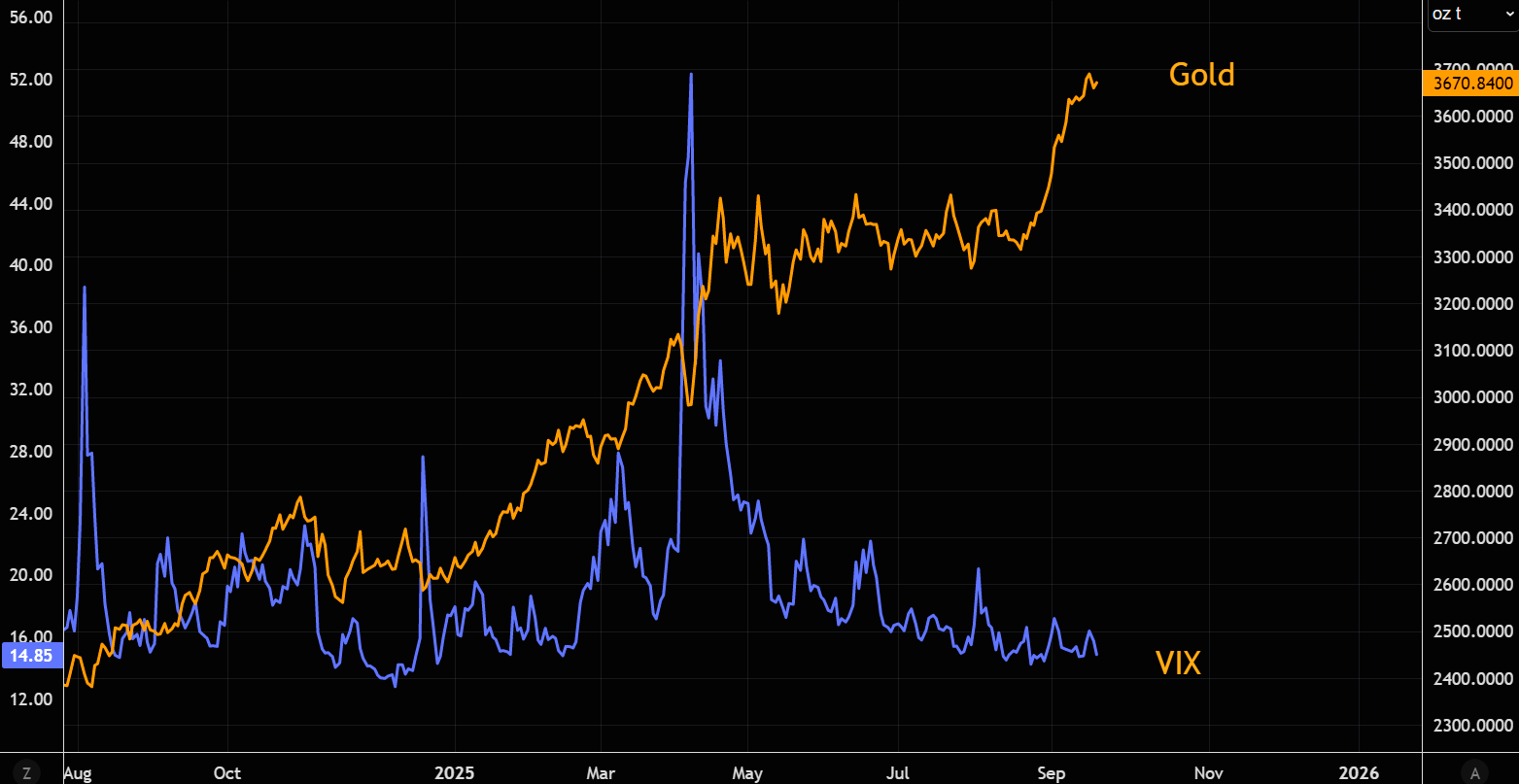

The hedge factor

Gold is the "everything hedge", but if you are looking for global equity hedges, then VIX looks relatively more interesting compared to chasing gold here.

Source: LSEG Workspace

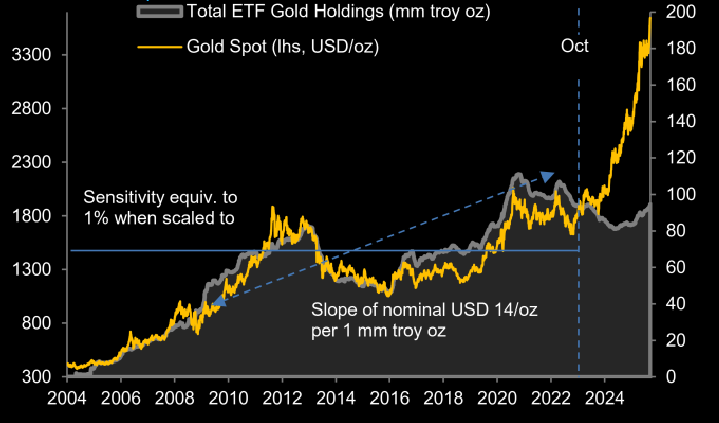

Before you get bearish

Room to increase

"Developed market ETF holdings still 17 mm troy oz below 2020 peak".

Source: DB

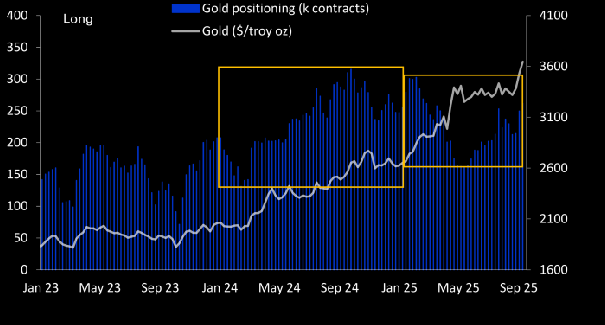

Also room to increase

"Spec futures positioning not extended on 1y, 2y lookbacks".

Source: DB

If you "must" chase it

Gold volatility has remained relatively subdued. Using upside call structures for the ones that "must" chase gold here is more attractive than chasing the underlying.