Goldman Compares Software to Newspaper Stocks

Just hold your nose and buy

Goldman comparing software to newspaper stocks that fell 95% in the internet era is about as bearish as it gets. Markets have seen this movie before: when analysts flirt with “zero” outcomes, real positioning is washed out and real expectations have already collapsed. More often than not, that’s when contrarians start paying attention. The only thing that stops us from starting to buy is that we kind of agree with the comparison - the fundamental outlook truly is awful.

Disruption

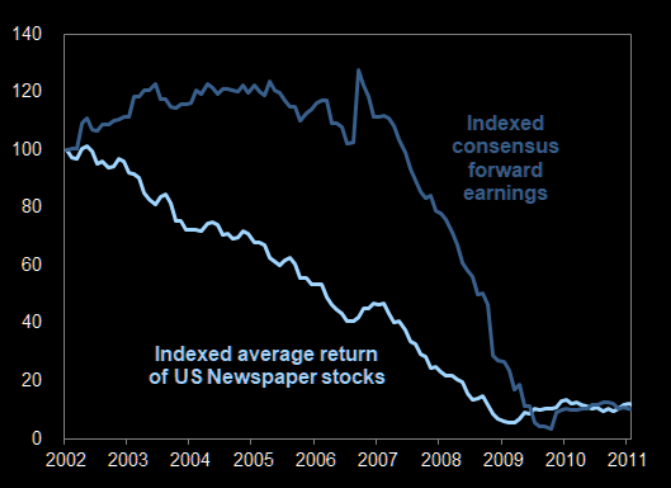

GS: "Historical episodes of major disruption risk suggest that share price stabilization will require stability in the earnings outlook. The multi-year decline of newspaper stocks ended only as earnings estimates bottomed

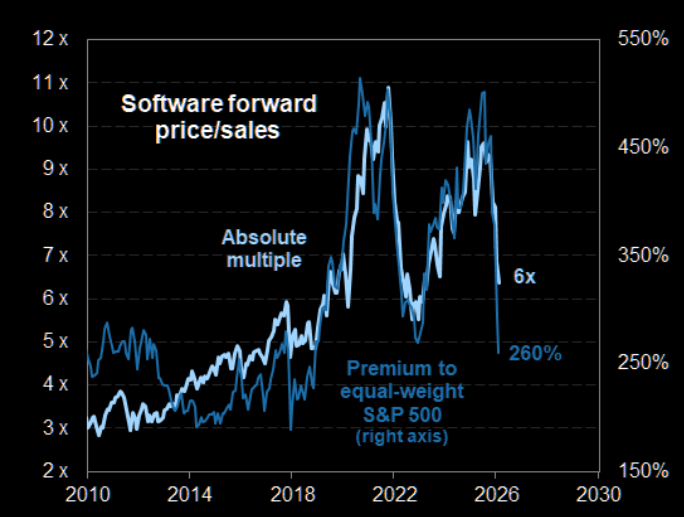

6x sales

Software valuations have de-rated sharply but generally remain above multiples of the average S&P 500 stock, particularly on a price to sales basis. The Software price/sales ratio has declined from 9x in September 2025 to 6x currently, and now ranks in the 65th percentile since 2010. Despite this decline, the industry trades at a 260% premium to the equal-weight S&P 500, in line with the historical average. Price/earnings valuations rank lower relative to history as a result of record profit margins.

Source: FactSet

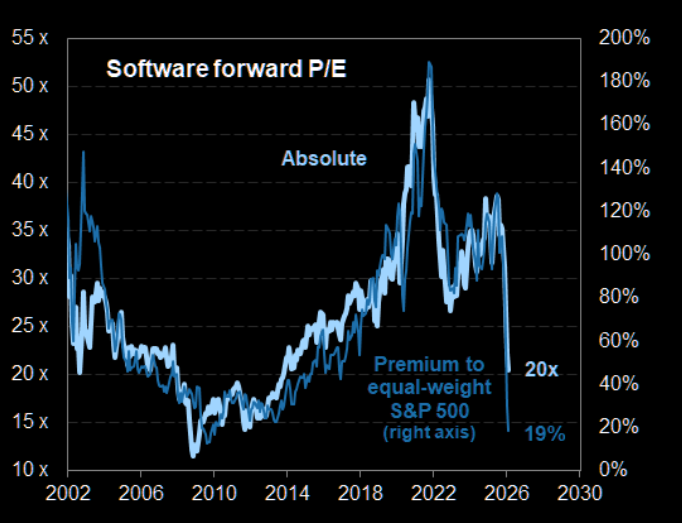

PE at 25th percentile

Price/earnings valuations rank lower relative to history as a result of record profit margins. On a P/E basis, Software trades at 20x, ranking in the 25th percentile since 2010; the 19% premium to the equal-weight S&P 500 multiple of 17x compares with the GFC trough of 13%.

Source: FactSet

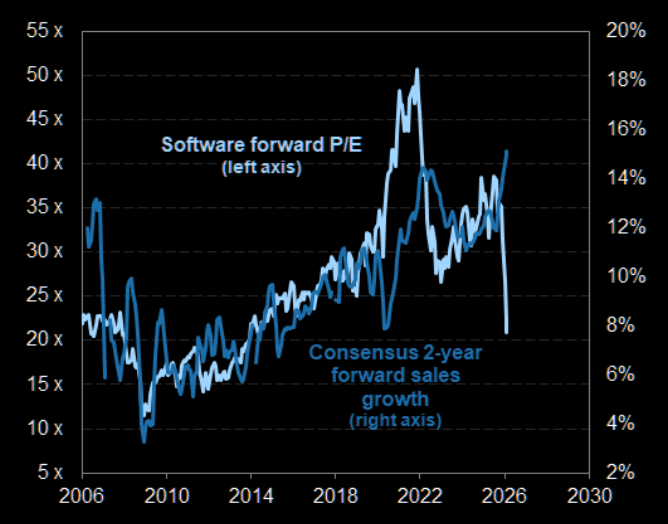

Sharp decline in growth expectations

The collapse in Software share prices implicitly reflects downside risk to record high profit margins and growth estimates. Coming into this year, consensus estimates pointed to two-year forward Software revenue growth of 15%, more than 2x the 6% revenue growth modeled for the median S&P 500 stock and the highest expected growth in at least 20 years.

Source: Goldman

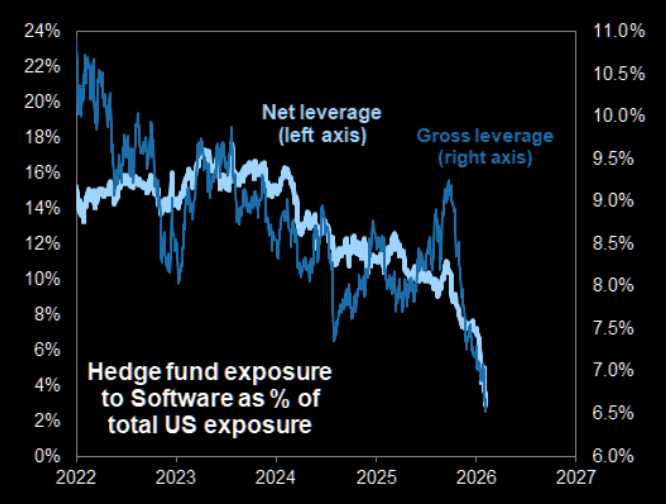

Hedge fund net leverage collapsed

Hedge funds have recently slashed exposure to Software. Net leverage down from 16% to 2%.

Source: GS Prime

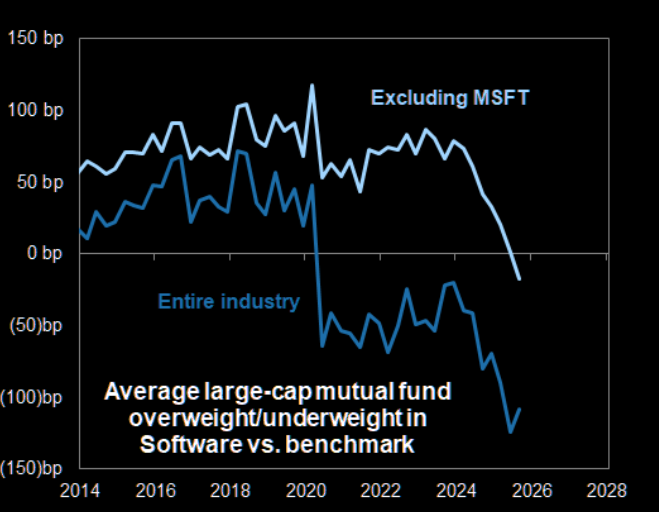

Mutual funds now underweight

Mutual funds have reduced their Software exposure.

Source: EPFR

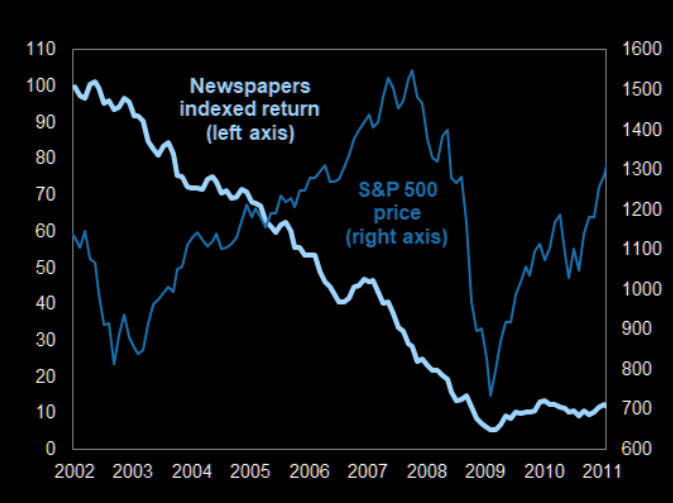

That newspaper feeling

GS: "One lesson from historical examples of industries facing disruption risk is that share price stability requires stability in the earnings outlook. Newspapers, for example, faced risk from technological disruption as the internet grew in the early 2000s. The share prices of the group declined by an average of 95% between 2002 and 2009."

Source: Goldman

Had to wait for the earnings trough

Newspaper share prices troughed slightly ahead of consensus earnings estimates.

Source: FactSet

Bear case might simply just become the norm

GS on Software: "We expect it will take 2-3 quarters of stable fundamentals for investor sentiment to improve – and even then, there is a scenario where the bear case simply gets pushed out to future years."