Gold's Consolidation Ending? Skew Suggests Squeeze

Gold and triangles

Gold squeezes, consolidates inside the triangle, breaks out again etc. Let's see how this last triangle plays out, but we are getting ready to move... Note the 50 day still very much intact.

Source: LSEG Workspace

Risk on

Gold has been a risk on asset for months. The latest squeeze in equities should be a tailwind. Chart shows gold vs. SPX.

Source: LSEG Workspace

Bullion over Bros

Gold vs. BTC gap continues to get wider and wider. If there is a mean reversion trade to be made we leave to you to decide, but gold is the king when it comes to storing value.

Source: LSEG Workspace

Don't forget

Gold loves rising Japanese rates. This remains a massive driver of the shiny metal, despite few talking about it on a daily basis.

Source: LSEG Workspace

Gold volatility

Gold volatility is down from recent "panic highs", but has trended higher over the past months. Gold upside isn't as attractively priced as it used to be, but playing possible break outs via call spreads still makes sense to us, and is to prefer over chasing the underlying.

Source: LSEG Workspace

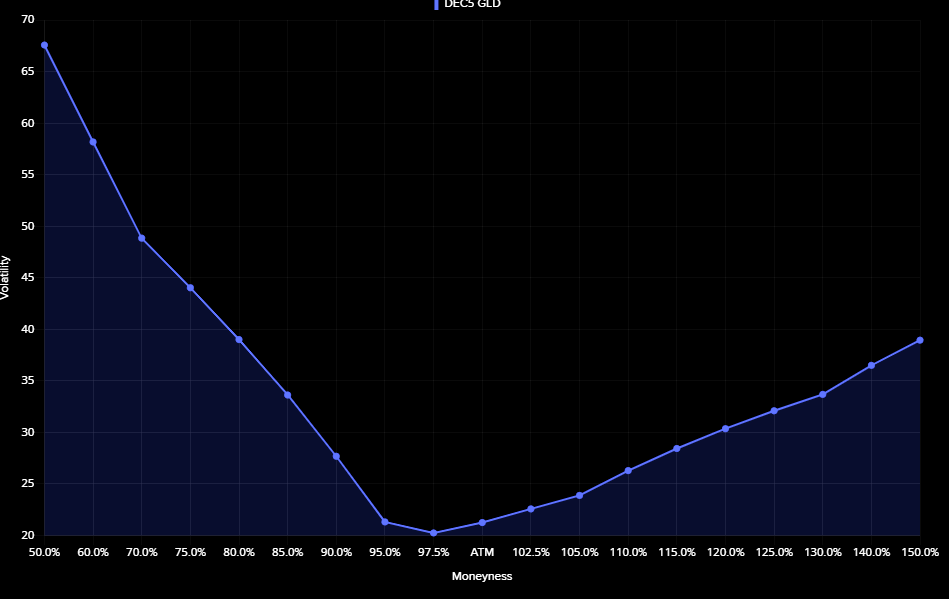

GLD skew

Downside Gold skew has steepened reflecting an increase in hedging activity. Despite this, GLD call skew remains strongly inverted (OTM calls > ATM calls), indicating that overall market sentiment for gold is still extremely bullish.