Gold’s Resonance Just Broke — Vol Screams As Late Longs Pile In

Welcome back

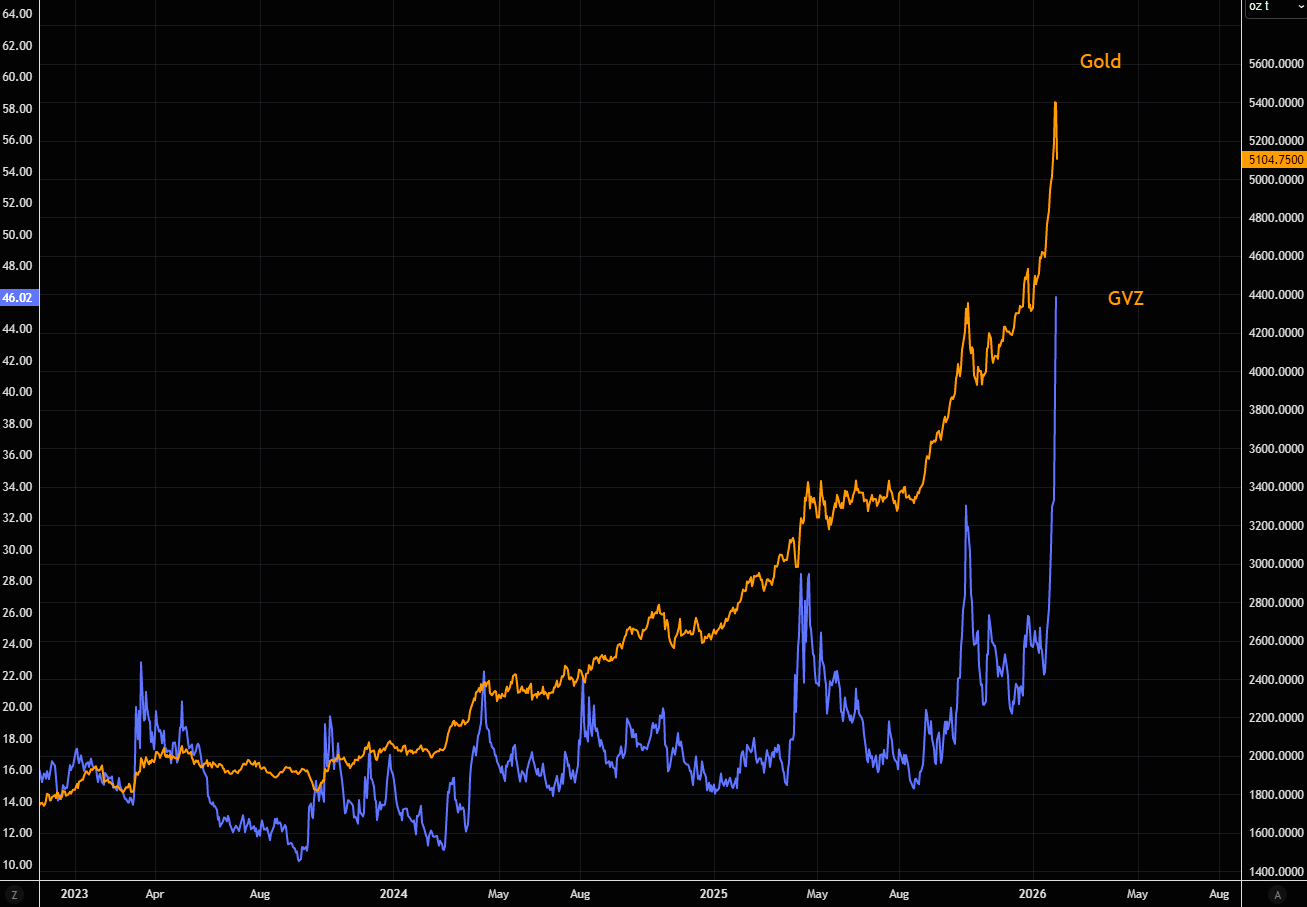

Gold about to re-enter the huge trend channel. Even a ~$500 pullback would only take us back to the rising trend line that’s been in place since September (yellow), roughly aligned with the 50-day MA. Momentum has already cooled fast: RSI dropped from 91 to 65 in just 24 hours. For context, the late-October reset didn’t bottom until RSI was closer to 50, right before gold started catching bids again. Note this is a log chart.

Source: LSEG Workspace

Volume mania

GLD volumes have gone from heavy to outright extreme. This isn’t what a healthy, sustainable market looks like. It has all the hallmarks of late-stage chasing, with a lot of participants pulled into longs they don’t really understand, and likely won’t have the relevant risk management in place when this starts to wobble in a more extreme fashion.

Source: LSEG Workspace

Remember resonance from physics class?

When a system is driven at just the right frequency, small inputs get amplified into big moves, but once that frequency slips, the amplification collapses fast. Gold has been in that resonance phase, and the recent volatility explosion is the tell: flows and momentum were perfectly aligned, but as that alignment breaks, volatility rises and the same feedback loop starts damping price back toward trend.

Source: LSEG Workspace

Blowing bubbles

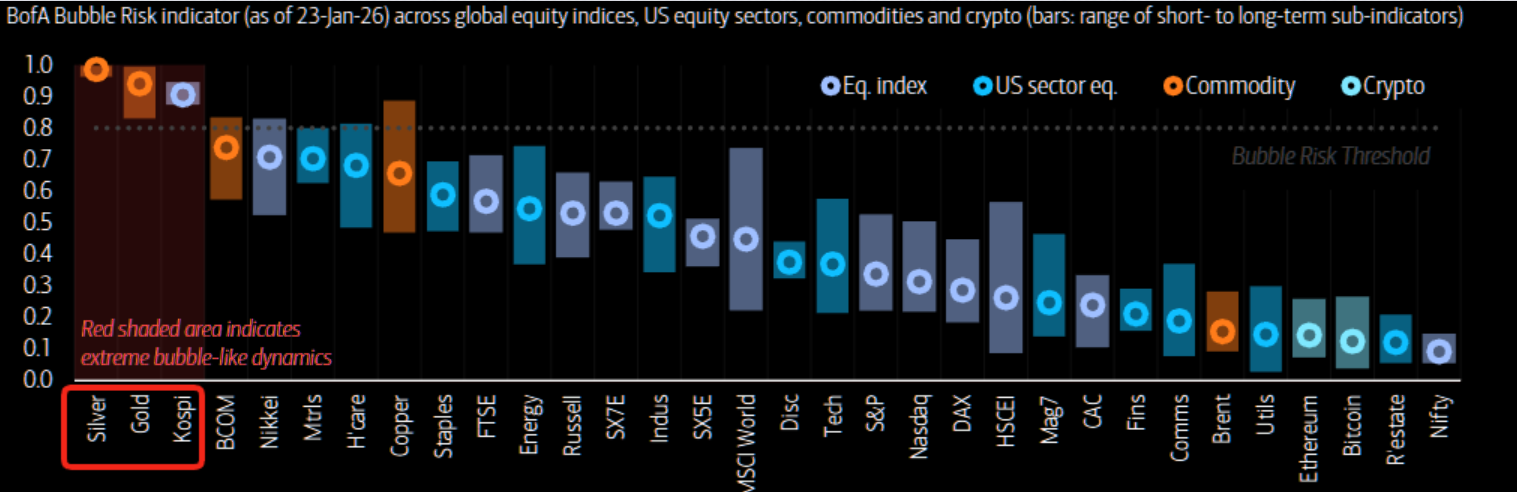

BofA absolutely nailed this one: Bubble Risk indicator shows gold (silver and KOSPI as well) in bubble territory... "pushed its Bubble Risk Indicator (BRI) to extreme readings above 0.9, historically a cautionary level that motivates watching for near-term downside risks and leveraging the asymmetry of options".

Source: BofA

Shitty hedge

Gold has long lost the global hedge logic. For this we have been pointing out you should use VIX and other instruments.

Source: LSEG Workspace

Decoupling the debasement logic?

Short term gap between gold and DXY (inverted) getting rather wide. Let's see how this plays out, but a lot of new money started chasing gold because of the latest DXY move....and seems they didn't count on Warsh.

Source: LSEG Workspace

Retail

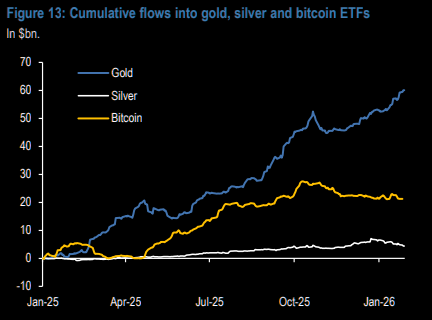

Retail embraced the “debasement trade” in early 2025 via bitcoin and gold ETFs, but flows diverged after July. Bitcoin ETF inflows stalled and turned negative in Q4, while gold ended the year near $60bn in cumulative inflows, with silver seeing most of its buying in Q4, pointing to a retail shift from bitcoin toward precious metals since August. (JPM)

Source: JPM, Nikos

What about institutions?

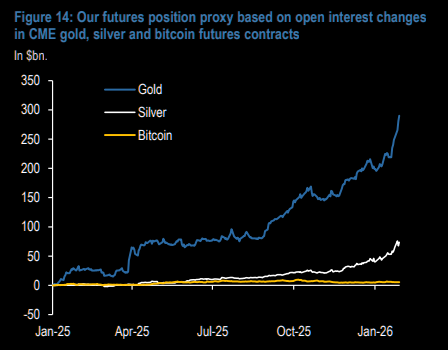

Institutional futures positioning has surged in silver since late last year, with gold showing a similar accumulation trend over the past year. By contrast, bitcoin futures positioning has remained largely flat, underscoring a clear institutional shift toward precious metals.

Source: JPM

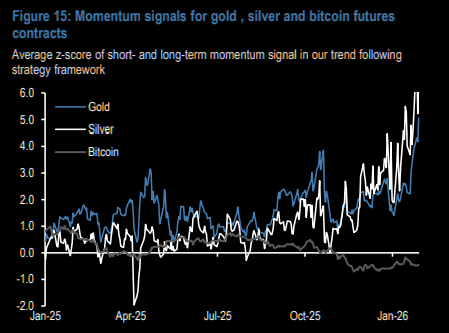

What about momentum?

Momentum signal, often used as a proxy for CTA-style positioning, show silver as heavily overbought, suggesting momentum traders have been a major driver of its recent rally. Gold futures also look very overbought, while bitcoin futures are oversold, increasing the near-term risk of profit-taking or mean reversion in gold and silver.

Source: JPM

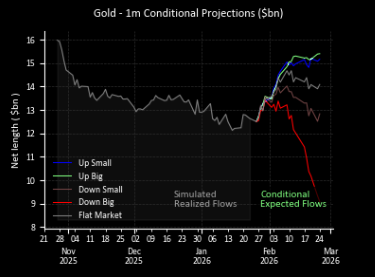

Big down, big selling

CTA downside convexity in gold is big.