Highest Expectations in 15 Years

Drawdowns happen

Here is how often S&P 500 drawdowns occurred in a given year since 1928:

-5%: 94% of all years

-10%: 63% of all years

-20%: 26% of all years

-30%: 10% of all years

-40%: 6% of all years

-50%: 2% of all years

We are long overdue for a set-back in the equity markets. Positioning and sentiment have gotten a little ahead of itself. Having said that, here is a continuation of our weekly "Fab Fundamentals" series that very one-sidedly looks at what is good in macro. The following charts on earnings, macro and liquidity will of course mean nothing over the next few days, but probably something over the next few months.

Source: Carson

Strongest earnings ever

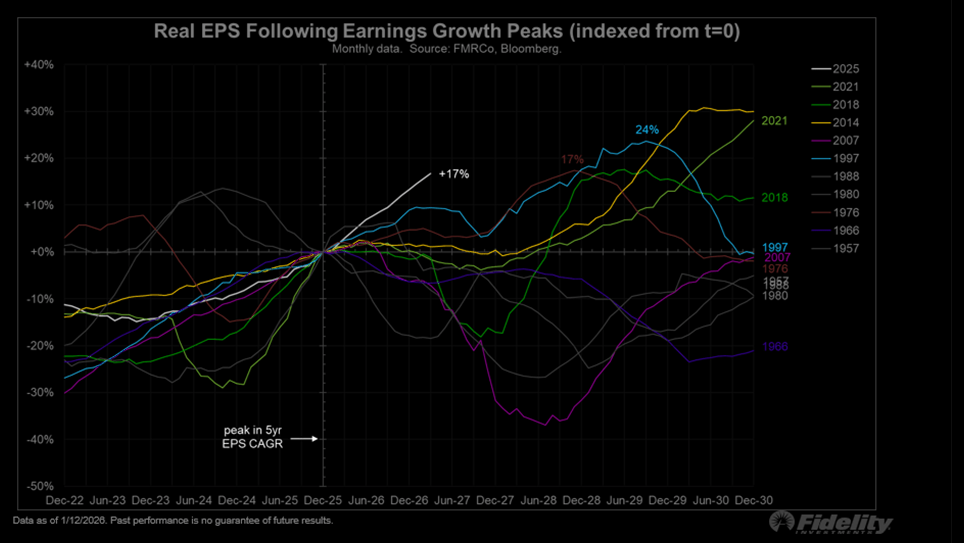

"Peak earnings growth and peak earnings are not always the same thing. Current estimates, suggest earnings could continue to advance higher by 17% over the next 5 quarters. If true, that will be the strongest continuation of earnings growth following a peak ever. Only the 1997 growth peak comes close." (Fidelity)

Source: Fidelity

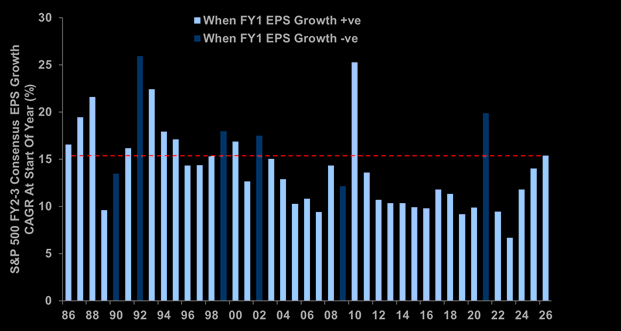

Highest in 15 years

Outside of recovery years, consensus EPS growth expectations for the next 2 years are the highest they have been at this time of the year in 15 years.

Source: Morgan Stanley

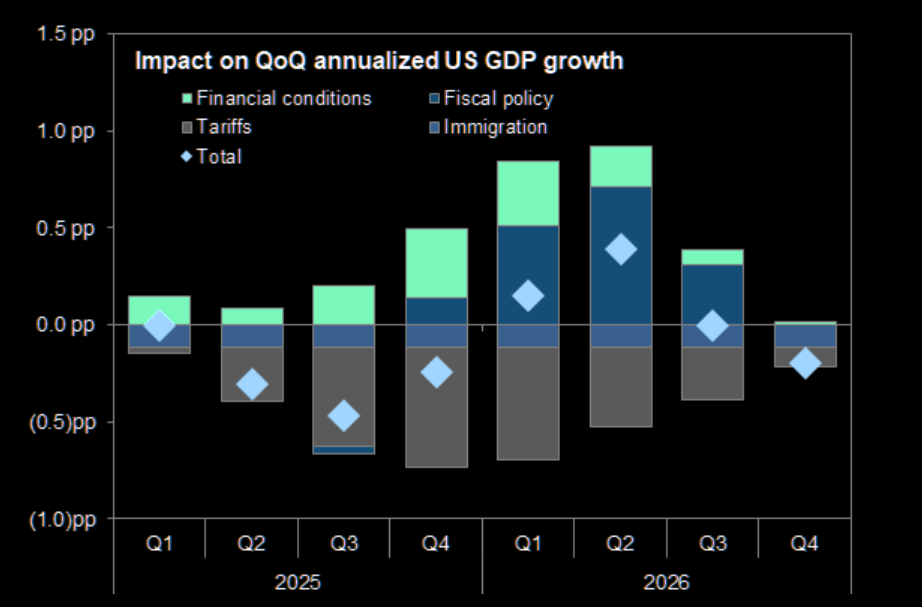

A lot of tailwinds

A combination of improving impulses should boost US GDP growth in early 2026.

Source: Goldman

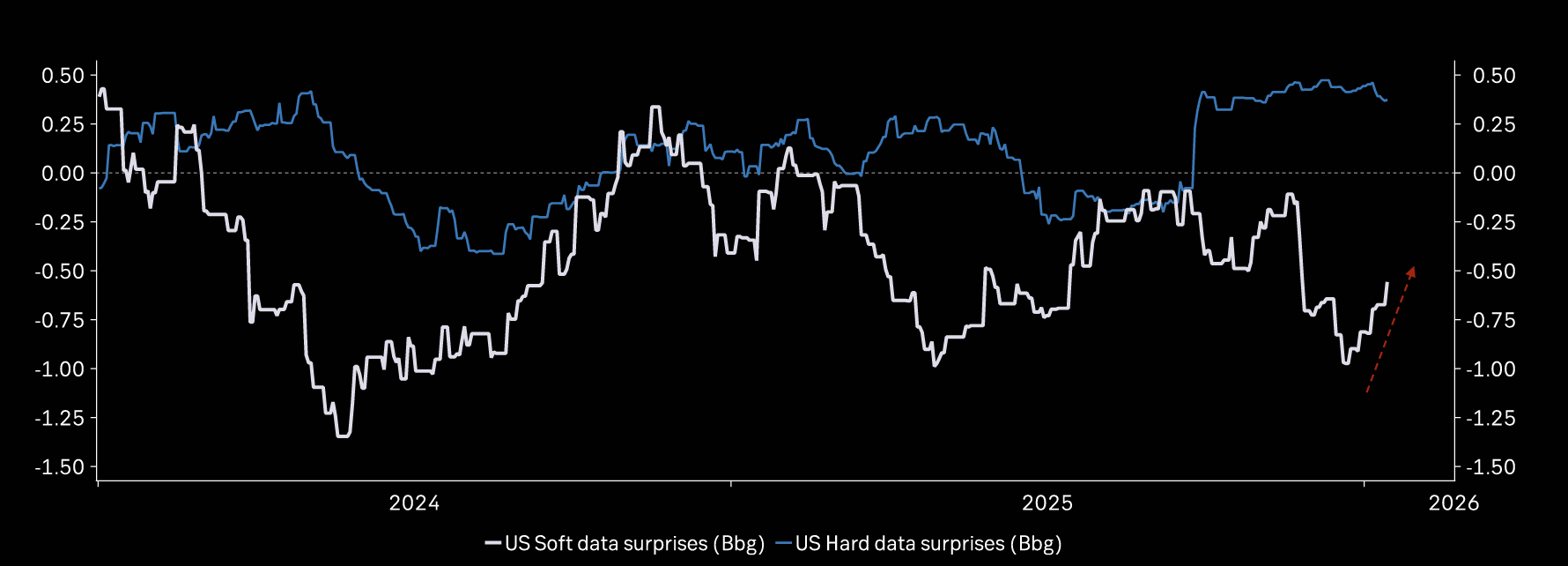

Both soft & hard

Soft indicator surprises have started improving while hard data surprises remain positive.

Source: Macrobond

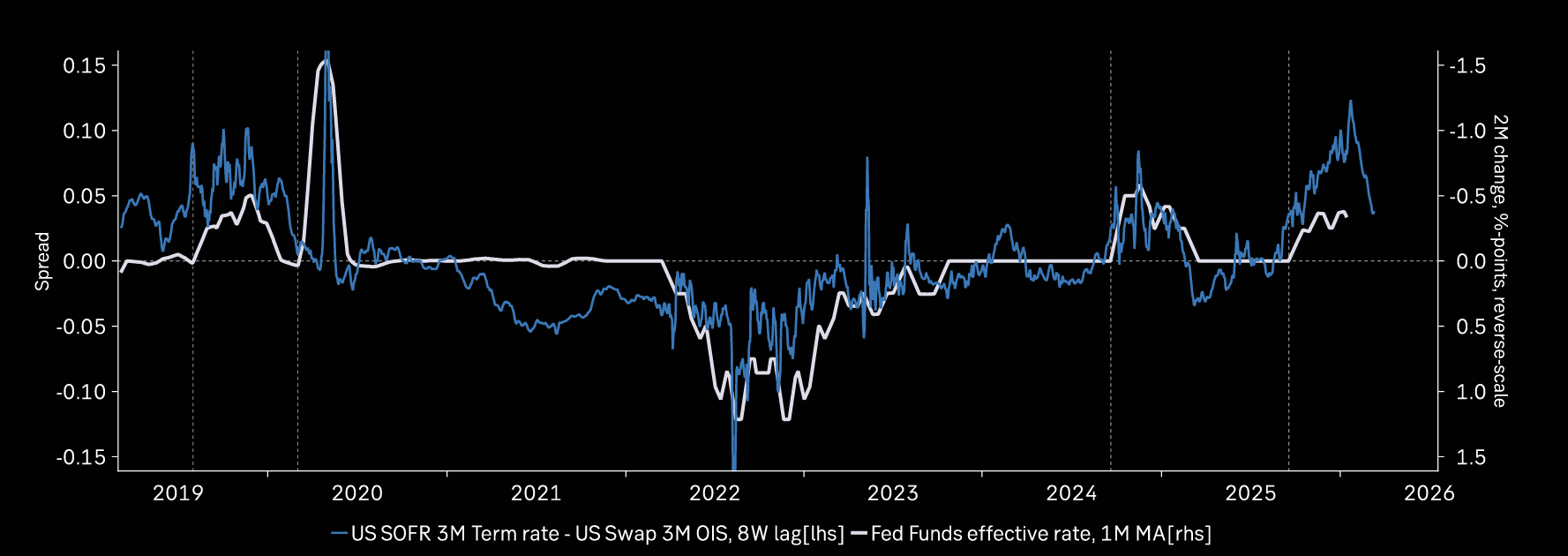

Follow the money

Liquidity is finally improving in the US money market after Fed restarts QE: positive signal.

Source: Macrobond

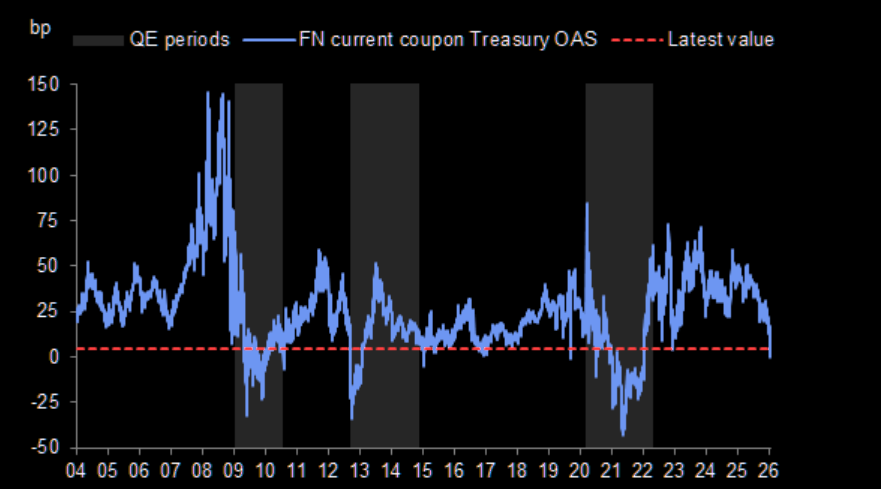

Smells like QE spirit

Current coupon OAS is at levels last observed during prior Fed QE purchase programs.

Source: Yield Book

Credit

Investment grade credit spreads are near historical lows. As are high yield credit spreads.

Source: Soc Gen Cross Asset

Source: Soc Gen Cross Asset

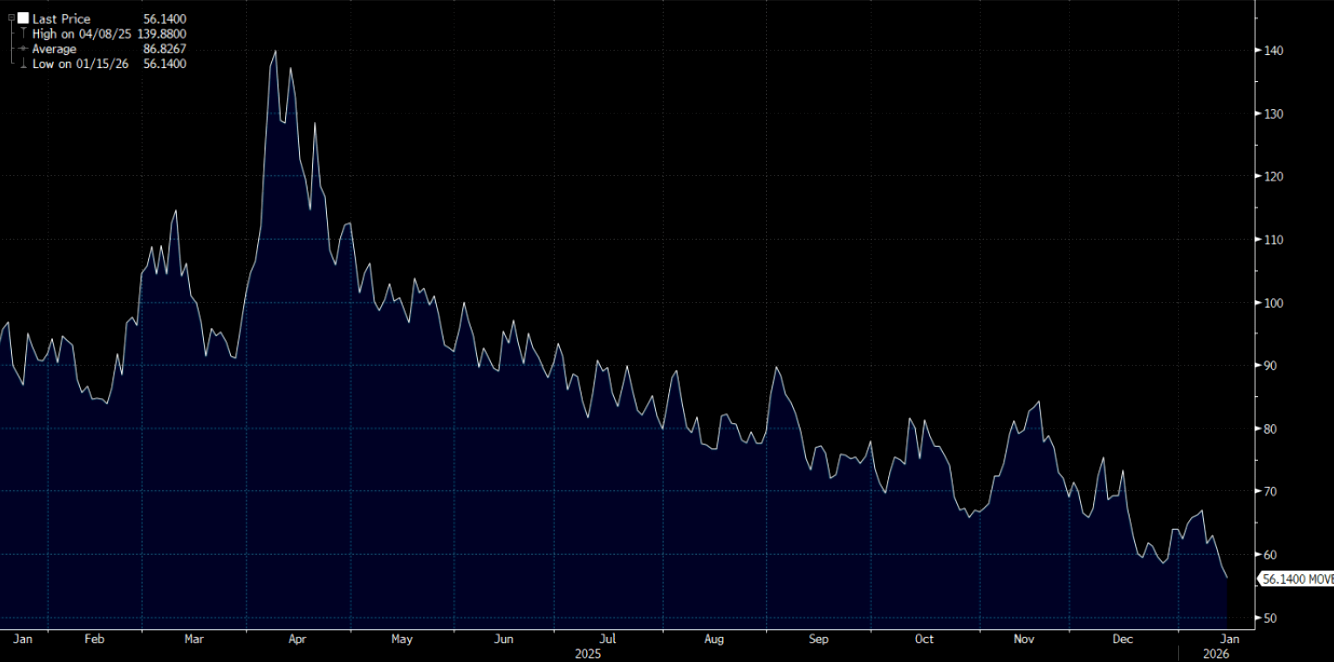

Macro vol

Bond volatility was printing new lows to close out last week going into the long weekend.

Source: Bloomberg

FX vol too

There has not only been a sharp drop in rates volatility but in FX volatility too.