This Is How Rate Accidents Start

Shhh… it’s back.

The US 10-year is closing in on the key 4.2% level. A sustained break above it risks reigniting the squeeze.

Source: LSEG Workspace

Breaking out

The 30 year pushing above the negative trend line. Haven't seen the long end trade here since the early September puke in rates.

Source: LSEG Workspace

SPX vs rates

Gaps are getting very wide... SPX vs. the 10 year (inverted) and the 30 year (inverted).

Source: LSEG Workspace

Source: LSEG Workspace

Pulling us higher

Gentle reminder of what Albert Edwards pointed out regarding the Japanese/US 10 year spread not long ago: "...these opposing forces are extreme... and unlikely to coexist for long."

Source: LSEG Workspace

Et tu Europe

European long end at massive levels. Close this slightly higher and we could squeezy violently higher.

Source: LSEG Workspace

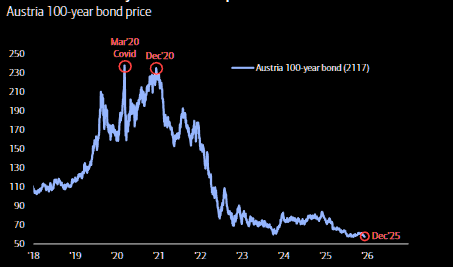

Remember FOMO momos?

Recall when the crowd was busy chasing Australian 100 year bonds a few years back? Well, its down 76%, printing new lows.

Source: BofA

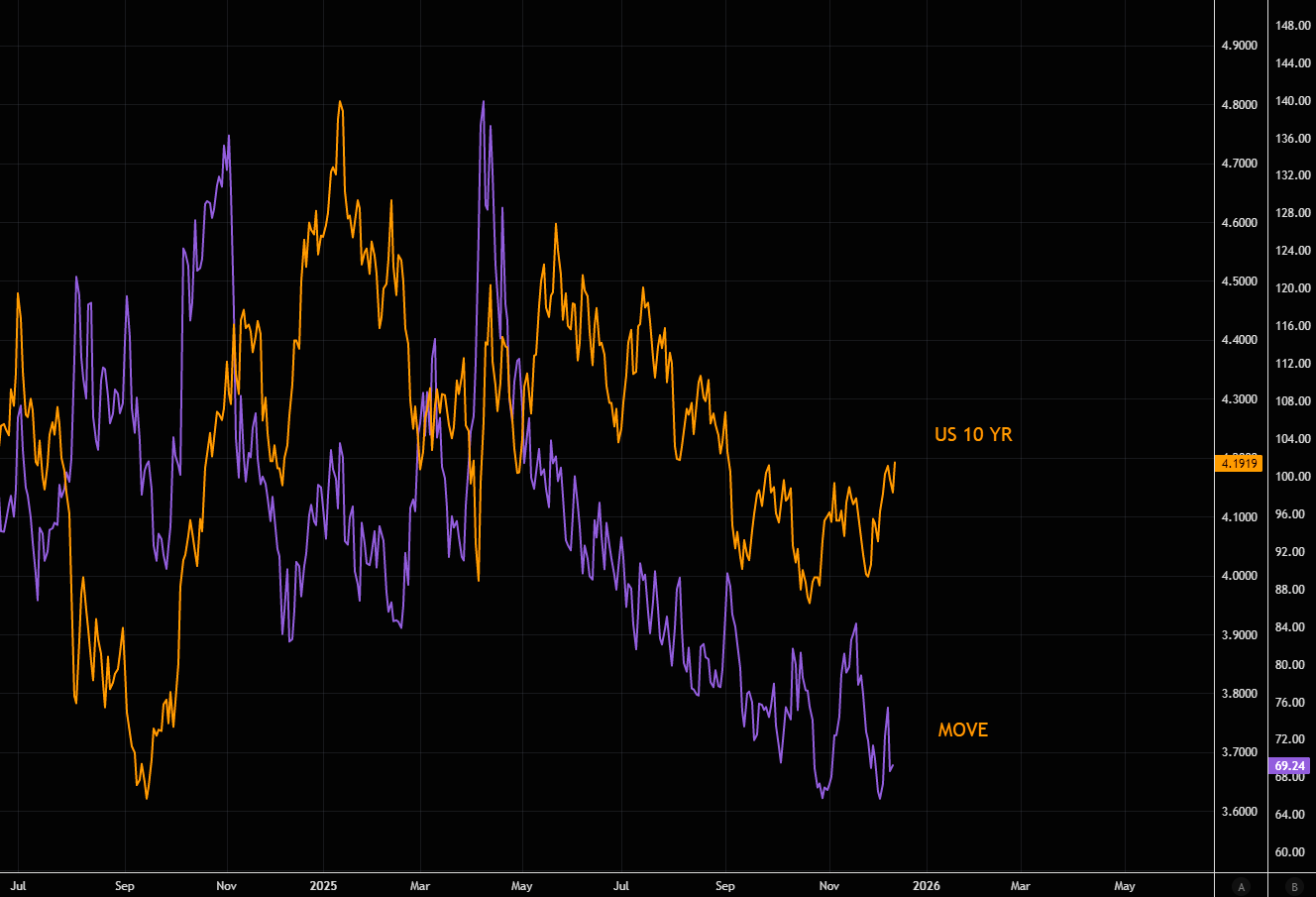

Forgotten?

Bond volatility has reset post FOMC and stays at rather depressed levels, but there is a bigger picture unfolding in rates. MOVE is not pricing this according to us.