If You See A Bubble - Ride It

Gangnam style

Korea’s chart looks almost too good: straight lines up, AI everywhere, buybacks surging, there is even a copper angle, and foreign flows still not crowded. Valuations aren’t crazy. Earnings are accelerating. This is usually the moment markets start whispering “bubble", right before the hardest part: deciding whether to fade it… or ride it.

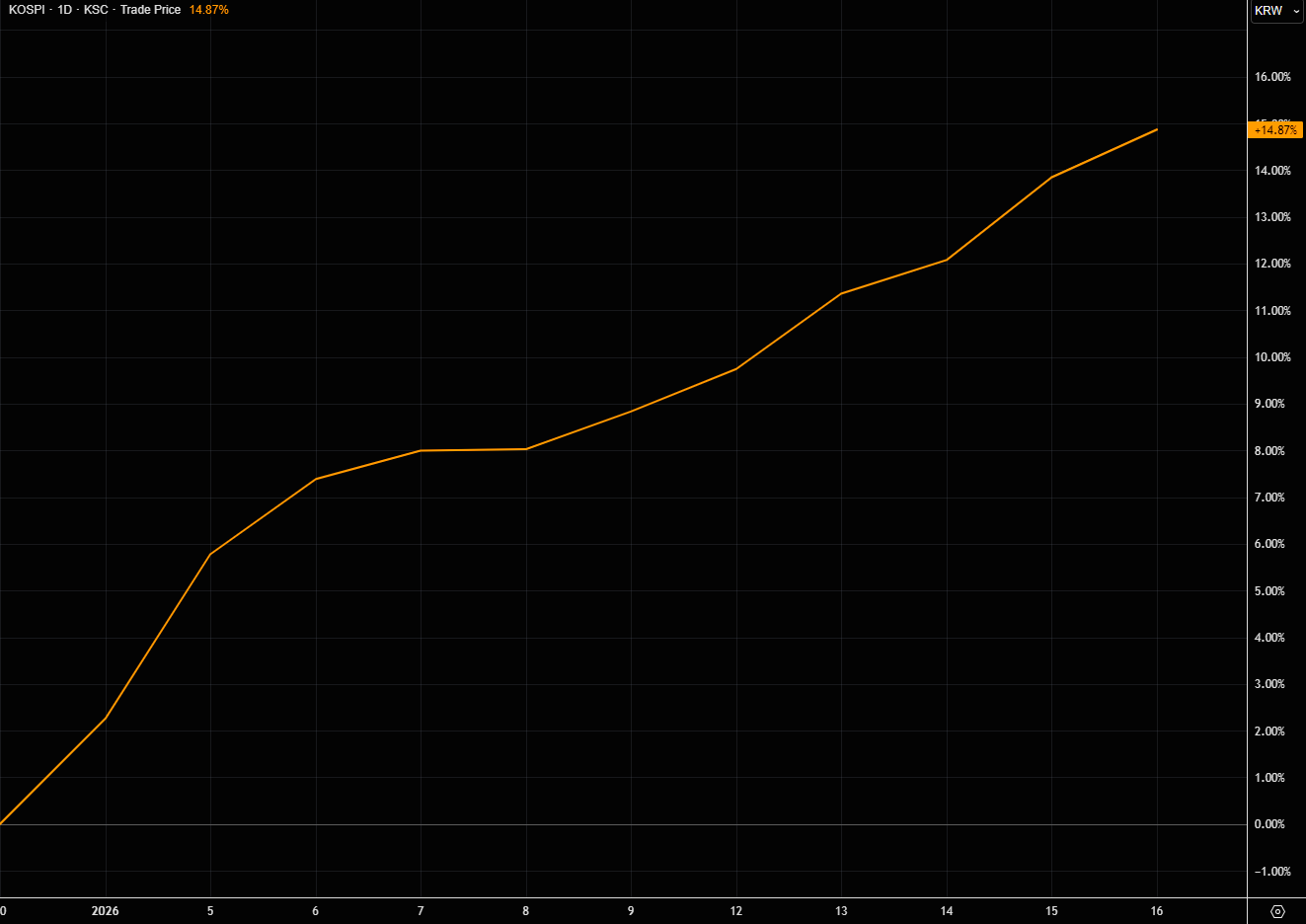

Did Young Madoff draw that curve?

The YTD curve for KOSPI looks a little "too easy"... up almost 15%.

Source: LSEG Workspace

King King KOSPI

The king of index performance last year has started the year with another bang. Note we are now overshooting the trend chanel, and RSI is at recent peak levels, trading around 85.

Source: LSEG Workspace

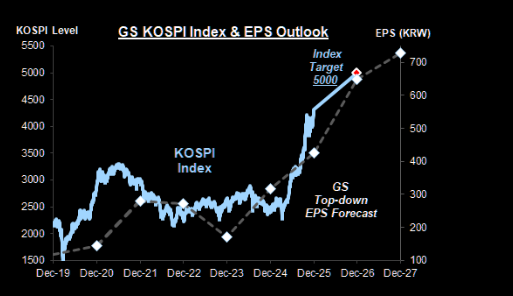

Let's all meet up at Kospi 5000

Goldman: "We expect another year of strong gains for Korean equities following a stellar 2025 performance. We forecast a 23% 12m USD total return in 2026, driven by above-consensus earnings growth amid a favorable macro backdrop and attractive themes. A supportive global macro environment, constructive fundamentals in Korean tech, industrial opportunities arising from geopolitical realignment, and continued corporate governance reform."

Source: Goldman

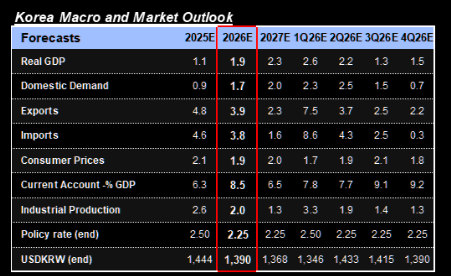

Korean Goldilocks

Domestic economy is expected to rebound in 2026 along with one policy cut in Q2/2026 and stronger KRW.

Source: Goldman

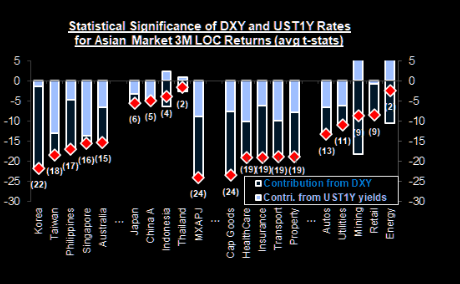

Macro tailwinds

Lower US short-term rates and a weaker dollar tend to strongly support Asian equity performance, notably in Korea, Taiwan, AEJ DMs, and cyclical sectors.

Source: FactSet

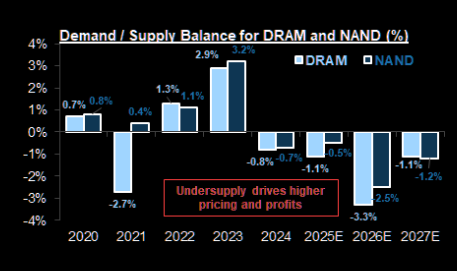

Got the AI angle

Hyperscaler capex is driving increases in semiconductor demand leading to large DRAM and NAND undersupply, in turn driving higher prices and operating profits in the semiconductor industry.

Source: Goldman

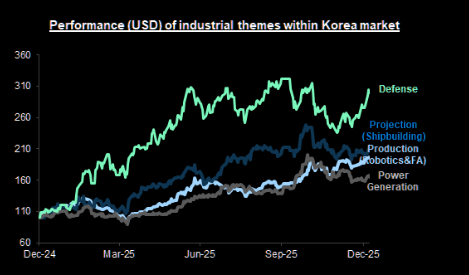

Geopolitical winner too

Elevated geopolitical risks have created multiple industrial opportunities for Korean companies.

Source: FactSet

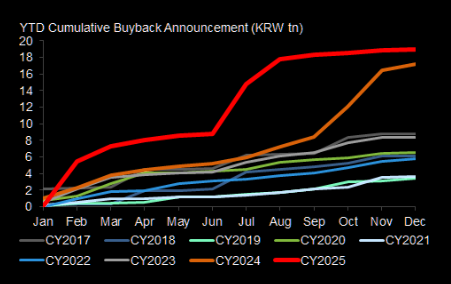

Buyback bid

Buyback activities accelerating from late 2024 and into 2025.

Source: Datastream

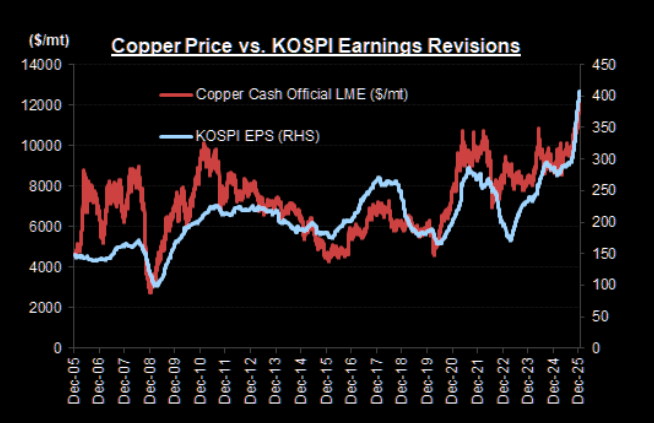

Korea the Copper play...

Copper prices and KOSPI earnings have exhibited a highly positive correlation sharing global macro cycles.

Source: FactSet

Still "cheap"

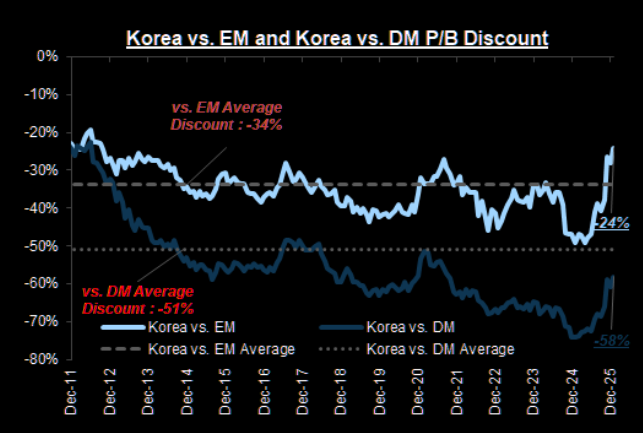

Despite the re-rating in 2025, Korean market still trades at a wide discount relative to EM and DM markets.

Source: MSCI

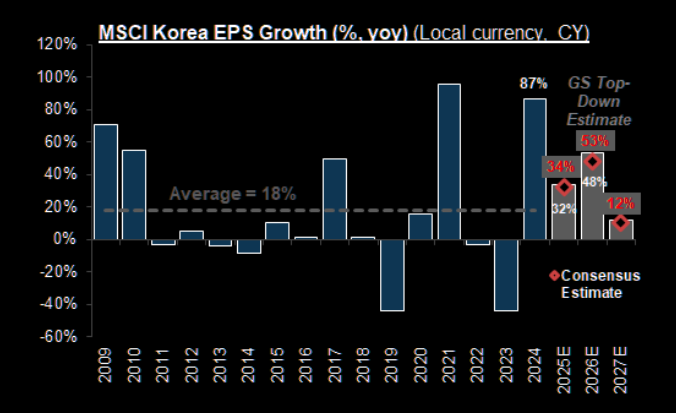

Earnings growth

GS: "We expect above-consensus earnings growth following two consecutive years of strong earnings growth."

Source: Goldman

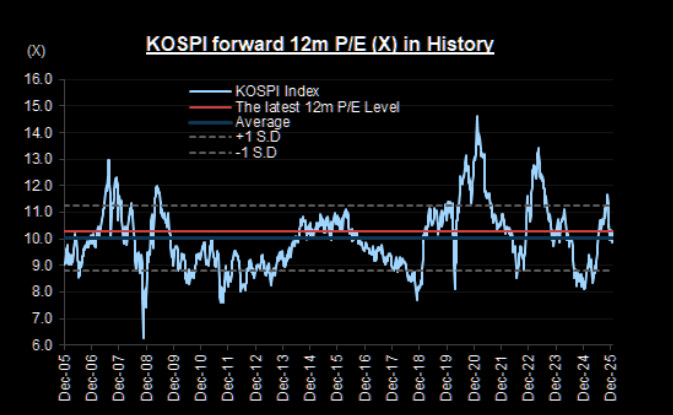

What other liquid market can you buy around "average"?

Considering strong earnings revisions, KOSPI NTM P/E also remains around historical average.

Source: Quantiwise

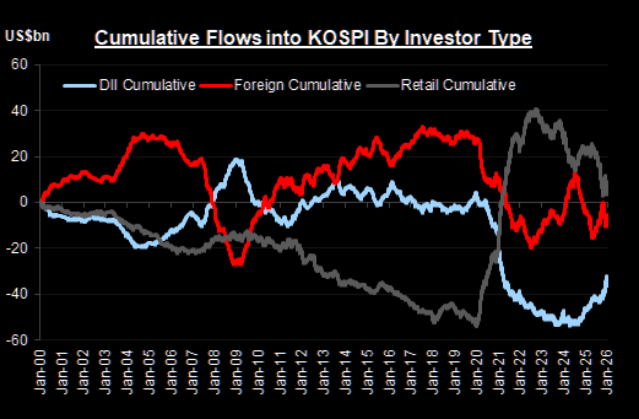

Not crowded

Overall flows are not crowded by any investor type despite the recent foreign inflows.

Source: Quantiwise

Won

"The South Korean won extended its decline toward its weakest level since the global financial crisis, intensifying pressure on authorities to defend the currency as local investors shift funds overseas." (Bloomberg)

Source: LSEG Workspace

Squeeze bubble

This is what happens when you add explosive squeeze to a bubble. Samsung electronics, massive AI play, has exploded to the upside lately. This is extremely overbought with RSI trading around the highest levels since 2021 actually.