The IPO Window Is Reopening. And This Time It’s AI, Musk, and a Trillion-Dollar Question

Stirring

After years of drought, the IPO market is stirring again. Not because retail is euphoric, but because capital finally has something big enough to sell. This is not 2021-style junk issuance; this is backlogged private giants + AI + geopolitics + capital hunger. And when the IPO machine restarts, it never does so quietly.

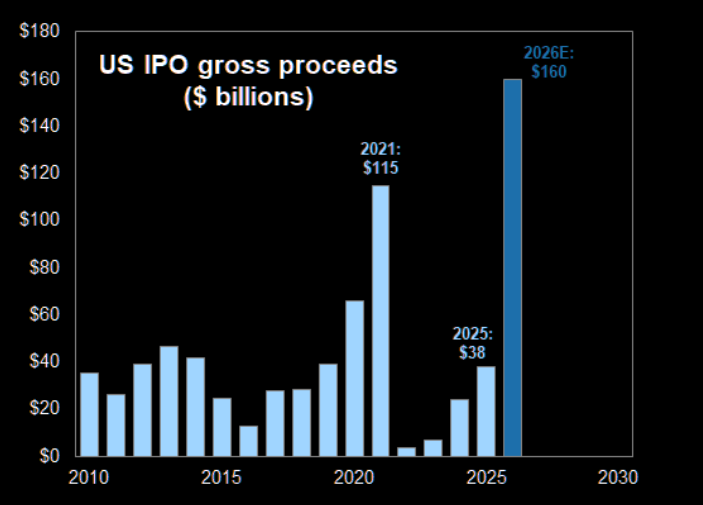

Goldman sees the floodgates opening

GS: "We forecast 120 IPOs this year and $160 billion in gross IPO proceeds in 2026."

Source: Goldman

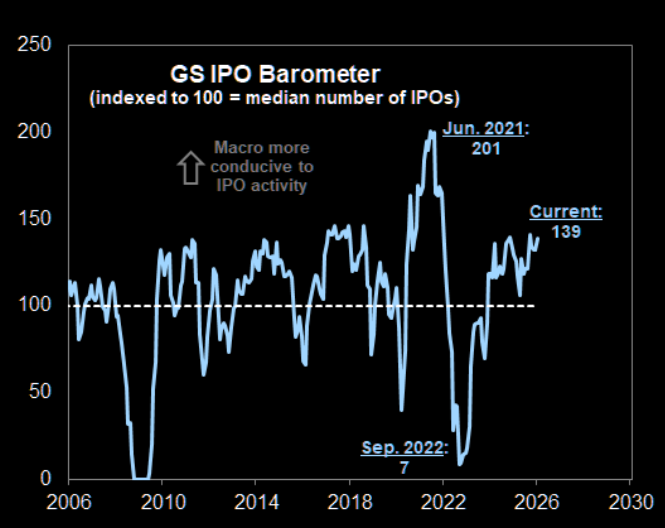

The macro environment is conducive

The macro box for IPOs is checked: Equities high, CEO confidence back and risk capital rotating out of private markets.

But the real story isn’t the number of IPOs. It’s which ones.

Source: Goldman

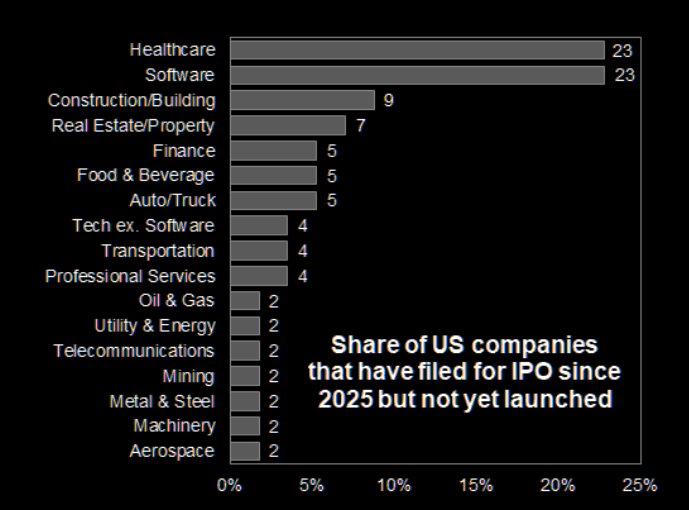

The backlog

The IPO backlog is Tech, AI, and Healthcare. Everything else is noise.

Source: Dealogic

IPO rumour candidates

1. SpaceX

A blockbuster candidate that could be one of the largest IPOs ever. The aerospace giant, now merged with Elon Musk’s xAI, is reportedly preparing for a 2026 listing with potential valuation in the $800B–$1.25T+ range. A "generational space-economy" public debut if it happens this year.

2. OpenAI

The AI leader behind ChatGPT is one of the most talked-about IPO prospects. Rumors suggest a potential listing could happen in late 2026 or early 2027, with valuations discussed as high as ~$1 trillion if public. It remains one of the most anticipated tech debuts.

3. Anthropic

Another big AI name, developer of Claude, which has been preparing for a public offering and is widely speculated to target an IPO in 2026 or 2027.

4. Databricks

The data + AI platform with a private valuation around $134B is consistently cited as a top IPO prospect for 2026, and could be among the largest software listings the year sees, if the current software climate allows for it.

5. Stripe

The fintech payments giant has been a perennial IPO watch list candidate. While it hasn’t confirmed timing, Stripe is widely expected to use the 2026 window when market conditions are favourable.

Wealth Singularity

If the IPO window truly reopens in 2026, there is one name that towers over all others - and it’s not a software platform or an AI lab. It’s Elon Musk.

A SpaceX IPO alone, at valuations increasingly whispered in the $800bn–$1 trillion+ range, would not just be another large listing. It would be a historical anomaly. Depending on structure and float, Musk’s net worth could leap by hundreds of billions of dollars almost overnight, pushing him into territory no individual has ever occupied. At that point, Musk wouldn’t just be “the richest man in the world.” He would be something closer to a self-contained capital market.

This matters because public markets have never had to price a human balance sheet like this before. There is no precedent for an individual with that level of liquid, mark-to-market exposure to infrastructure critical to:

1. national security

2. global communications

3. space launch capacity

4. AI compute supply

A SpaceX IPO would not just mint wealth, it would reprice power.

Not about the models anymore

In the latest Hard Fork episode, Casey Newton revisits one of the biggest structural shifts in tech, the AI IPO race, against the backdrop of SpaceX’s consolidation with xAI and broader strategic realignments among AI leaders.

Their discussion is about how the AI narrative itself is reshaping capital structures. They note that SpaceX’s acquisition of xAI, effectively folding an advanced AI group into a space-centered machine, signals a departure from siloed experimentation toward integrated, deeply capitalized infrastructure plays.

“The AI IPO race isn’t just about models anymore — it’s about capital strategy and control.”

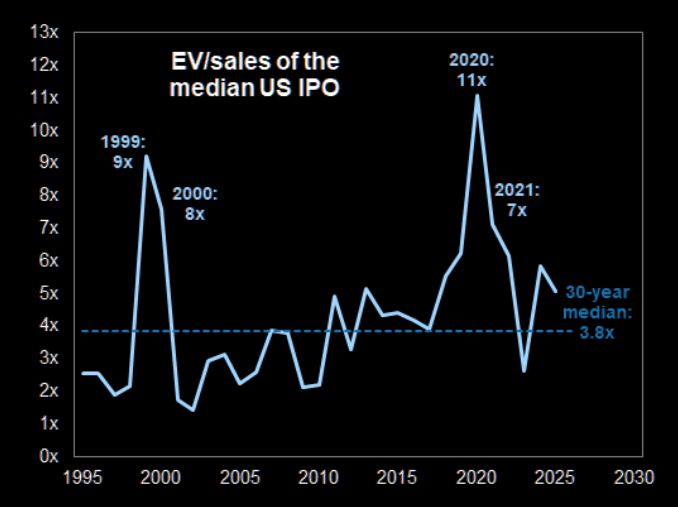

Average

Looking at old-fashioned boring valuations for recent IPOs we can see that they are near the historical average. This will of course not be applicable to some of the upcoming larger-than-life IPOs.

Source: FactSet

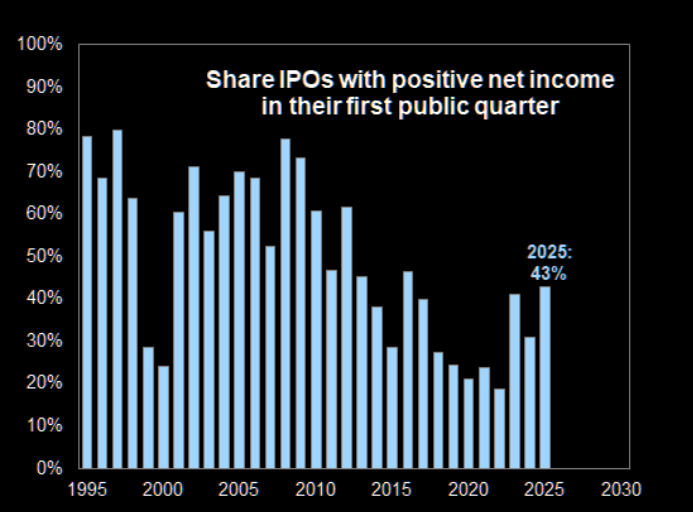

Less than half profitable

43% of recent IPOs are profitable.

Unprofitable? Yes. Unlistable? No.

Profitability is optional when you’re selling compute, data, or intelligence.

Source: FactSet

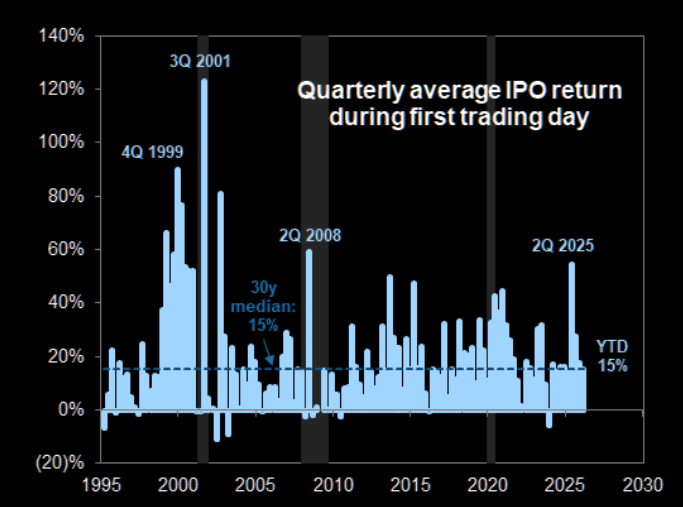

That first day pop

The average 2026 IPO has jumped by 15% on the first trading day, in line with the 30-year average. In addition, strong initial returns for recent IPOs have been short lived, with IPOs launched since the start of last year generating below-average returns during the subsequent few weeks and months.

Source: FactSet

Interesting times

The IPO window is reopening, and the defining feature of this cycle is scale. It is about listing infrastructure rather than apps, with AI and strategic assets driving issuance. At the extreme end sits a potential SpaceX IPO, which would not just reopen the market but redefine what public markets are being asked to absorb. The key overall market risk is not the listings themselves, but the market’s capacity to digest them, often reflected in multiple compression in related sectors, brief volatility spikes around pricing weeks, and “sell-the-comps” behavior as capital is reallocated. Interesting times, by any definition.