King SOX Flexes. Software Hits Do-Or-Die. Gold Cleans Out Excess.

King SOX

SOX bounced right on the 50 day, squeezing hard today. The long term trend channel remains very much in place.

Source: LSEG Workspace

Incredible

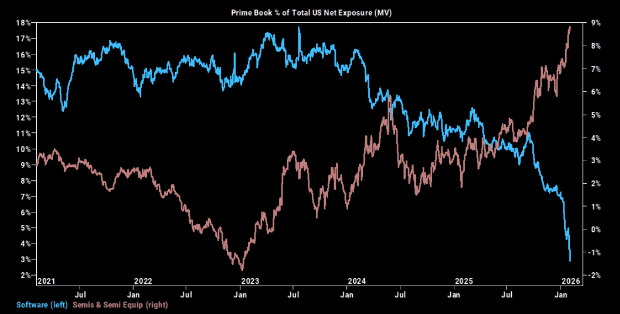

Semis vs software positioning reaching new extremes on a daily basis it seems.

Source: GS

Do or die

Software (IGV) down to massive levels. RSI is beyond oversold. Let's see how things play out from here...

Source: LSEG Workspace

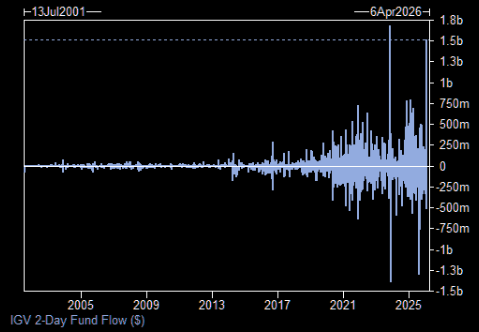

Real money coming in?

IGV has taken in over $1.5 billion worth of inflows over the past two sessions (GS).

Source: GS

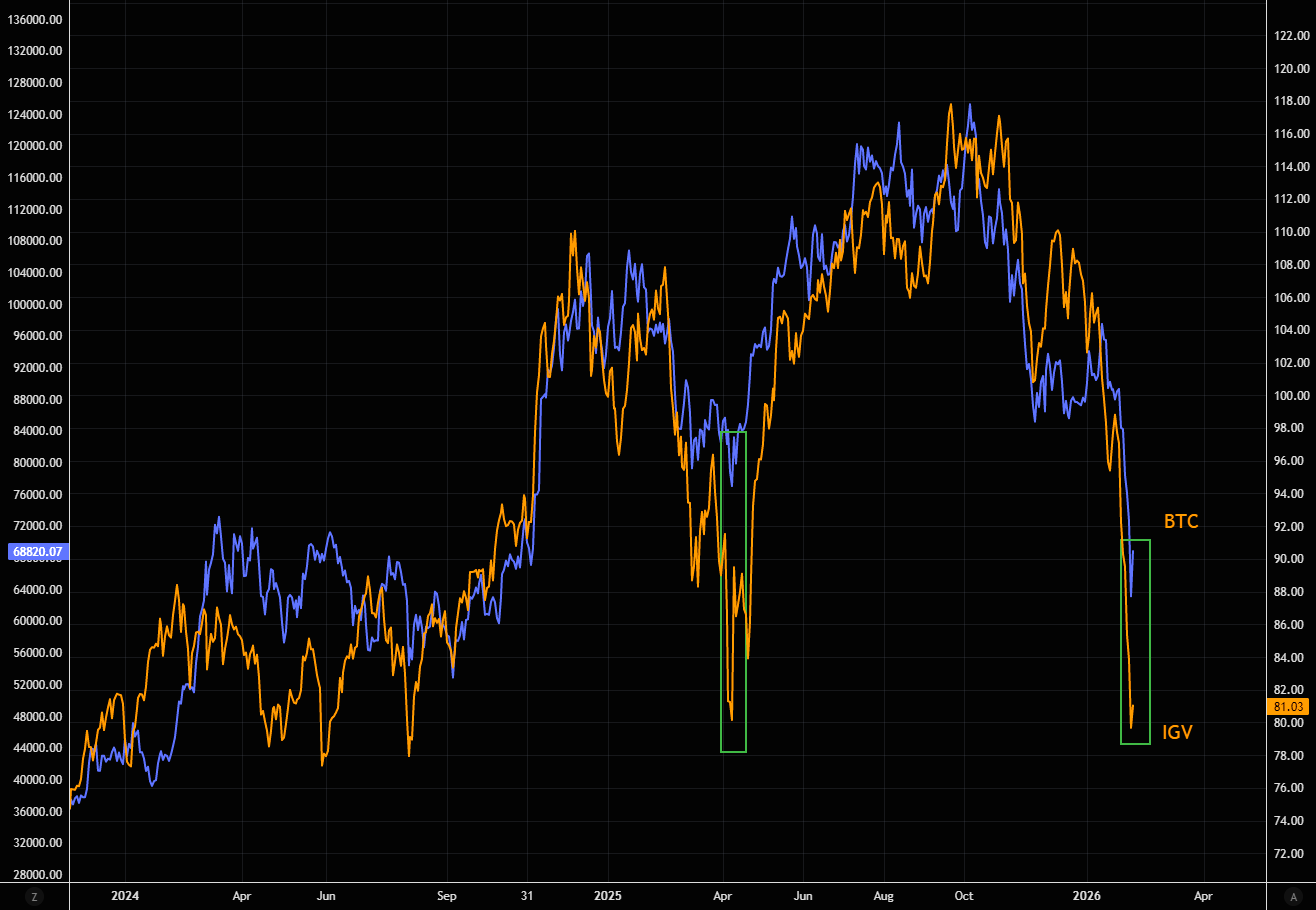

Follow Bitcoin?

IGV and BTC have traded in close tandem for years. During last spring’s bottoming process, BTC caught early bids first, with strength later spilling over into software. The setup is starting to look similar again. More on the software crash here.

Source: LSEG Workspace

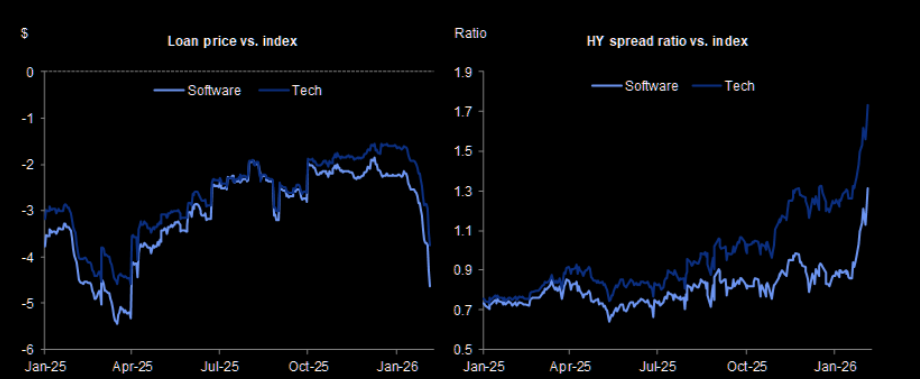

Software credit

Software credit has underperformed by a historic magnitude over the past week. More here.

Source: iBoxx

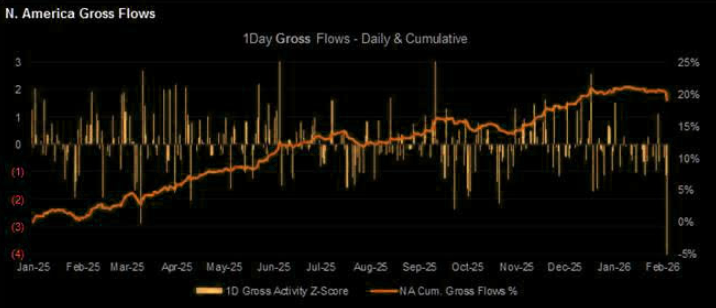

The de-gross

Massive de-grossing.

Source: JPM

Checking in on the déjà vu

The déjà vu we have been outlining recently continues to play out. Markets went nowhere from Nov 2024 until the breakdown in Feb 2025, and the past few months have followed a very similar script. We broke below the 100-day MA a few sessions ago, exactly what we saw last February, with the 21-day now closing in on a cross below the 100-day.

NASDAQ is sitting on short-term support here. A brief bounce is possible post the massive de-gross… but the risk is that it’s just a pause before the more serious move lower. Full note here.

Source: LSEG Workspace

Gold technicals

Gold remains trading above the big trend line. We are right on the 21 day, with the 50 day way lower. Our base case is that gold needs to consolidate here, before any new direction can take place.

Source: LSEG Workspace

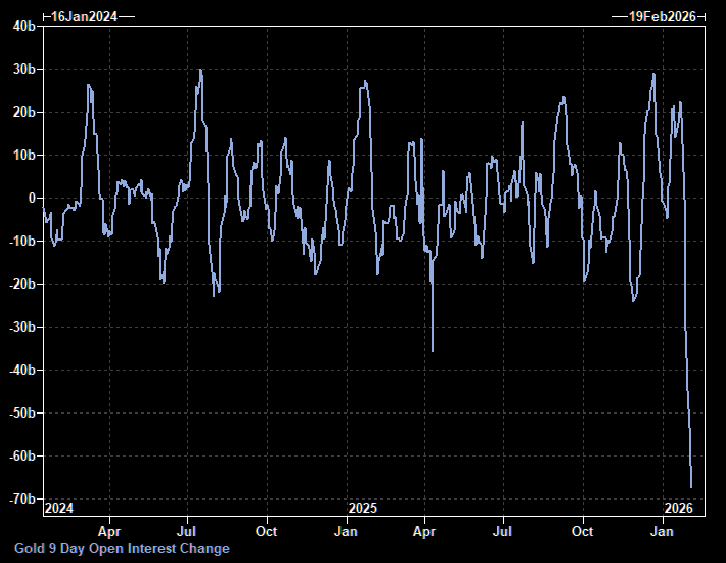

Wow

More wild gold stats: Futures exposure collapsed at an unprecedented pace during the latest crash, reflecting heavy speculative liquidation. Aggregate open interest fell by $40.6bn over the period, and by $67.5bn since Jan 22, well beyond any comparable episode in the past two years, underscoring continued long unwinds. Latest gold note here.

Source: GS

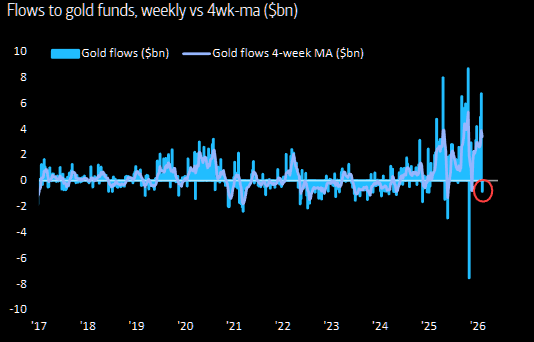

New in gold

First weekly outflow from gold since Nov’25.