KOSPI Beast Mode: Another +3%

The one and only

KOSPI added another 3% overnight. The strength of this trend is hard to ignore, every pullback has essentially bounced right off the 8-day moving average.

The short-term trend channel remains perfectly intact, although price is starting to look slightly stretched even versus the 8- and 21-day MAs. Meanwhile, the 50-day is trading far below current levels, underscoring just how persistent the upside momentum has been.

Our view remains unchanged from recent months (first outlined on January 5): buying pullbacks toward the 21-day continues to be a simple, but highly profitable strategy.

Source: LSEG Workspace

Not even...

...extremely overbought. We have seen much higher RSI readings during peak upside panic moves in the KOSPI.

Source: LSEG Workspace

Truly MAG

KOSPI vs MAG index performance over the past 6 months needs little commenting.

Source: LSEG Workspace

Still chasing NVDA?

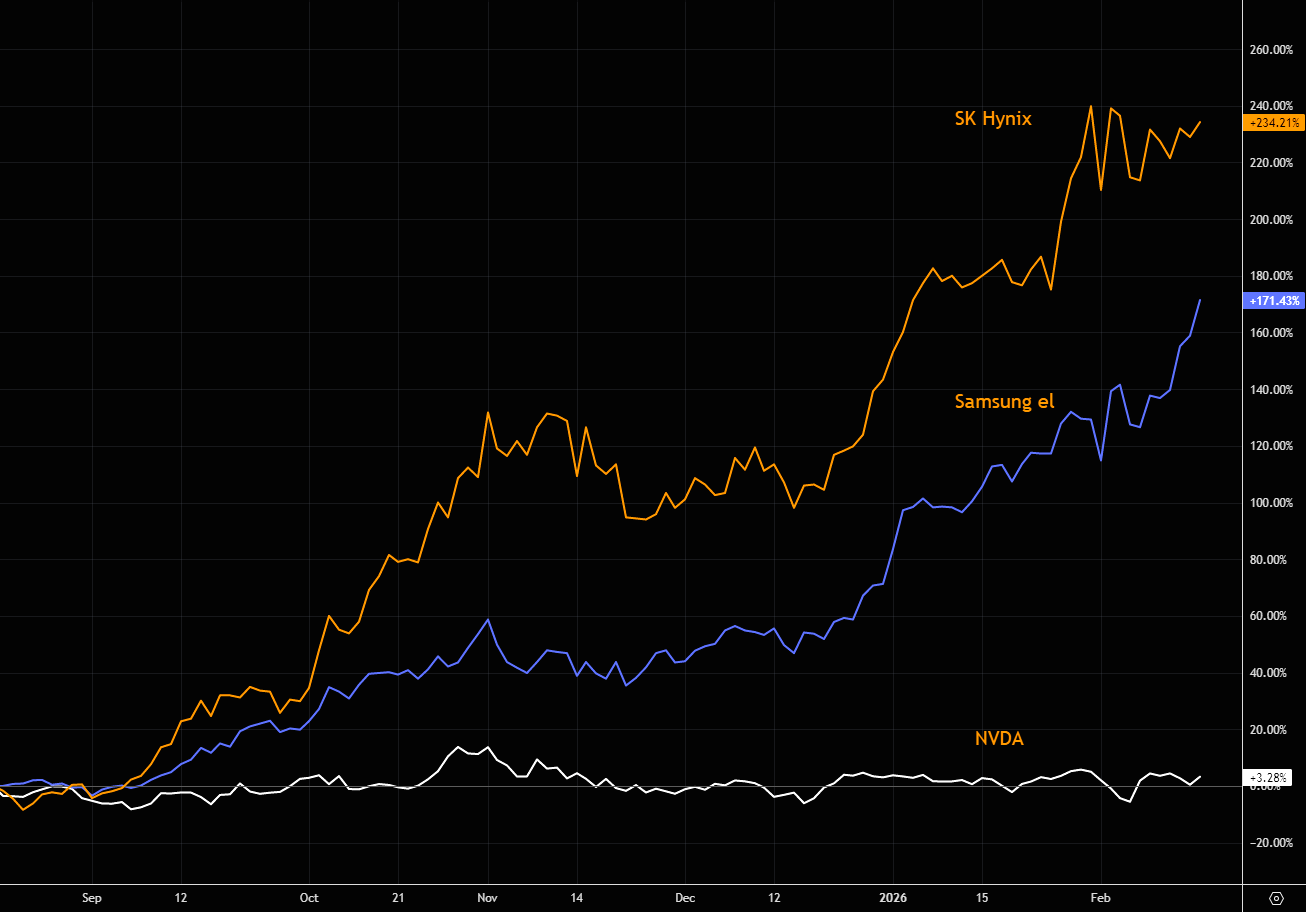

The AI space is so much more than waiting for NVDA to restart the engines. Performance over the past 6 months: SK Hynix +234%, Samsung el +171%, NVDA +3%. Great video worth watching on this theme here.

Source: LSEG Workspace

Higher for longer

GS have nailed the bull in Korea, and over the past weekend they raised their KOSPI target to 6,400, implying more than 20% upside.

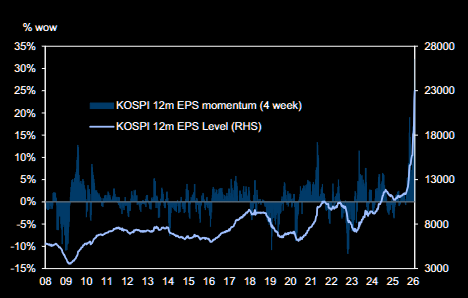

1. Earnings momentum is accelerating sharply: after +36% growth in 2025, 2026 earnings are now forecast at +120% (vs. +115% consensus), up from just +30% expected late last year.

2. Semiconductors are driving the upgrades, supported by exceptionally strong industry dynamics and sustained US cloud/hyperscaler capex growth (2026 capex now projected at $666bn vs. $548bn at the start of the year).

3. Tight memory supply (DRAM and NAND shortages) is boosting pricing power, with high operating leverage in this capital-intensive sector likely translating into outsized profit gains.

Source: GS

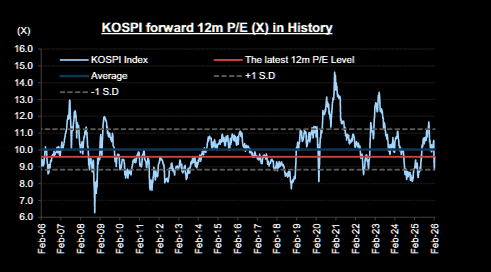

Valuation

KOSPI 12m forward P/E multiple has remained below its historical average.

Source: GS

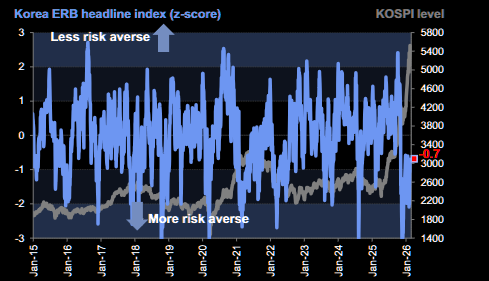

Positioning

Positioning in Korean equities remains conservative. Goldman adds some color: Foreign investors’ aggregate ownership of the Korean equity market is still below the midpoint of its long-term range, with FIIs net sellers of roughly $6bn year-to-date.

Domestic retail investors were net sellers last year and have only recently shifted back to net buying. At the same time, cash balances in retail brokerage accounts sit at record highs, around KRW 100tr (US$70bn), suggesting meaningful dry powder that could support future inflows.

Chart shows Korea equity risk barometer, still far from extremely bullish...

Source: GS

Before you go all in

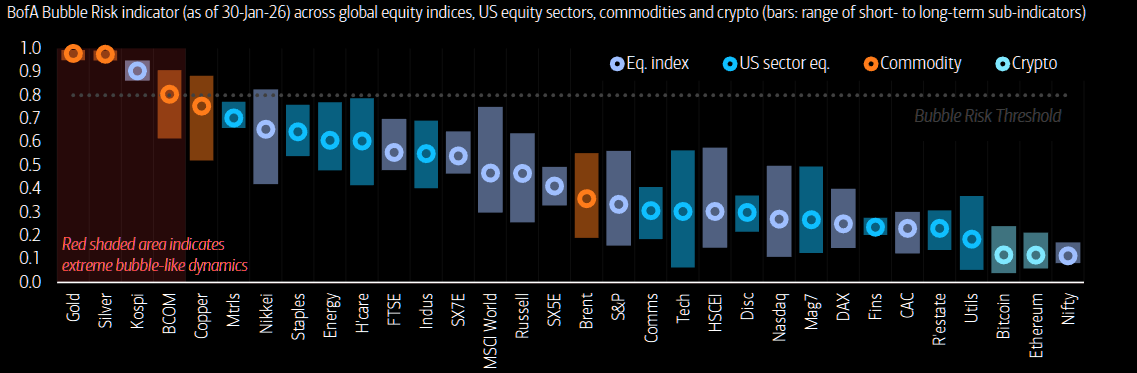

Bubble risk

KOSPI is the only equity index in bubble risk territory according to BofA's model.

Source: BofA

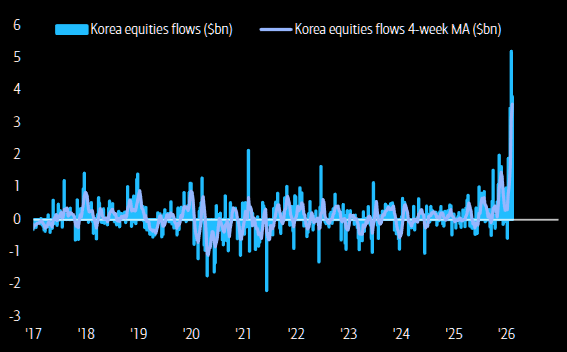

Sucking in some

Record 4-week inflow from Korea equities.

Source: BofA

On pause signal...unleash hell.

"I think we are close to megacaps announcing pause in AI capex. When it happens we will see US memory stocks drop 50% (Korea 30%), like silver few weeks ago. This is a Trumped up market of rolling bubbles (quantum cmp, rare earths, tether-gold, crypto, nuclear, AI capex ...)" (Kolanovic)