Life After Silvergeddon: Bagholders, Broken Vol and a Fading Bounce

Not so sexy

Silver drew in heavy chasing with little conviction or plan, leaving many investors stuck holding positions they now hope can get back to breakeven. Technically, silver bounced to the 21-day MA, rolled over, then found support near the 100-day, but the latest rebound is losing steam. The setup risks forming a second lower high.

Source: LSEG Workspace

Silver Fibo

Main Fibonacci levels to watch. We are right on the 50% level. First support at $76, second support at $64 (right where we bounced a few sessions ago). Resistance: $84 and then $92.

Source: LSEG Workspace

Parabolic

As we’ve been writing, parabolic moves often end in tears, and silver has been no exception. The key question now is whether price revisits the 200-day MA, as it has during past parabolic unwinds. Chart 2 for the ones that fancy log scales.

Source: LSEG Workspace

Source: LSEG Workspace

Normalization

SLV volumes went beyond crazy. This should continue to calm down.

Source: LSEG Workspace

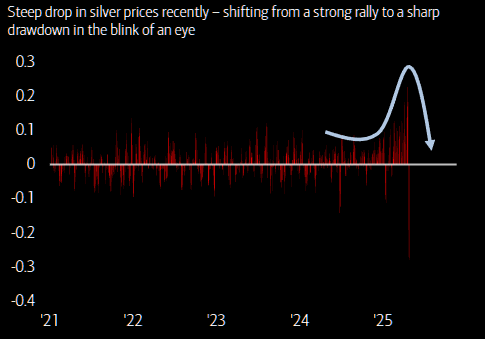

Fast market

Volatility in silver has been among the most extreme across assets, often unfolding, as BofA notes, "in the blink of an eye."

Source: BofA

Takes time, collect theta

We’ve written extensively about how extreme, and ultimately broken, silver volatility became during the upside panic. These kinds of volatility shocks take time to work through the system. The October upside panic, which was mild compared to the latest squeeze, took more than a month to fully flush. Expect more erratic two-way price action as this shock continues to feed through. For those expecting silver to range, there should be ample opportunities to collect theta, with silver volatility still pricing roughly 6% daily moves.

Source: LSEG Workspace

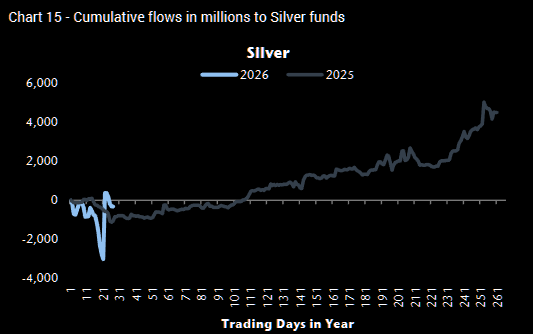

Big inflows

Not amazing bounce despite a strong bounce in inflows...