The Long End Revolts — You Should Be Nervous

Breaking out

The 30 year pushing above the negative trend line. Haven't seen the long end trade here since the early September puke in rates.

Source: LSEG Workspace

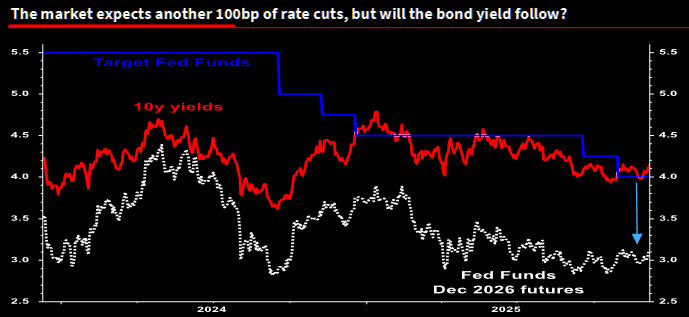

The question

The US now looks increasingly isolated in a global market that is leaning toward further easing. Much of the debate focuses on whether lower Fed Funds, under a more politicised and divided Fed, can actually drag down long-end yields and mortgage rates. But the more uncomfortable question according to Albert Edwards is whether global forces could push US long rates higher instead.

Source: Soc Gen

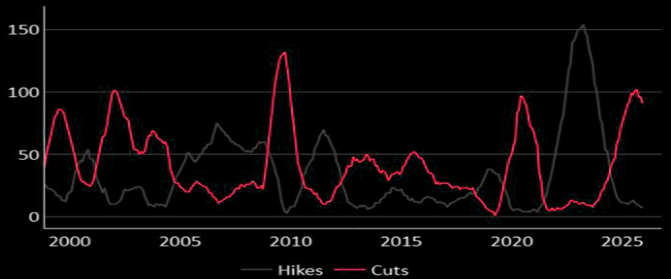

Over

Soc Gen's Global Central Bank Tracker shows the easing cycle is over (12 month rolling policy moves).

Source: Soc Gen

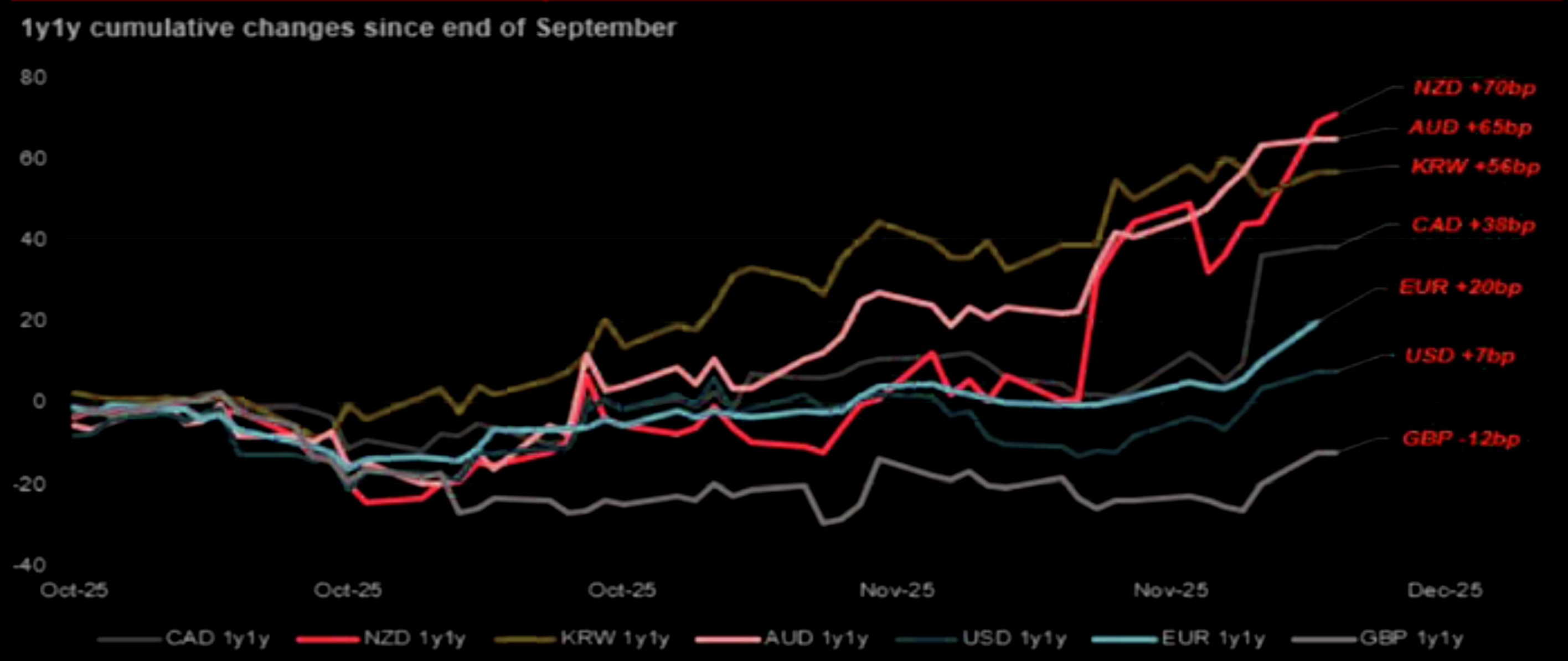

Watching Asia closely

The last few weeks have seen a surge in expectations of higher rates, led by Asia. Soc Gen's Spratt: "...violent price action in KRW, AUD and NZD as investors rapidly shift from easing, to pausing, to tightening bias. The market has been reluctant to price a pause. Once the policy direction is clear, the risk reward has been to lean into that direction."

Source: Soc Gen

Be nervous

Adding to the upward pressure is a development few expected: bond yields are rising even in deflation-hit China. The Fed may be easing, but if yields are climbing across the rest of the world, the US 10-year is likely to be dragged higher as well. That’s not a backdrop equity investors should be comfortable with according to Edwards.

Source: LSEG Workspace

Time for MOVE

The bond volatility reset has been epic, but expecting the MOVE to stay at current levels given the latest trajectory in rates seems naive.