Meta-verse became Meta-wide

The AI story now runs on credit

Hyperscalers are funding the build-out with debt pushing record issuance into credit markets. Equity cheered early. Now credit is doing the heavy lifting — and equity price action is starting to notice.

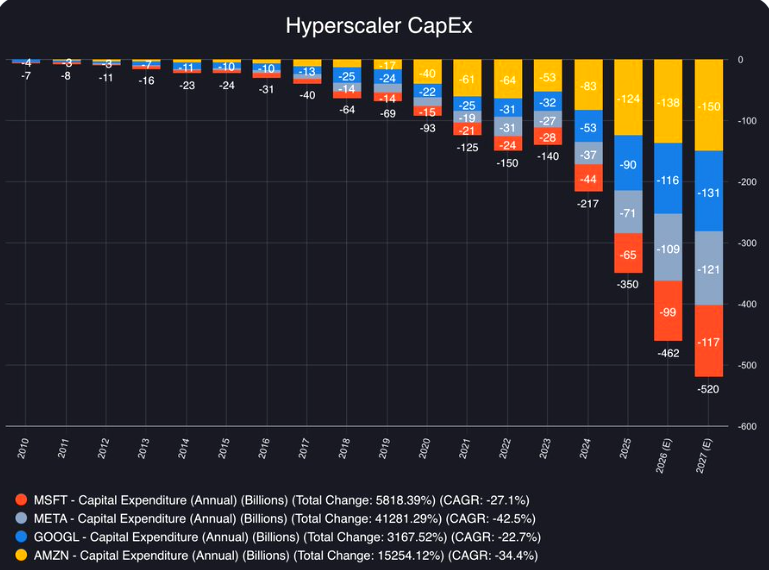

More than half a trillion

Nothing new here but numbers just seem to be going up and up. Analysts expect the Hyperscalers to spend $520 billion on CapEx in 2027.

Amazon: $150B

Alphabet: $131B

Meta: $121B

Microsoft: $117B

Source: fiscal.ai

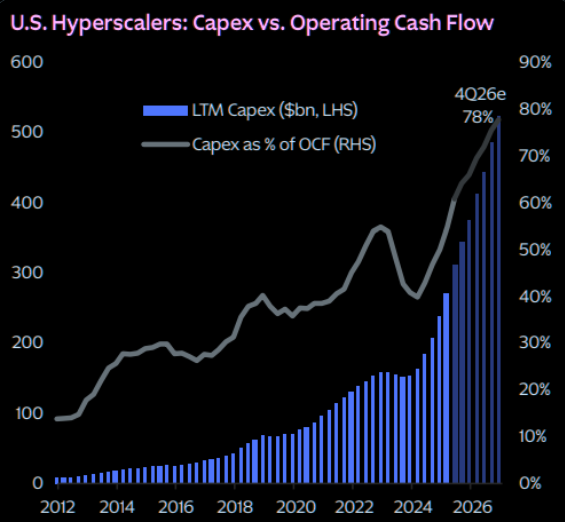

Capex eating cash

KKR says that capex as a percentage of operating cash flows is reaching unprecedented levels for the hyperscalers.

Source: KKR

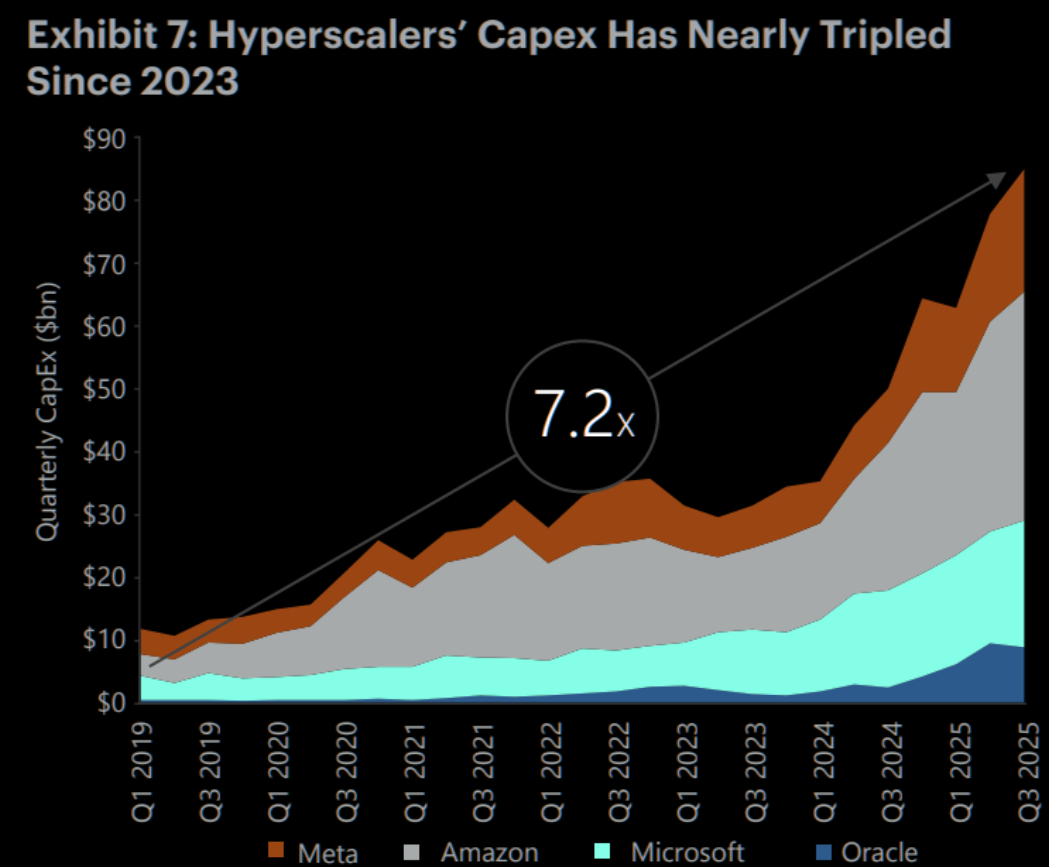

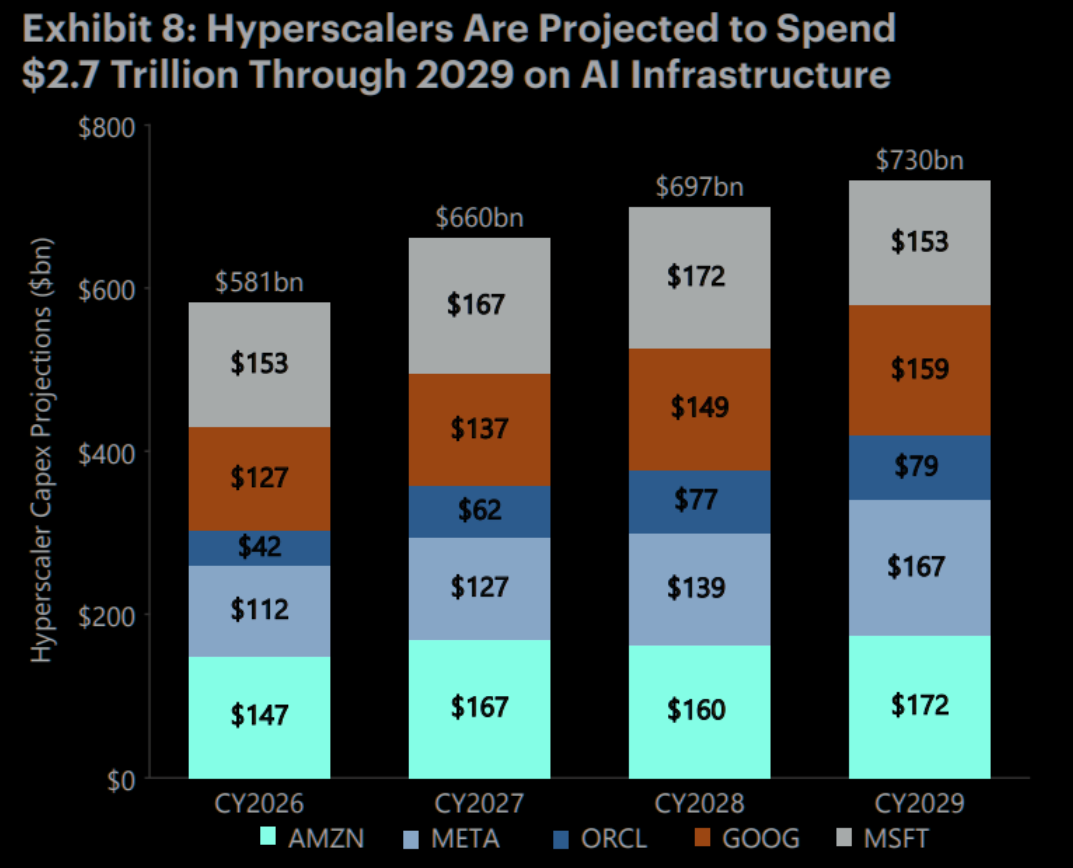

AI credit

AI is now the single largest source of incremental credit supply. Hyperscaler capex has tripled since 2023. Projected spend: $2.7 TRILLION from 2025-2029. And they're pivoting hard to debt - Oracle, Meta, Google, Amazon priced $90B in deals in Q4 alone.

Source: Apollo

Source: Apollo

One big AI bet

If hyperscalers fund just 20% of AI capex through IG, AMZN becomes the 3rd largest issuer in the index. Google goes from 67th to 8th. A "diversified" portfolio might just be one big AI bet.

Source: Apollo

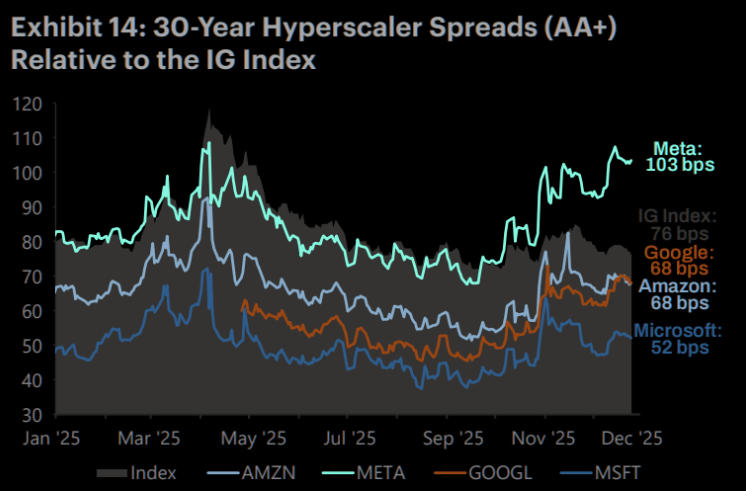

Meta-verse became Meta-wide

AA-rated Meta debt trades WIDER than the overall IG index (~80 bps). The flood of high-quality hyperscaler issuance is pushing the market's "risk-free" spread anchor higher. This has potential to reprice the entire market.

Source: FRED

The equity market seems to notice

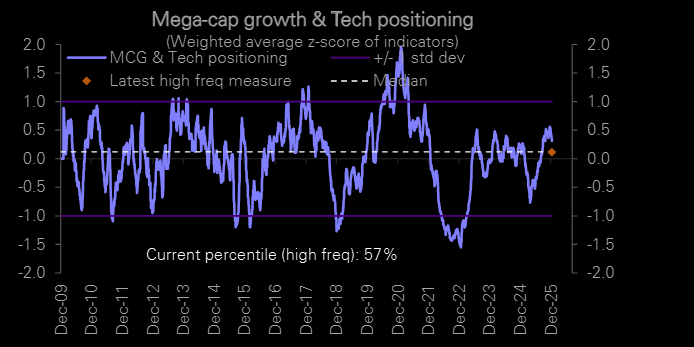

Selling Mag7

Mega-cap growth & Tech positioning registers a big drop in the latest reading.

Source: Deutsche Bank

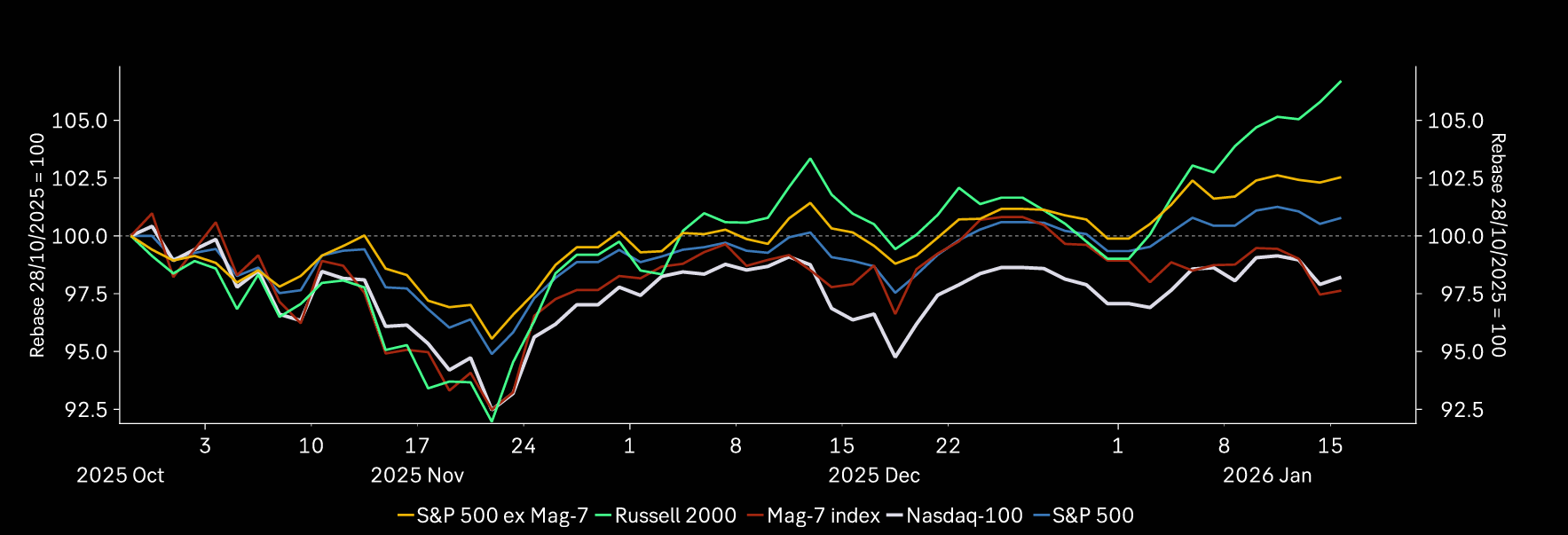

Breaking December lows

Neil Sethi: "Mag-7 ETF ended the week at the least since Nov 24th. Isn't there some rule about breaking the December lows?"

Source: Trading View

Beaten by Little Brother

US small caps now lead the way while Nasdaq and Mag-7 remain below November peaks.

Source: Macrobond

Rotation

The Mag 7 are at a key level relative to the equal-weight index.