From Mom’s Basement To $6bn In 12 Months

Fastest ever

Lovable went from zero to ~$6bn in valuation in about a year, reached $100m in ARR faster than anyone before it, and minted a 26-year-old founder as a paper billionaire. The story sounds absurd, almost engineered for maximum virality. But beneath the fairy-tale numbers sits something more interesting: a clear signal of where AI works, where capital is flowing, and how the VC playbook has changed in this cycle.

Another week, another AI unicorn

Another week, another AI unicorn. But this one comes with a twist. Swedish-founded AI startup Lovable has raised roughly $300 million, pushing its valuation to about $6.6 billion. The round, backed by CapitalG and Nvidia, instantly turned the two founders into paper billionaires.

The valuation number alone would normally invite scepticism. Especially so, as Lovable almost appeared out of nowhere, founded in 2023, but really took the current form and launched the product only one year ago.

Quite lovable

This might read like a puff piece. That’s fine, and intentional. We’re not investors in the company and we’ve spent most of the past six months writing about why large parts of the AI narrative are bloated, overpromised, and economically thin. Most “ AI use cases” don’t justify their valuations. Most won’t. But every bubble produces a few genuine businesses. Lovable appears to be one of them, not because it promises intelligence, but because it quietly compresses labour, time, and cost in a place where the gains are measurable. And we use the product and really adore it. This is the "other" AI story, the one that actually works.

Dwarfed

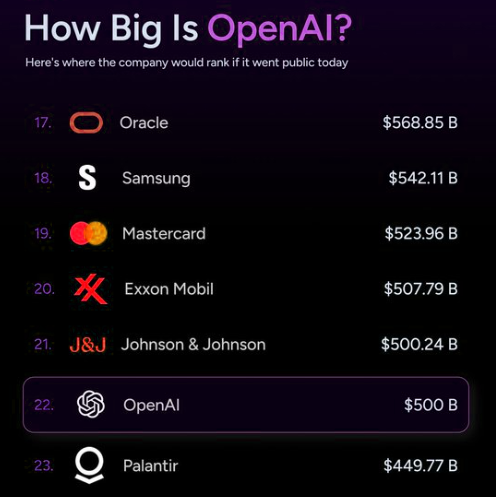

Before anyone starts screaming "bubble" over a >$6bn valuation for a company that was founded less than 2 years ago - let's just remember that OpenAI is now currently the 21st largest company in the world at $500bn. Now that could very well be the bubble.

Source: Jarsy

Sweden’s Unicorn factory

Sweden has become one of the world’s most efficient startup exporters. From Spotify and Klarna to Skype, iZettle, Mojang and King the country has repeatedly converted a small domestic market into global software and technology platforms. Over the past decade, Sweden has produced 40+ billion-dollar tech companies.

Fastest growth ever

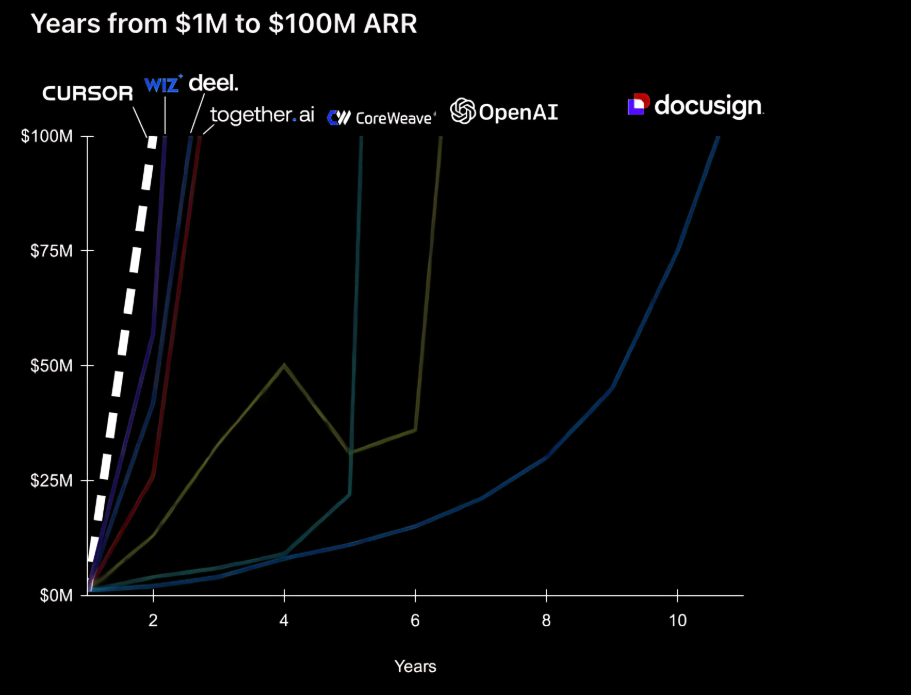

According to multiple reports, Lovable reached roughly $100 million in annualized subscription revenue in under a year.

Lovable claims that it became the fastest-ever software company to reach $100 million in annual recurring revenue (ARR), doing so in just eight months after launch, which outpaced other high-growth tech companies like OpenAI, Cursor, and Wiz.

Those figures are reported, not audited. But even allowing for optimism, the pace explains why capital arrived so quickly, and why it arrived at such a large number.

Source: Cursor

The numbers

1. $200M ARR. In July the company announced $100M ARR. Today, 4 months later, that figure has doubled.

2. 5 million. That’s how many visits they’re seeing to Lovable-built websites and apps every day, a 2x increase in two months.

3. 100,000. New projects are built on Lovable every single day from people around the world.

(Source: self-reported by the company)

Democratizing coding

Lovable builds what’s often described as a “vibe coding” platform - software that lets users create apps, websites, and workflows using natural-language prompts instead of traditional code. This is how the founder describes it:

"We launched Lovable with a simple belief: everyone should be able to build software. Not just the 1% who can code."

The promise isn’t artificial general intelligence. It’s something more modest and more valuable: compressing the time and skill required to turn ideas into working software.

In practical terms, Lovable aims to remove boilerplate engineering work, lower the barrier for non-coders, and let small teams ship faster without growing headcount. That distinction matters, because most AI hype collapses at the point of execution.

Real AI efficiency

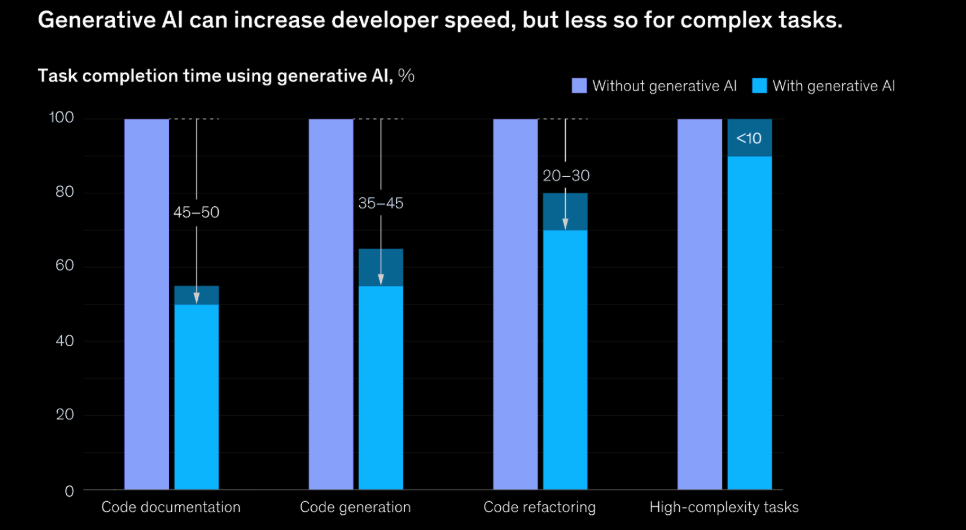

While much of the AI narrative still floats on future potential, coding assistance is one of the rare areas where productivity gains have already been measured.

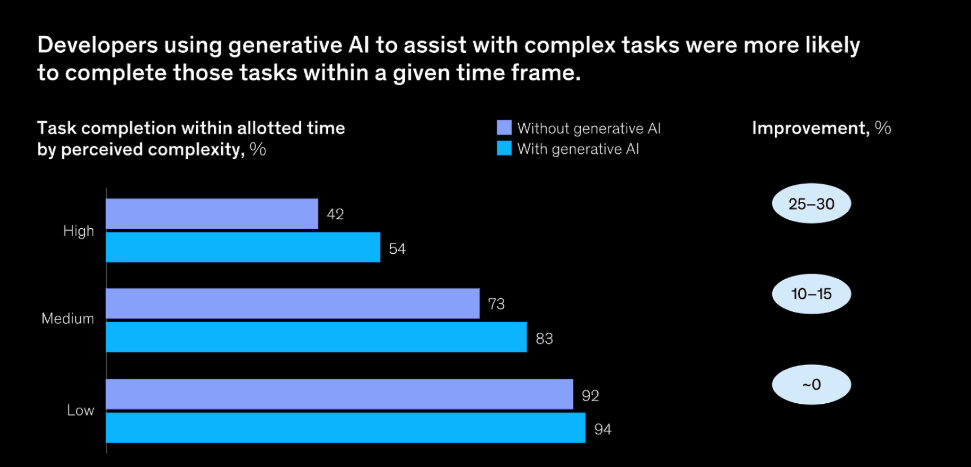

Controlled studies of AI coding tools show output increases of roughly 25–30%, with the largest gains among junior and mid-level developers. Even senior engineers see measurable efficiency improvements. Industry research has also found that tasks like documentation, refactoring, and routine code generation can often be completed 30–50% faster, depending on the task, with AI assistance.

Source: McKinsey

AI productivity

Developer surveys back this up. More than 80% of developers now cite productivity as the primary benefit of AI tools, not creativity, not automation, but speed.

This is the quiet reality behind Lovable’s valuation. It doesn’t promise to replace engineers. It shrinks the number of hours required per unit of software.

That’s a concrete economic lever, and one venture capital understands very well.

Source: McKinsey

A New Billionaire Cohort

Lovable’s rise also lands its founders inside a rare demographic.

There are now 13 self-made billionaires under the age of 30 globally, a record high. Most were minted through AI-driven businesses. Only a handful built their companies outside the United States, and Fabian Hedin, at 26, is one of them.

Risks, there for sure are a few..

Let’s be clear: not everyone thinks this fairy tale valuation tells the whole story. As the company hurtles toward a $6.6 billion valuation just months after a $1.8 billion round, skeptics are asking the obvious questions about defensibility and real business fundamentals.

Critics have pointed out that Lovable’s sky-high multiple rests largely on ARR projections and investor enthusiasm, not three years of sustained customer revenue, the kind of multi-year growth that traditional rankings use to identify truly resilient companies.

In startup circles, questions about Lovable’s moat persist. The rapid early edge that came from viral adoption of the open-source GPT Engineer has arguably “eroded” as competitors race into the same “vibe-coding” space, and if every AI coding tool converges on similar capabilities, it’s unclear what will give Lovable a structural advantage.

The rest? Foggetaboutit

Lovable may succeed. It may fail. That’s almost beside the point.

What matters is that, in an environment flooded with AI abstraction, capital has zeroed in on a use case that quietly works. Not grand intelligence. Not sentient machines. Just fewer hours per feature, fewer engineers per product, and faster iteration across the software economy.

As long as markets keep rewarding story first and substance later, skepticism is warranted. But in this case, the story happens to be anchored to something measurable.

And that’s why this one stuck. Even at $6bn in valuation. The other trillions and trillions in "AI value" in listed and private markets is however a very different story...