No Shorts, No Cash, No Protection

Shorts giving up

Short interest in SPY and QQQ has collapsed lately.

Source: JPM

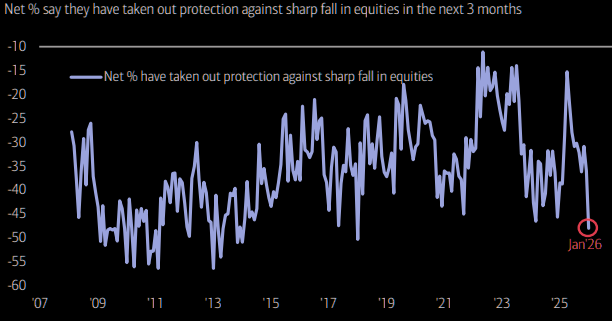

Protection is for suckers?

Almost 50% of investors in BofA's FMS haven't taken out protection against big sell offs. What could possibly go wrong?

Source: BofA

Soon…

The biggest seasonality of the year kicks in for VIX.

Source: Equity Clock

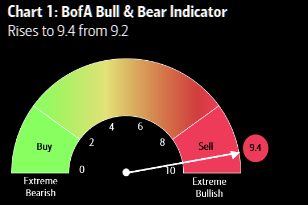

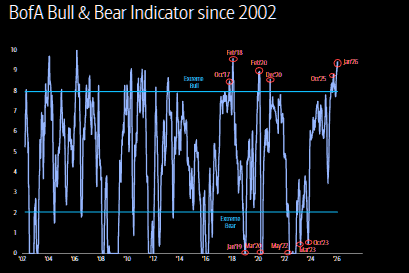

The contrarian sell

BofA's bull/bear indicator moving into even more red, extreme contrarian sell, zone. Add to this: "89% of MSCI global stock indices trading above both 50- day & 200-day moving averages this week…stocks in “overbought” territory (rule is >88% = “sell signal” for risk assets)."

Source: BofA

Source: BofA

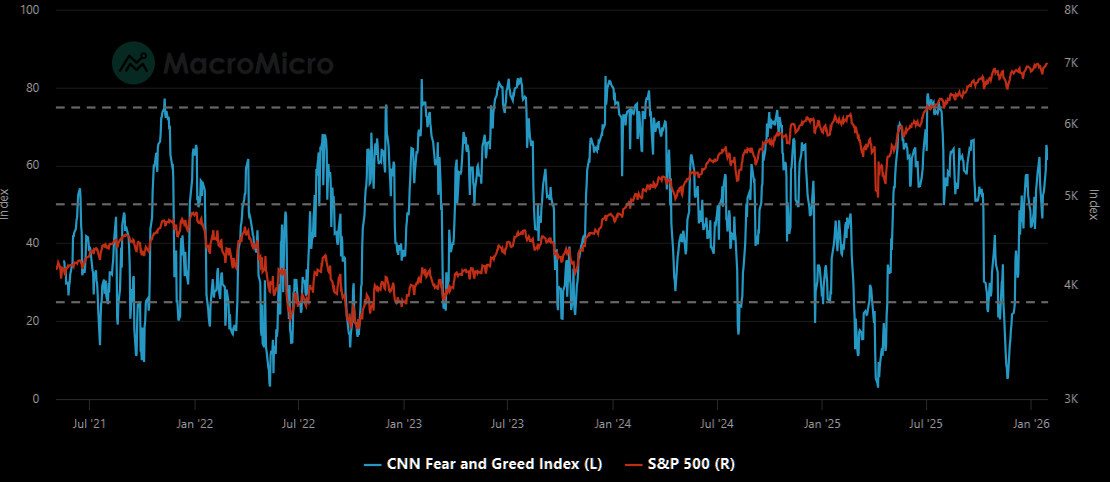

Greed

We remain trading at rather greedy levels, not extreme, but close to the highest levels in a long time.

Source: MacroMicro

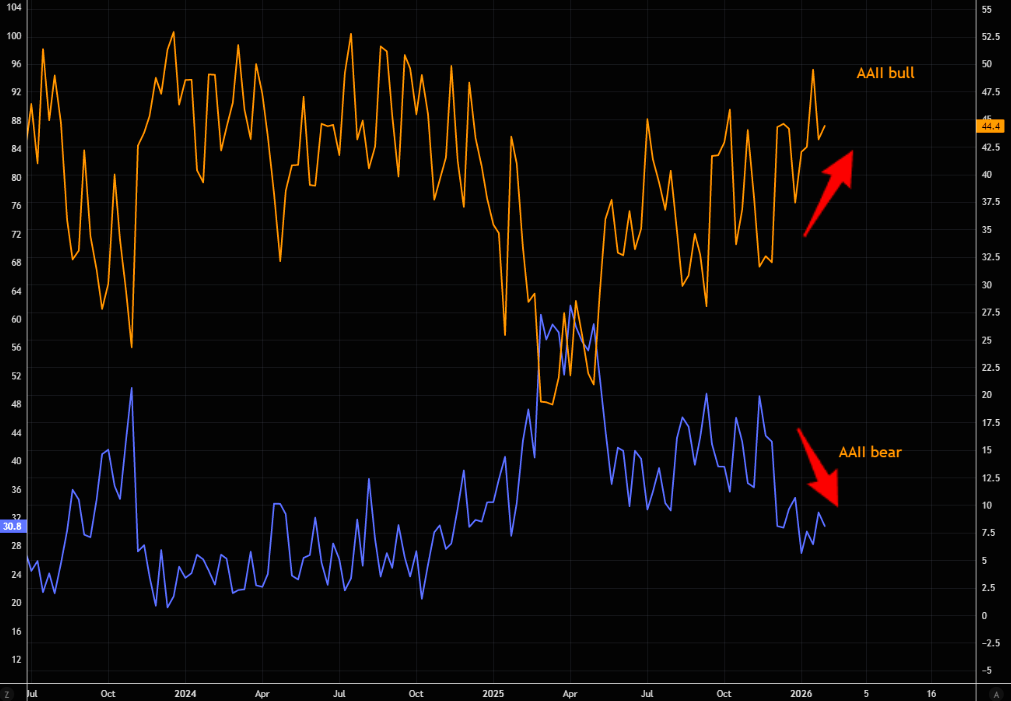

Sentiment

AAII bulls are still many, and bears few.

Source: LSEG Workspace

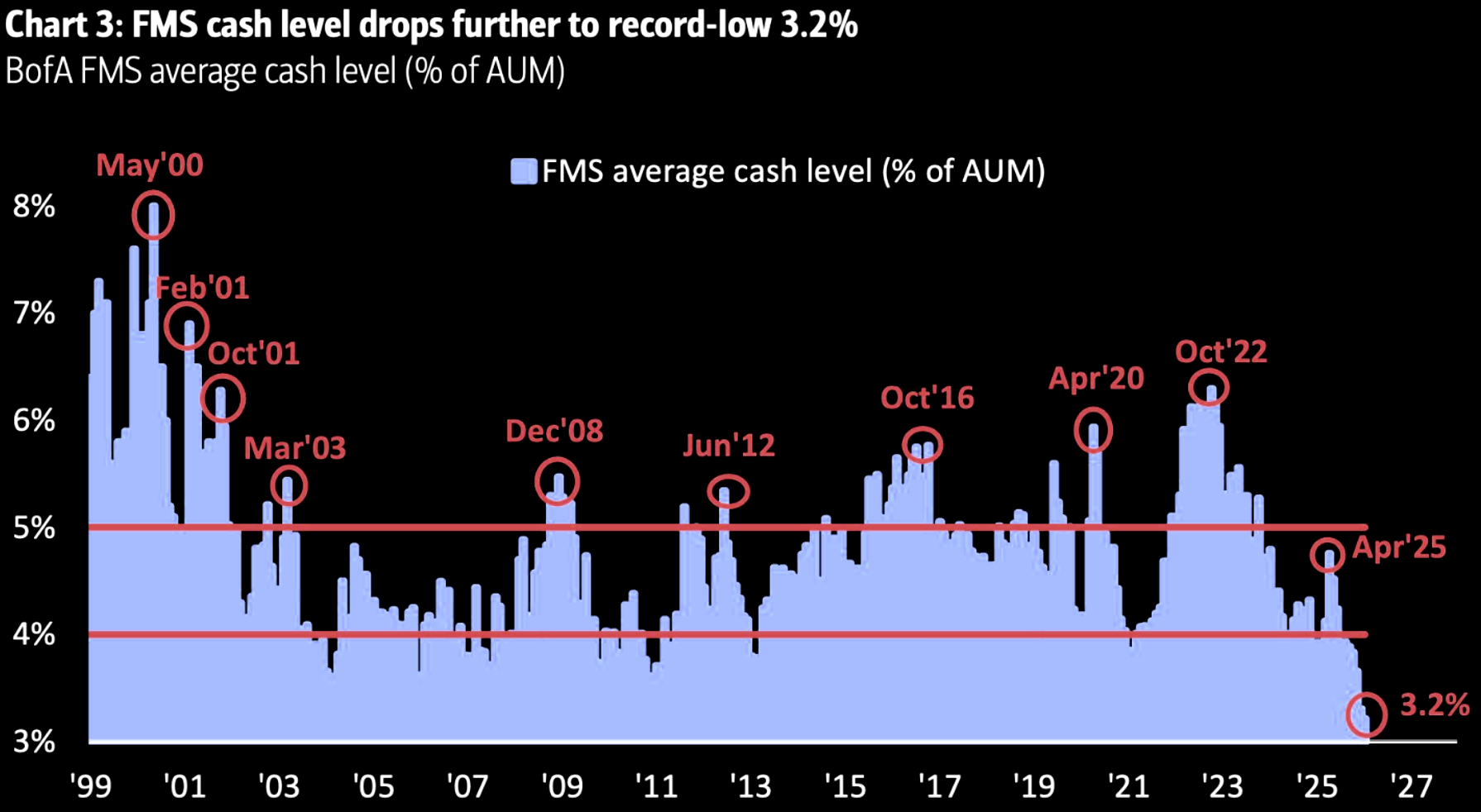

Got no cash

Record low cash pile according to BofA's latest FMS. Not the stuff you see at lows...

Source: BofA

Persistent

SPX remains stuck in the same range it’s been trapped in for months, yet the bid in skew just won’t go away. Investors keep paying up for low-delta puts, pushing skew higher. That’s usually what you see when the crowd is long, but happy to buy cheap teeny options that feel like protection but aren’t proper hedges. Worth noting: we saw a very similar skew build just before markets rolled over last year.