Nobody Owns The Right Tail

iMAGine we hold

First real up candle in weeks for MAG, right off range support. When the heavyweights turn, it matters.

Source: LSEG Workspace

Too much fear, and too little right tails

Friday poetry by McElligott: The extremely steep skew, rich downside in index puts, elevated upside in VIX, and high vol-of-vol from persistent over-hedging, looks increasingly exposed to a vol melt lower.

Despite recent de-grossing, spot equities refuse to break down. If the tape continues to hold, the setup favors a squeeze higher in equities, a rally investors likely under-own. Nobody owns the right tail.

And if the market lifts, systematic overwriters may be forced to chase as calls trade through their strikes.

Source: Nomura

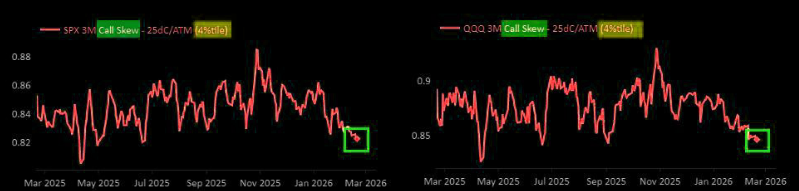

Zero upside fear?

The right tail has been crushed, with index call skew in full crash mode as “yield enhancers” aggressively sell upside premium.

The question now: could the next move be spot up, volatility up?

Source: Nomura

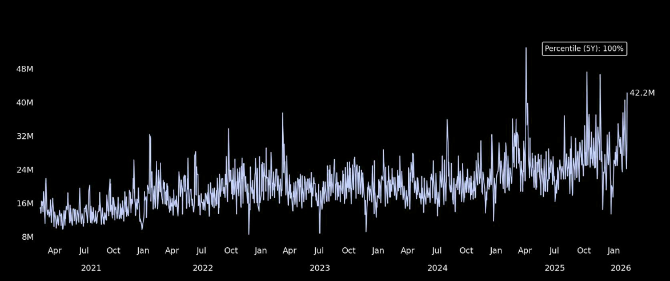

Lot of put love

Will all that premium go to waste? Don’t forget: theta bleeds, puts decay, and as downside optionality evaporates, dealers are forced to buy back deltas. That’s how hedges quietly turn into fuel.

Source: Citadel/Rubner

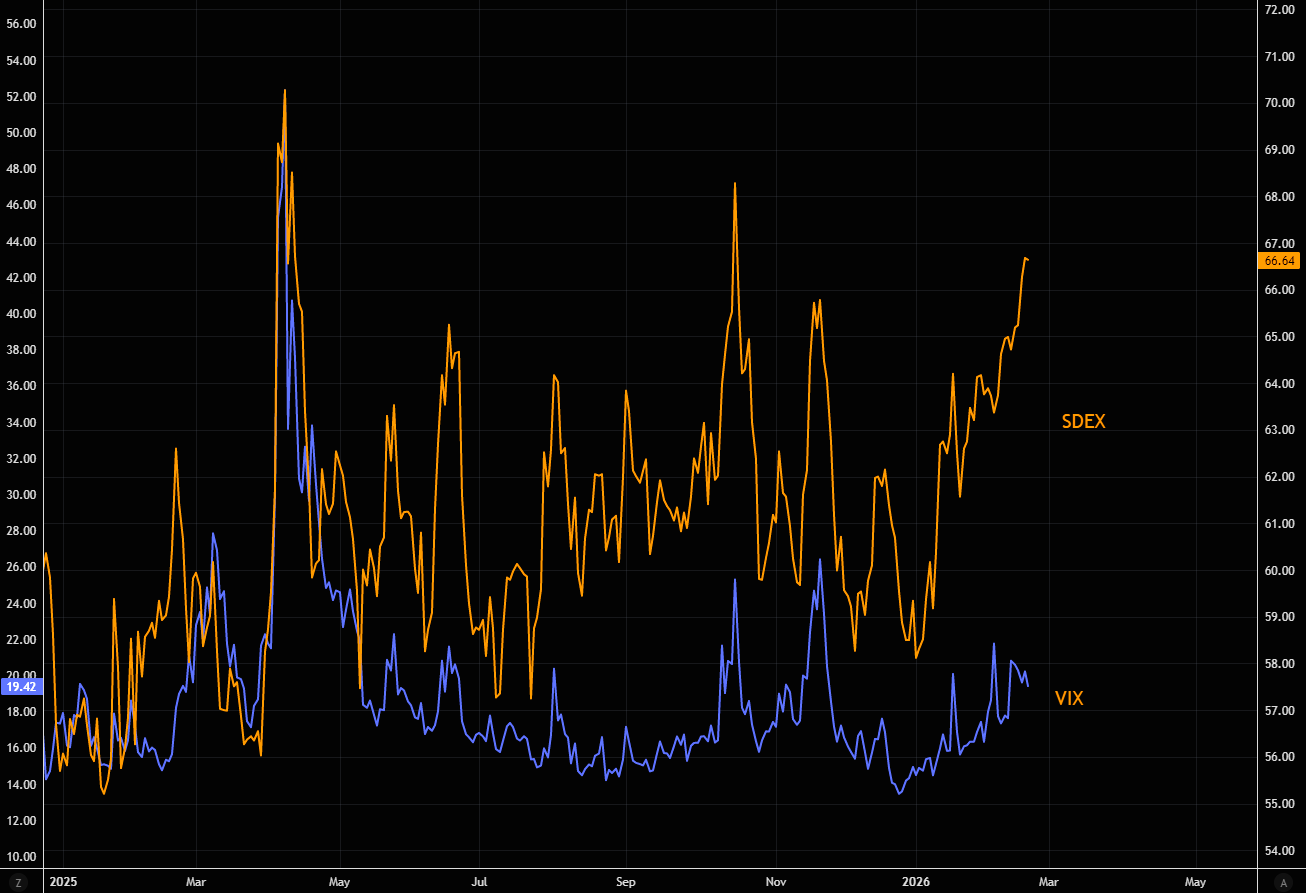

That downside protection

Skew has surged and remains at rather elevated levels. Chart shows VIX vs SDEX index.

Source: LSEG Workspace

Vol players

With 1-month volatility cratering again and 3-month volatility continuing to grind lower, vol-control strategies are generating roughly +$8.1bn of U.S. equity buying as they re-scale exposure.

Source: Nomura

Works both ways

SPX liquidity has fallen off a cliff. In this environment, even small moves risk being magnified.