Oil Blows Through The 200-Day As Upside Panic Kicks In

Black gold

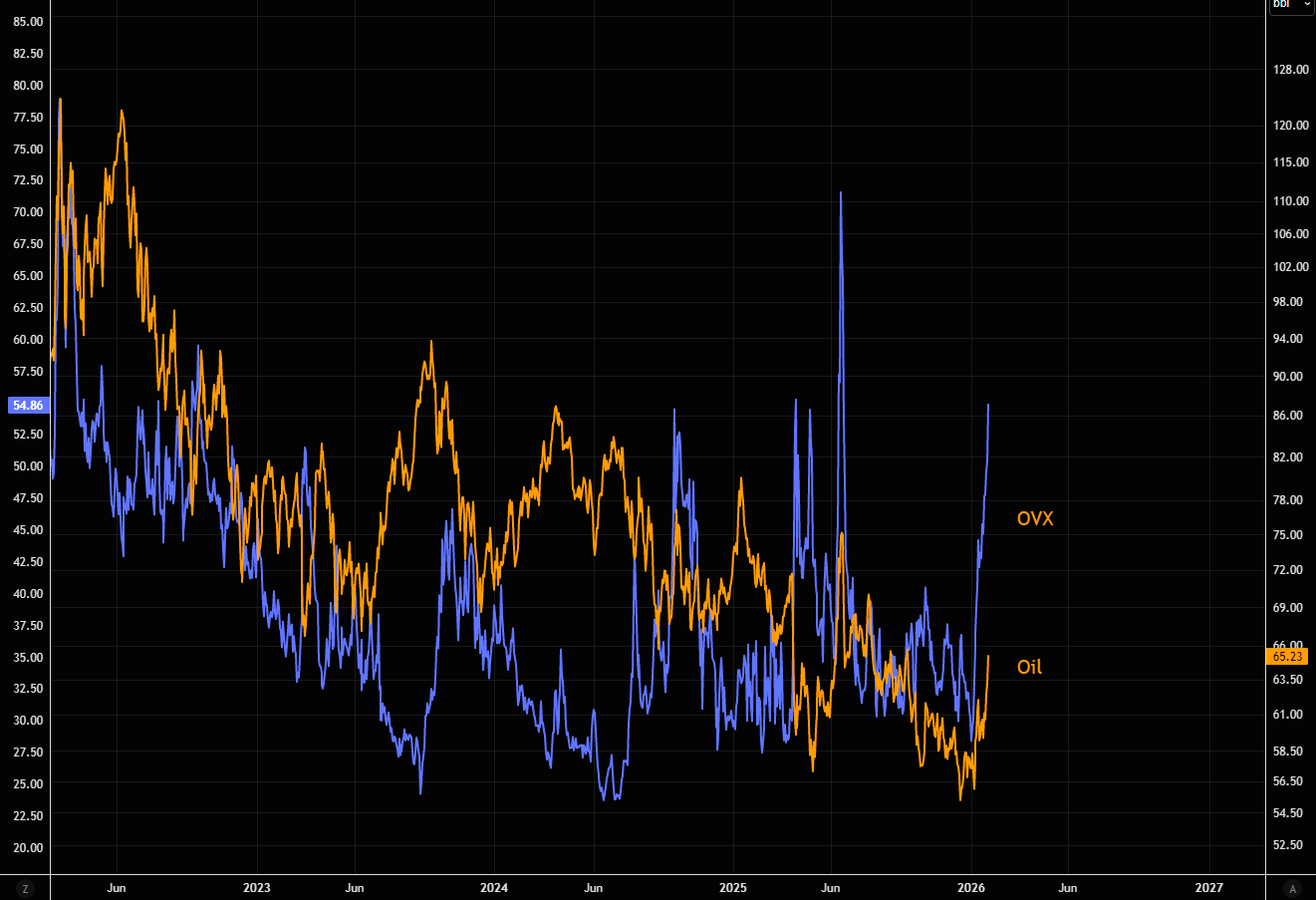

On January 9 we outlined the squeeze case for oil and we wrote: "Oil is smashing through the negative trend line. Even more notable, crude is set to close above the 50-day, something we’ve barely seen in recent months." Fast forward to today and oil is now trading well above the 200 day MA. Note we are $2 from the big negative trend line. Chasing here is getting late, although momentum is rather impressive.

Source: LSEG Workspace

Upside panic in a pic

Oil volatility, OVX, has exploded to the upside over the past sessions. This is what a furious squeeze does, forces people to chase upside exposure.

Source: LSEG Workspace

Last time we checked...

...oil was a commodity, and commodities have been in fashion.

Source: LSEG Workspace

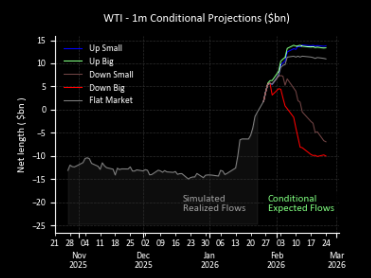

CTAs in oil

A few weeks ago, upside convexity in oil was significant. That has shifted during the squeeze as CTAs quickly chased momentum. While some upside convexity remains, the setup is no longer as clear or as attractive as it was back then, at least not from a front run CTAs perspective.

Source: GS

Imagine

Recall what Hartnett pointed out in December: "...all commodities will soon look like gold". Not assigning a very big probability to this, but still...

Source: LSEG Workspace

That inflation connection

US 10 YR breakevens surging in tandem with oil.