Oil Is Breaking Out — And The Crowd Isn’t In

Boom

Looks like Trump bottom-picked the oil low. We flagged the oil squeeze last week, and black gold has ripped higher since. Crude is now well above both the 50- and 100-day MAs, a setup we haven’t seen in ages. The downtrend is broken. Positioning says this squeeze isn’t done yet.

Source: LSEG Workspace

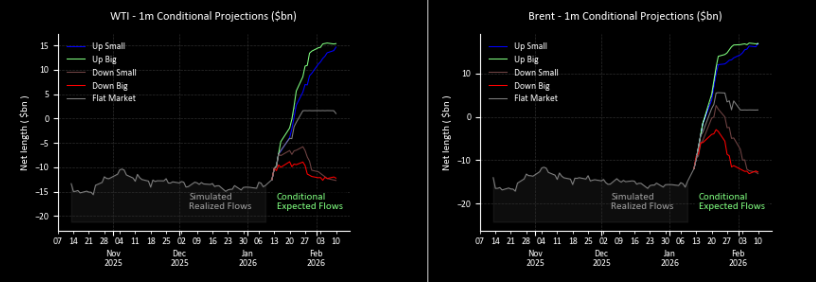

Forced to buy

CTAs must buy oil, irrespective of "emotions"...

Source: GS

Upside panic

Oil volatility continues to surge as the crowd is forced to chase upside exposure via options. That pressure naturally spills into spot prices. We haven’t seen this kind of OVX pickup since the summer squeeze. Recall what JPM pointed out last week: "Among the top ten oil reserve countries, the US (#9) has invaded Venezuela (#1); Russia (#6) is under heavy sanctions; Saudi Arabia (#2) is facing off against the UAE (#8) in Yemen; and there are riots in Iran (#4)".

Source: LSEG Workspace

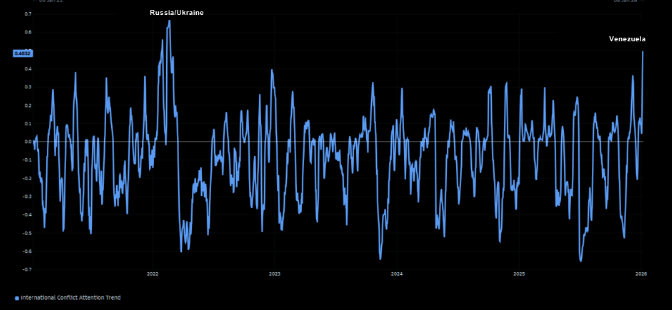

Attention

International conflict attention at highest levels since Russia/Ukraine started.

Source: GS

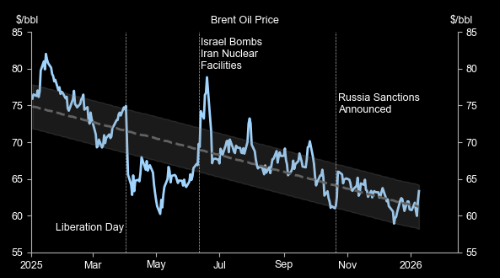

Is this time different?

Oil declined last year despite spiking repeatedly on geopolitical supply scares.

Source: GS

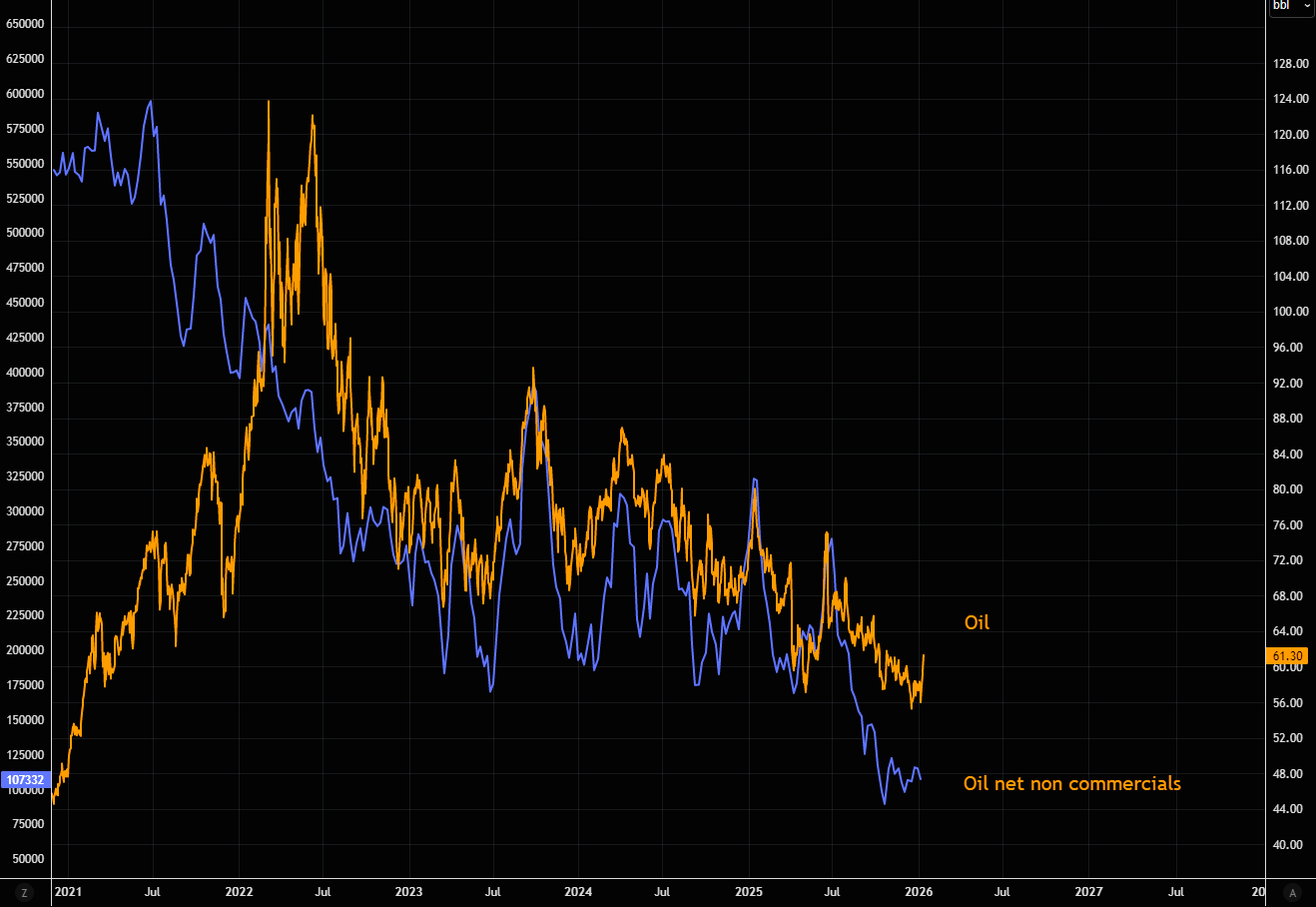

MIA in oil

The structural collapse in oil net non-commercials means longs are almost extinct.