Over-Hedged Markets, The Capex Paradox, And A Brazil Squeeze

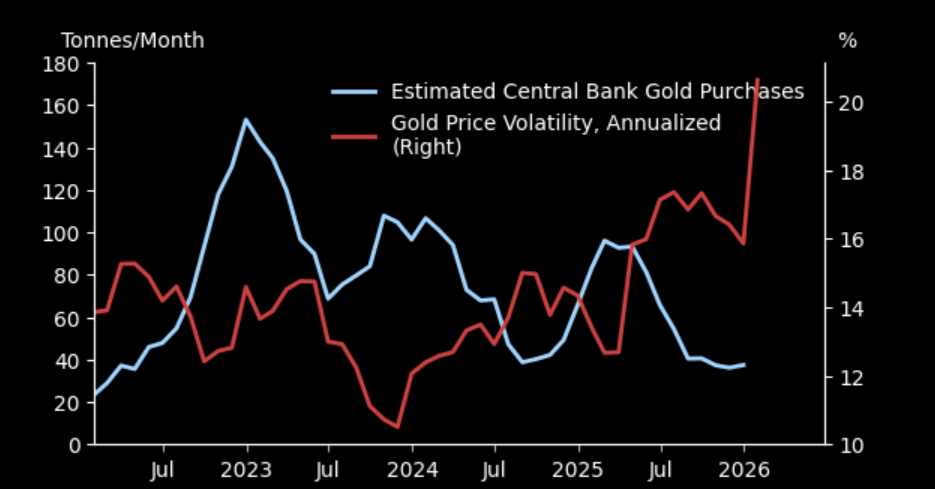

MAG holding

First real up candle in weeks for MAG, right off range support. When the heavyweights turn, it matters.

Source: LSEG Workspace

Too much fear, and too little right tails

Friday poetry by McElligott: The extremely steep skew, rich downside in index puts, elevated upside in VIX, and high vol-of-vol from persistent over-hedging, looks increasingly exposed to a vol melt lower.

Despite recent de-grossing, spot equities refuse to break down. If the tape continues to hold, the setup favors a squeeze higher in equities, a rally investors likely under-own. Nobody owns the right tail.

And if the market lifts, systematic overwriters may be forced to chase as calls trade through their strikes.

Source: Nomura

Lot of put love

Will all that premium go to waste? Don’t forget: theta bleeds, puts decay, and as downside optionality evaporates, dealers are forced to buy back deltas. That’s how hedges quietly turn into fuel.

Source: Citadel/Rubner

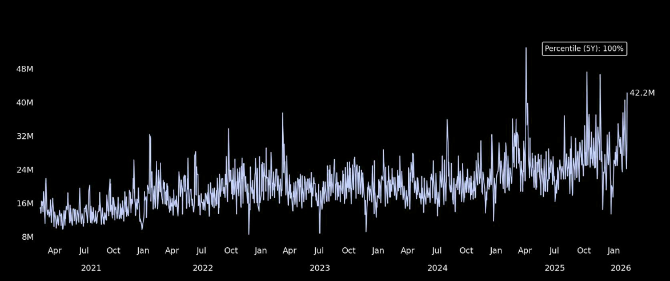

The CAPEX paradox

The Capex paradox is simple: if AI Services are commoditized but still require massive capital, who finances the spending that sustains AI Hardware demand? More great charts here.

Source: Stifel

Bull do Brasil

A little over a year ago, we flagged Brazil as one of the most bombed-out assets to watch. Since then, EWZ has surged, effectively going vertical, highlighted by the aggressive gap higher in mid-January. The fundamental story remains intact, but EWZ is now approaching a significant resistance zone just overhead. More recently, we’ve also learned that legendary investor Stanley Druckenmiller has been building a position in EWZ over the past several months. How do you play it from here?

Source: LSEG Workspace

Wanna see spot up, vol up?

Underexposed investors have been forced to chase Brazil longs via calls, leading to a surge in both price and volatility.

Source: LSEG Workspace

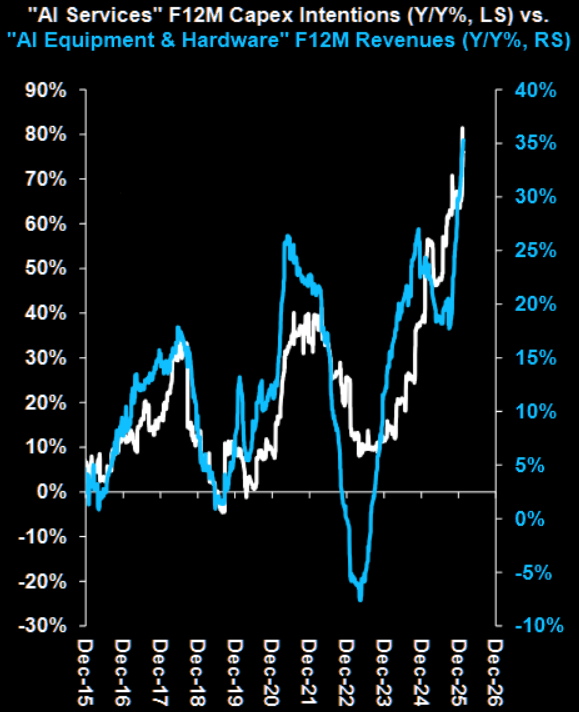

Growth pricing

GS: "Growth pricing still below our forecasts". More from Goldman's Dominic Wilson here.

Source: Goldman

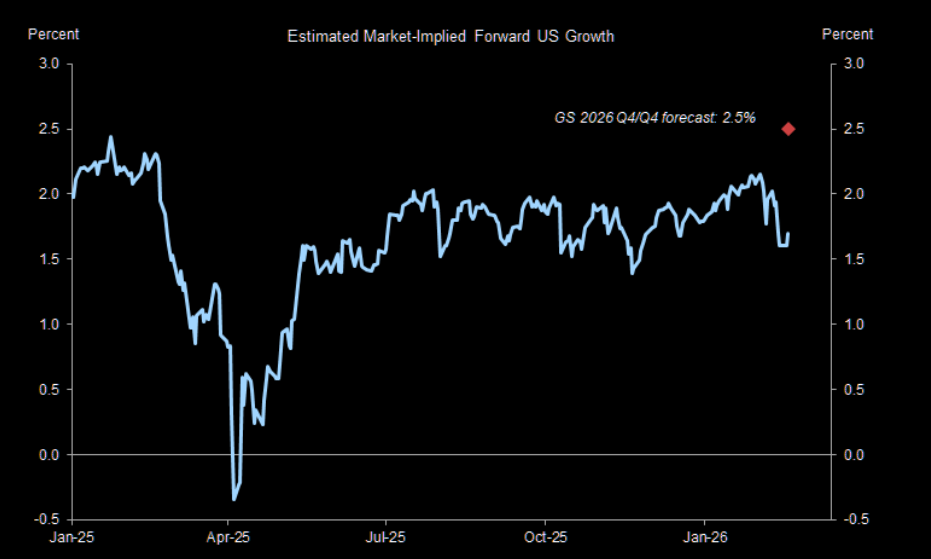

Slowdown in central bank demand

"The rise in volatility, in turn, has led to a slowdown in our central bank demand nowcast (22 tonnes in December 2025, with the 12-month average now at 52 tonnes), which we see as temporary." More on gold here.

Source: Goldman

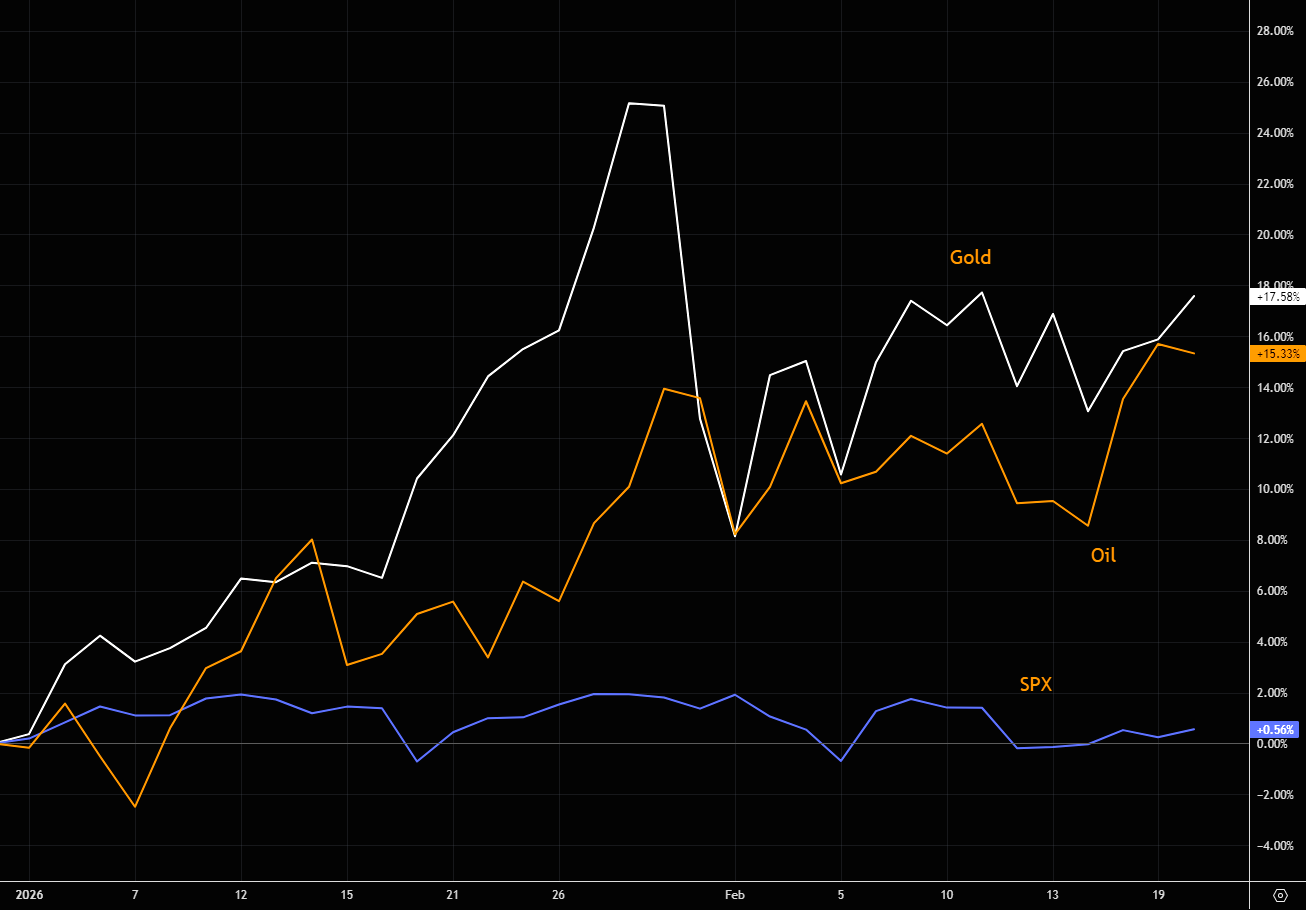

Oil and geopolitics

Following geopolitical shocks over the past 90 years, oil has been the best performer over the subsequent three months (up 18%), followed by gold (6%) and U.S. stocks (4%).

Six months out, gold continues to outperform (up 19%), equities stall, and oil typically reverses its initial gains. Conclusion: trade oil, own gold. (Hartnett)

Source: LSEG Workspace

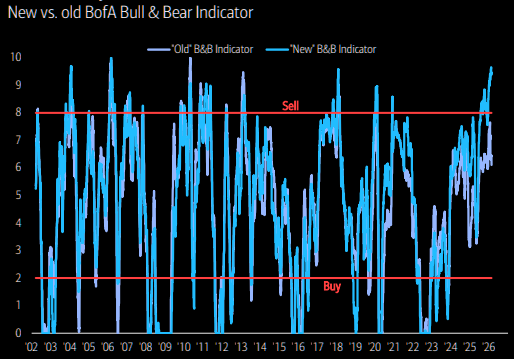

Can you dismiss this one?

The Bull & Bear Indicator moved above 9.5 on February 3rd, a level seen only three times in the past 25 years (Jan 2004, Mar 2006, Jan 2018).

In those prior instances, over the next three months, the median maximum drawdown was -4.3% for ACWI, -5.5% for the S&P 500, and -8.6% for the Nasdaq.