Range-Bound Stocks, Restless Vol

Still stuck

SPX remains stuck in the range that’s been in place since October. We outlined our long VIX logic some time ago, and volatility has risen steadily since then, making the trade less attractive at current levels. That said, the Fed meeting is approaching, and the déjà vu from last year remains a non-negligible risk.

Source: LSEG Workspace

Trending

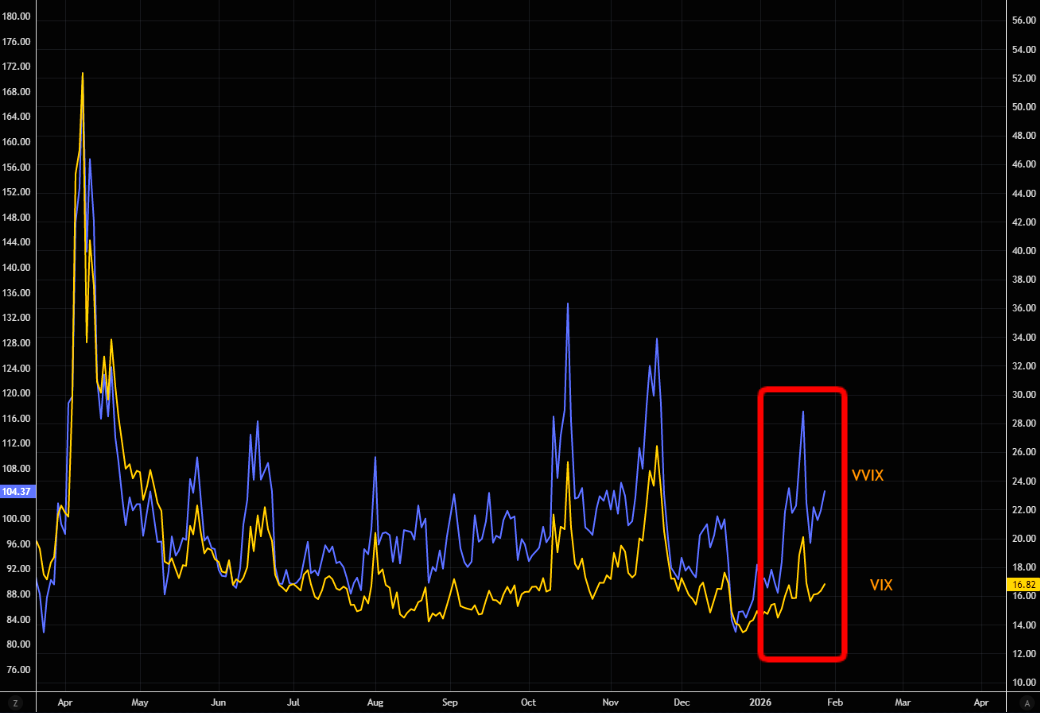

Despite ATHs and things feeling "rosy", VIX has been trending higher. "Big brother", VVIX, has actually surged.

Source: LSEG Workspace

Hello old friend

Spot up, volatility up showing up lately.

Source: LSEG Workspace

Skew on the rise

Rising SPX and skew well bid. Watch this closely as rising skew means people are paying up for protection.

Source: LSEG Workspace

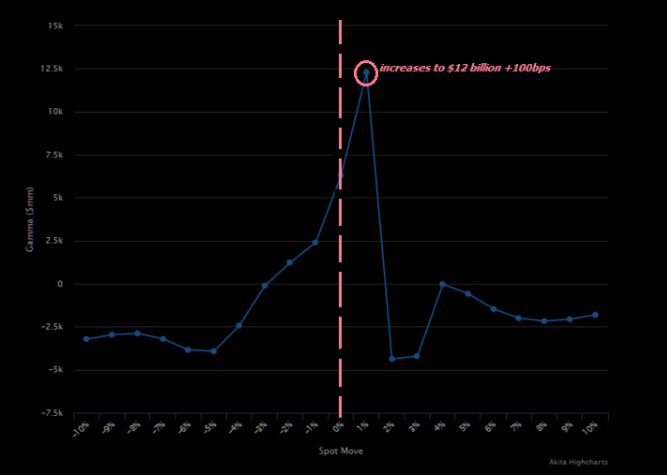

Peak gamma

Almost tried what Goldman's Garrett pointed out: "gs futures strats calculate $6bn of long gamma at spot, which increases to $12bn long gamma +100bps higher... in english, a 100bps rally in spx cash creates supply of ~35,000 e-minis from market makers". Worth noting is that gamma rolls off rather quickly should we move up/down 2%.

Source: GS

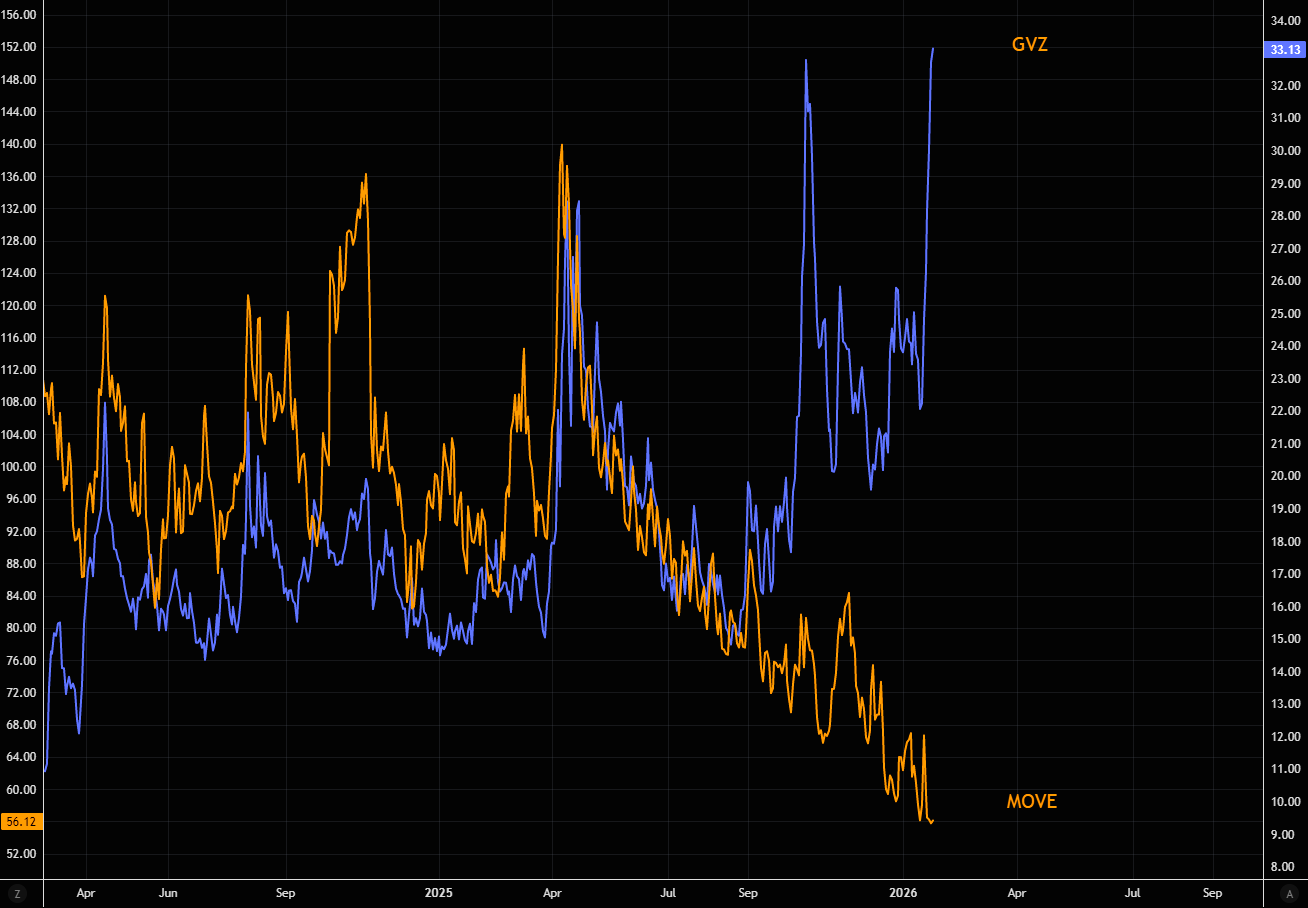

THE vol Jaws gap

Bond volatility in full meltdown mode still, while gold volatility is pricing something totally different. Can both be right going forward?