Rates on the MOVE - And the Market Isn’t Buying the Fed

That was quick

The latest move higher in rates is the most aggressive squeeze since July. We’re now well above the negative trend line and have closed above the 100-day, though still below the 200-day.

Source: LSEG Workspace

Zoom out

The 10-year has been stuck in a range for years. A close above 4.2% could trigger a further squeeze, though there’s no clear longer-term trend in place right now.

Source: LSEG Workspace

Achtung

Germany's 10 year has been on fire since the powerful breakout a few sessions ago. Note we are well above the 200 day. Chart 2 shows the longer term view. 3% is the "magical" level.

Source: LSEG Workspace

Source: LSEG Workspace

US the laggard

Nobody has missed the moves in Japanese rates. Germany has "joined", while US is trying lately.

Source: LSEG Workspace

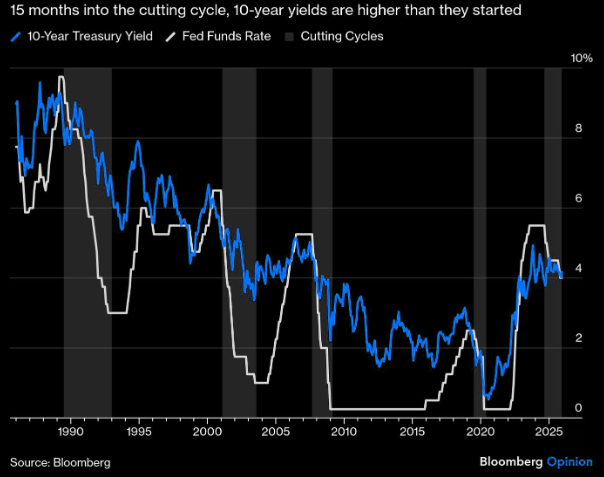

They aren't listening

Traders aren't listening to the Fed. Authers writes: "The market could always be wrong, but this suggests extreme dubiousness about the scope for aggressive easing. And it’s happening even though the market is convinced that the administration will get itself a more dovish Fed once next year’s changes to regional presidencies and the chairmanship have gone through."

Source: Bloomberg

On the MOVE

Bond volatility catching some bids as FOMC approaches...

Source: LSEG Workspace

MOVE matters

SPX dislikes rising bond volatility. Chart shows SPX vs. MOVE (inv).

Source: LSEG Workspace

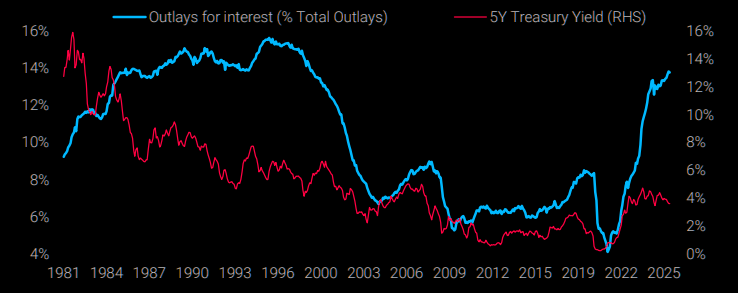

Lastly... on that interest rate cost

Treasury can’t afford a rise in financing costs: interest already consumes ~14% of federal outlays. In the early 1990s it was higher, but five-year yields were 6.1% vs. 3.7% today. A move toward 6% feels distant, yet if growth and inflation reaccelerate and markets price hikes despite Fed guidance, a sharp curve steepening is next. That process could begin as soon as May, once a new Fed Chair pulls the terminal rate forward, unless the current slowdown extends into next year. And a 20% tariff tax, however it’s absorbed, won’t boost economic activity. (Blitz)