Remember Fear?

Remember fear?

We’ve been laying out the logic for volatility to rise over the past week, positioning was complacent, spot was flat, and the pressure was building underneath. Now the cracks are starting to show, particularly in tech, where volatility metrics are flashing stress signals across the board.

Tech stress

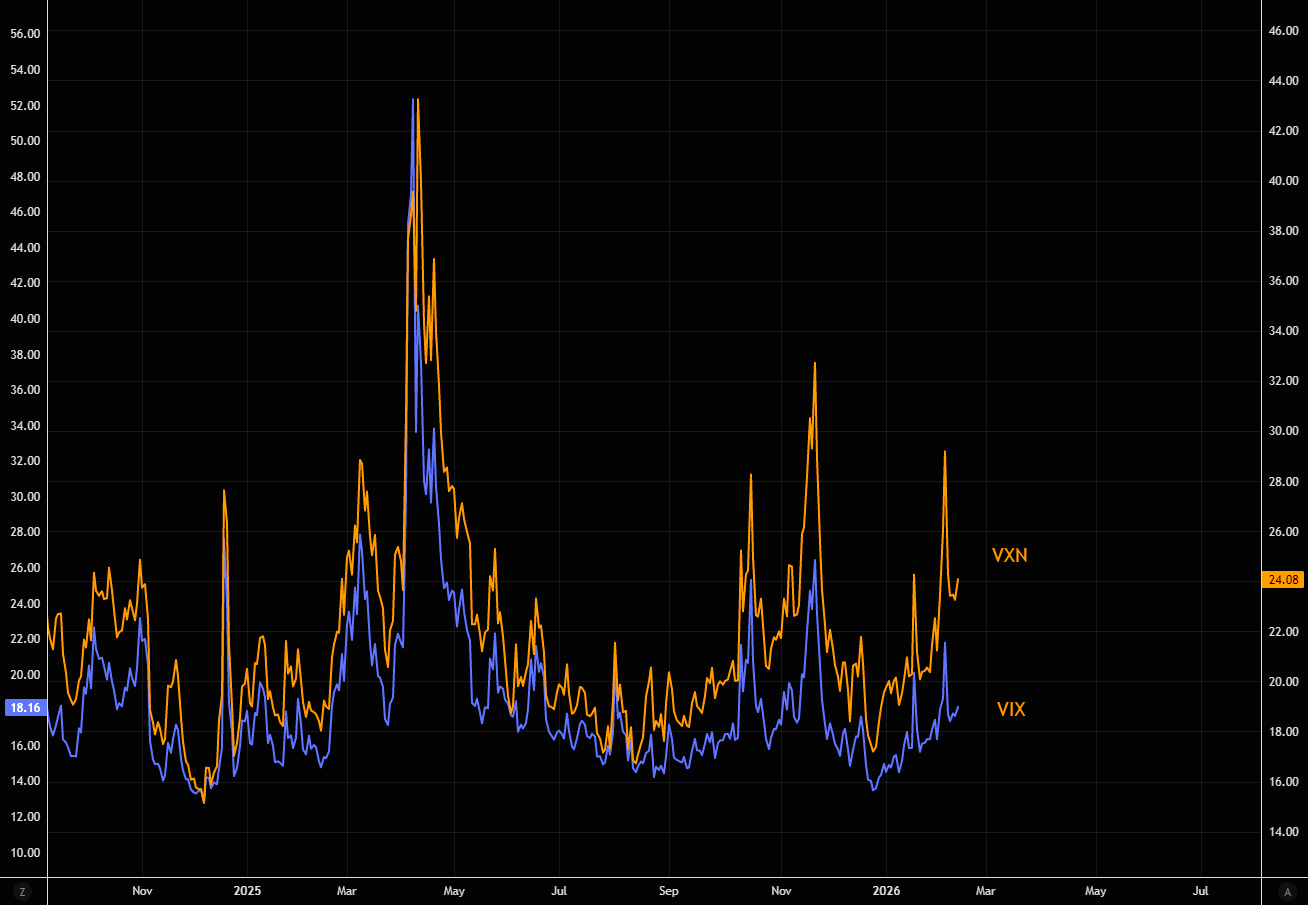

VXN continues to trade at a historically wide premium to VIX, highlighting persistent stress in tech. The divergence underscores how concentrated the pressure remains beneath the surface.

Source: LSEG Workspace

Trending higher

VXN vs VIX ratio has trended higher since the summer.

Source: LSEG Workspace

There is a connection

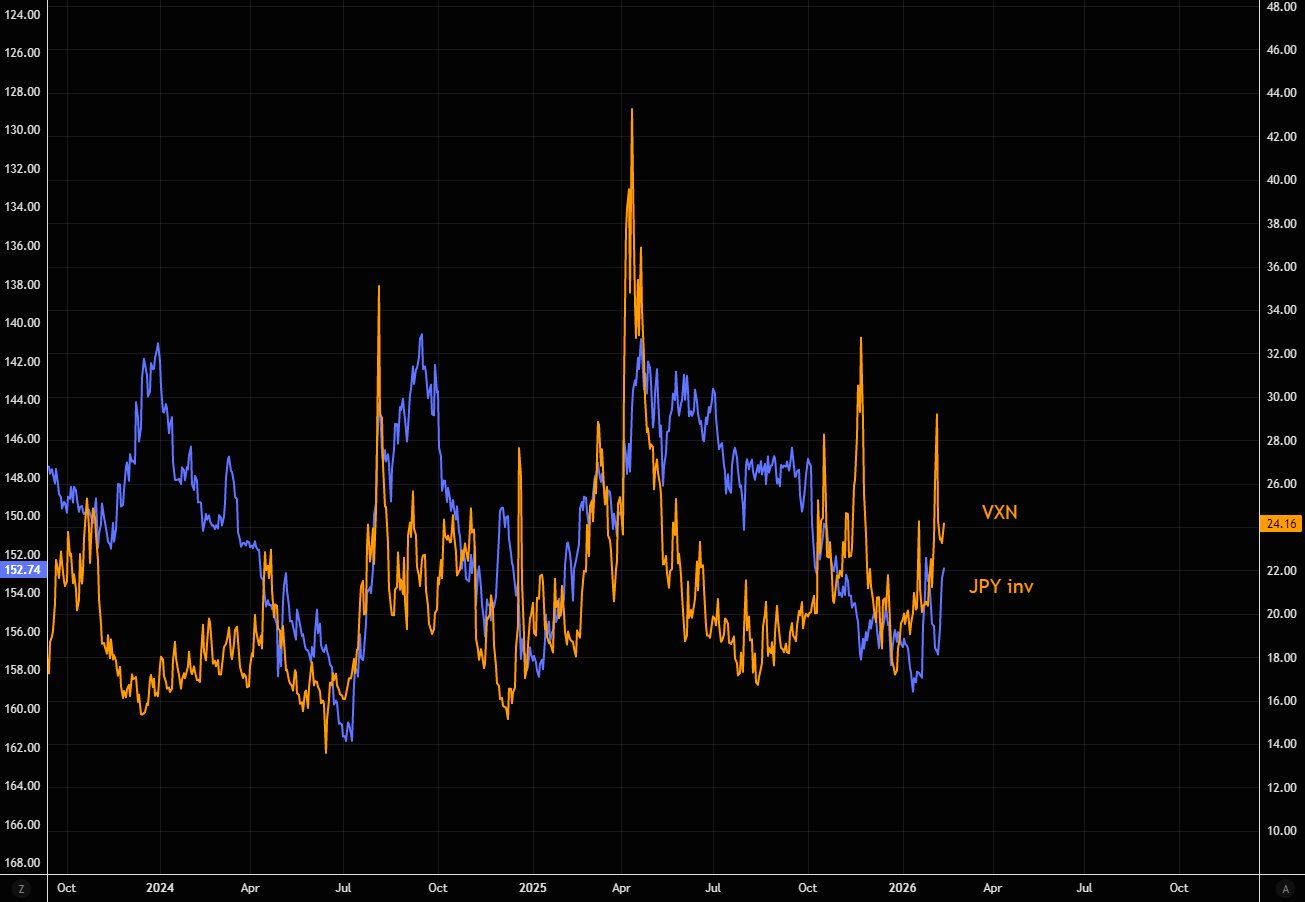

There is a strong connection between the JPY as a carry trade and tech. NASDAQ volatility has picked up most of the sharp JPY appreciations over the past years.

Source: LSEG Workspace

Skew you

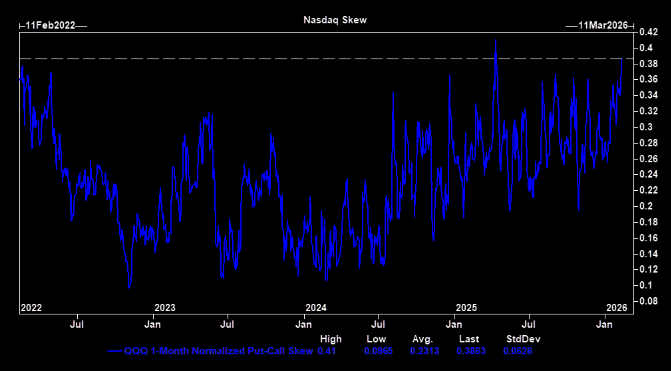

We’ve been flagging the sharp rise in SPX skew over the past few weeks. The move has been aggressive, especially considering SPX has gone nowhere for months, a clear sign of building under-the-hood stress.

Source: LSEG Workspace

NDX as well

NDX put-call skew has exploded higher, now trading not far from Liberation Day panic levels. The crowd is nervous about tech downside.

Source: LSEG Workspace

Got hedges?

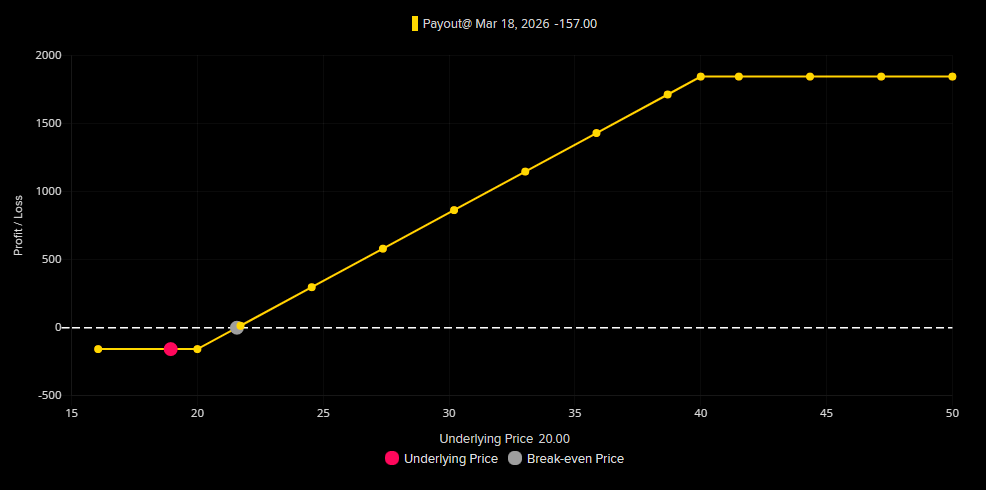

For those nervous about another pullback over the next month, VIX call spreads remain one of the cleanest hedges on the board.

Structure GS derivs team likes:

VIX 18 March ’26 20 / 40 call spread costs $1.45 (ref 19.32f), offering roughly 13x max payout if fully in the money.

Source: LSEG Workspace

Could get "nasty"

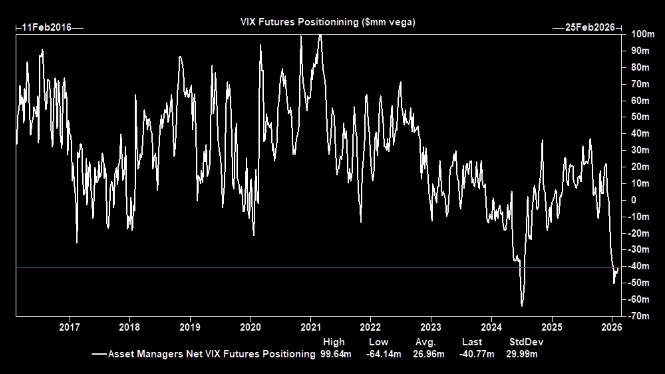

VIX shorty is rather aggressive here...

Source: GS

Would be perfect

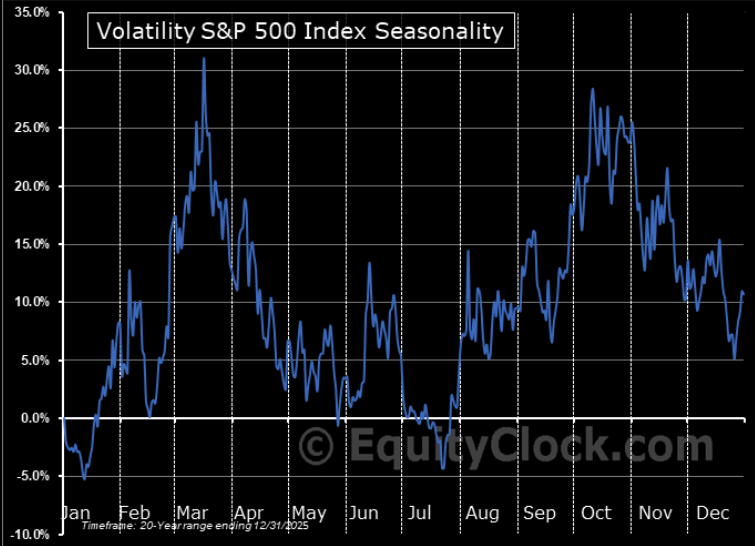

VIX seasonality from here is very strong...