The Risk-On Reflation Trade Is Back

The flow to know

Prime brokers are singing the same tune: risk is back. Industrials and banks are being bought aggressively, leverage is climbing, shorts are getting squeezed, and reflation trades are heating up. It’s not full euphoria yet, but the re-risking is no longer subtle.

Risk-on reflation: Buying industrials

GS Prime: "Global Industrials stocks saw the largest net buying on our record, driven entirely by long buys. It’s worth noting that both gross and net exposures in Industrials (as % of total US Prime book) are now at the highest levels on our record (since 2016)."

Source: GS Prime

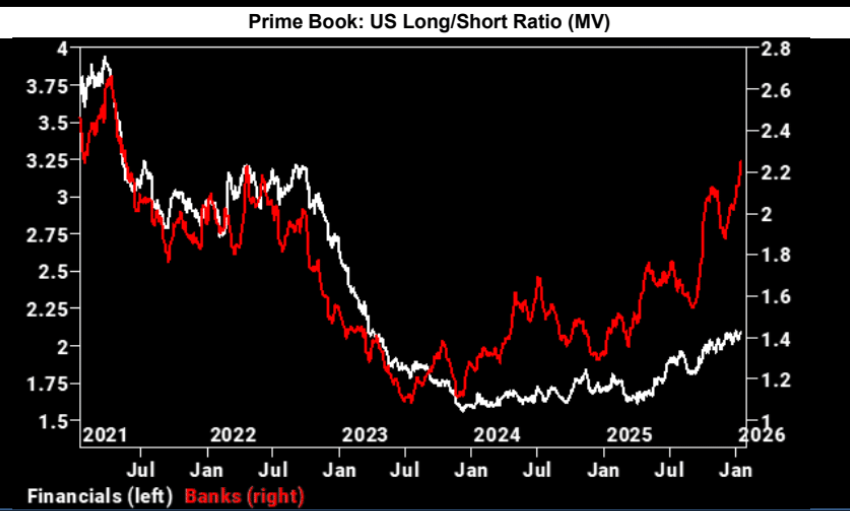

Risk-on reflation: Buying banks

GS: "US Banks long/short ratio now stands at 2.24, which is hovering 3-year highs and ranks in the 93rd percentile vs. the past five years."

Source: GS Prime

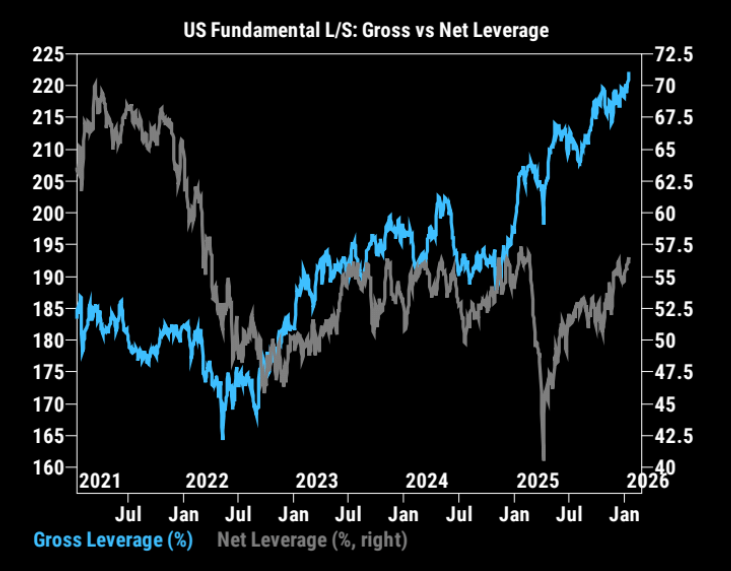

Reflation re-risking

GS Prime: "US Fundamental L/S Gross leverage rose+2.7ptsto 222.3% (100th percentile one-year) ,while US Fundamental L/S Net leverage rose+0.6pts to 55.9% (89th percentile one-year)."

Source: GS Prime

Short squeeze

MS QDS: "Pressure building in highly shorted names."

Source: MS QDS

Back to early December levels

JPM: "...our broader US Tactical Positioning Monitor saw another 1wk increase of +1.5z, which has extended the 4wk metric to +1.7z, which puts it back to where it stood in early Dec. Additionally, the level of positioning is back up to +0.6z or 81st %-tile since 2015. Some of the key drivers of the increases recently are a combination of ETF and Retail flows."

Source: JPM

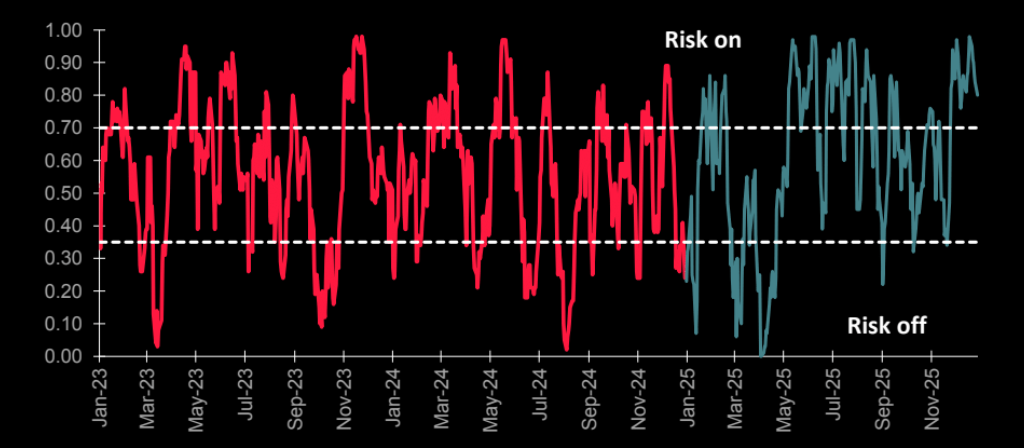

A permanent risk-on

Soc Gen Cross Asset: "The SG Sentiment Index hit zero just after ‘Liberation Day’, signalling a risk-on reversal, and then rarely re-visited a risk-off period there after."

Source: Soc Gen Cross Asset

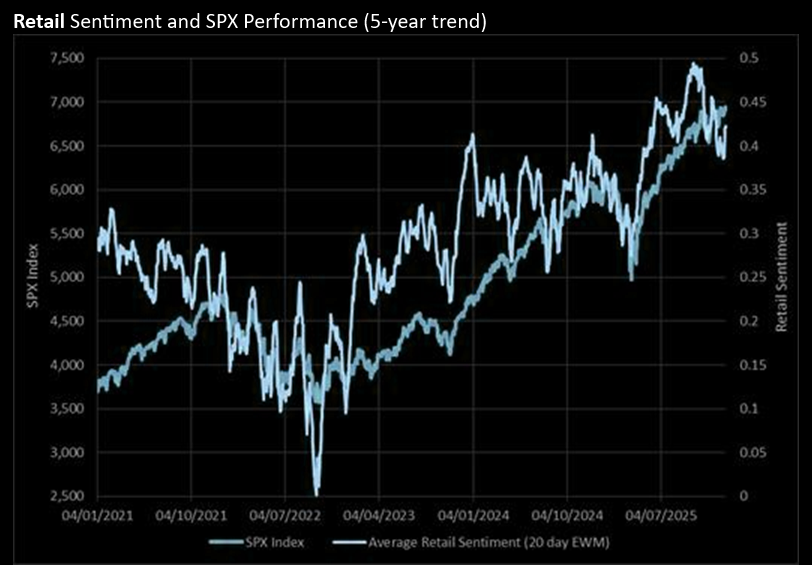

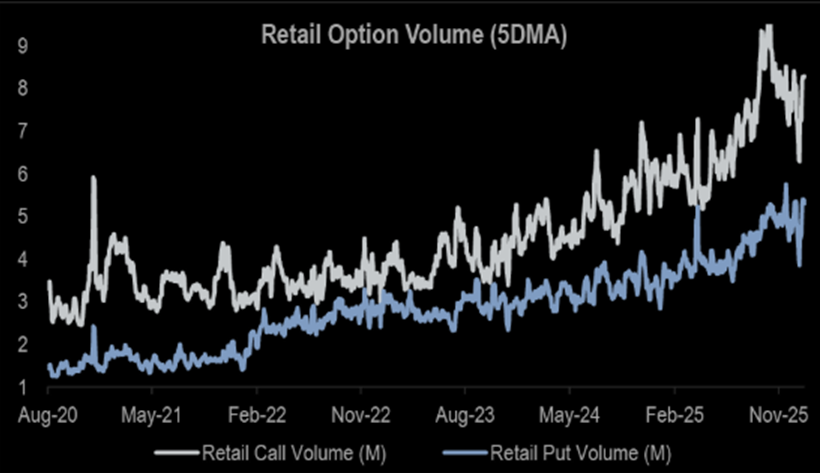

The Retail Roar

JPM: "...retail sentiment (per our Data Intel team) does not appear to be back to highs yet…"

Source: JPM

Retail call option activity

JPM Quant: "...and Retail Call Option Volumes (per JPM QDS) are not yet back to extremes."

Source: JPM Quant

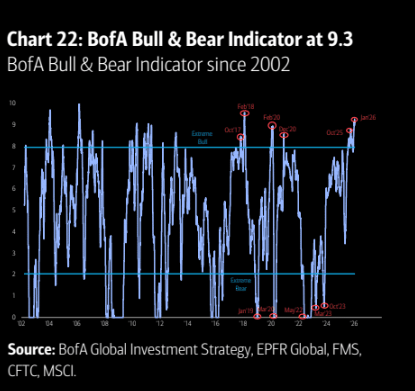

Red alert

Hartnett: "Our BofA Bull & Bear Indicator is at 9.3 signal which is a sell."

Source: Harnett

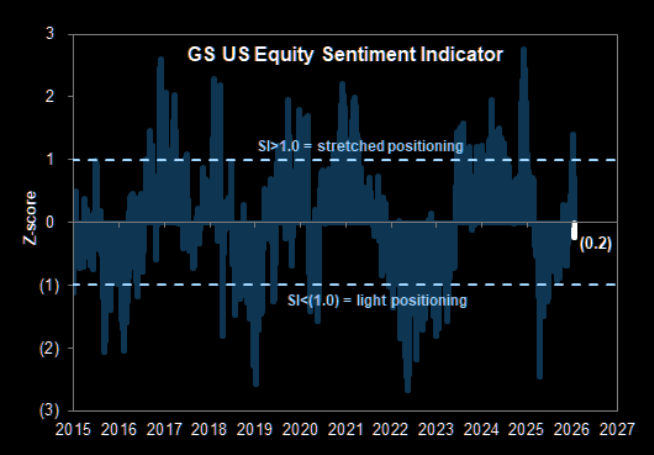

What...?

GS US Equity Sentiment Indicator of investor positioning does not make sense at all. Fire the intern.