Russell Takes a Much-Needed Pause — But The Bull Isn’t Done

Extended

The Russell is reversing near the upper end of its large trend channel, a normal pause after the powerful squeeze in small caps. Note how extended Russell still remains above the 50-day MA.

Source: LSEG Workspace

Too much too fast?

The IWM/QQQ ratio has moved aggressively higher over the past 2 months. We are seeing a much needed pause.

Source: LSEG Workspace

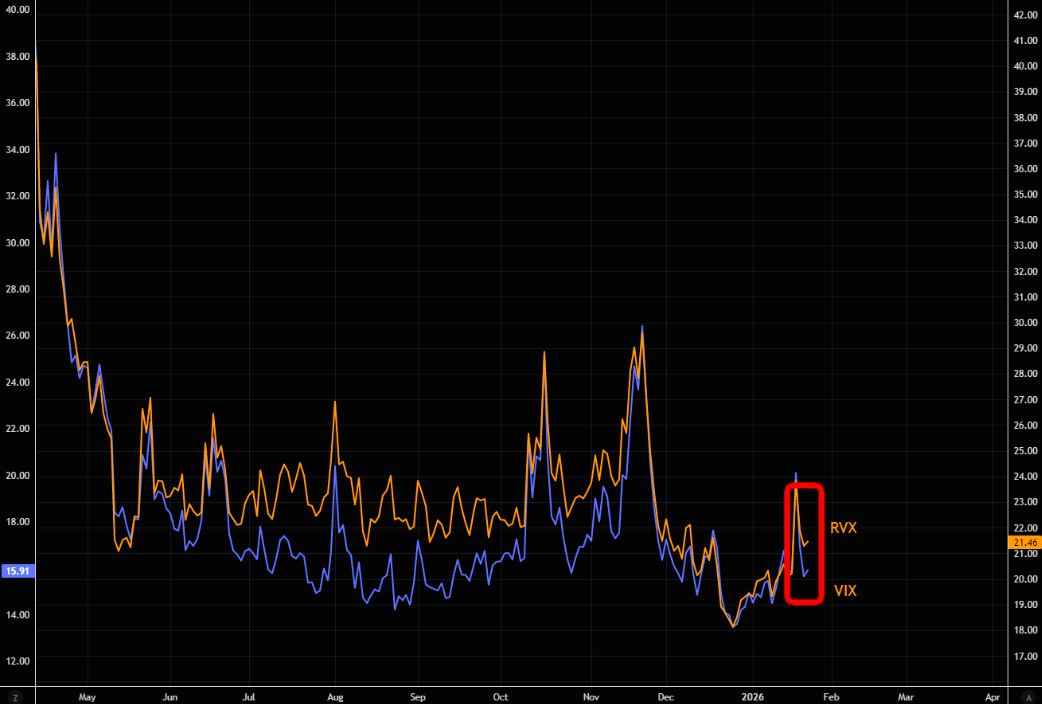

Haven't seen this in a while

Russell volatility trading with a gap vs VIX for the first time since mid November.

Source: LSEG Workspace

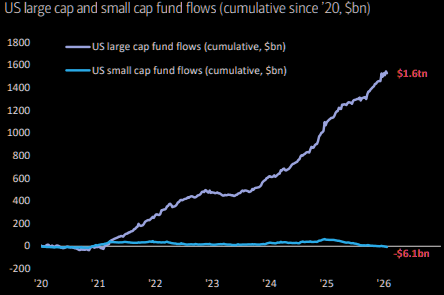

Room to move

An ugly Russell candle to end the week, but zooming out, the setup still leaves room for further upside if rotation starts to pick up more meaningfully "decade-to-date $1.6tn inflow to US large cap vs. $6.1bn outflow from small cap" (BofA)

Source: BofA

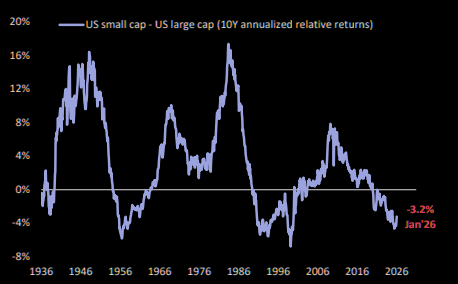

Recent Russell squeeze

Zooming out again for some longer term perspective.

Source: BofA

Trump pivoting

With approval slipping, Trump is pivoting aggressively to address affordability through direct government intervention rather than traditional monetary, fiscal, or trade policy. The strategy targets corporate margins, energy, healthcare, credit, housing, and power, shifting pressure from “big” incumbents toward smaller and mid-cap beneficiaries. This strengthens the case for small and mid-caps as the Main Street, reshoring, and manufacturing trade into the midterms.