Sell Low, Buy High - And Ignore the Code Red?

Two weeks of "agony"

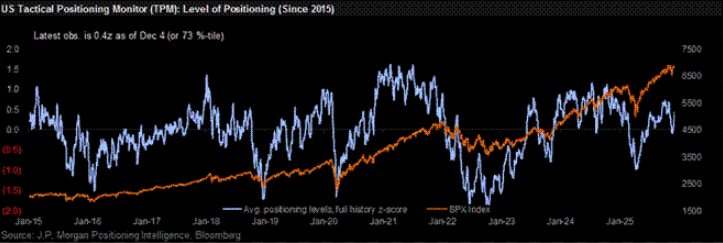

Two weeks ago positioning was falling, HFs were net sellers, hedging was picking up, CTAs were cutting exposure, and Retail flow was fading. Shorts were working, and HF alpha held up. Now everything has flipped, buying has surged across cohorts, the 1-week change in JPM's US Tactical Positioning Monitor is at +3σ, shorts are squeezing, and North America HF performance has turned tougher MTD.

The sharp swing from negative to strongly positive positioning leaves the market vulnerable if the Fed is very hawkish next week. But before you get too bearish, historically, big flips like this, late 2023 and late 2024, have tended to precede further market gains. (JPM market intelligence). Full note here.

Source: JPM

This is new

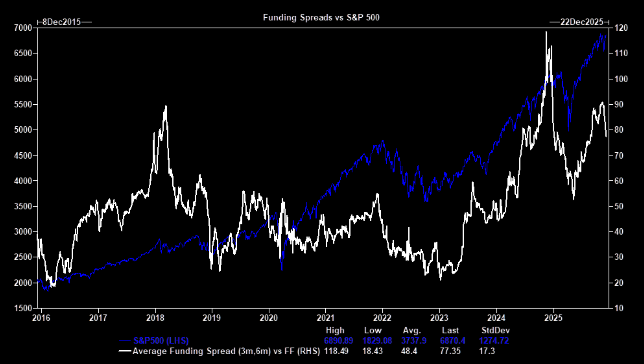

Professional investors have faded this last rally...at least judging by the funding spreads.

Source: GS

Panic gone

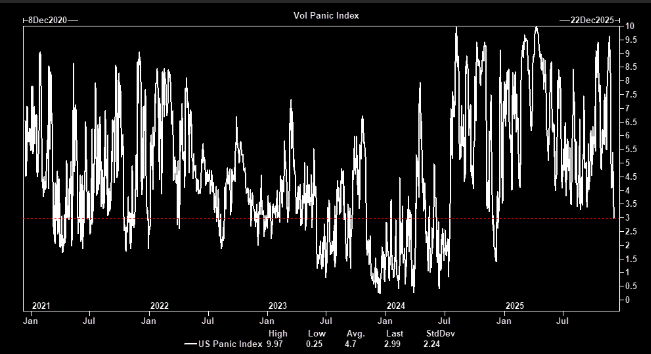

US volatility panic index at year lows basically.

Source: GS

CTA Corner

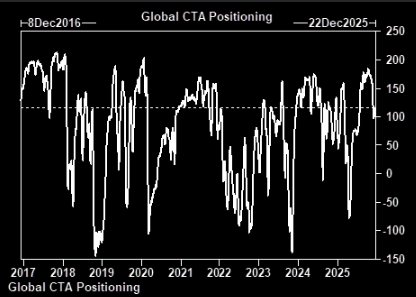

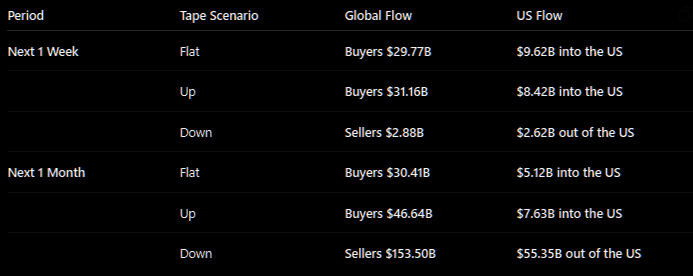

Systematic flows have flipped into a clear tailwind for US equities according to GS. Over the next week, CTAs are projected to be buyers in every scenario. The cohort now sits long $116bn globally (75th percentile) and long $45bn in the US (79th percentile). Thresholds are: ST: 6754, MT: 6512, LT: 6070.

Source: GS

Source: GS/TME

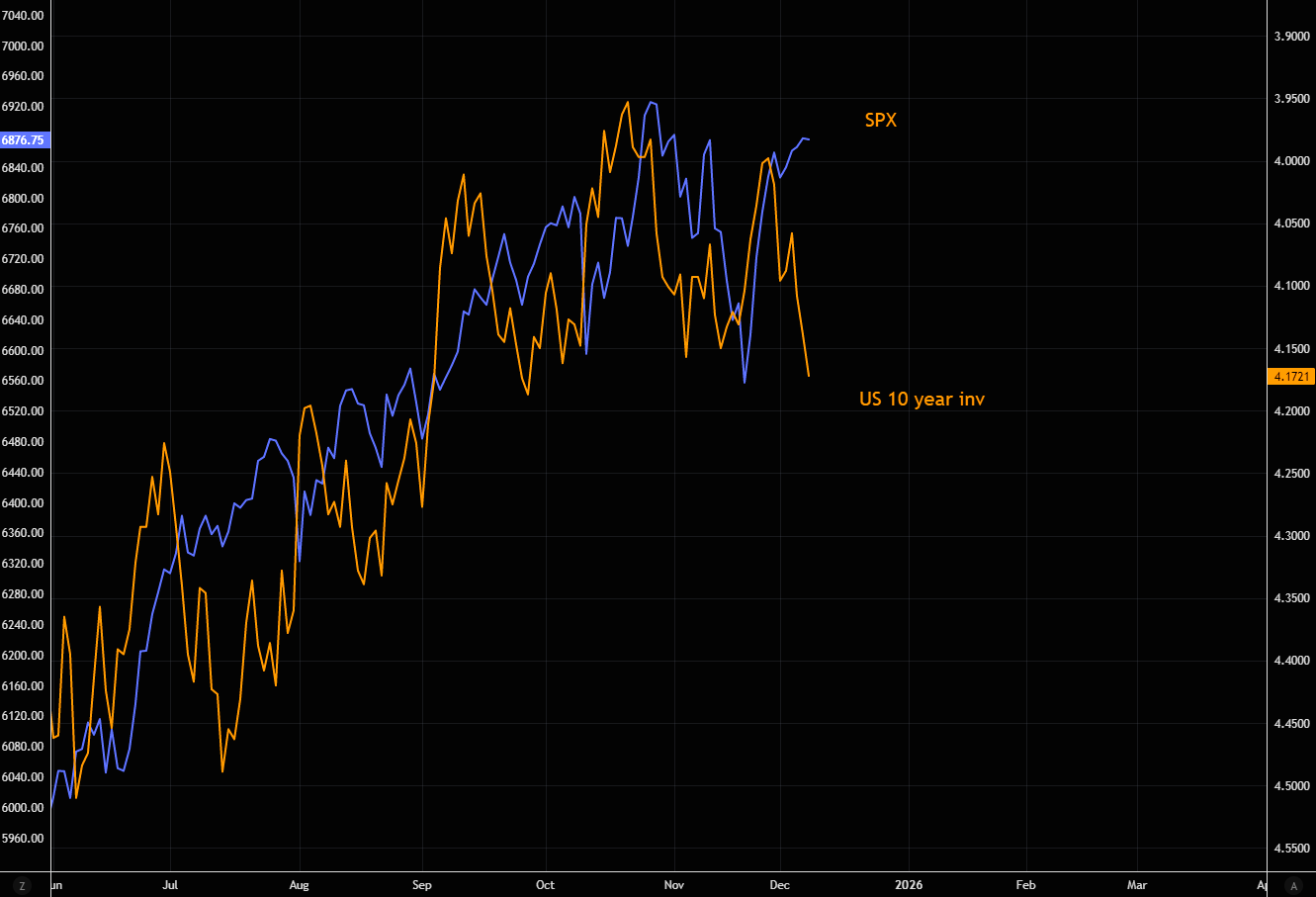

Remember the 10 year?

SPX and the US 10 year (inverted) have moved in tandem for months. The latest gap is getting rather wide. More bond charts worth watching here.

Source: LSEG Workspace

This could be the mother of all break-outs

"Over the past 150 years, U.S. growth has stayed remarkably close to a 2% trend even with past technological revolutions. We think it’s conceivable that accelerating AI-driven innovation could boost growth above that trend."

Source: BlackRock

Terrific tech

"U.S. tech mergers rebounded to their highest levels since 2021 this year, driven by big bets on AI and more tie-ups under a deal-friendly presidential administration. Total tech merger value reached $543 billion, more than the combined value of the past two years". More here.

Source: The Information

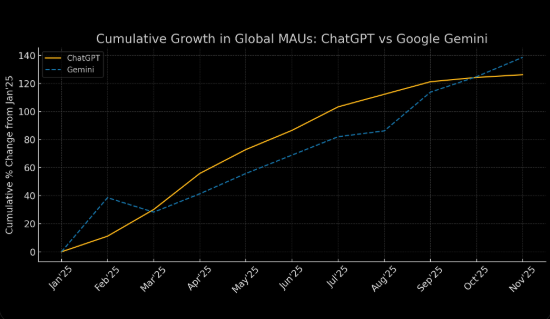

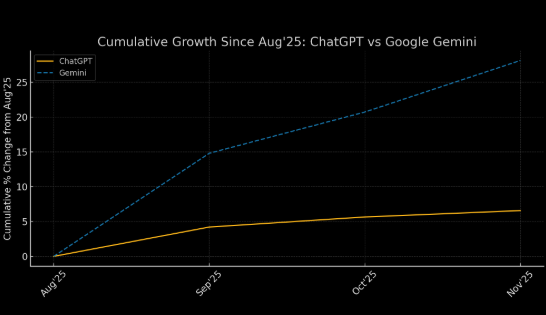

On that code red

ChatGPT’s global MAUs grew only ~6% from August to November, reaching about 810M, a pace Sensor Tower says may signal saturation. Over the same period, Google Gemini’s MAUs jumped ~30%, boosted by its new Nano Banana image model. The report also highlights a key edge for Google: twice as many U.S. Android users access Gemini through the OS itself rather than the standalone app, giving it broader, frictionless reach across Android’s global user base. (TechCrunch)

Source: TME

Source: TME

Just in time?

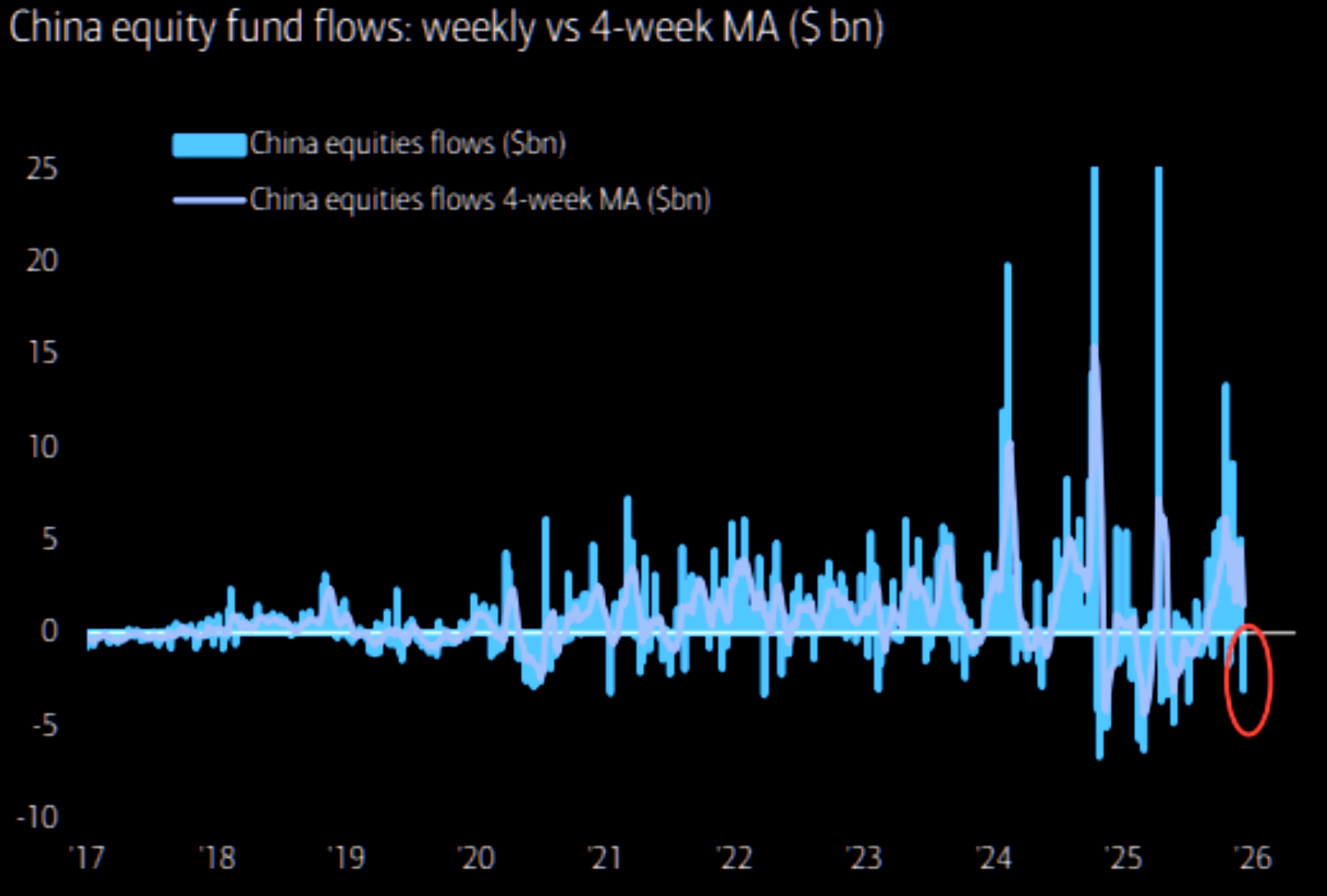

Biggest China outflows just as China is catching bids. Full note here.

Source: BofA

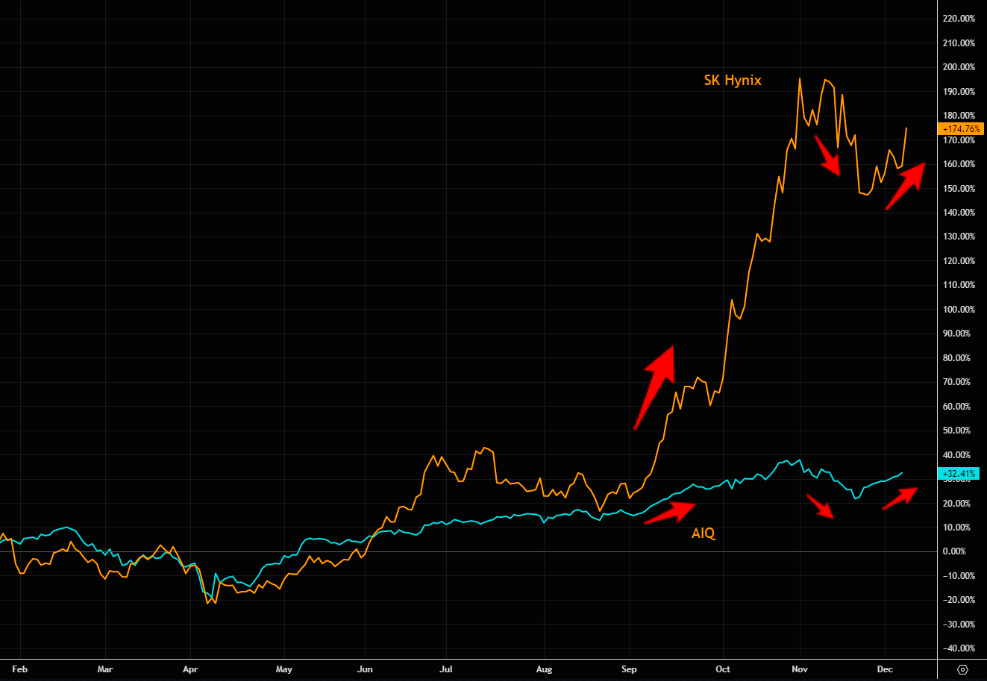

AI "sentimentor"

SK Hynix is AI on steroids. Chart shows it vs the AIQ.