Should You Take a Bite of the Rotten Apple?

Forbidden Fruit?

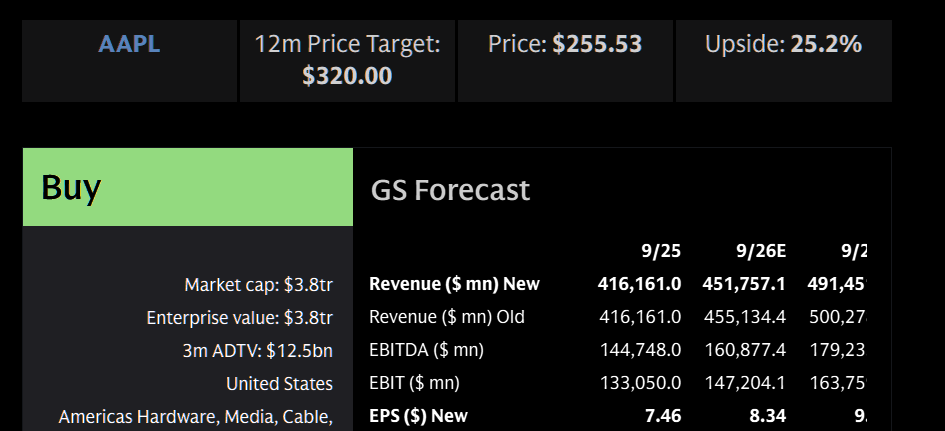

AAPL has now traded red for 7 consecutive weeks, its longest losing streak in more than 3 years. The stock is down 10% since Christmas Eve. The chart does not look good. Goldman is however out overnight defending the stock and sees both revenue, margin and EPS beat in the upcoming report. Is the king of returning cash a buy here?

Breaking Bad

Apple started losing the anti AI outperformance touch late last year. The stock has now crashed through some major support. We are well below the 50 day (now negatively sloping) and also below the 100 day here.

Source: LSEG Workspace

Apple knew...

On the 8th of January we highlighted that the fade in Apple was becoming rather extreme versus the market and asked ourselves: "As Apple goes...goes the market...?".

The 1st chart is what it looked like on the 8th and the 2nd chart is the current gap vs. Nasdaq.

Source: LSEG Workspace

Source: LSEG Workspace

Goldman sees buying opportunity

GS: "We view the stock weakness as a buying opportunity into a continuation of the iPhone refresh cycle. iPhone demand in the next 2 years is likely to benefit from the iPhone Fold. The products price/mix growth and continued mix shift toward Services should help support gross margins....iPhone will remain the consumer device of choice for accessing new AI tools, clearing overhangs related to competition."

Source: Goldman

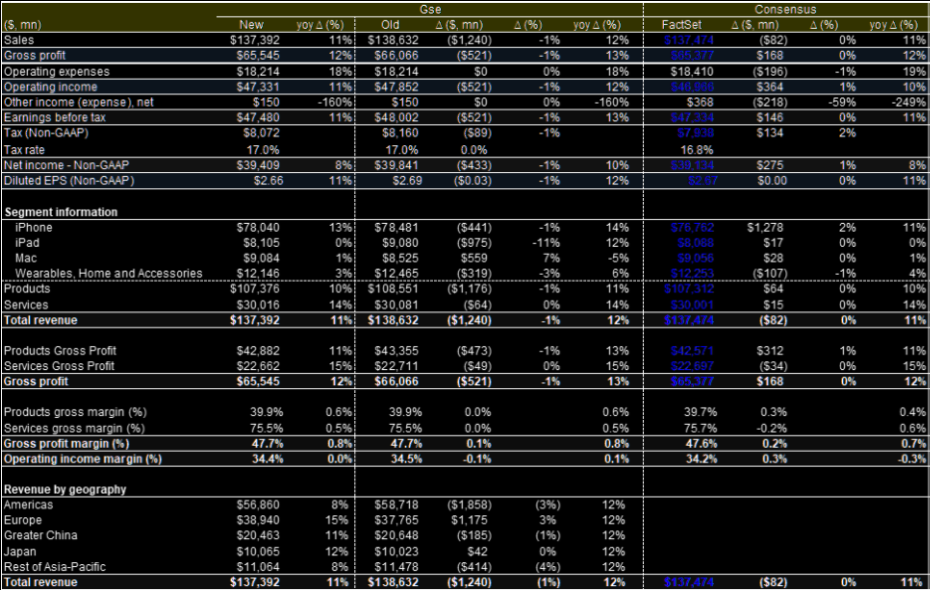

Revenue beat

GS: "We expect AAPL to deliver a slight revenue beat driven by iPhone."

Source: Goldman / FactSet

EPS and margin beat

GS: "For the March F2Q26E quarter, we forecast EPS of $1.88 with revenue of $104.4 bn (v. Visible Alpha Consensus estimates for EPS of $1.85 and revenue of $104.9 bn), gross margins of 49.1% (v. consensus 47.7%), and opex of $18.0 bn (v. consensus $17.5 bn)."

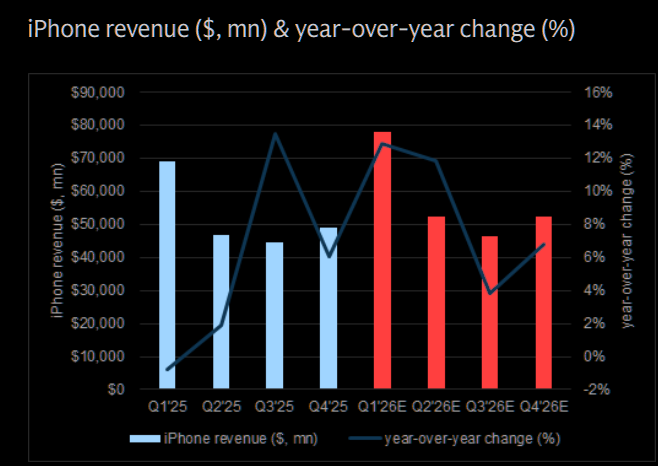

iPhone revenue

GS: "We estimate iPhone revenue should grow +13% yoy to $78.0 bn in F1Q26E."

Source: Goldman

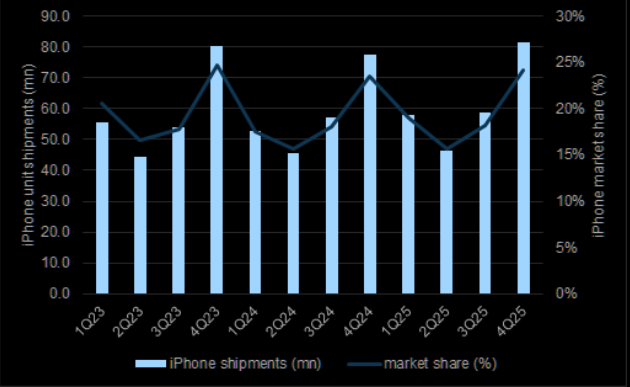

25% share

IDC estimates C4Q25 iPhone unit shipments grew 5% YoY to 81.3 mn, representing 25% of overall market shipments.

Source: IDC

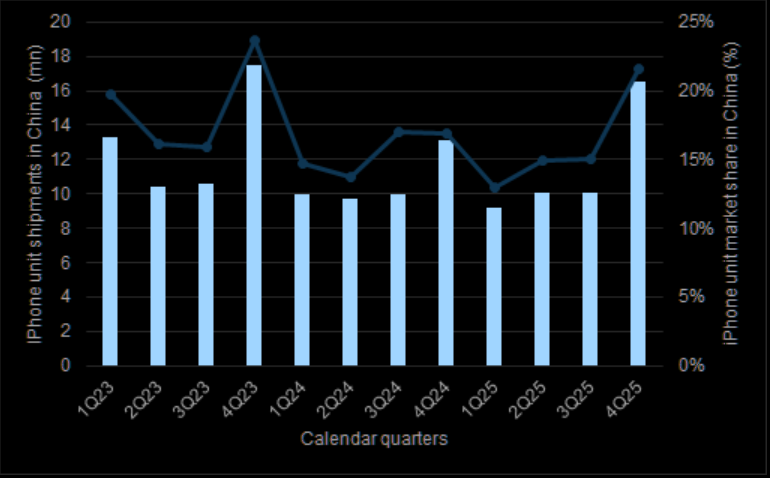

Nice China growth

iPhone unit shipments in China of 16.5 mn grew 26% YoY, representing 22% market share.

Source: Omdia

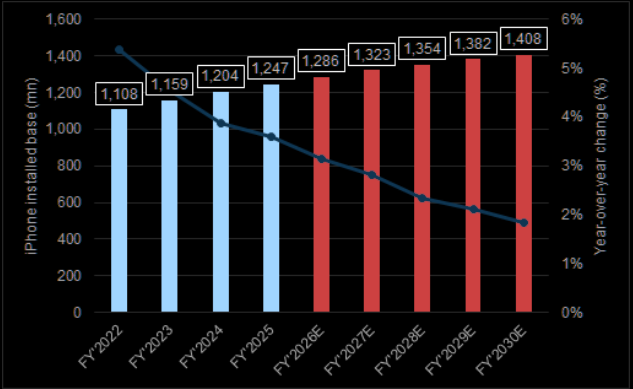

1.3bn installed base

GS: "We believe that the active iPhone installed base will approach ~1.3 bn in F2026 as first smartphone and switchers continue to more than offset churn."

Source: Goldman

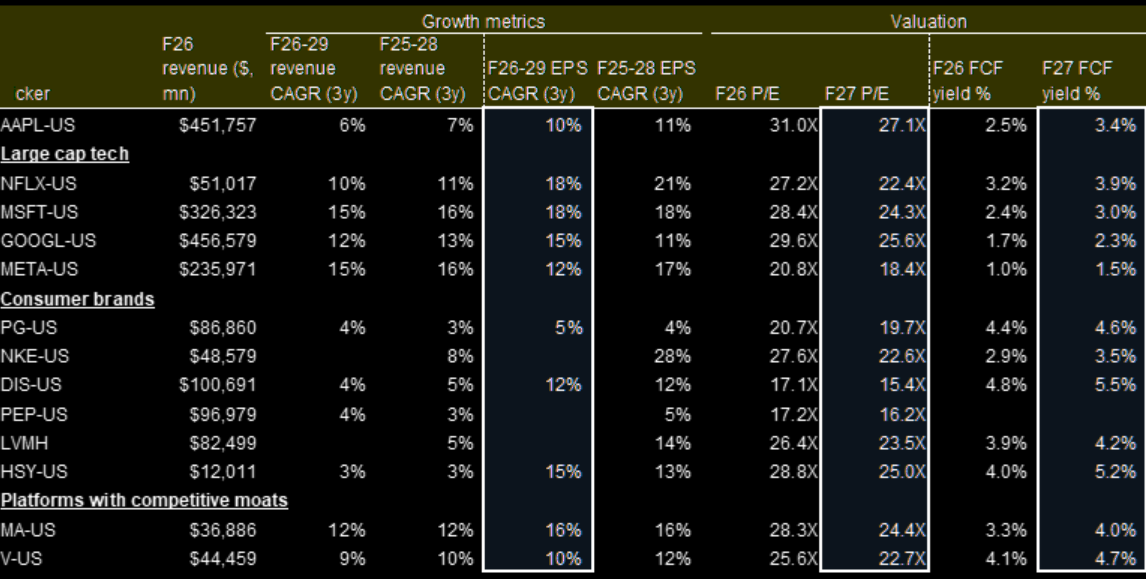

Valuation

AAPL v. select comps in large cap tech, consumer brands, and payments.

Source: FactSet

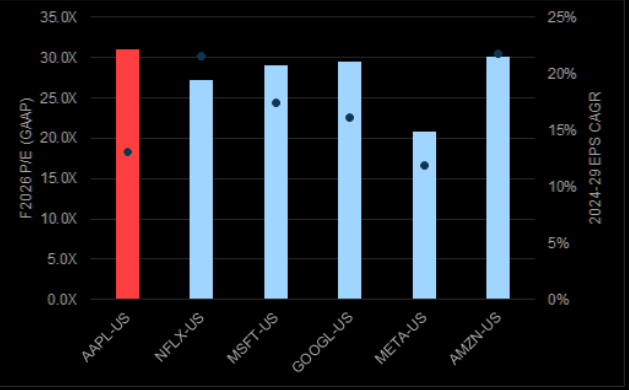

In line with Mag7

APPL trades in line with select large cap tech peers.

Source: FactSet

Slightly above & slightly below

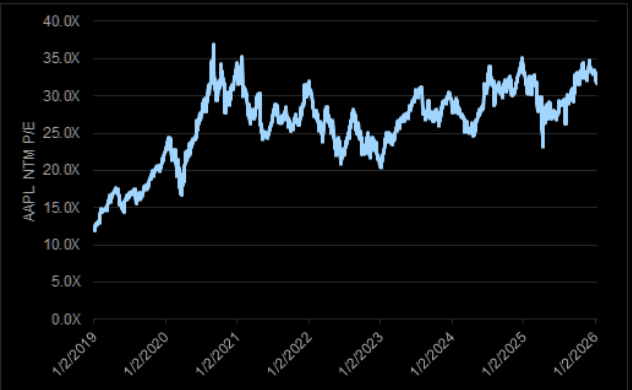

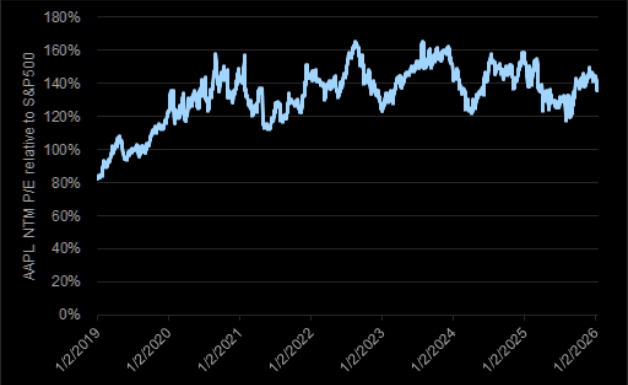

AAPL trades at ~31X NTM P/E v. 2020-25 average of ~28x (chart 1). On a relative basis, AAPL trades at ~136% the S&P 500 NTM P/E, just below its 2020-25 average of 139% (chart 2).

Source: FactSet

Source: FactSet

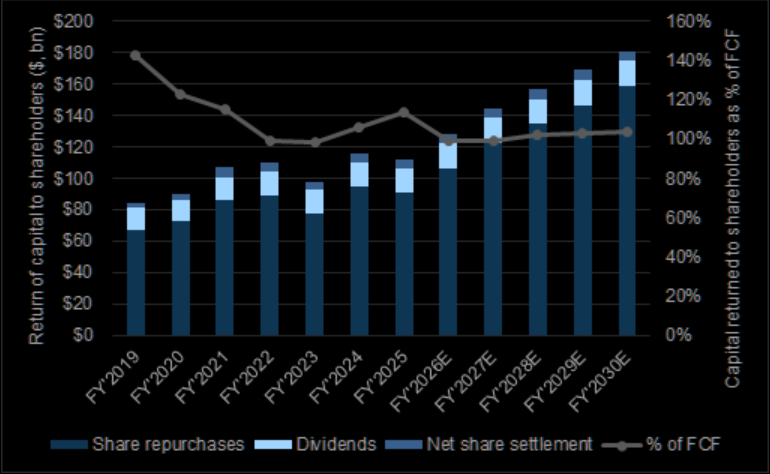

King of returning cash

Gs: "AAPL returned >$110 bn of capital back to shareholders in F2024, and we expect this to grow over time as shareholder capital returns scale with growing free cash flow."