Silver Goes Full Metal: 1979 Vibes

Silver’s Smashing Pumpkins moment

Smashing Pumpkins’ 1979 is culturally loaded with nostalgia, regime change, and end-of-cycle energy. The song is about youth, disillusionment, and cycles ending — which maps uncomfortably well onto silver today.

Exactly one year ago to the day, we wrote about silver as a buy (link). Then, the case for silver was about recovery, valuation, and optionality. Now it’s about momentum, volume explosions, and historical echoes. When silver starts posting its best weeks since 1998 and inviting constant 1979 comparisons, it’s a sign we’re likely closer to the later innings than the opening act. These are the phases where volatility spikes, narratives harden, and rallies are better sold into than bought..

Let´s look at the latest observations in silver.

1979

Silver is on track for their best year since 1979 – a year that delivered the Iranian Revolution, the second oil crisis, double-digit inflation, a sliding dollar, the Soviet invasion of Afghanistan, and the Hunt brothers’ memorable attempt to corner the Silver market.

What a week

Silver up 18% this week. That's the most since Feb 1998(!). And it comes after last week having the best week since 2020.

Source: Trading View

Not good, says Elon

Beijing's shift to require government licenses for all silver exports from January 1, 2026, replaces the old quota system and threatens to limit outflows from the world's top refiner. Elon Musk warned this hurts industries like solar panels, EVs, and electronics that rely on silver's conductivity. With a 148.9 million ounce deficit last year and another projected for 2025, prices have nearly tripled since January, drawing eyes to potential $100 highs while skeptics note volatility risks.

"This is not good. Silver is needed in many industrial processes." (Elon on X)

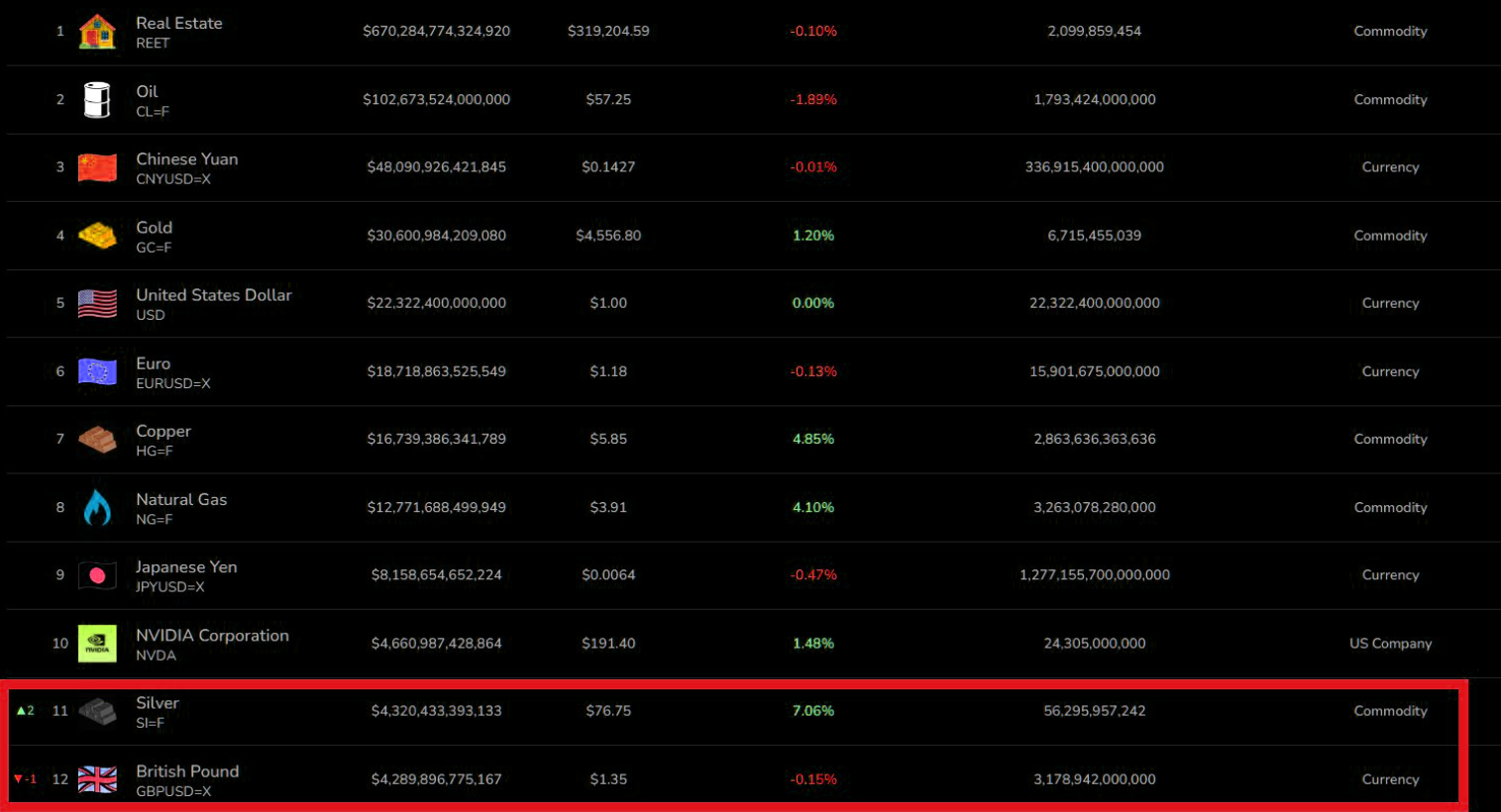

Metals outrank money

Silver overtakes the British Pound as the World's 11th most valuable asset. Data from @AssetMarketCap - not exactly sure how they calculate all this market caps (futures & physical?)

Source: @AssetMarketCap

Volume explosion

Silver ETF SLV volume exploded Friday. More than $9.6 billion of $SLV was traded. This only happened twice before: April-May 2011 and February 2021.

Source: subu trader

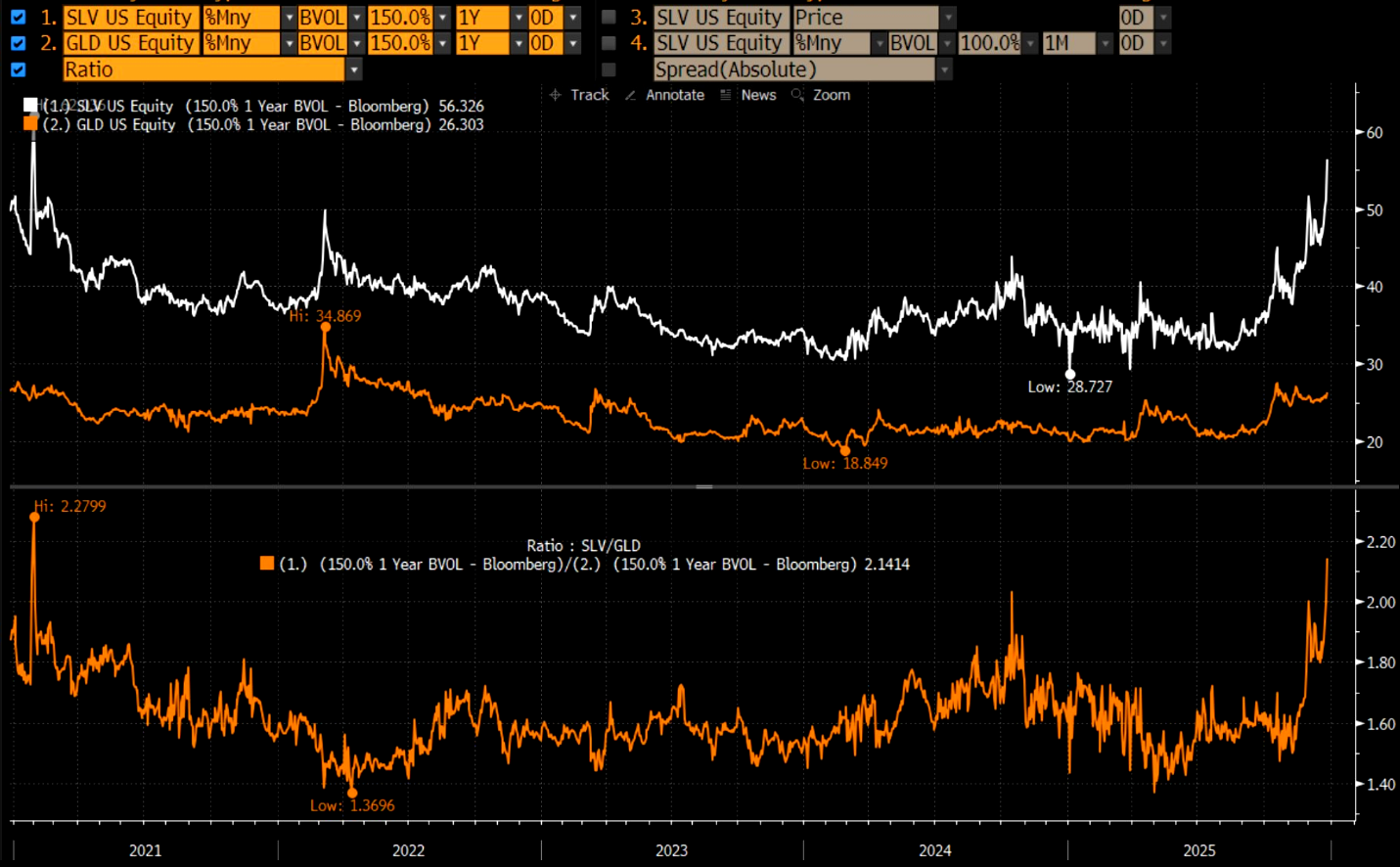

Silver / Gold vol

"The ratio of silver to gold vol is essentially at an ATH. Currently, one year 50% OTM calls on the $SLV carry an implied vol of 56. That's more than double the same strike vol in $GLD... chart below."

Source: Alpha Ex LLC

The quants are long

Slightly outdated chart as this is from earlier in the week which is an eternity in silver now, but the conclusion is still the same. Silver never closing below the 100-hour MAs in the latest up-move - which means that the quants are max max max long.

Source: Spectra Markets

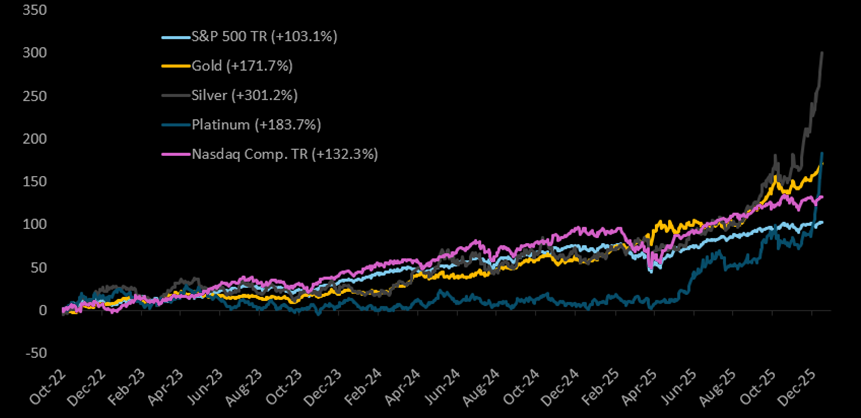

Beating bull

Here is a look at the performance of the S&P 500, the Nasdaq Composite, and gold, silver, and platinum since the current bull market for stocks began on 10/12/22. As shown, gold is now up 171.7%, platinum is up 183.7%, and silver is up just over 300%! All three metals have now easily beaten the stock market during the AI Boom.

Source: Bespoke

Hyperinflationary feel

"Having grown up in an emerging market, I can say with confidence that precious metals are starting to show a hyperinflationary feel that isn’t getting enough attention" (Octavio Costa)

Source: Octavio Costa

Dr Copper too

US copper futures (/HG) all-time weekly closing high.

Source: Trading View

Just awakening...

"Keep in mind that silver adjusted for money supply is only now breaking out from more than 45 years of resistance." (Octavio Costa)

Source: Octavio Costa

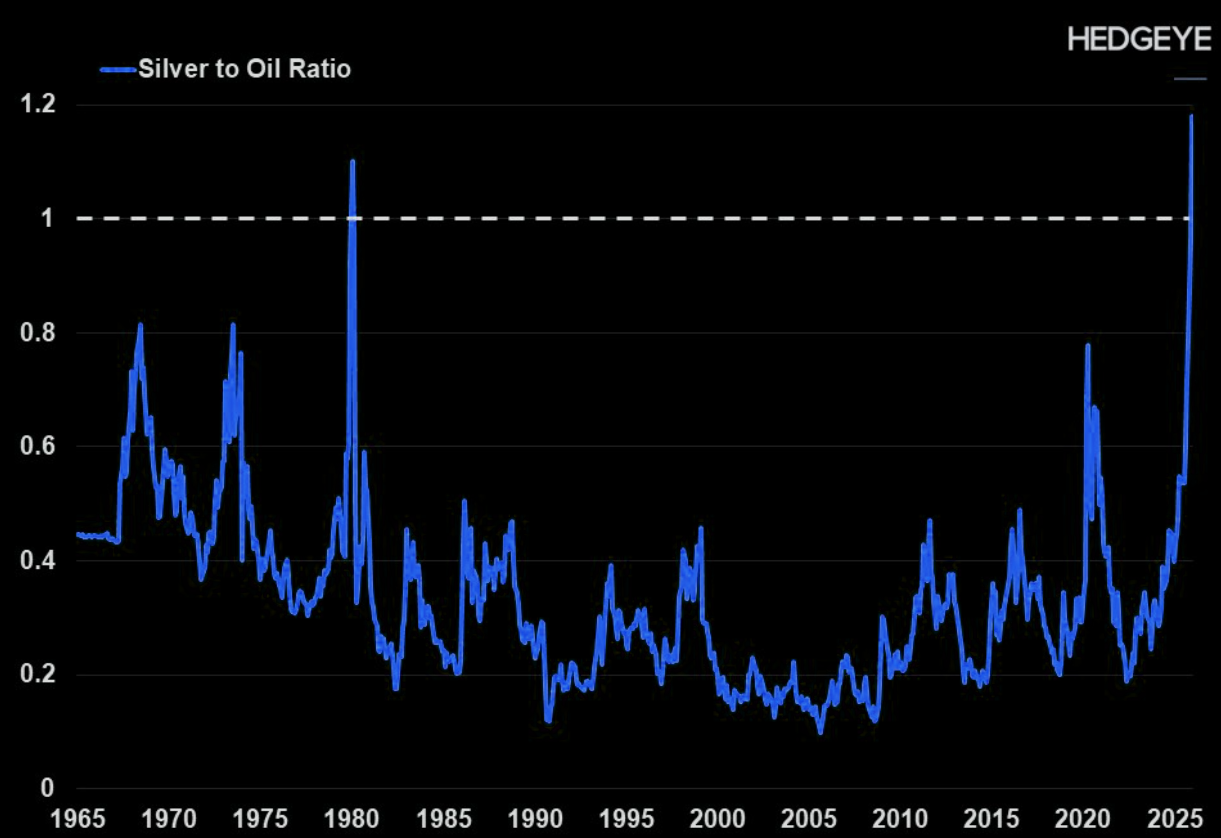

An ounce of silver

An ounce of silver is now worth more than a barrel of oil. This has only happened once before (once again slightly outdated as it is 5 days old...).