Silver Has Entered the Danger Zone — Volume Explosion

Volume mania

SLV volumes have been extreme during the melt up. The last bar makes you think if everybody is in now?

Source: LSEG Workspace

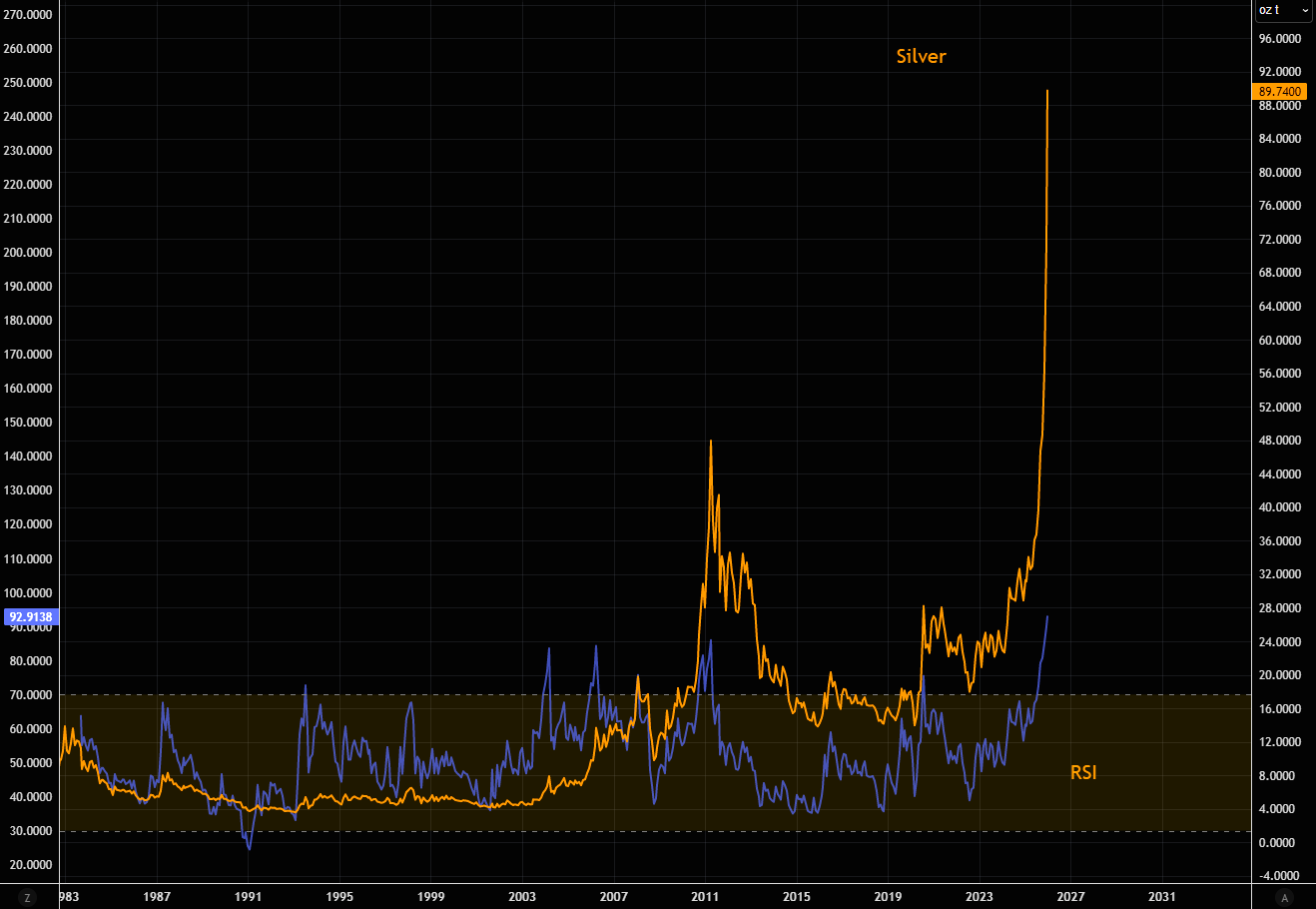

93 bro!

Silver’s monthly RSI is sitting at 93. Sure, that’s not something short-term punters lose sleep over, but history suggests this is where things often end in tears. Crowds tend to get sucked in near the highs, only to discover too late that they never had a proper risk-management plan when the tape turns.

Source: LSEG Workspace

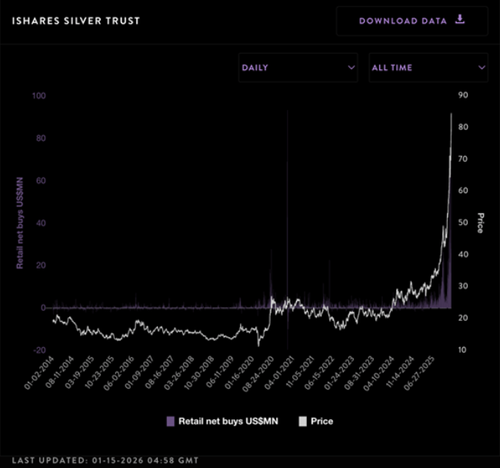

Retail's silver love

If you still wonder who is driving the silver move...

Source: Vanda

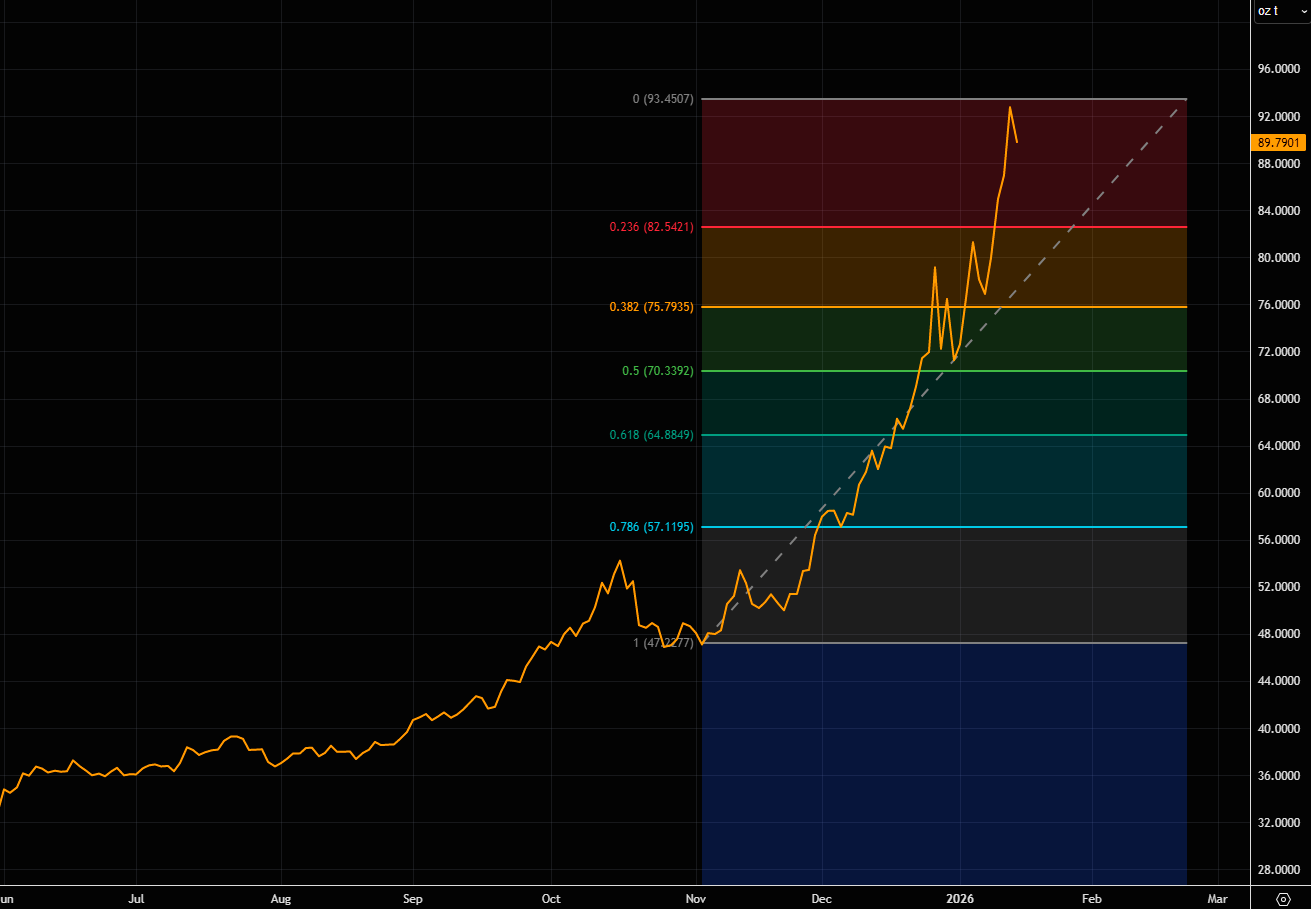

Could easily pull back...

...toward the 21-day (~$76) without doing any real damage to the trend. Even a deeper reset toward the 50-day around $63, which feels unthinkable now, was trading reality less than a month ago.

Source: LSEG Workspace

Beyond extreme

The volatility explosion in silver has been beyond extreme. Few trade silver volatility as an asset in its own right, but as we’ve been flagging, this is a broken market. VXSLV is pricing ~5% daily moves, while the crowd has piled into upside via calls. A pause or modest pullback would see that optionality deflate fast, and with it, spot selling pressure kick in.

Source: LSEG Workspace

Fibo levels

Silver Fibonacci levels to watch.

Source: LSEG Workspace

Silver speculators

Silver net non-commercials have stubbornly refused to join this historic squeeze. Is that an enormous implied bid still lurking, or do they “know” something on a longer-term horizon? The last time we saw a similar dislocation between price and specs was in 2011. Back then, the specs turned out to be the long-term smart money.

Source: LSEG Workspace

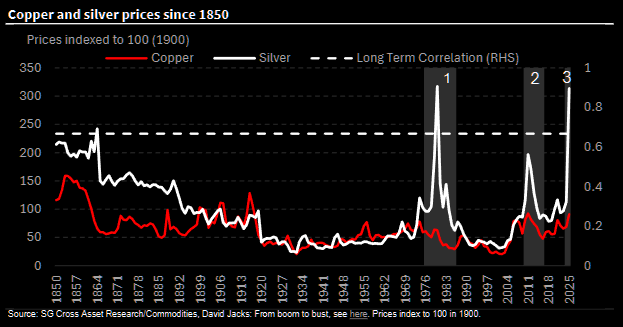

The copper connection

Given the deep historical, technological, and refining links, you’d expect copper and silver to move closely together, and the data backs that up. Using price data going back to 1850 reveals a remarkably tight long-term relationship, with major breakdowns few and far between. Notable exceptions include the Hunt brothers’ squeeze in 1980 and the GFC, when copper sold off on recession fears while silver rallied on uncertainty. Outside of these episodes, the relationship has remained structurally strong writes Soc Gen.