Silver Looks Untouchable — But Indecision Is Creeping In

Silver "indecision"

Silver has printed a second consecutive doji candle. A doji signals indecision, two in a row strengthens the message. Dojis following strong bull runs deserve close attention. Note that silver hasn't put in two calm days in a long time.

Source: LSEG Workspace

Impossible?

Silver feels unstoppable, but it’s stretched at the top of a steep channel. The 21-day MA sits near channel support around $82, a level last seen just eight sessions ago.

Source: LSEG Workspace

The rates connection

Could the rise in rates dampen some of silver's extreme momentum?

Source: LSEG Workspace

Watch silver volatility

It wouldn’t take much. Even a pause could trigger call selling as traders wake up to how punitive theta has become, a setup that risks weighing on spot.

Source: LSEG Workspace

Implied bid

Silver specs have ticked higher lately, but positioning remains far from crowded. The key question: do they step in on a pullback, or have they already given up?

Source: LSEG Workspace

Summing up silver

"Price at an all-time-high yet spec positioning in New York and Shanghai remains close to the lows; we think Chinese and Indian physical demand (partly from retail) has been the driver behind the last leg of the rally. Desk view is price has run too far but we’re reluctant to short until we see physical premia ease."

Probably better entry points

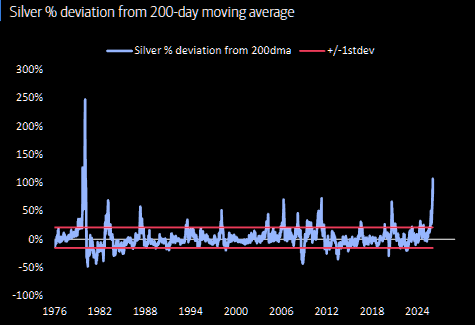

Hartnett points it out: "...silver 104% above 200-day moving average = most overbought since 1980".