Silvergeddon

Permanently higher plateau?

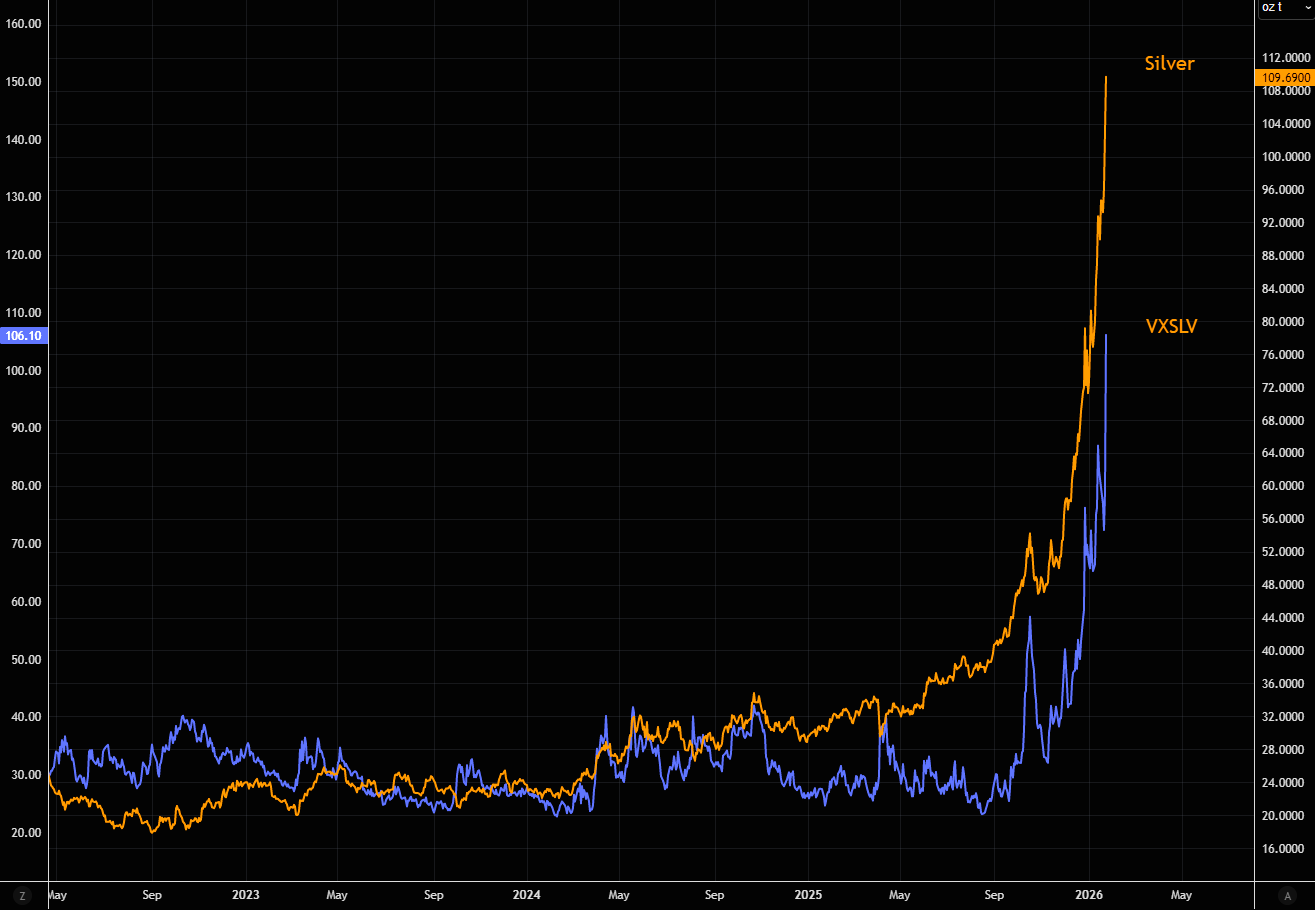

Silver’s super-squeeze is running out of superlatives. Price action now looks more like a meme stock than a “serious” hard asset. Some argue the move is so fundamentally driven that technicals no longer apply. Maybe, but it’s worth noting that we haven’t seen hard assets this stretched versus the 21-day MA, let alone the 50-day, in a very long time.

Source: LSEG Workspace

Silvergeddon

Silver volatility is totally "broken" by now. This is pure upside panic playing out in real time. People desperate to get in here, as well as shorts, are buying upside volatility in panic. VXSLV is currently around 106 (it traded at 124 at day highs). Something trading at 106 volatility is pricing around 7% daily moves. That is beyond extreme for a MEME stock, not to mention a bar of silver.

Source: LSEG Workspace

Volume mania

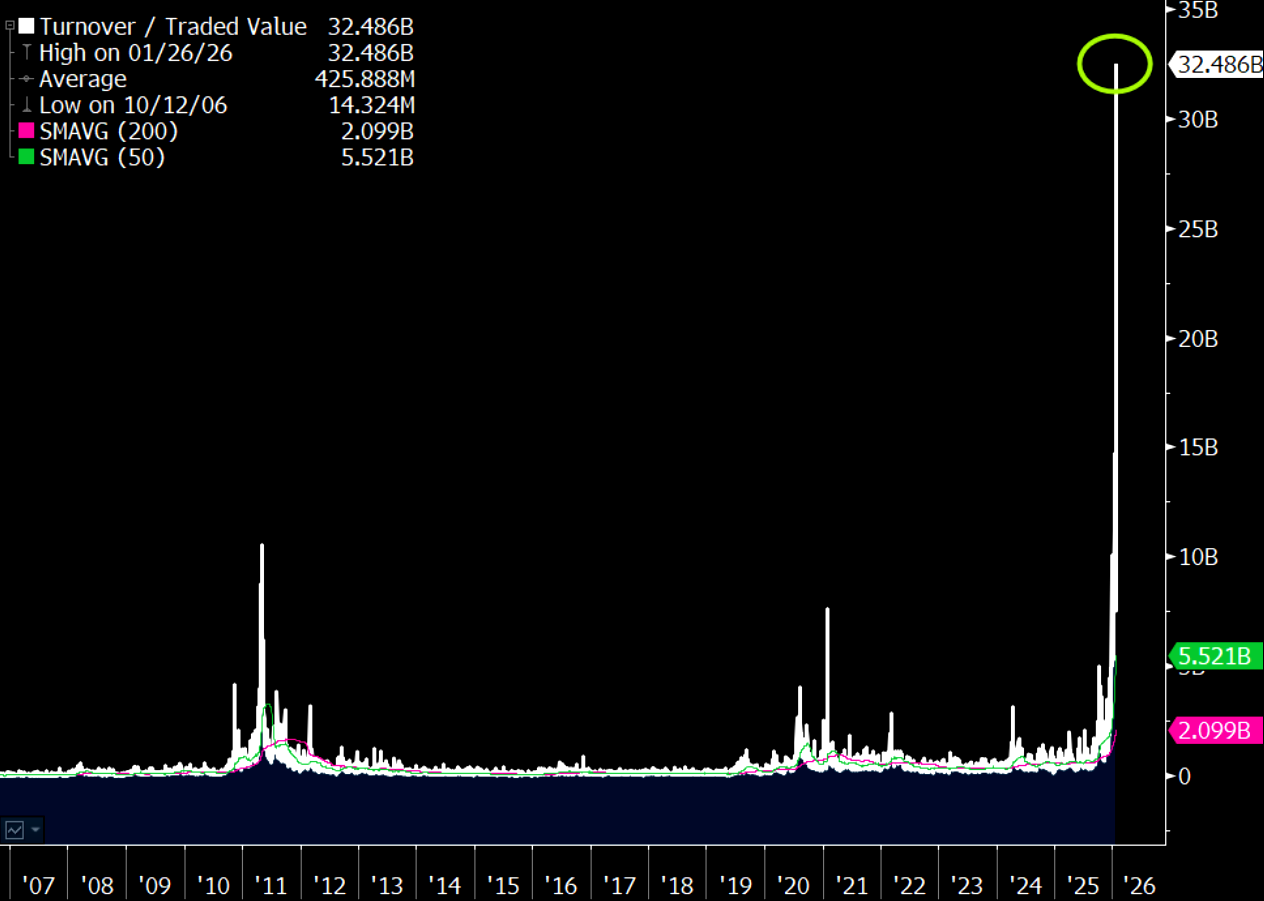

SLV volumes today are outright ridiculous. Feels like the last wave of FOMO momentum has been forced into chasing silver. The result: an absolutely massive shooting star on record volume. It doesn’t get more upside-panic than this.

Source: LSEG Workspace

Gamestop vibes

SLV just printed ~$32bn in volume, roughly 15× its average and by far the most traded security on the planet today. For context, SPY ~$24bn, NVDA and TSLA ~$16bn each. Hard to recall the last time something this relatively small completely took over the tape. GameStop vibes. (Eric Balchunas)

Source: Bloomberg

Who's buying?

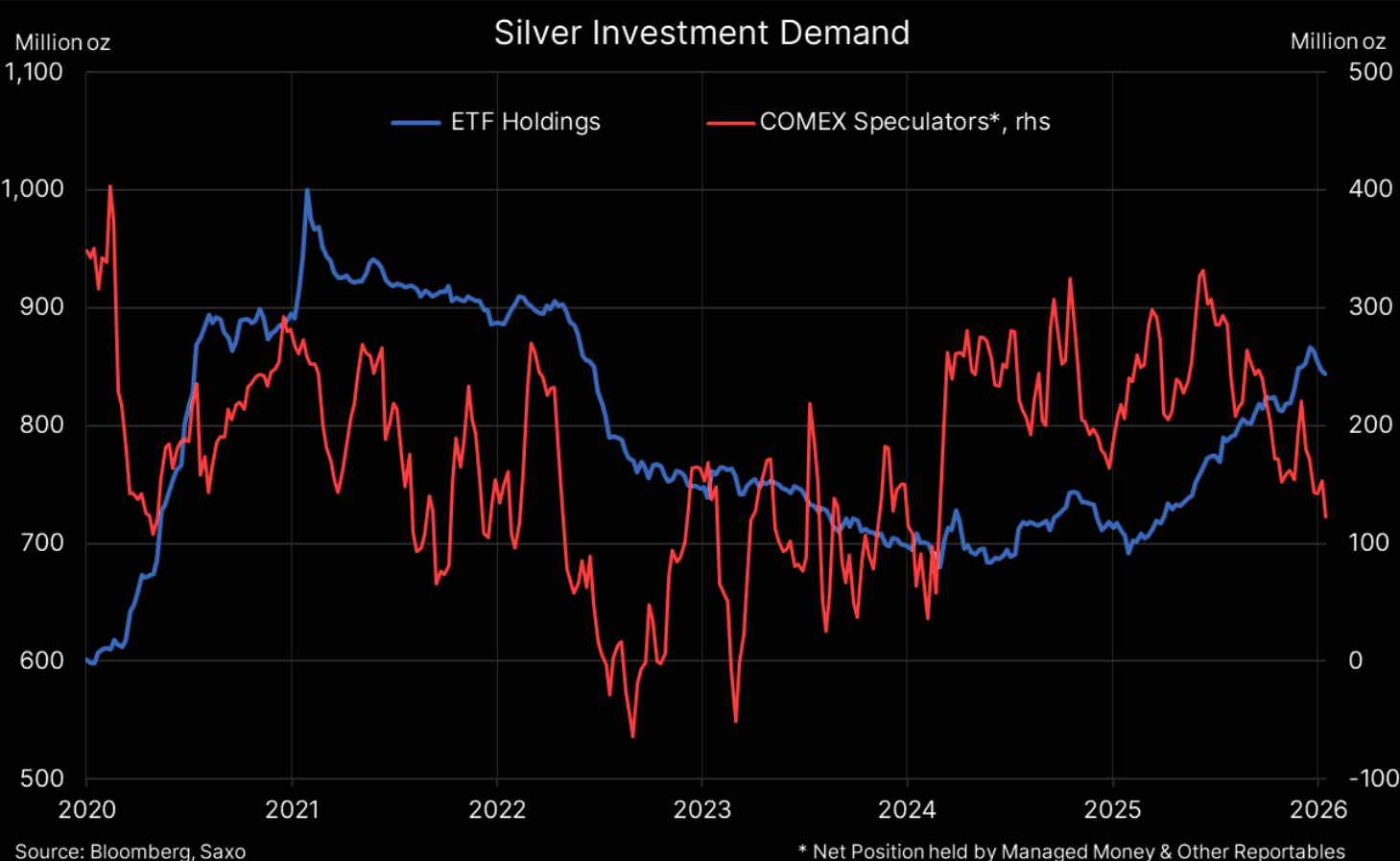

Silver's latest squeeze occurring with speculators as well as ETF holdings moving lower...

Source: SAXO

From China with love

The Shanghai–London gold spread now needs a bigger chart. Attention turns to Chinese speculators, key drivers of the silver squeeze, and how their behavior evolves as the Lunar New Year approaches.

Source: SAXO

You are here

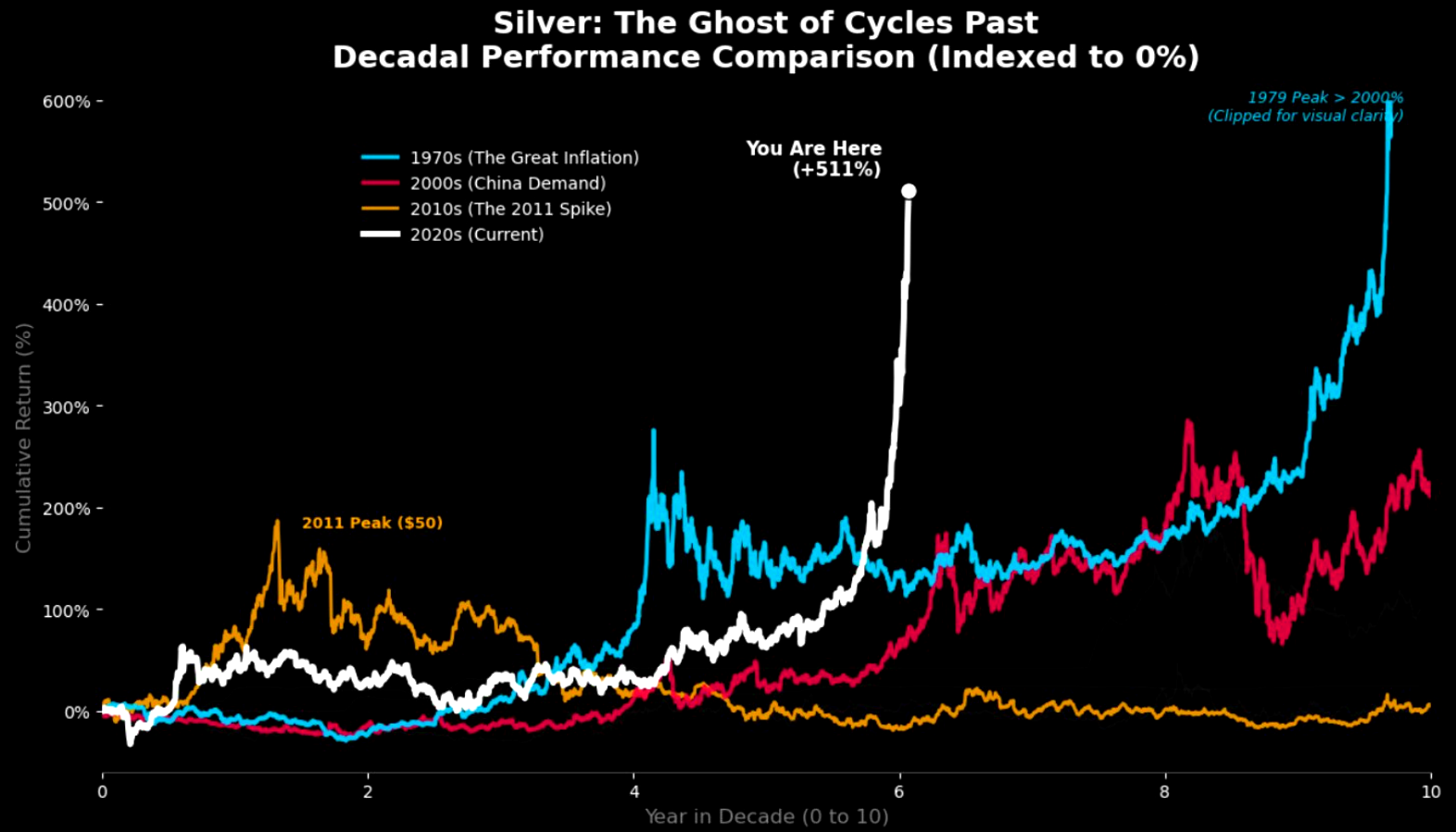

A quick look at silver across major cycles puts this decade into perspective. Cumulative return by Year 6:

• 1970s: +145%

• 2000s: +40%

• 2020s: +520%

By the numbers, this decade isn’t just different, it’s in a league of its own. Great chart via Bloomberg's Michael McDonough.

Source: Bloomberg

46!

Gold/silver ratio at 46. We are entering big levels for this spread.