Silvergeddon Unleashed

Always

Parabolic moves don’t fade, they always break. We warned in Silvergeddon earlier this week that silver was morphing into a GameStop-style momentum squeeze, built on leverage and late chasing. That setup is now unraveling, with the ongoing crash inflicting huge P/L pain.

Source: LSEG Workspace

Beyond brutal

Silver has officially turned into a superspeed market. The 21-day MA sits at $92.5, while the 50-day MA isn’t until around ~$75. Today’s candle so far is beyond brutal, and it’s exactly the kind of price action you see when parabolic structures start breaking.

Source: LSEG Workspace

Zooming out a bit

Silver monthly RSI still at absolutely crazy levels, trading just below 94, despite today's crash.

Source: LSEG Workspace

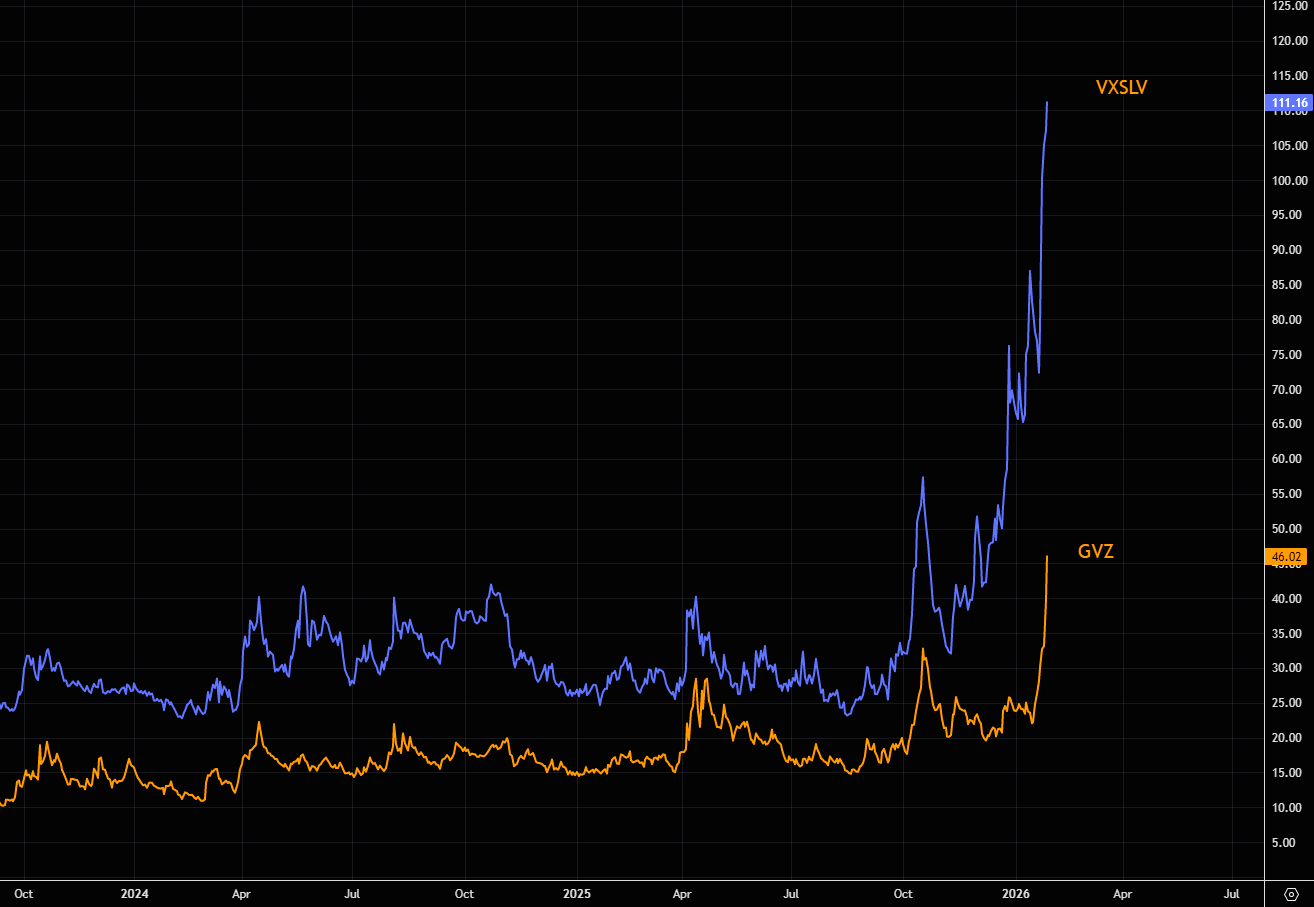

Volatility panic

There is exploding volatility, and then there is silver volatility. VXSLV traded around 25 at autumn lows. It closed at 111 yesterday. These moves aren't healthy, hence our take on silver volatility basically being a broken market. Managing risk for anybody with slightly bigger positions is impossible. Chart shows gold and silver volatility.

Source: LSEG Workspace

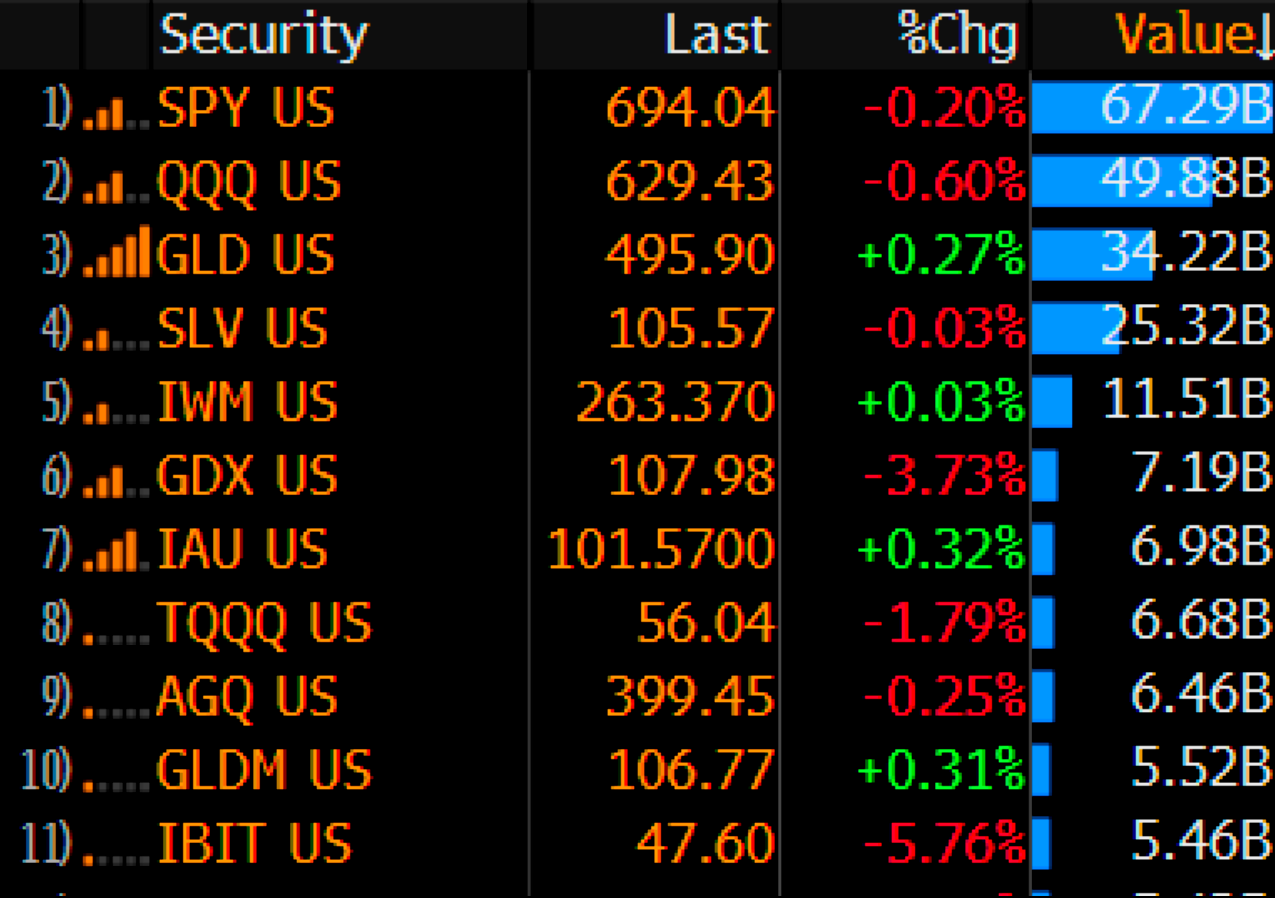

Mania

"Seven of the top 11 most traded ETFs are commodities (gold, silver, bitcoin). That's def a first. The GLD volume is the craziest, that's about 50% beyond its old all-time record. Top 5 day all time for IBIT and SLV too." (Eric Balchunas)

Source: Eric Balchunas

Dollar decoupling

Short term gap between silver and the DXY (inverted) at very wide levels. Is the debasement logic still valid, or?

Source: LSEG Workspace

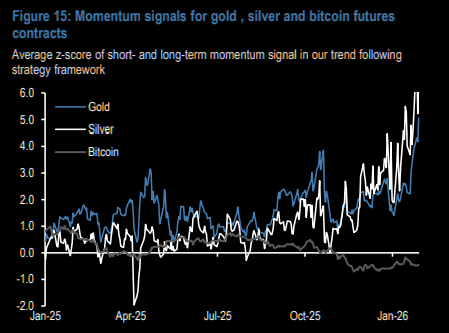

What about momentum?

Momentum signal, often used as a proxy for CTA-style positioning, shows silver as heavily overbought, suggesting momentum traders have been a major driver of its recent rally. Gold futures also look very overbought, while bitcoin futures are oversold, increasing the near-term risk of profit-taking or mean reversion in gold and silver.

Source: JPM

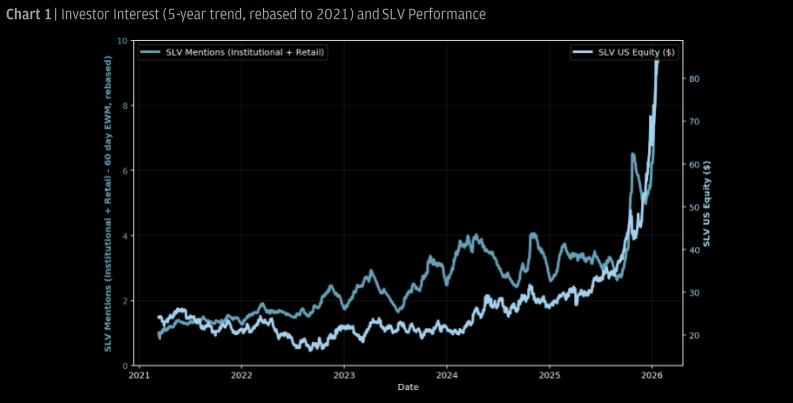

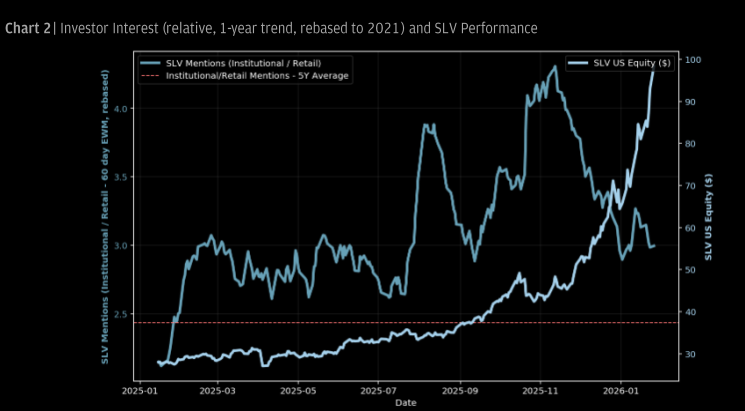

Retail and silver

Investor interest in silver has grown sharply over the past five years. While institutional participation stayed broadly stable through 2025, retail interest accelerated into Q4 as silver exploded to the upside, with ETF volumes and social activity surging. The data and online chatter reinforce that retail flows have become a key driver of recent price action, and an important factor to watch as volatility rises, writes JPM's great data asset team.

Source: JPM

Source: JPM

What about institutions?

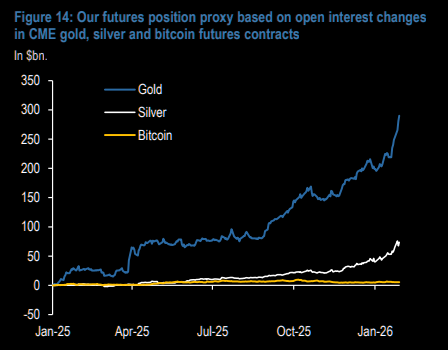

Institutional futures positioning has surged in silver since late last year, with gold showing a similar accumulation trend over the past year. By contrast, bitcoin futures positioning has remained largely flat, underscoring a clear institutional shift toward precious metals.

Source: JPM

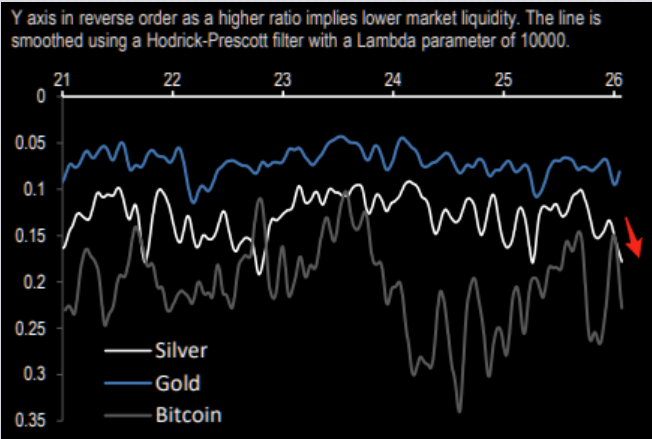

Thinner liquidity

Liquidity conditions in silver are flashing warning signs. Using the Hui–Heubel ratio, which captures how much trading volume is needed to generate a given price move, silver has consistently shown a higher HH ratio, indicating thinner liquidity and weaker market breadth than more liquid assets. More importantly, silver’s market breadth has deteriorated in recent weeks, suggesting that reduced liquidity has amplified the latest price swings, writes JPM's Nikos.