Software Exodus & Small Cap Tech Flush

Software exodus

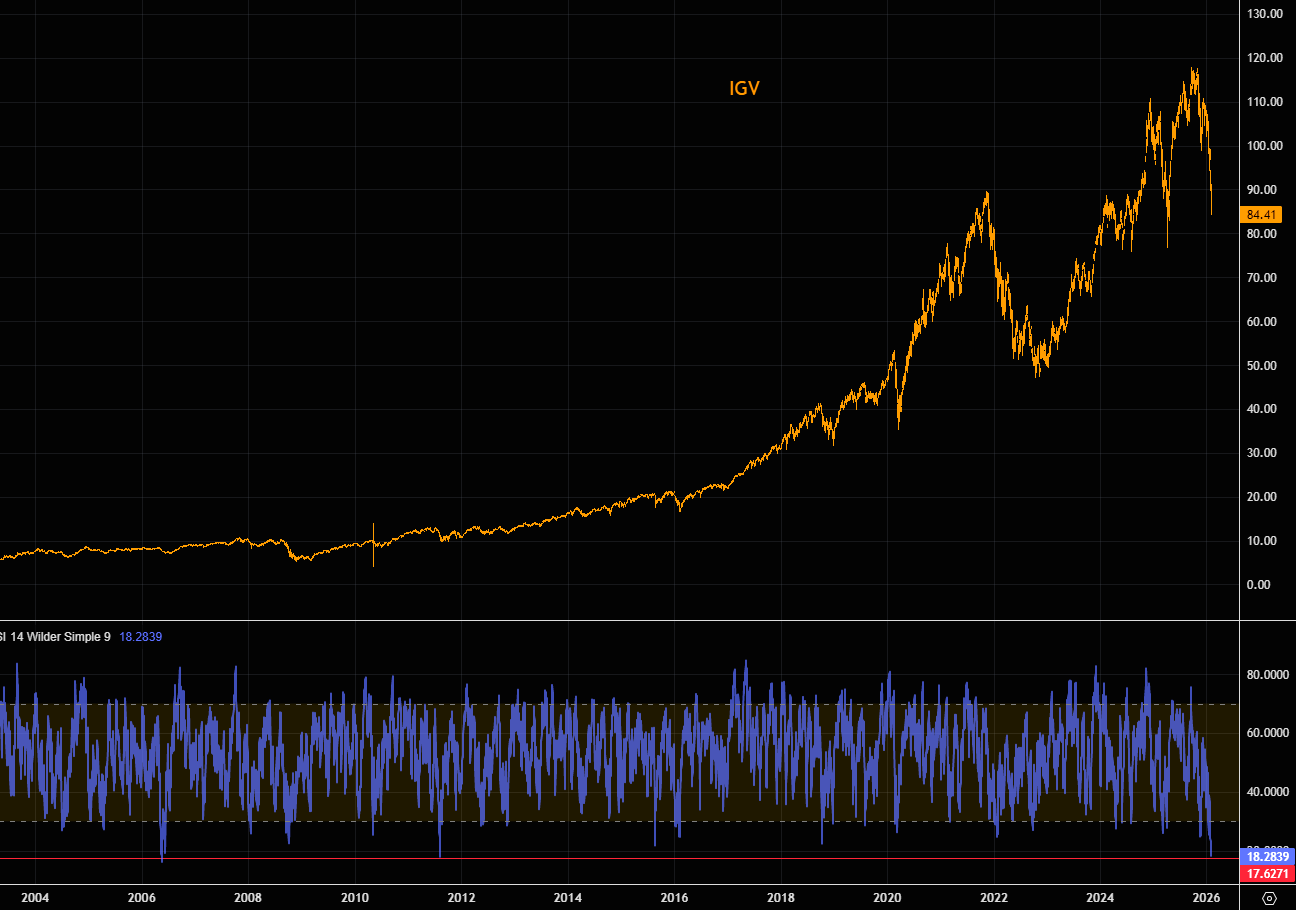

IGV at the most oversold levels since "forever" basically (RSI 18!). More on this theme and downside convexity in markets here and here.

Source: LSEG Workspace

Stressed tech

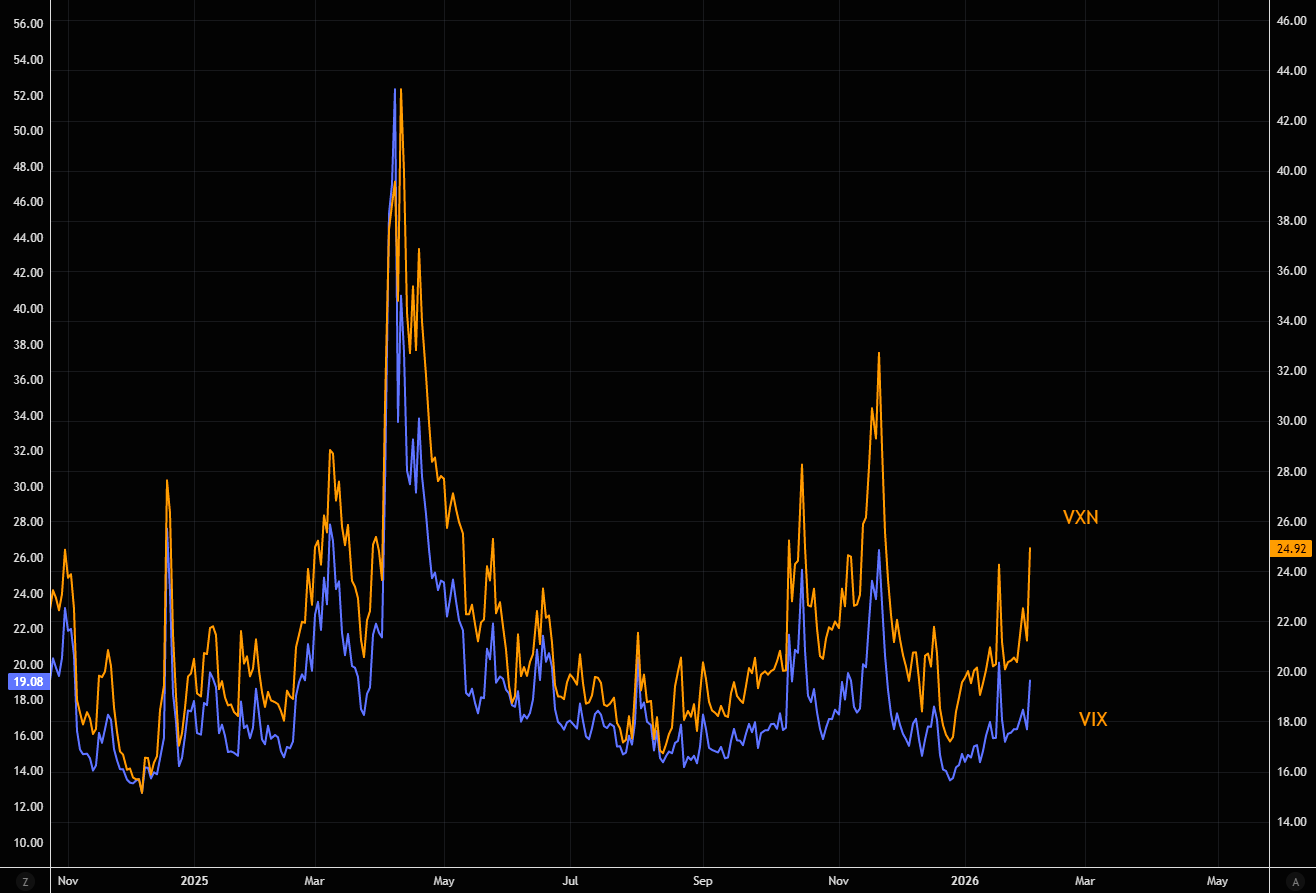

VXN at the highest levels since late November. Note that VXN has "outperformed" the VIX lately.

Source: LSEG Workspace

Without the generals?

Can SPX continue to trade at ATHs basically with generals like MSFT in full crash mode and NVDA trading boring/soggy?

Source: LSEG Workspace

Big small cap tech puke

Small tech puking by close to 5% as of writing. Massive down candle, right down to the 200 day MA. Not pretty.

Source: LSEG Workspace

Imagine...

...big tech starts glancing at what small cap tech has been doing lately? The gap is very short term wide.

Source: LSEG Workspace

Almost perfect

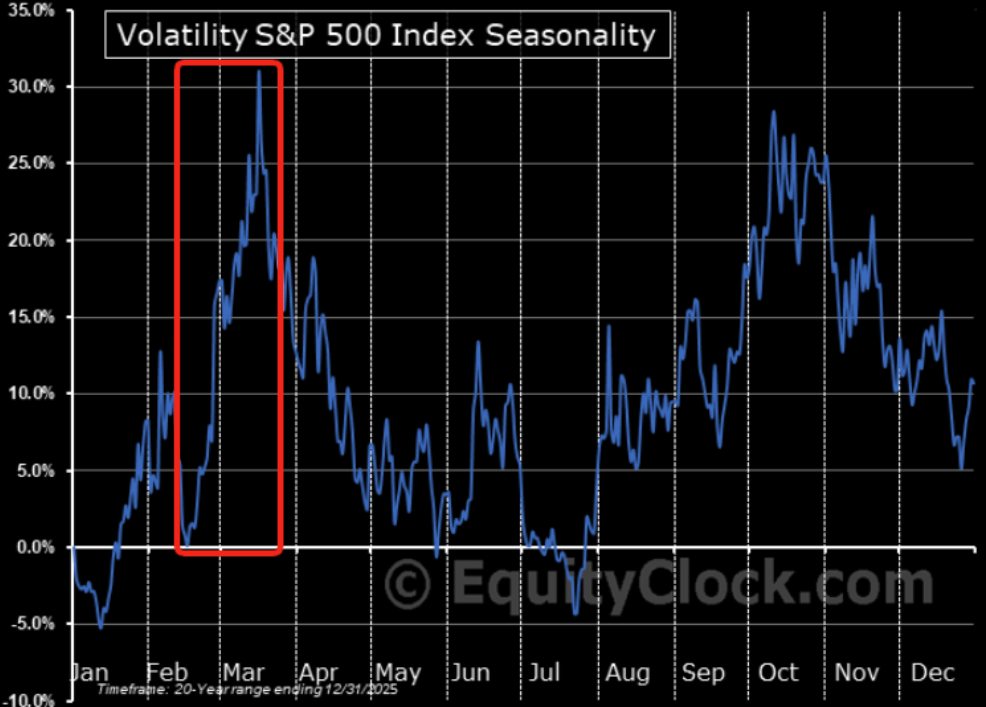

VIX looks to be front running seasonality by a week or two...

Source: Equity Clock

BTC technicals

We outlined our latest BTC logic in our note "BTC myths are breaking..." on Jan 21 (here). BTC has crashed since then, trading at the lowest levels since Trump won the election. The big trend line is long gone as we trade well below the 100 and the 200 day MA. $70k is the next support to watch. Momentum is so bad, you almost feel like trying a few early longs...More here.

Source: LSEG Workspace

The gold bounce

Gold briefly traded below both the 50-day MA and the rising trend line during the latest bout of chaos. The rebound has pushed price back above the 21-day MA. Initial resistance sits near $5,100, roughly the 50% retracement of the large down candle (excluding the shadow), with the 8-day MA just below. Latest on precious metals here.

Source: LSEG Workspace

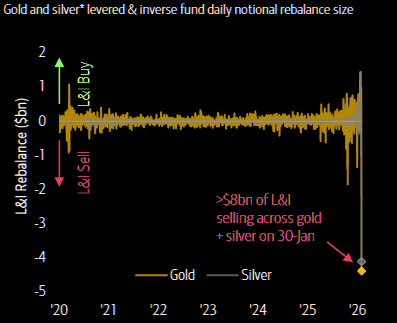

That precious size sell

"On Friday 30-Jan, L&I (leveraged and inverse) funds sold >$8bn across gold + silver (~$4bn each) in response to historic pullbacks in those assets".

Source: BofA

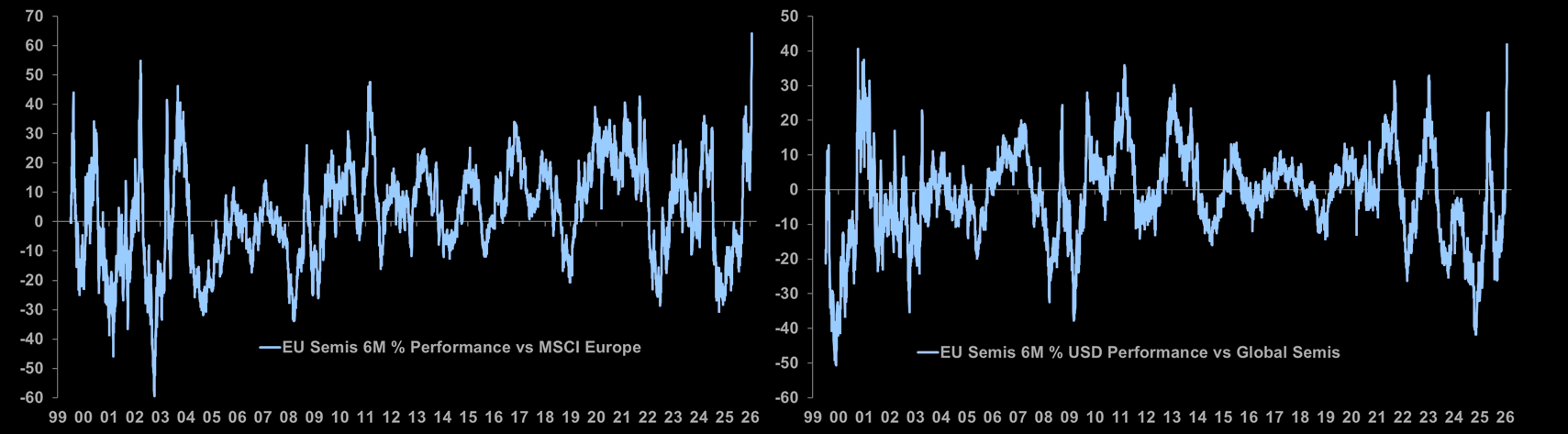

EU semis

EU semis have just enjoyed their best-ever 6M outperformance vs both i) the EU market and ii) global semis…Latest note on Europe here.