SPX Stuck, Rates Unstuck, Silver Panics

Stuck

SPX remains stuck inside the range that has been in place since September. Bull flag and a break out, or a double top? We aren't getting excited until we break out of the range. Until then treat this as a mean reverting market.

Source: LSEG Workspace

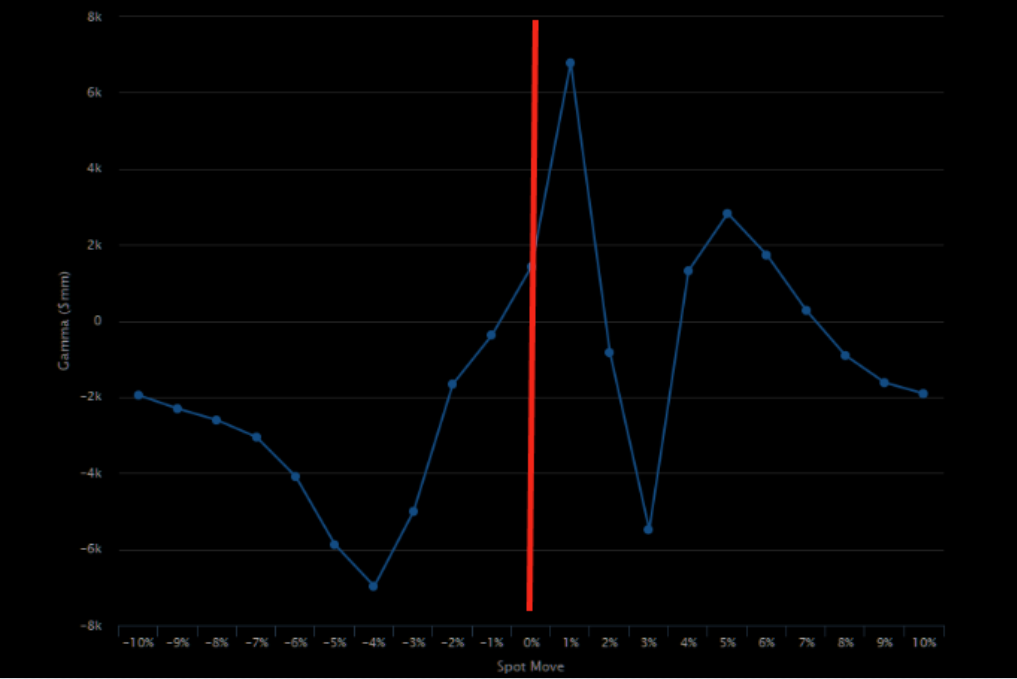

Stability...

...at these levels, but dealers turn short gamma on both up/down 2-3%.

Source: GS

That was quick

The latest move higher in rates is the most aggressive squeeze since July. We’re now well above the negative trend line and have closed above the 100-day, though still below the 200-day.

Source: LSEG Workspace

On the MOVE

Bond volatility catching some bids as FOMC approaches...

Source: LSEG Workspace

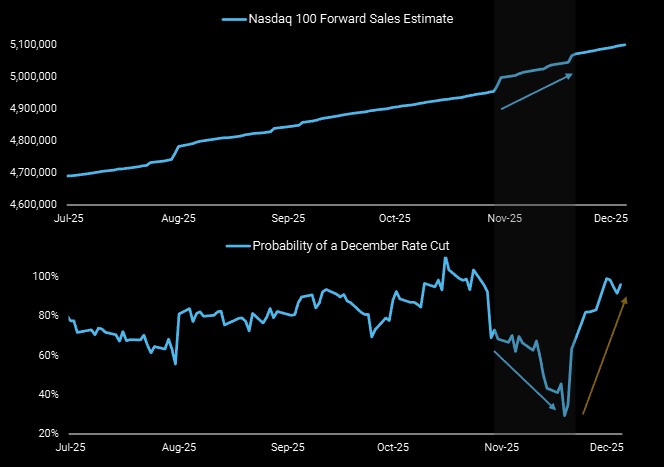

Fed rules

Main driver of price action since late October has been the Fed.

Source: MS

Source: MS

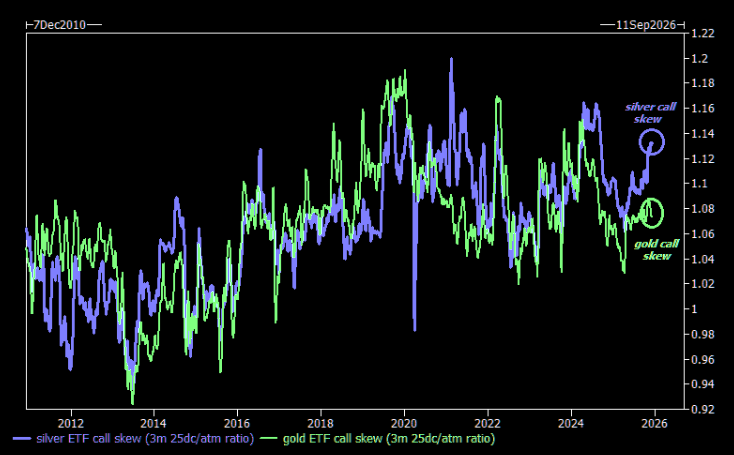

Upside panic

The crowd is chasing silver in an extreme way. Call skew has exploded to the upside, making gold call skew look "poor"....Our latest silver note here.

Source: GS

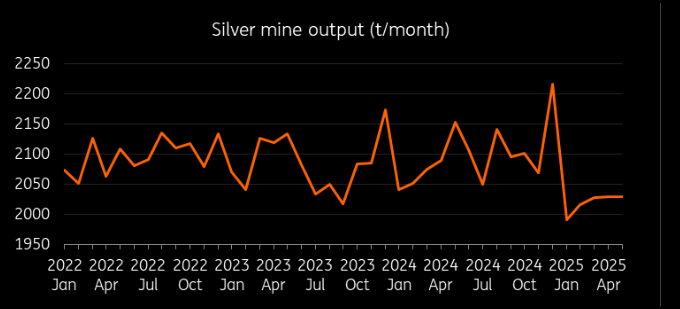

Silver supply

Silver is set for a fifth straight year of supply deficits, with output structurally inelastic since 70–80% comes as a by-product of other metals. Mined production is down ~3%, constrained by lower ore grades and a lack of new projects.

Source: ING

Big time laggard

Silver is the beta play, but gold has badly lagged this silver squeeze. Time for a catch-up?

Source: LSEG Workspace

Offense in defense

European defense names have all surged over the past sessions. The Trump peace plan looks dead for now (more here). Recall what Citi pointed out recently regarding the pullback in defense: That pullback may be a gift...a ceasefire would only mark the start of Russia’s rearmament cycle, and Europe will have to spend heavily to keep it in check. Si vis pacem, para bellum.

Source: LSEG Workspace

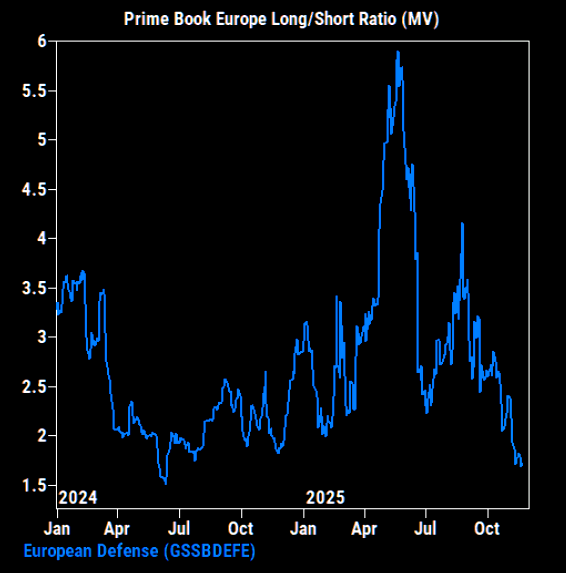

Defensively positioned in defense

The long/short in defense has puked and is at rather depressed levels.