Surging Silver — AI Eats the Moat, Credit Picks Up the Tab

Roaring Russell

Russell has been the big outperformer this year, leaving both SPX and NDX behind. That said, small caps are now dancing around the major reversal level last seen in late 2021. A bit too much, too fast? Note how far price has stretched above the 200-day MA. This matters, as Russell still lacks a clear longer-term trend. Latest note on small caps here.

Source: LSEG Workspace

Source: LSEG Workspace

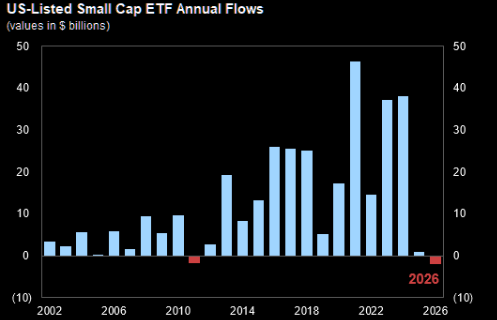

Depressed flows

2025 was a brutal year for small-cap ETF flows. The category saw its worst net outflows since 2021, even as the Russell 2000 delivered double-digit returns. The broader investor base remains underinvested, particularly given that equity ETFs overall posted another banner year of inflows in 2025. Meanwhile, persistent supply from sticky channels has continued into early 2026, writes GS.

Source: GS

GS says very small effects of the 10% tariff

"While implementation is highly uncertain, we estimate that a 10% tariff would lower real GDP in the affected European countries by 0.1-0.2% via lower exports. The inflation effects would likely be very small and a Taylor rule would point to modestly lower policy rates, all else equal." More on Europe here.

Source: Goldman

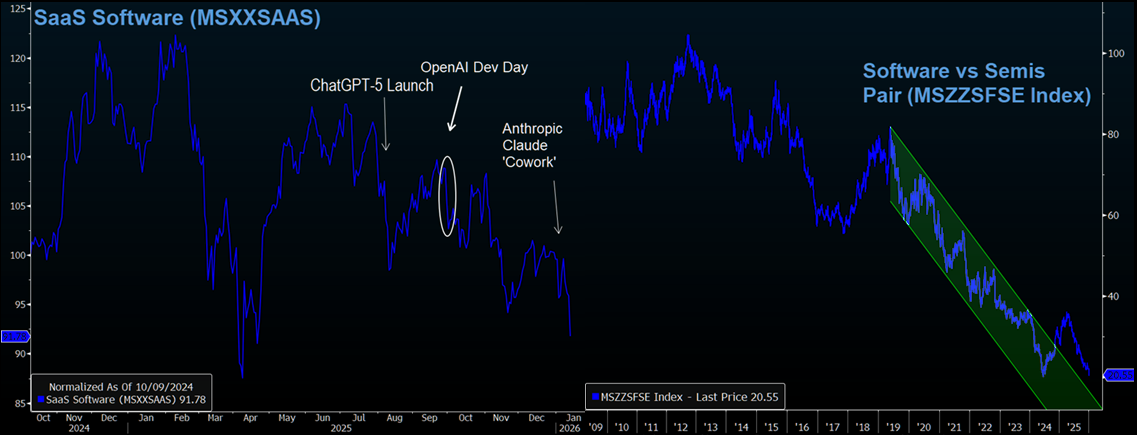

AI ate the software MOAT

AI model proliferation is undermining the software moats and accelerating relative underperformance. More here.

Source: MS

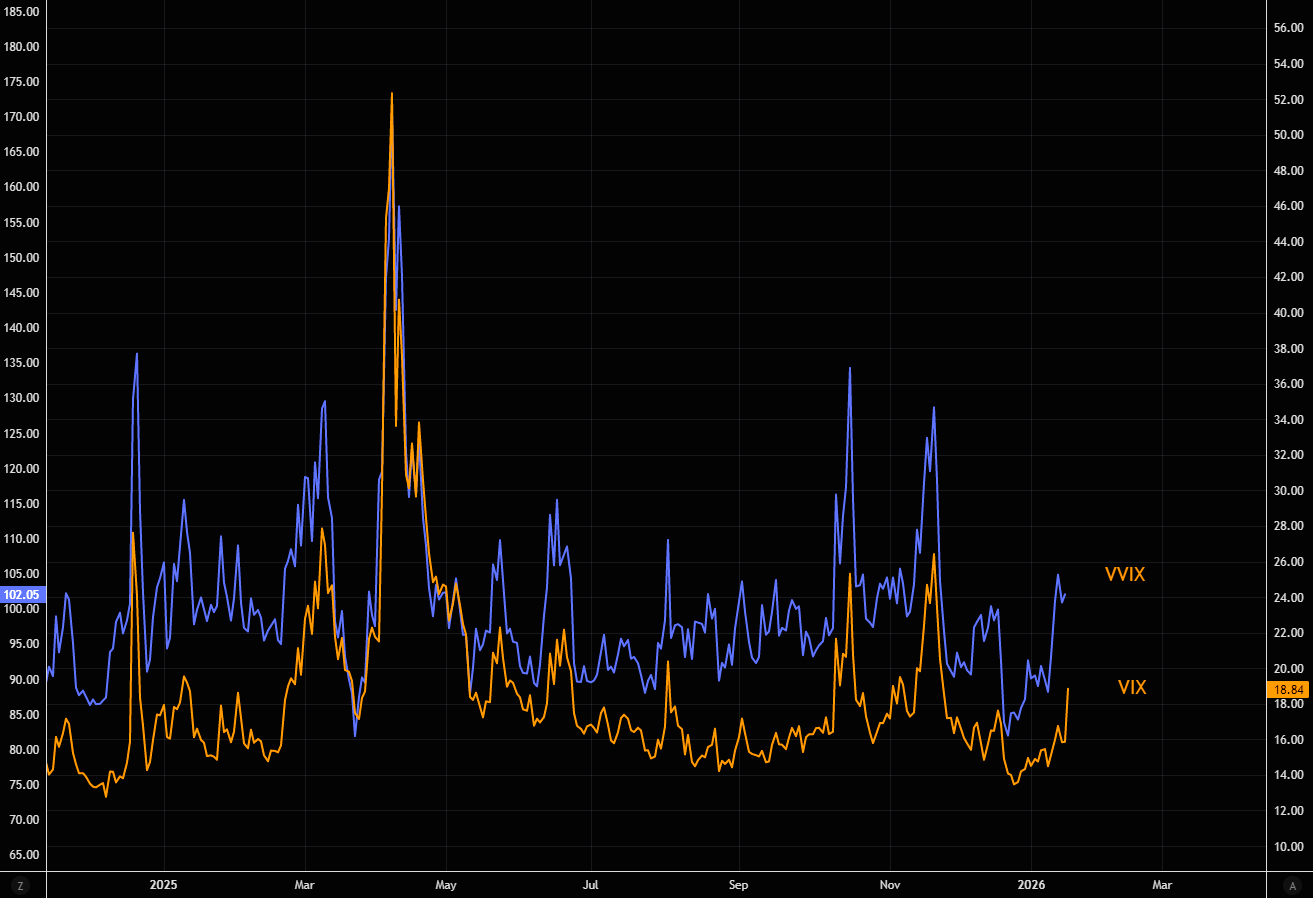

VVIX knew

VIX closing part of the huge gap vs VVIX. More here.

Source: LSEG Workspace

Gold loves it

Perfection prevails as gold and the Japanese 10 year move in lockstep.

Source: LSEG Workspace

What matters most near term...

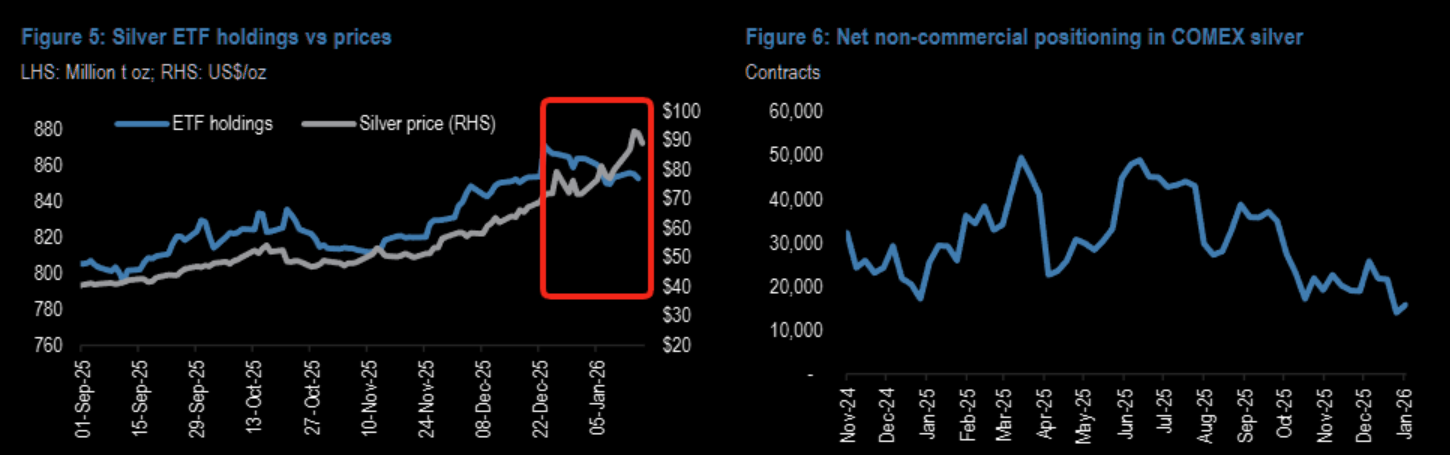

...is the strength of investment and ETF demand for silver according to JPM. Metals Focus estimates global ETP holdings rose by 278m oz in 2025 (+27% YoY) to ~1.32bn oz, with Bloomberg-tracked ETFs up ~12% in 4Q alone. Even as silver inventory has flowed back to London since October, ETFs have absorbed a meaningful share, limiting growth in free-float physical supply. LBMA data show London vault holdings up 104m oz since September, but free-float holdings have risen by only ~60m oz. As long as retail and ETF demand remains strong, physical tightness could persist, and continue to fuel the rally, writes the investment bank.

Source: JPM

Watch closely

We’re starting to see a decoupling between ETF flows and silver prices. Through much of 2H25, ETF inflows and prices moved in lockstep, but that relationship has broken since late 2025. Nearly $20/oz, around 25% of silver’s rally since after Christmas, has occurred alongside a net 18m oz outflow from Bloomberg-tracked ETFs, on top of managed money futures length that has been declining since mid-December. Latest on silver here.

Source: JPM

AI credit

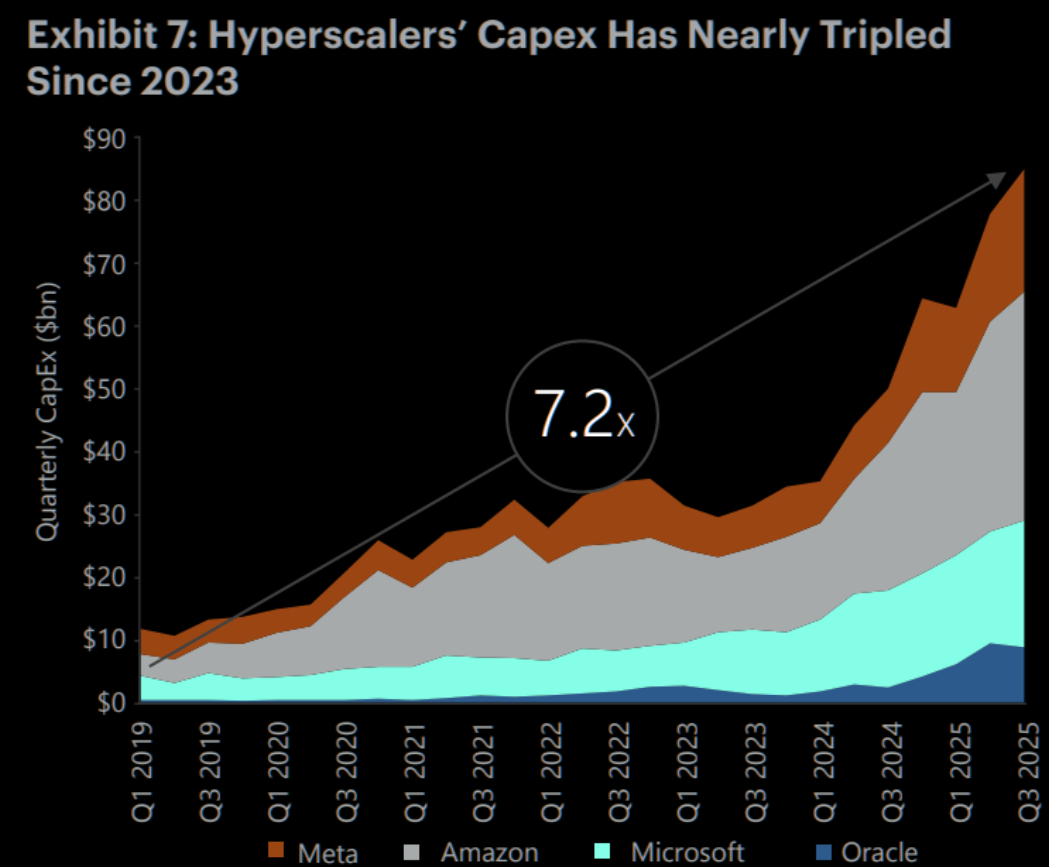

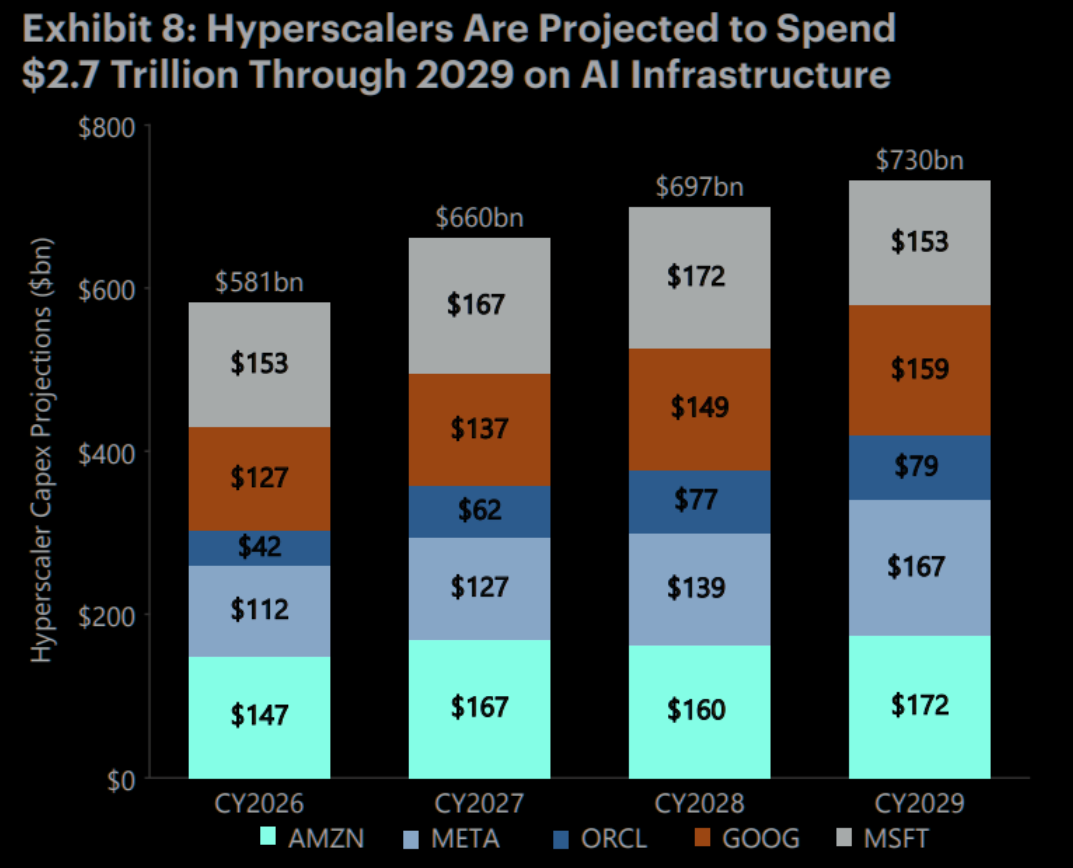

AI is now the single largest source of incremental credit supply. Hyperscaler capex has tripled since 2023. Projected spend: $2.7 TRILLION from 2025-2029. And they're pivoting hard to debt - Oracle, Meta, Google, Amazon priced $90B in deals in Q4 alone.

Source: Apollo

Source: Apollo

One big AI bet

If hyperscalers fund just 20% of AI capex through IG, AMZN becomes the 3rd largest issuer in the index. Google goes from 67th to 8th. A "diversified" portfolio might just be one big AI bet. Full note here.