Systematic Tsunami: BofA says there could be $130bn of selling this week

Done & dusted?

JPM prime brokerage says that the selling and gross reduction over the past 4 weeks is very close to prior extremes. BofA highlights that there could still be enormous (>$130bn) of systematics selling this week in a down-tape. Here are 12 relevant charts and quotes on positioning and flows from the Wall Street prime brokerage desks.

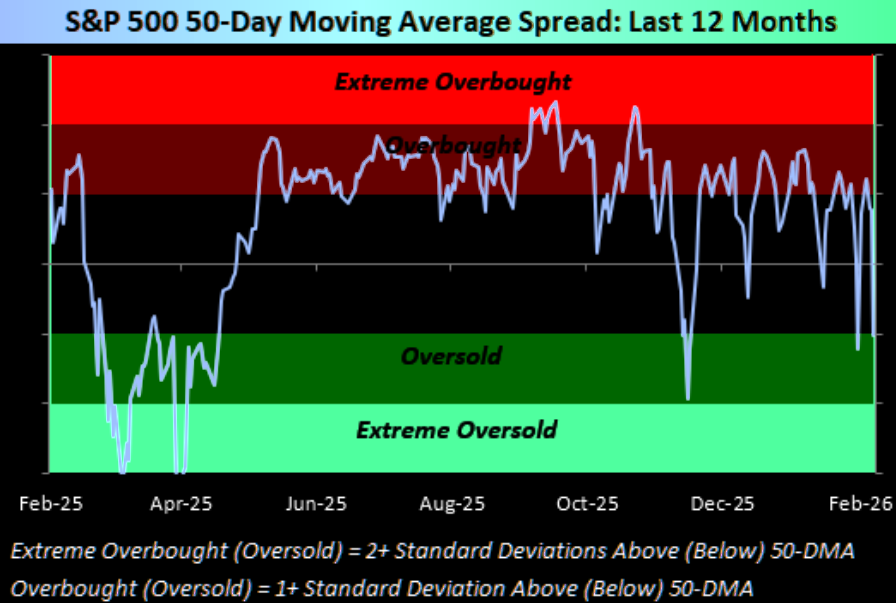

Fast market

Bespoke: "Earlier this week, we noted that this was the first time in the S&P 500's history that it went from overbought to oversold and back to overbought in the span of one week or less. Since then we've gone back into oversold territory."

Source: Bespoke

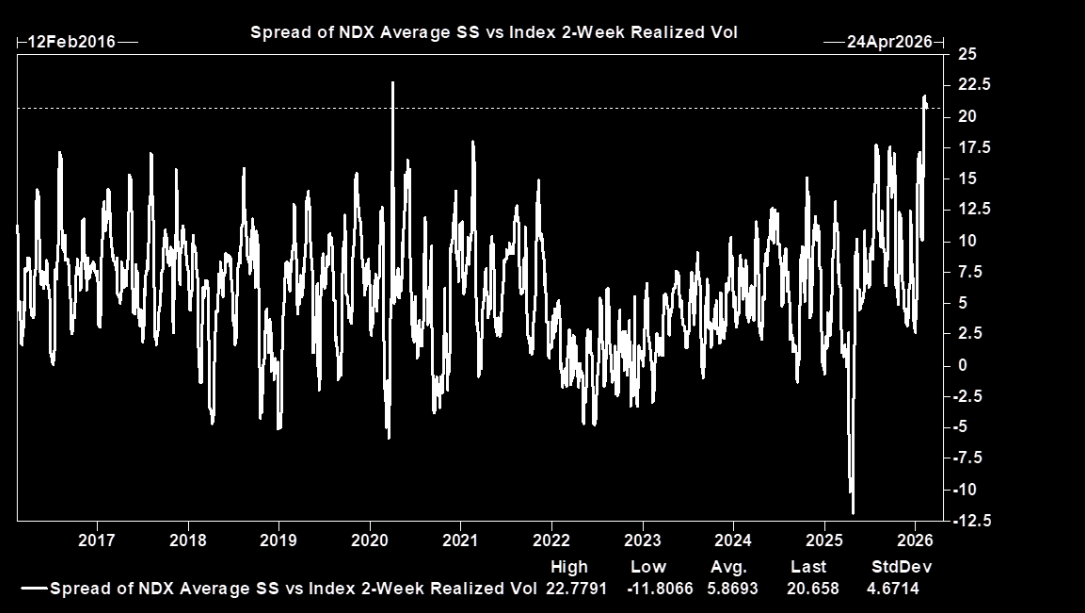

This has been a high vol tape

GS: "At the singles level, dispersion has been the main theme. The moves in singles vs. the broader index have been extreme."

Source: GS

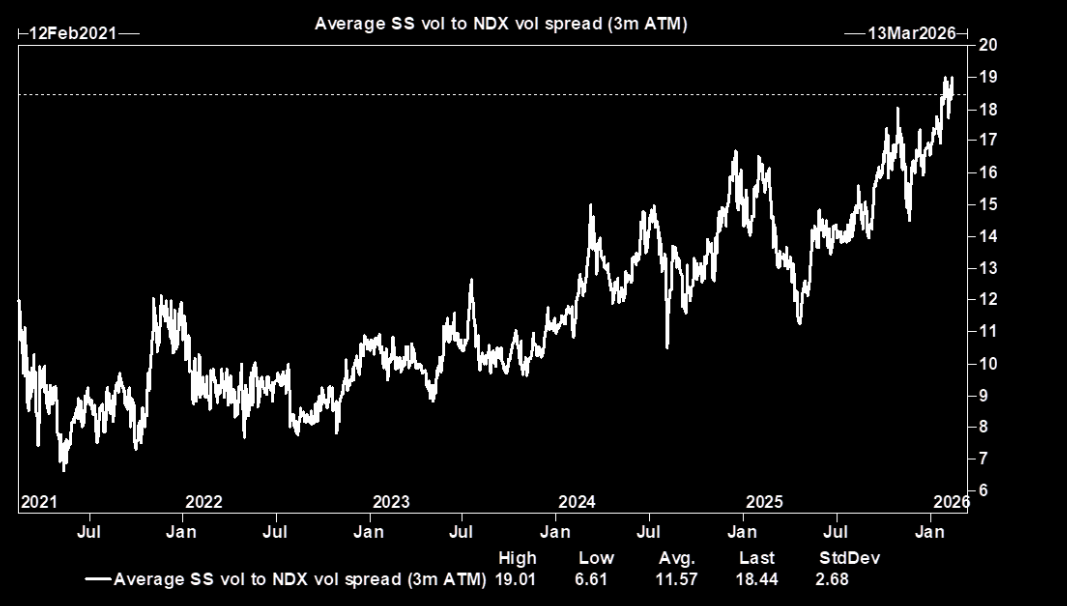

Expect dispersion to continue

GS: "The moves under the surface don’t appear to be relaxing anytime soon. The average implied SS vol to index vol spread (3m ATM) continues to widen out. In other words, the market is expecting the dispersion to continue."

Source: GS

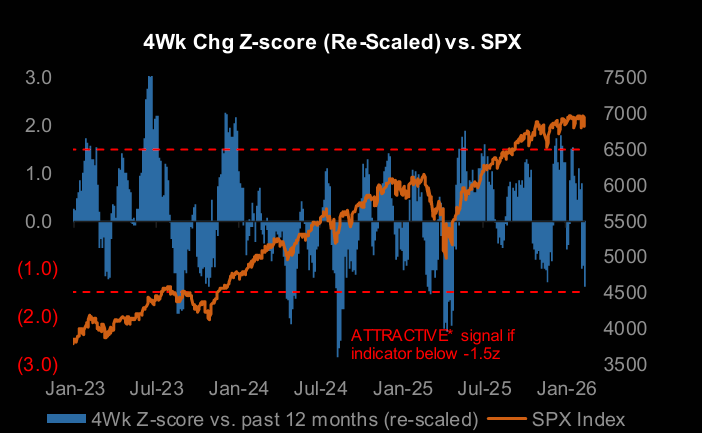

Closer to prior extremes

JPM: "Further de-grossing puts 4wk gross flows closer to prior extremes (though not there yet."

Source: JPM PI

Cleaned up

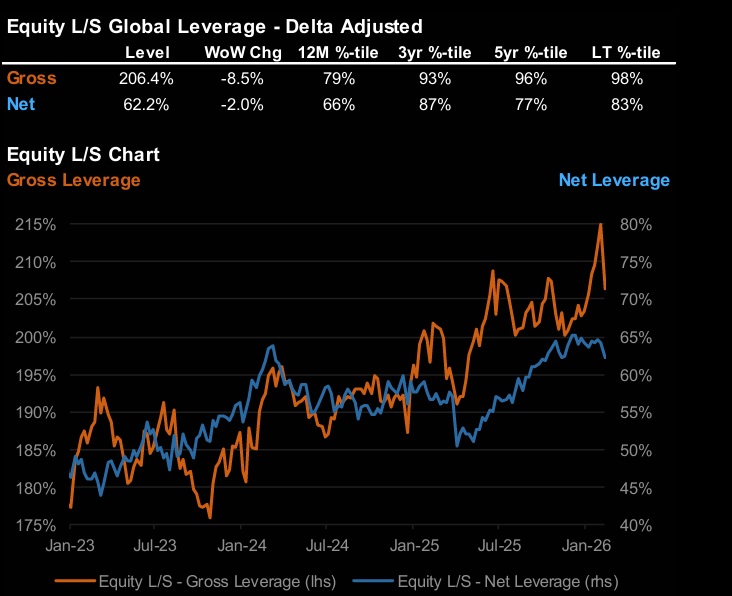

Equity long short fundamental hedge funds have cleaned up their gross and nets a bit. 12m percentiles somewhat off the extremes.

Source: JPM PI

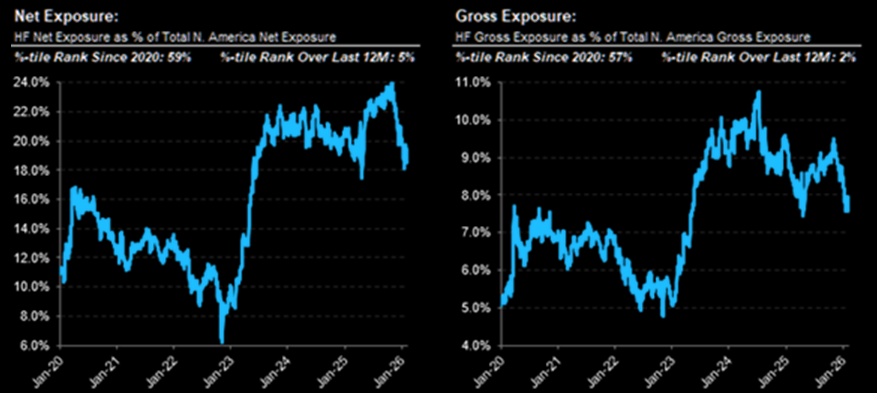

Meaningful Mag7 selling

MS PB: "Meaningful Mag7 selling by hedge funds, both nets and gross down a lot."

Source: MS PB

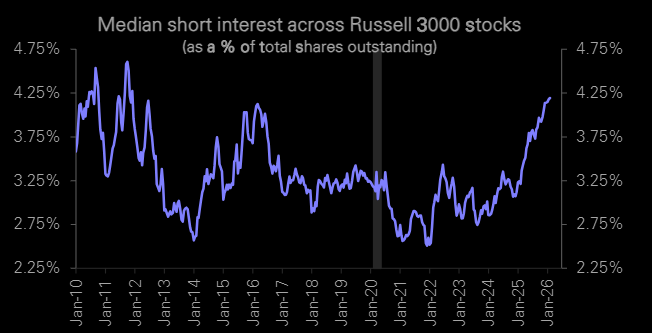

13 year high in this short metric

Median cash shorts taken as % of shares outstanding for the Russell 3000.

Source: Compustat

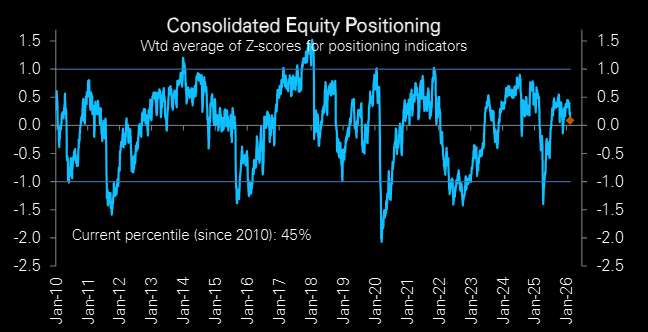

Lowest in 2 months

"Our measure of aggregate equity positioning fell further this week to end slightly above neutral (0.09sd, 45th percentile), , the lowest in over two months and a significant drop from being overweight at the start of the month. Discretionary investor positioning declined to modestly underweight (-0.23sd, 32nd percentile), and is heading towards the bottom end of the cautious range it has been in over the last year."

Source: Deutsche Bank

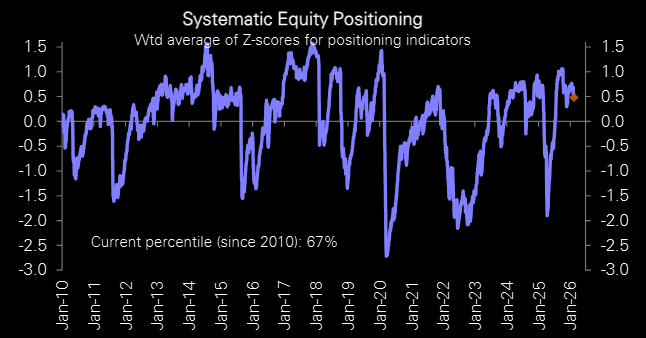

Systematics 6 7

Systematic strategies positioning (0.48sd, 67th percentile) also declined this week. This is the lowest percentile we have seen in a while.

Source: DB

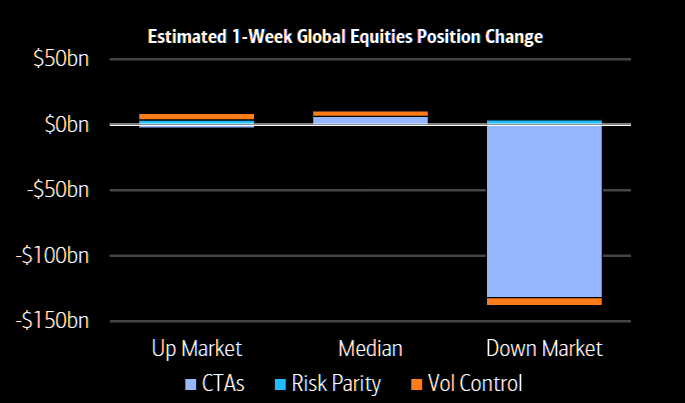

Asymmetric

BofA: "Systematic strategies could sell $134bn in a down market, buy $9bn if markets are flat, and buy $6bn in an up market."

Estimates are for global equities and the week ahead.

Source: BofA

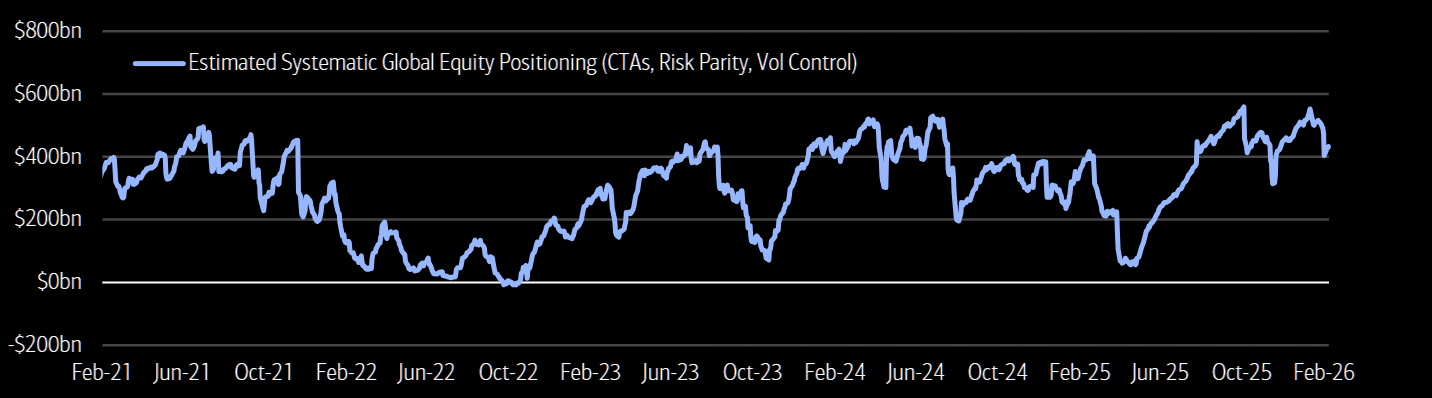

Elevated on a 5-year horizon

Systematic global equity positioning across CTAs, risk parity, and volatility control remains elevated relative to the last five years.

Source: BofA

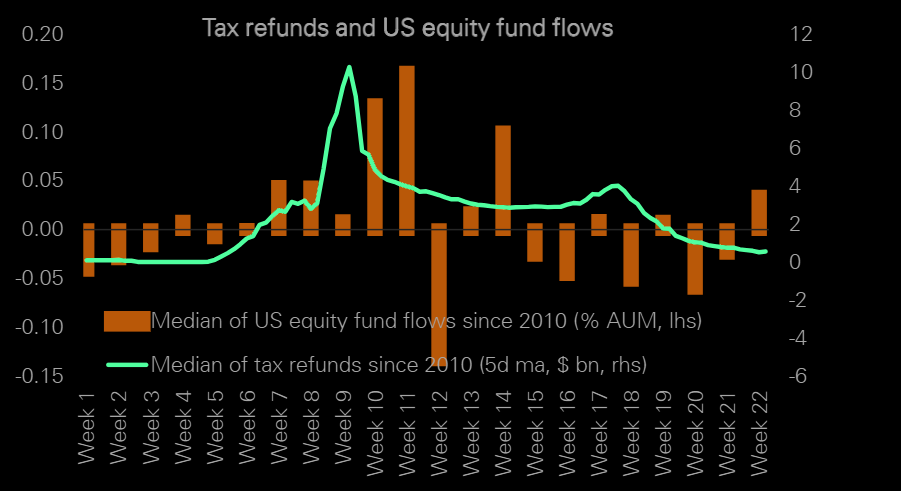

Tax refunds

Tax refund season sees a significant pick up in US equity fund inflows.