Tactical Upswing Confirmed

The bull case keeps getting reinforced

As part of our Monday series highlighting constructive market signals, several indicators are reinforcing a cautiously optimistic view. Money supply growth is improving, PMIs are stabilizing, and market breadth is widening, a combination that historically aligns with periods of tactical upside rather than stress.

"Up & to the right"

Andrew Sheets, Chief Cross-Asset Strategist for Morgan Stanley says that most growth indicators are moving "up and to the right".

"Any single indicator can, and eventually will, let investors down. But when a broad set of economically sensitive signals all point in the same direction, we listen. Taken together, we think this alignment is still telling a story of supportive fundamental tailwinds, while key measures of stress hold. Until that evidence changes, we think those signals deserve respect."

Tactical upswing confirmed

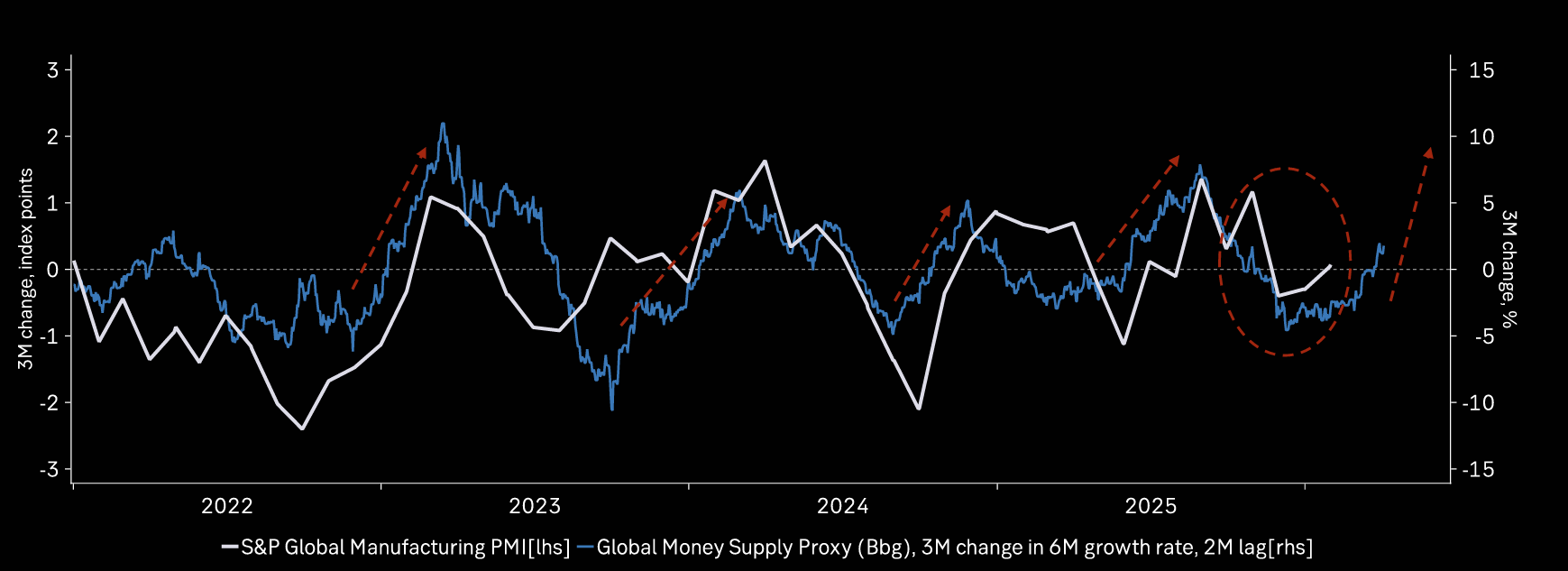

Tactical upswing confirmed as money supply growth picks up. Global money supply is rising and the official PMI release confirmed shift to tactical upswing.

Source: Macrobond

More PMI upside ahead

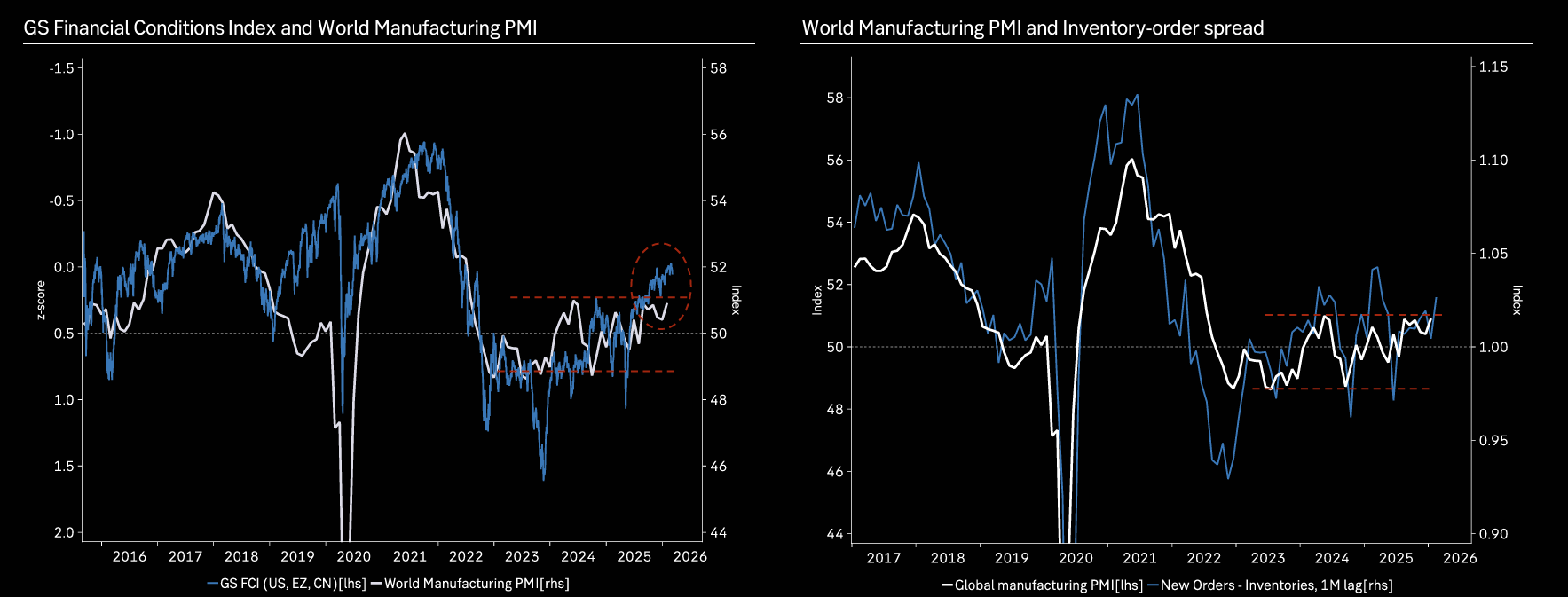

Inventory-orders spread and global financial conditions suggest more PMI upside ahead.

Source: Macrobond

More on the money connection

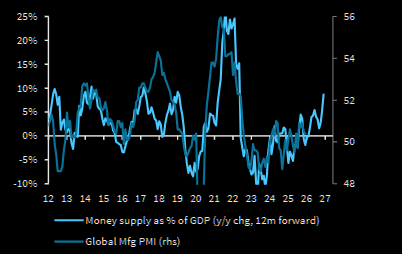

Rising global money supply bodes well for PMIs.

Source: Barclays

Breaking out

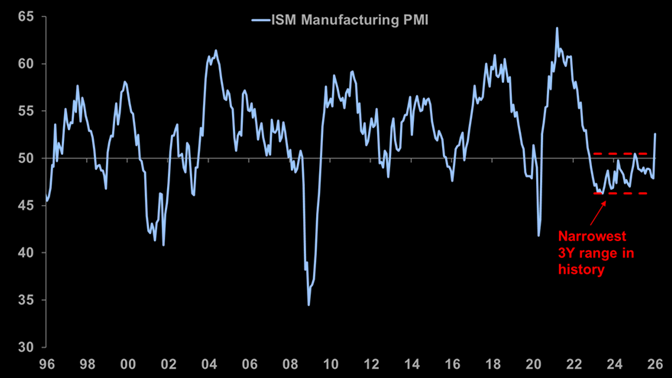

ISM Manufacturing PMI has been stuck in the tightest 3-year range... until now.

Source: Morgan Stanley

Q2 & Q3

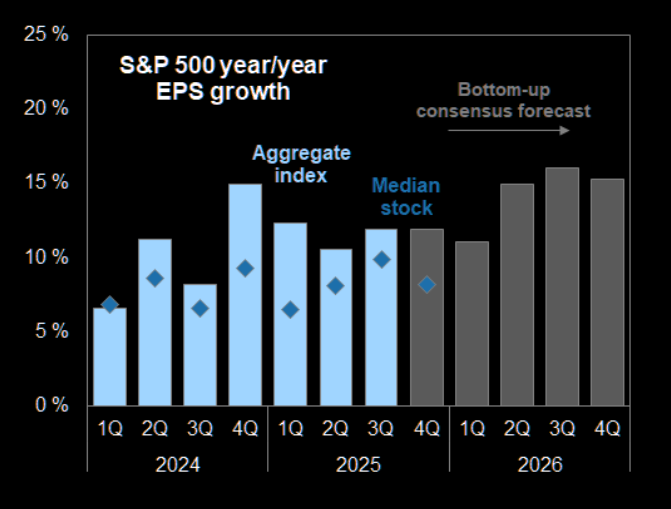

Look at the nice consensus growth numbers for S&P500 EPS for Q2 and Q3. And remember that we almost always beat.

Source: FactSet

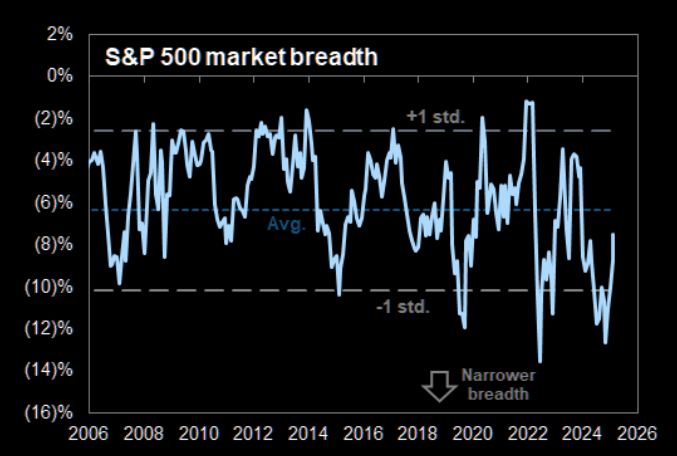

Breadth is improving

S&P 500 52-week market breadth.

Source: Goldman

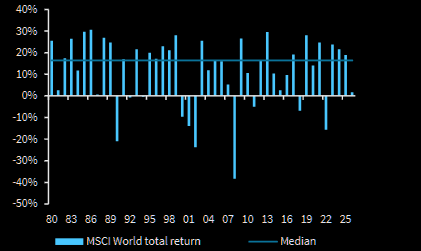

20% is the new normal

Global equities have delivered 20% per year now 3 years in a row.

Source: Barclays

Dry Powder

So much money on the side-lines.

Source: ICI

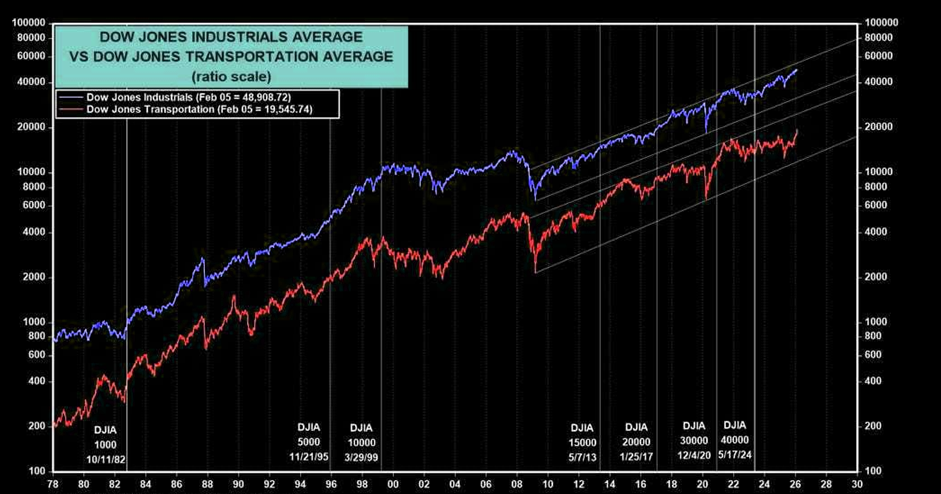

Dow Theory

“At or near their recent record highs are the DJIA and the DJTA. So Dow Theory is confirming that the bull market remains intact.”