Tech Cracks, Stress Explodes — But Software May Be Hitting Exhaustion

That déjà vu

We keep coming back to this déjà vu setup. Markets are replaying the same pattern we saw from Nov ’24 into the Feb ’25 selloff. This time, we consolidated since last November, and suddenly things look ugly again. Last year’s real puke began when NASDAQ broke the 100-day MA. We’re seeing that exact break today.

Source: LSEG Workspace

Follow crap tech?

Small cap tech continues the crash move. NDX has taken notice, but do we see a proper catch down move?

Source: LSEG Workspace

Not so sexy

SOX is putting in one of the biggest down days in a long time. Both the steep trend line and the 50-day MA sit just below here, must-hold levels.

Source: LSEG Workspace

Nasty NASDAQ

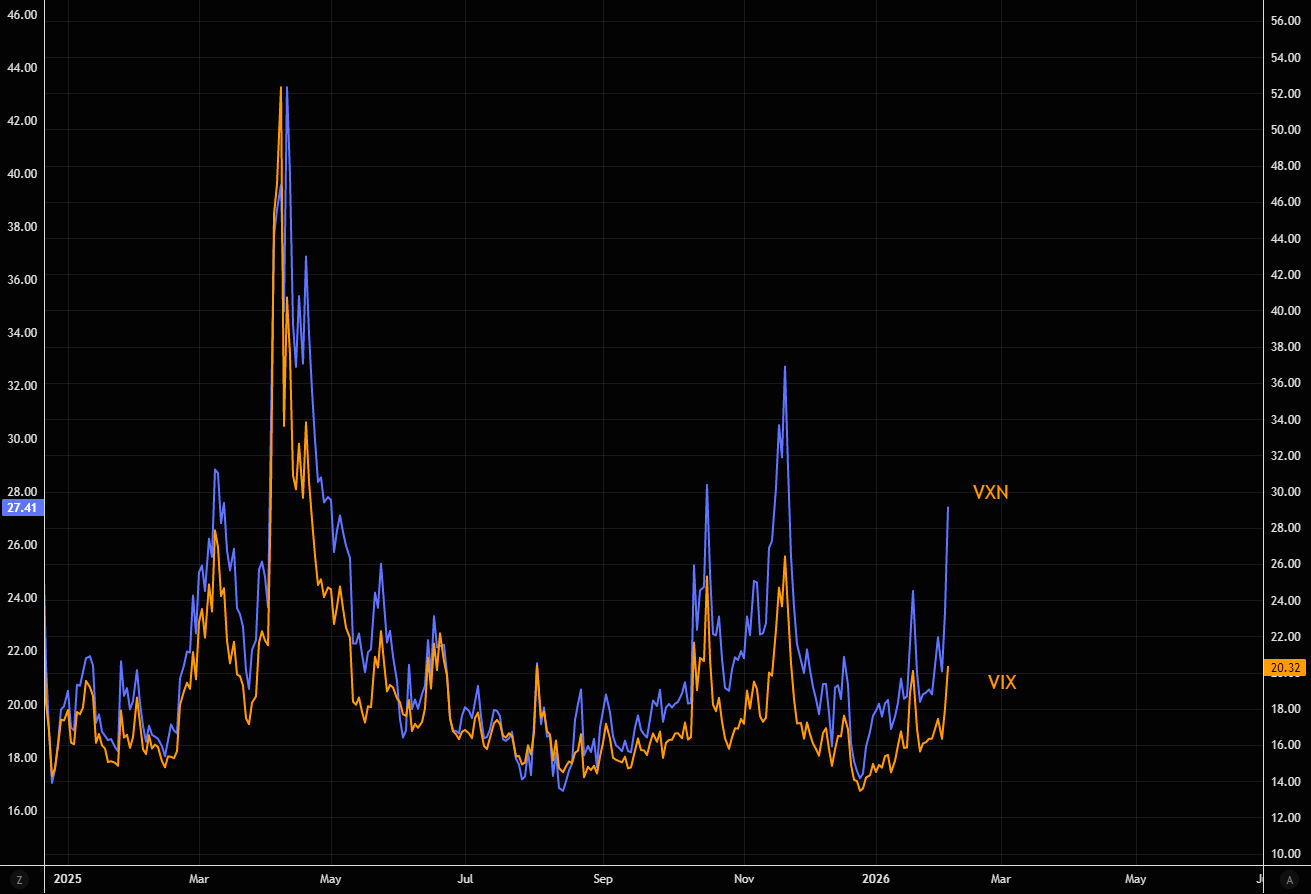

NASDAQ volatility continues to surge. The reaction in VXN has been very aggressive so far. Chart shows NDX vs VXN (inverted).

Source: LSEG Workspace

Stressy tech

VXN leaving big brother VIX way behind. Absolute and relative tech stress has exploded to the upside.

Source: LSEG Workspace

SPX levels to watch

Recently we outlined the downside mechanical flows that could be triggered should the market move lower. Latest levels to watch now via GS: SPX 50dma: 6877 // NDX 100dma: 25,194 (previously tested/held this until today) // ST CTA: 6907 (broken) // Med term: 6701 (down another ~2.5%)

Used to be same same

Imagine if BTC still carries some of that aggregate investor psychology... The gap vs NASDAQ remains absolutely huge.

Source: LSEG Workspace

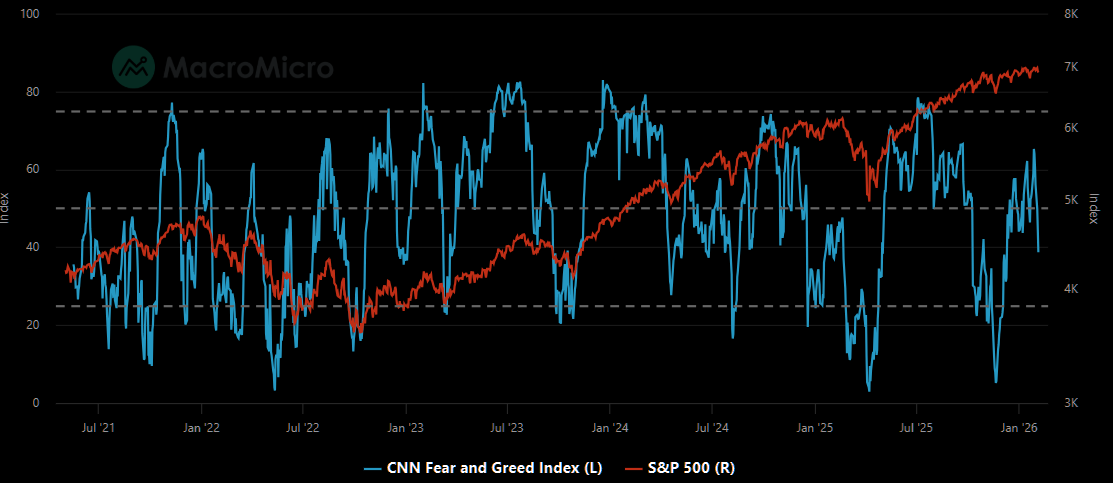

That was quick

From rather "deep" greed (never reached extreme) to fear in a few sessions. Note extreme fear doesn't kick in until 25...

Source: MacroMicro

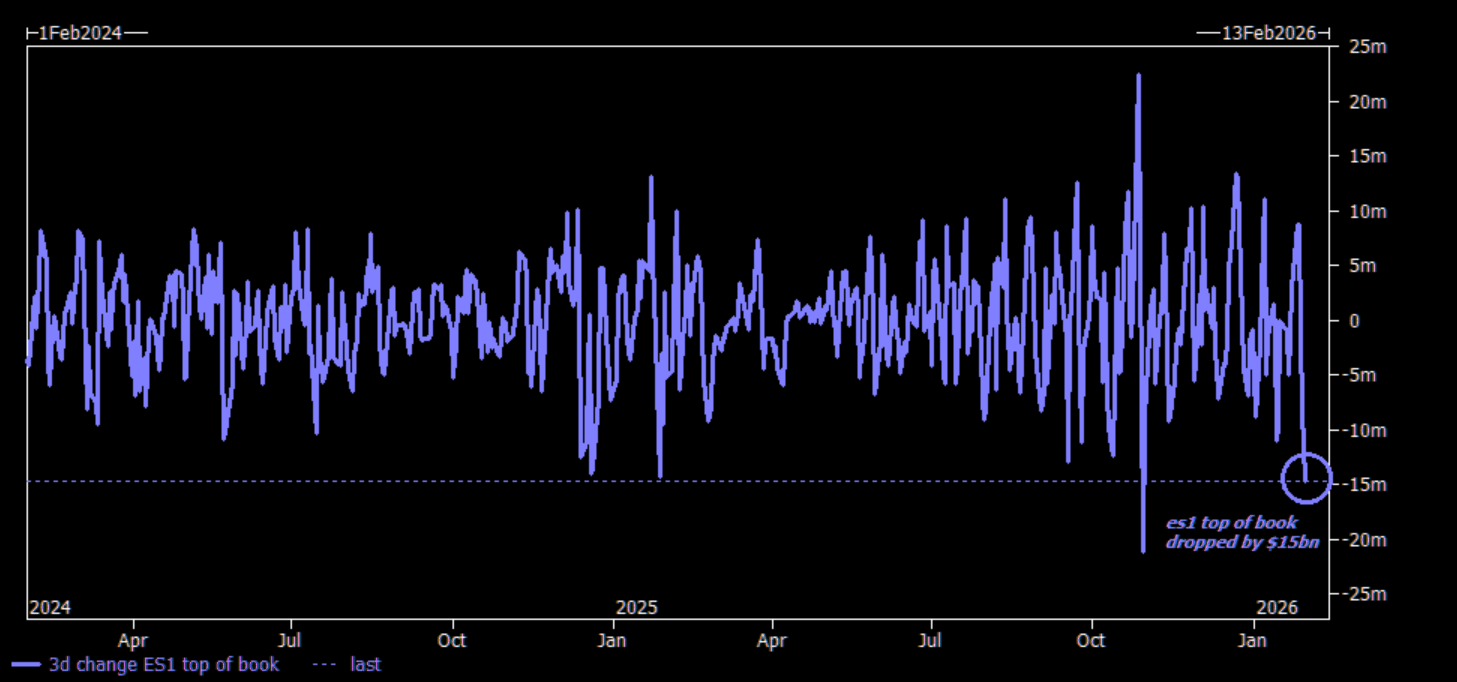

Shitty liquidity

Liquidity vanished going into the latest sell off...Good luck reshuffling big books, and this goes both ways.

Source: GS

Been waiting for you

IGV putting in a massive hammer candle so far today. A hammer candle post such a sharp move lower could be the short term exhaustion signal. We would be willing to try a few daring bounce trades in this hated space. Full note here.