Is Tech Screamingly Cheap Now?

From froth to footing

Tech has been taken apart. Forward PEGs sit at five-year lows, relative P/E premiums are near seven-year troughs, and positioning has been flushed. Earnings growth still leads the market and in a twist few saw coming, Microsoft now trades at a lower multiple than IBM.

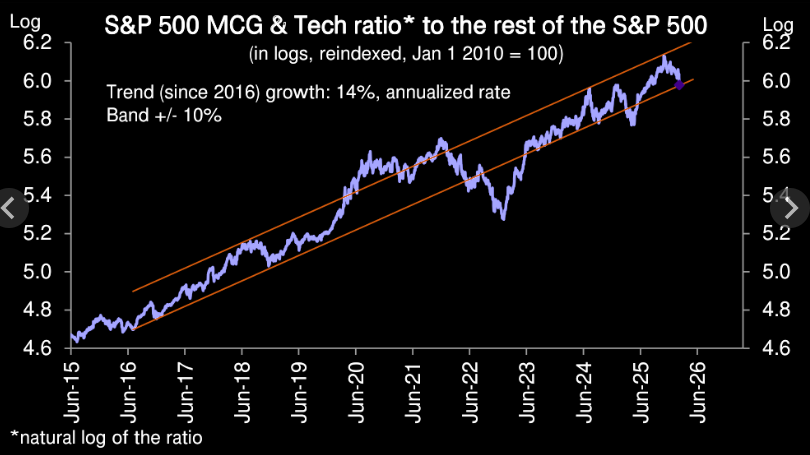

The trend is your friend

Mega-cap growth and Tech stocks bounced off the bottom of their decade-long outperformance channel versus the rest of the S&P 500.

Source: Deutsche

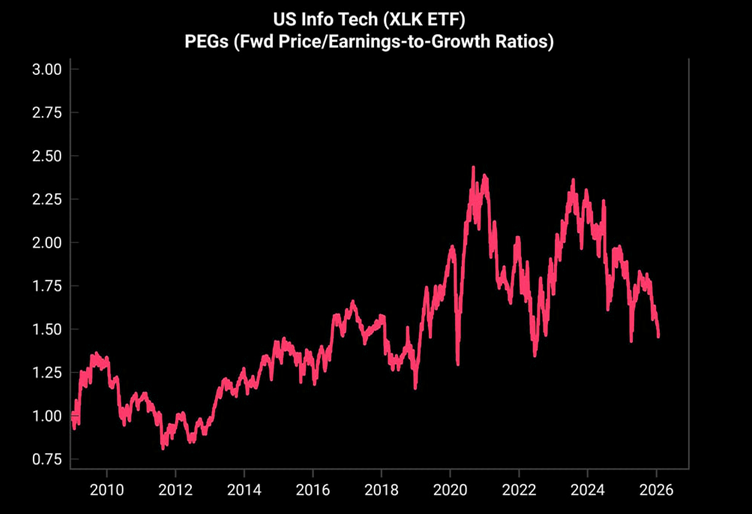

5-year low

US tech stocks have seen a significant de-rating, with forward PEG ratios now trading near 5-year lows.

Variant Perception: "The "froth" has largely come out of the sector despite the long-term growth story remaining intact."

Source: Variant Perception

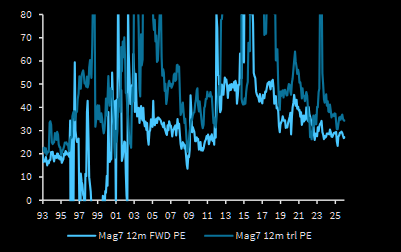

7-year low

Deutsche Bank goes even further and sees a 7-year low.

"The relative P/E premium for MCG & Tech is near a 7-year low"

Source: Deutsche Bank

Moderating Mag

Barclays points out how much the Mag-7 multiples have moderated.

Source: Barclays

The NDX PE deration

GS tech specialist Peter Callahan: "I watch the fwd P/E multiple of the NDX relatively closely … in the post ZIRP era, it has generally topped out at ~28x-29x – and, on the wides, tries to find its footing in the ~24x-25x range (outside of market “events” like Liberation day in the Spring’25 or the rates mania Fall’23)…"

Source: Zero Hedge

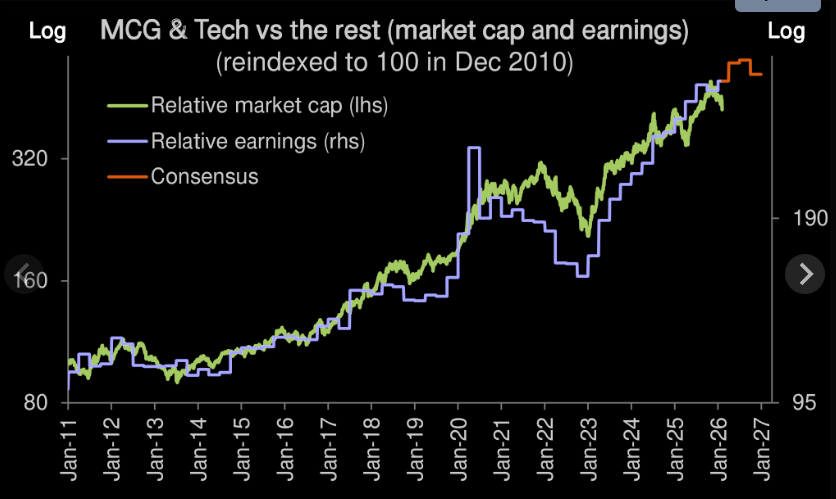

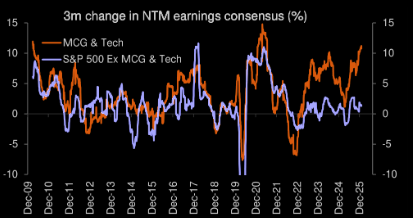

Sizeable decline in earnings

The selloff over the last 3 months is now pricing in a sizeable decline in relative earnings.

Source: Deutsche Bank

Still better growth

Earnings growth for MCG & Tech continues to run significantly ahead of the rest.

Source: Deutsche Bank

Revisions

Earnings revisions for MCG & Tech continue to massively outpace the rest of the S&P 500.

Source: DB

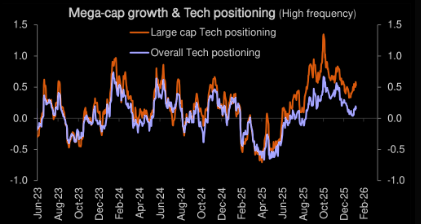

Positioning

Positioning for Tech has fallen sharply; near neutral for Tech overall but still above neutral for large cap Tech.

Source: Deutsche Bank

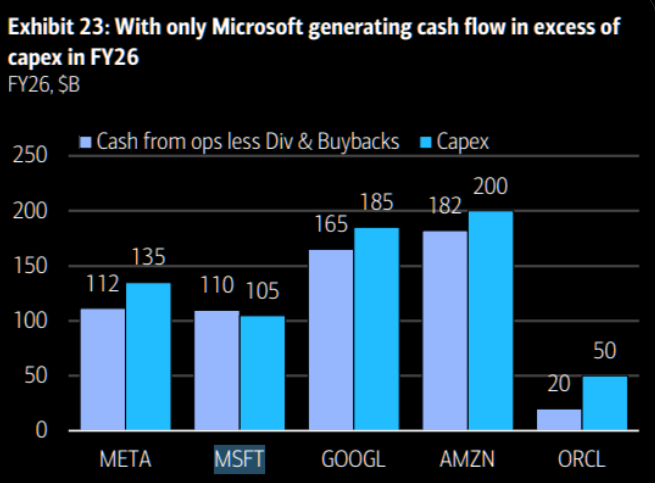

Cash flow concerns

Let´s end on a negative note and that has to focus on free cash flow concerns. Only Microsoft generating cash flow in excess of capex in FY26.

Source: BofA

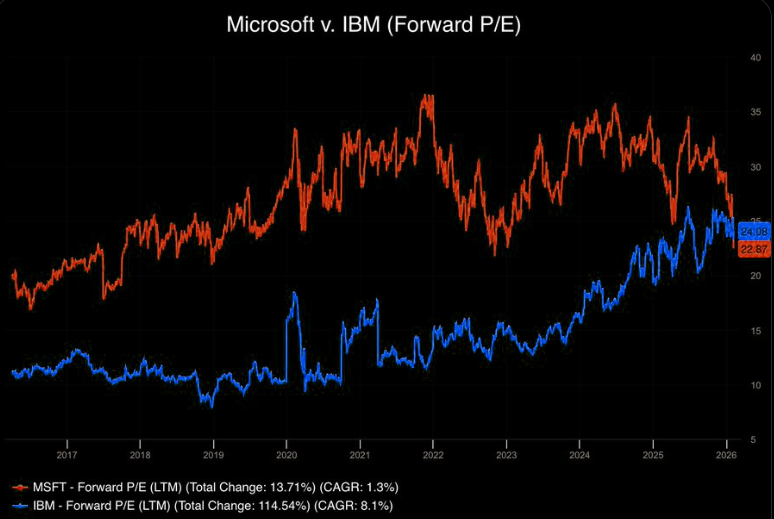

Enter IBM

Let´s actually end with this observation from fiscal.ai. Microsoft now trades at a lower forward multiple than IBM, for the first time in 10+ years.

Forward P/E:

MSFT: 22.9x

IBM: 24.1x