They Seek It Here, They Seek It There...

That elusive recession

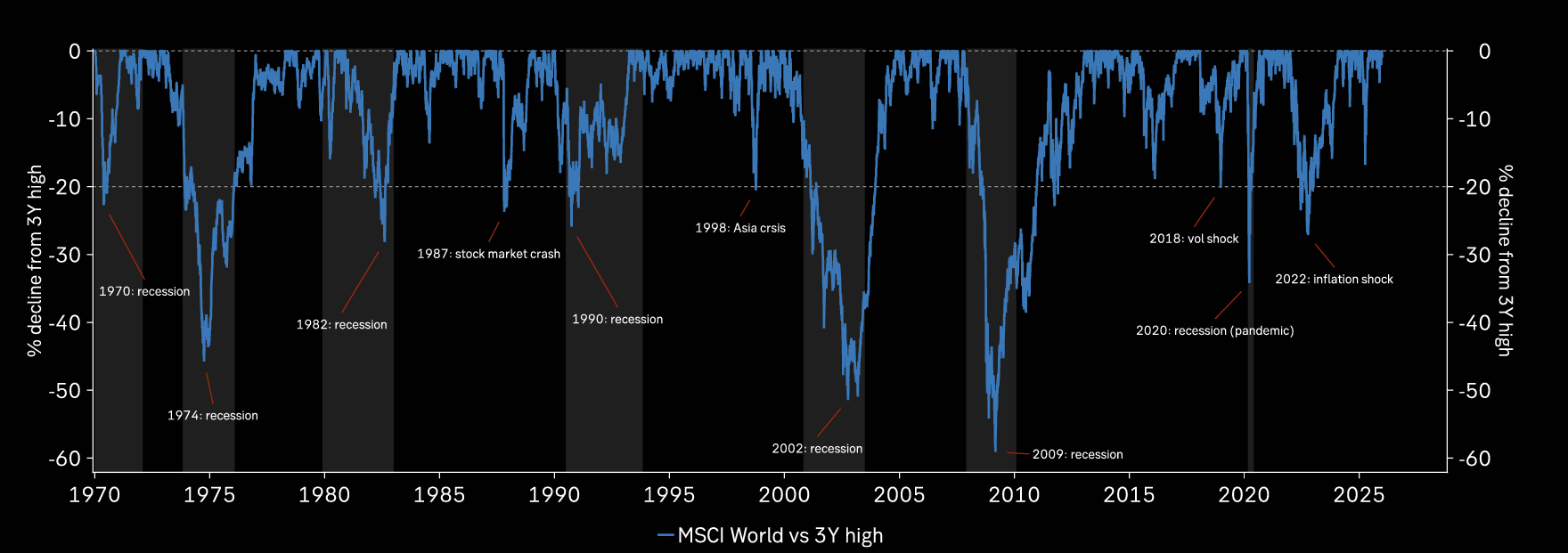

You can always find weakening indicators if you look hard enough. Job searches are surging, yield curves still invert, and economists are uneasy. But markets tell a different story: recession probability near zero, bond volatility asleep, and equities priced for anything but trouble. Let's look at some different aspects on theme of recession.

Always the grumpy economist...

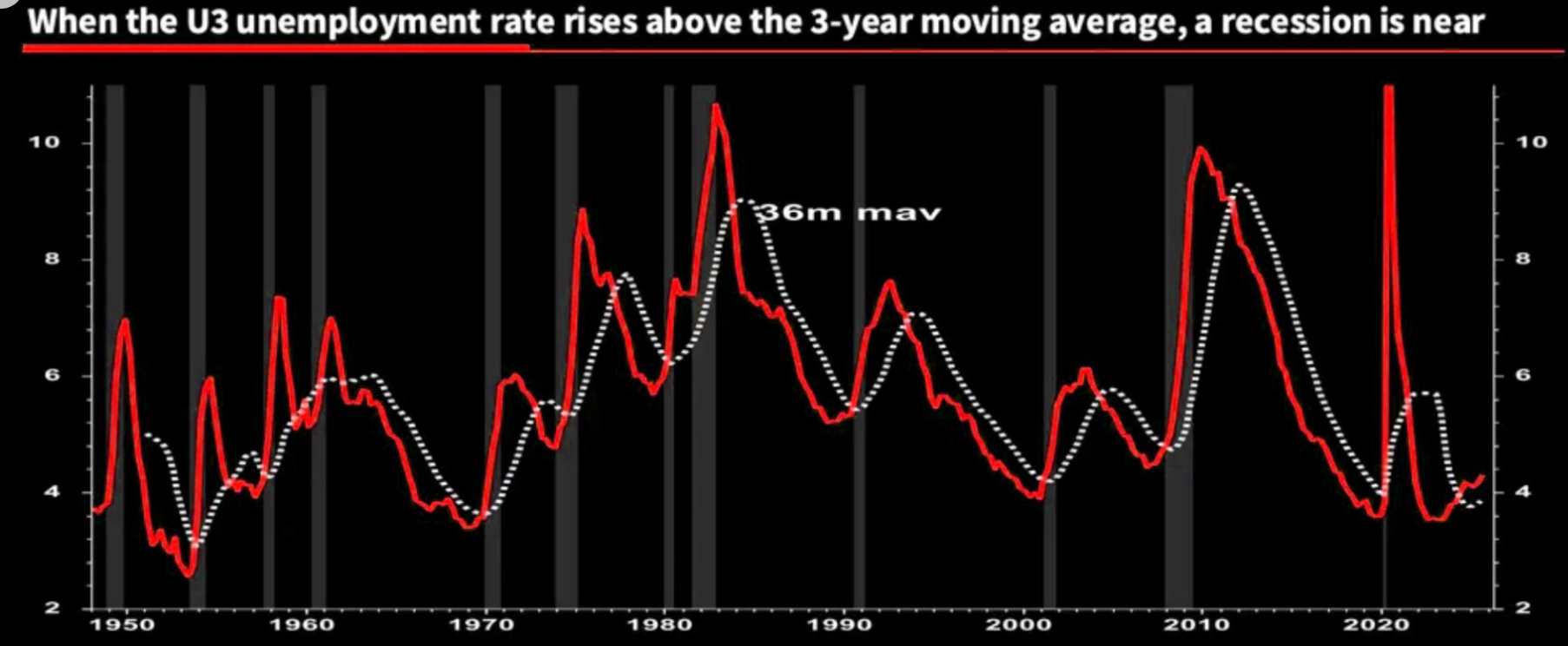

"No-one is predicting a US recession in 2026 despite this simple indicator having a 100% track record of success. This time may well be different, but you've got to have a bloody good reason to ignore this. Are you feeling confident."

Source: Albert Edwards

Always the weakening indicators...

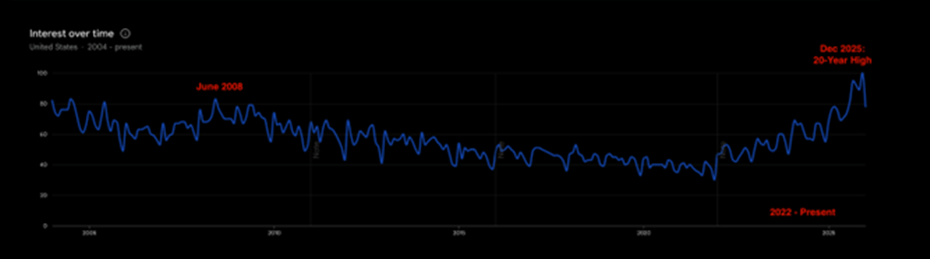

You could wake us up in the middle of the night and we would be able to cite 100 different macro indicators that are currently weakening and that you could use to spin a recession case. That is nothing new. Here we represent it with that searches for “find job” reached a new 20-year high at the end of December 2025, surpassing even levels last seen during the 2008 Financial Crisis and Great Recession. Americans are searching for jobs more than even during the Great Recession despite the US still being in a nominal economic expansion.

Source: Google Trends

What does Miss Market say?

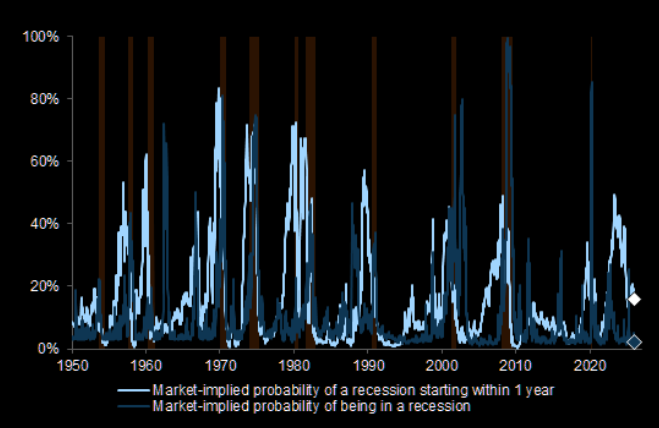

This note does not focus on what the economists say or individual indicators but rather what Miss Market is pricing in. First Goldman's recession probability indicator.

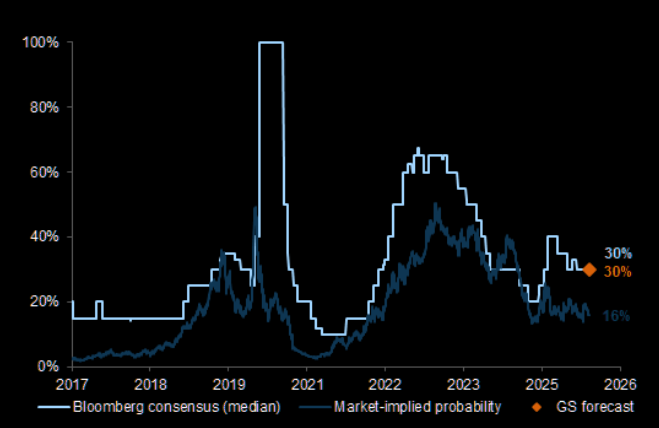

Market-implied US recession probability for being in a recession right now = very close to 0%. The same probability for getting into one in the next 12 month has come down a lot in the recent past and is now in the mid-teens, as per Goldman data.

Source: Haver

By indicator

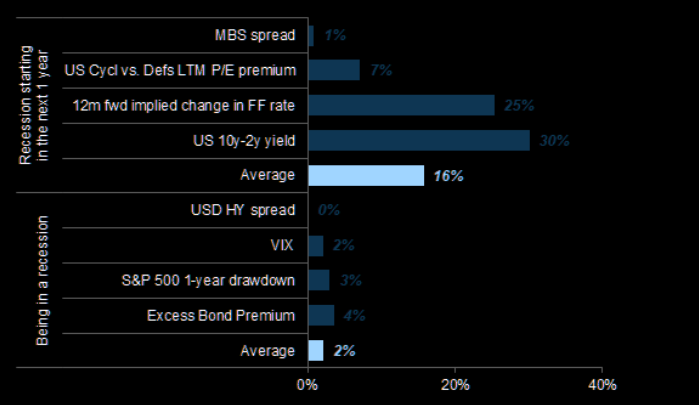

Market-implied US recession probability by indicator. Some very low numbers... The 10y-2y spread is the most "extreme".

Source: Haver

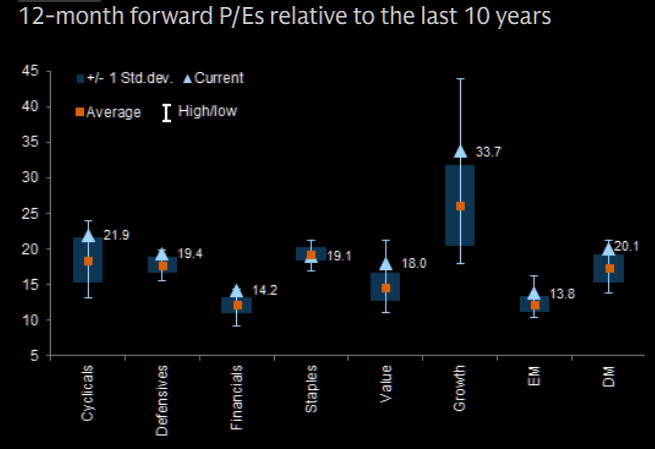

No sector pricing in a recession

Valuation ranges of MSCI World styles indices.

Source: Datastream

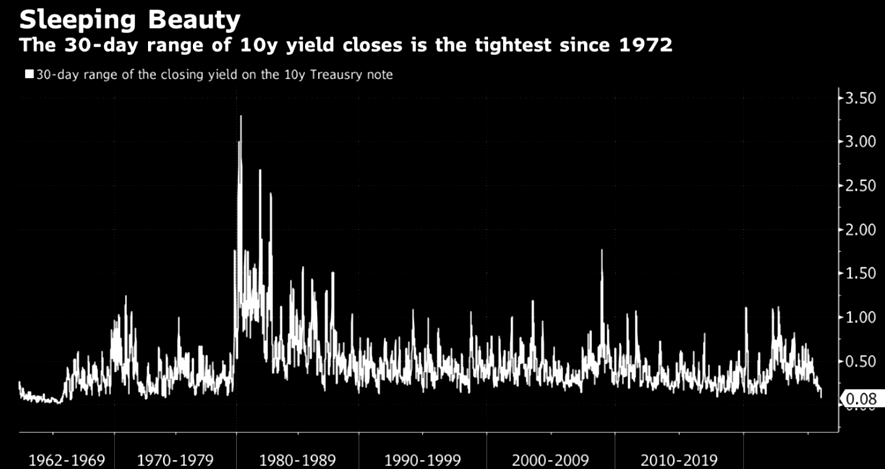

Bond market calm

The bond market has never been so quiet... the 30-day trading range for the benchmark 10-year US Treasury, which is now the tightest it’s been since the 1970s. Meanwhile, the trading range for the 30-year has reached a record low.

Source: Bloomberg

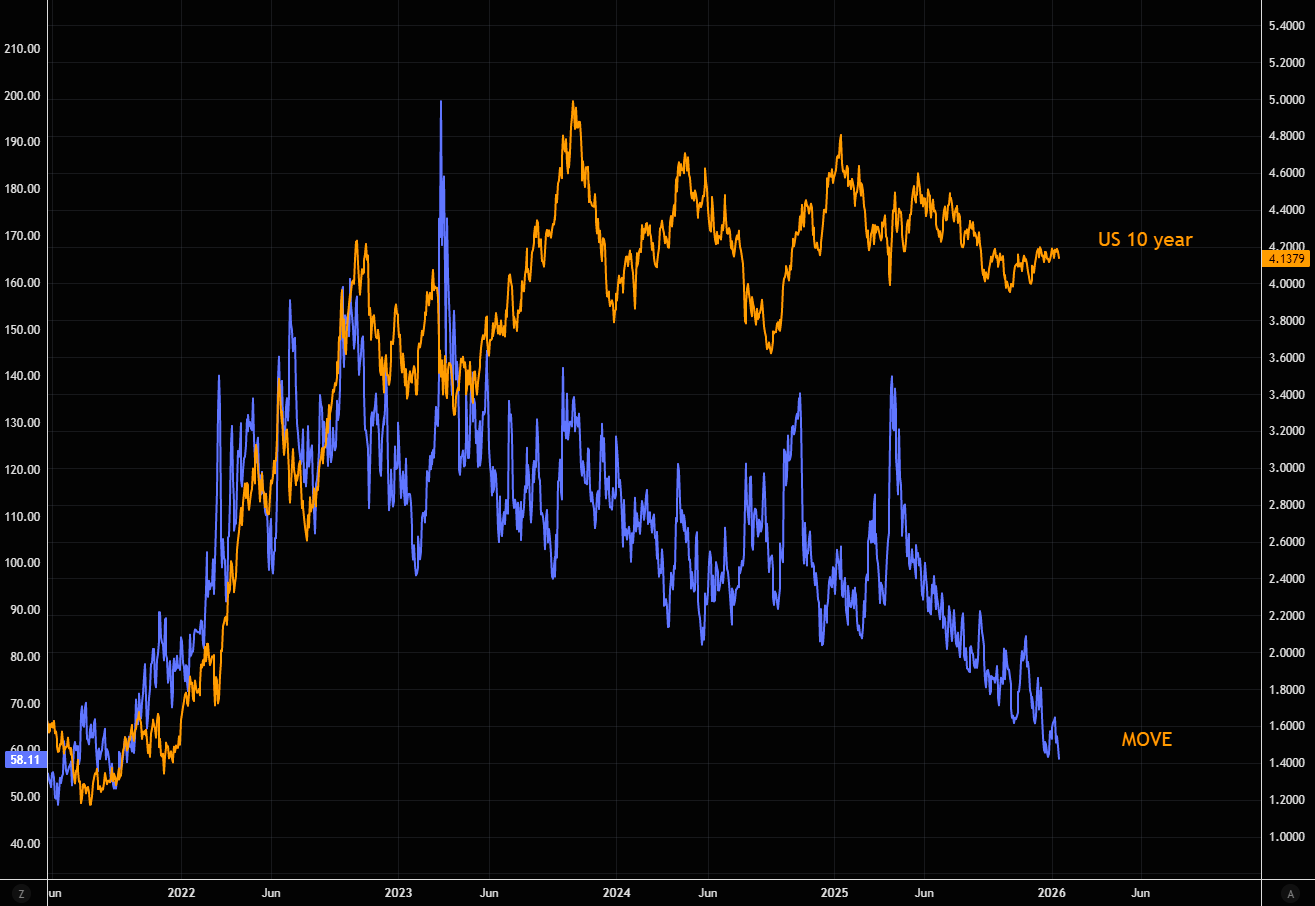

No MOVEs

Bond volatility continues crashing. MOVE just printed the lowest levels since October 2021.

Source: LSEG Workspace

What about consensus?

Probability of a US recession in the next 1 year as per Bloomberg consensus numbers.

Source: Goldman

What about the herd?

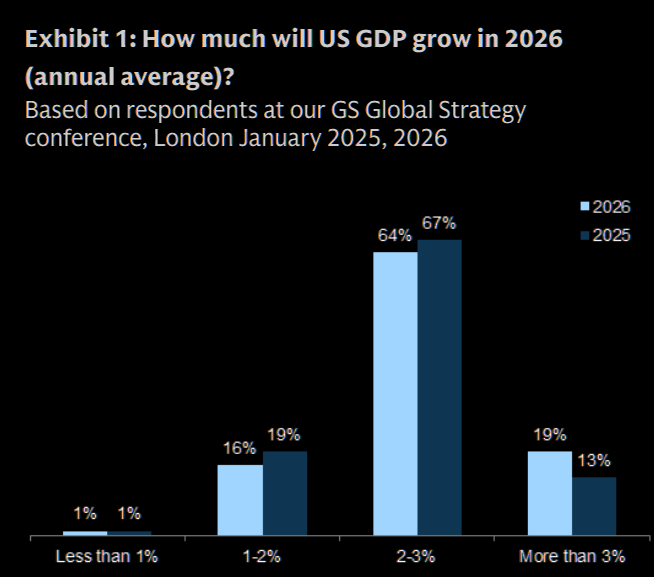

Over 80% of surveyed clients expect US GDP growth around at or above consensus (2.1% for 2026), with recession fears nearly vanishing. US GDP optimism is at a multi-year high.

Source: Goldman

Equities love this

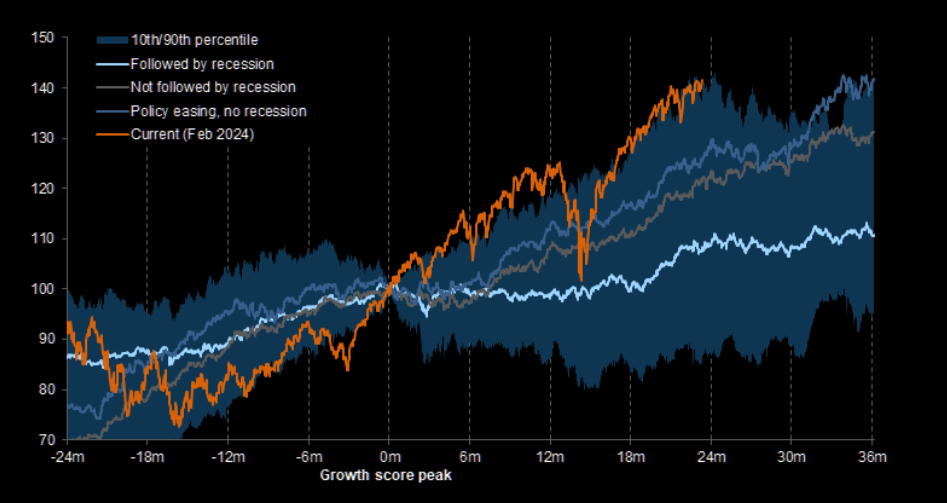

Remember that equities love this backdrop AS LONG as there is no recession...

GS: "Equities tend to perform well on average following growth score peaks, as long as there is no recession and especially if there is policy easing."

Source: Goldman

Never ever

It is that simple: never go underweight unless you expect recession.