Thinking About Bottom Fishing in Software

A sector laid low, and a question of value

Software stocks have suffered one of their worst relative drawdowns this century, erasing years of outperformance. With sentiment deeply negative and technical indicators stretched, investors are beginning to ask whether the selloff has created opportunity - or merely reset expectations lower.

6 years of gains gone

Software relative to the S&P 500 is a particularly brutal chart... essentially 6 years of relative gains wiped out.

Source: Kevin Gordon

Worst this century

Software Stocks now underperforming the Nasdaq by the largest margin this century.

Source: @barchart

Worse than COVID

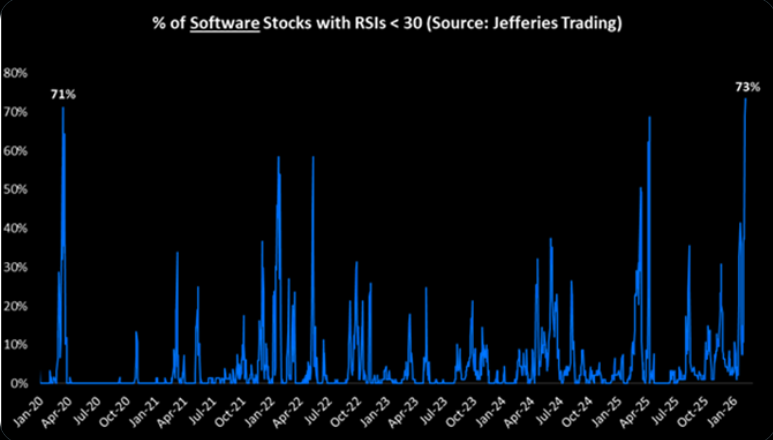

Worse than March 2020 (from Jefferies).

Source: Jefferies

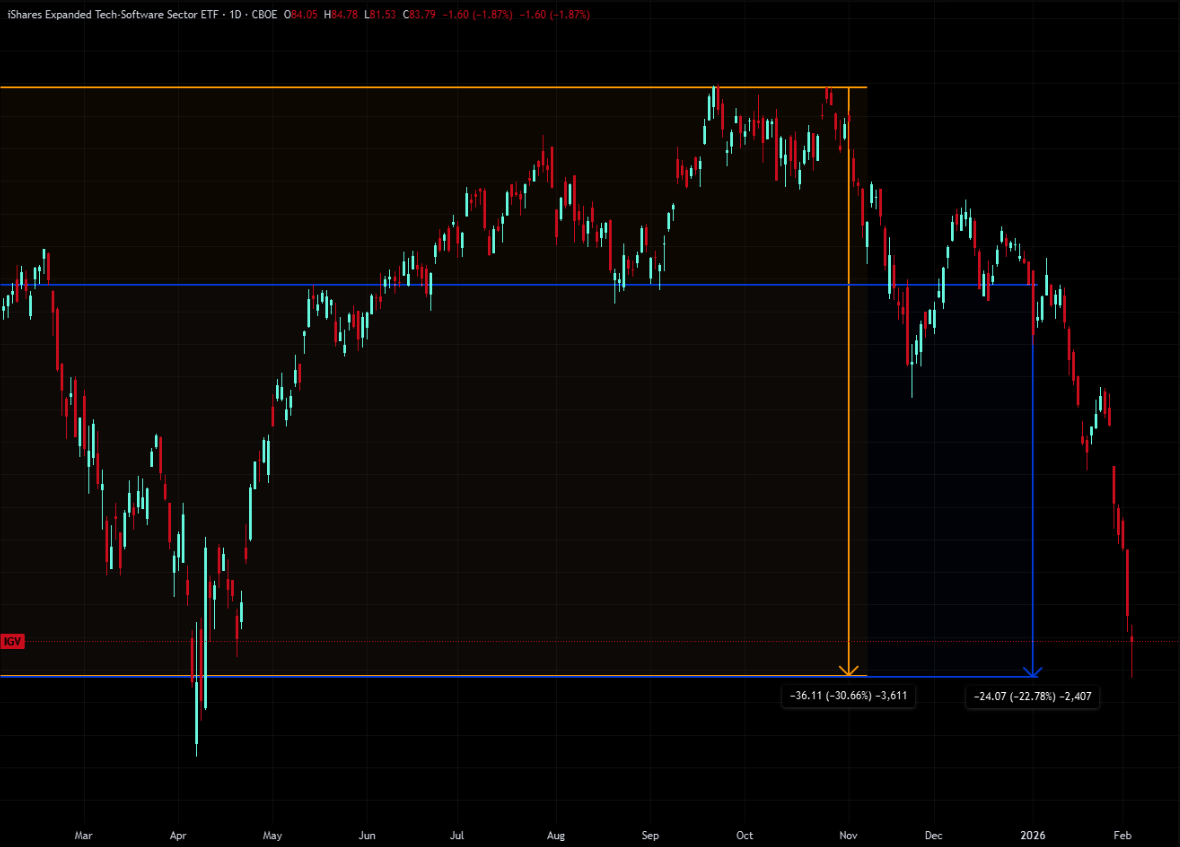

Hammer

IGV with a massive hammer candle yesterday. After such a sharp move lower, this could be the short term exhaustion signal.

Source: LSEG Workspace

Jensen

Jensen Huang: Market is wrong about software stocks:

"The notion that AI is somehow going to replace software companies is the most illogical thing in the world and time will prove itself."

Interview date: 3 February 2026.

Inverse of the 2021 euphoria

JPM excellent Mark Murphy:

"1) in recent months our sense is that investor concerns have finally caught up with the rate-of-change vector for AI and likely begun to overshoot to the downside

2) Our CIO Survey series does not suggest the imminent death of the broader software landscape, to any material extent.

3) It feels like an illogical leap to extrapolate Claude Cowork Plugins, or any similar personal productivity tools, to an expectation that every company will hereby write and maintain a bespoke product to replace every layer of mission-critical enterprise software they have every deployed

4) the current state of investor psychology has started to feel like the inverse of the 2021 software euphoria period, in which the same institutions that are currently selling software stocks at 25-30 year valuation lows relative to Semis were buying Software as fast as they could when the group was at a 20-year valuation high, fully convinced that Cloud was the world’s greatest business model and interest rates would remain at zero forever."

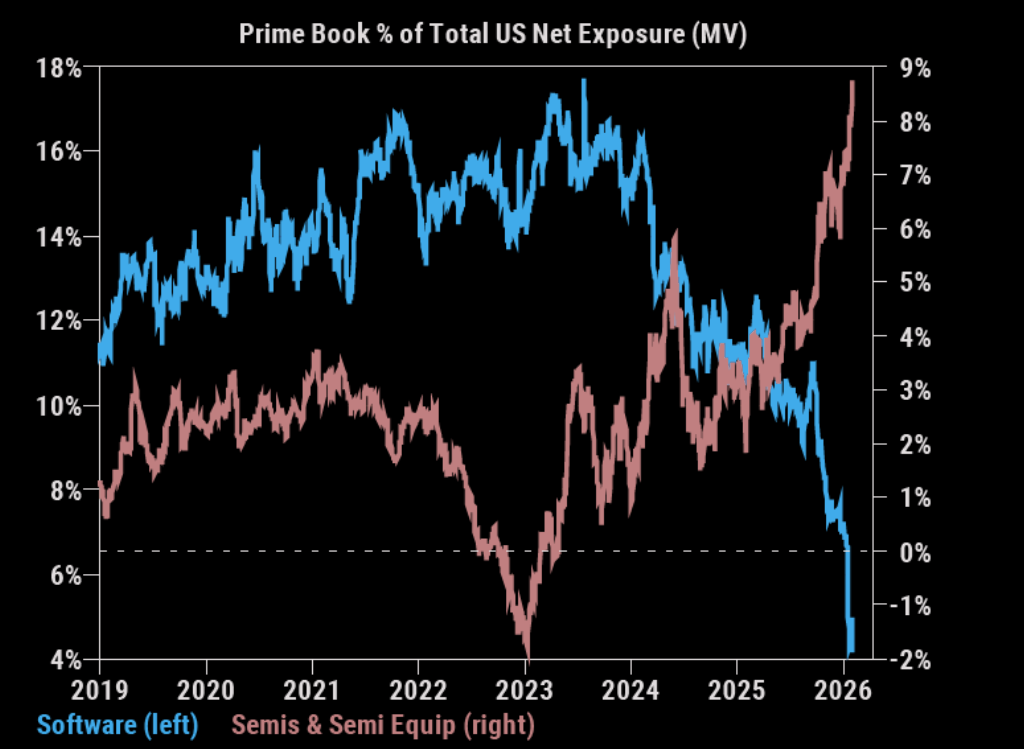

Source: GS Prime

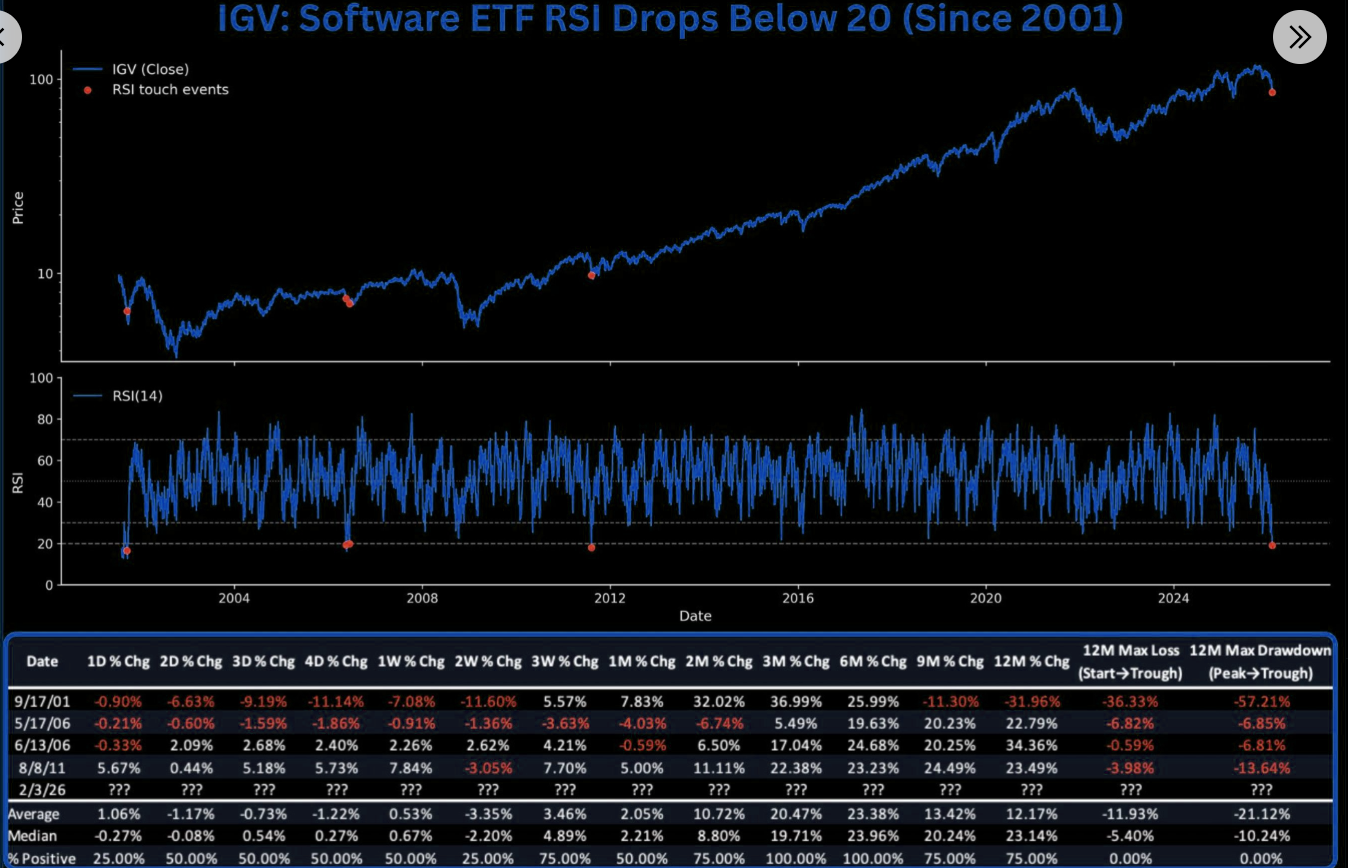

When this oversold...

Software is very oversold. History pointing to big 3-month rally (>20%). Note - n = 4.

Source: Bluekurtic

Thinking about bottom fishing

"if you're thinking about bottom fishing in IGV, Jeffrey Yale Rubin at Birinyi Associates notes that the average bear market in the group is a slide of -32.53%, with the worst drop, -53.94%, during the global financial crisis. It was at one point down -30.7% Wednesday (-23% YTD)."

Source: Neil Sethi

Not exactly basement bargain

Software still trades at 8x sales. Proper valuation support is still a long way down.

Source: Bespoke

Betting on a bounce?

You're not the only one. Software ETF IGV Call volume SOARED to a record high.

Source: Subu Trade

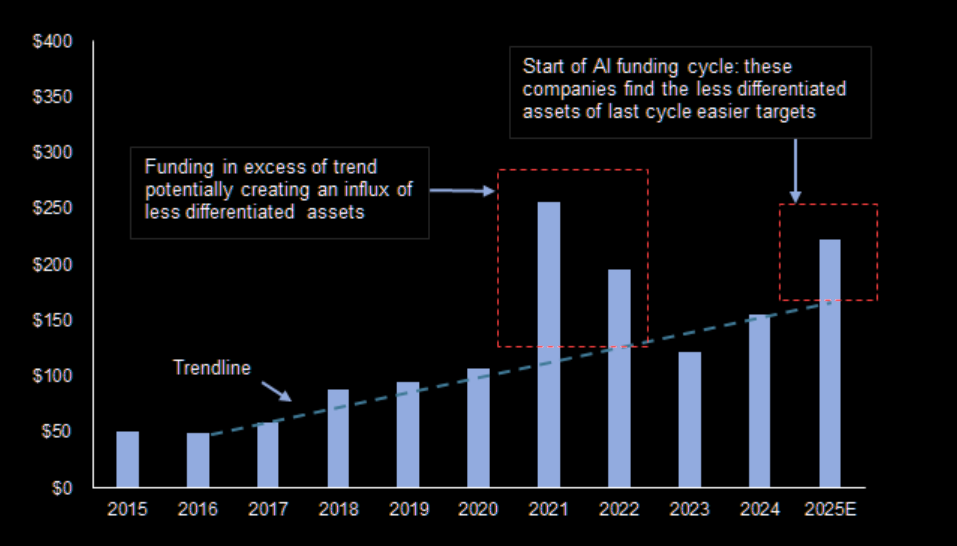

Easy money - structural problem

GS: "Excess funding in 2021 and 2022 may have created a cohort of companies that are inherently less differentiated and more exposed to incremental competition."

Source: Pitchbook

Bear case might simply just become the norm

GS on software: "We expect it will take 2-3 quarters of stable fundamentals for investor sentiment to improve – and even then, there is a scenario where the bear case simply gets pushed out to future years."

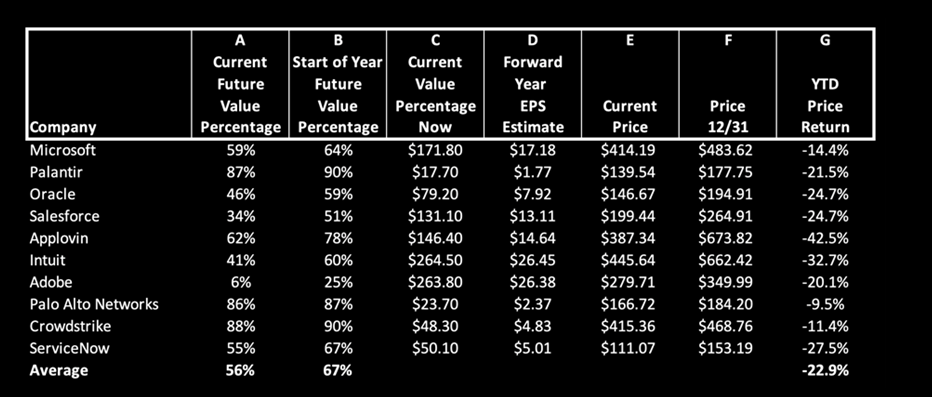

Future value

"The year to date bear market in major software names (average: -22.9 percent) has only taken mean valuations to 56 percent Future Value, down from 67 pct at the start of the year. In other words, more than half the sector’s stock prices are still based on expected future improvements in earnings power. Gen AI has certainly dinged investor confidence in the space, but valuations still imply a long runway of earnings growth into the distant future..."