The (Very Old) Empires Strike Back

Not a miracle. Not nothing either

The EU and India have reached a political agreement on a Free Trade Agreement covering ~2 billion people and ~25% of global GDP, quickly branded “the mother of all deals.” It’s not just trade policy. It’s Europe quietly admitting it needs a new growth partner. But before anyone starts pricing a macro miracle, let’s be clear: this is diversification, not salvation.

This deal won’t save Europe. It won’t offset US tariffs.

It won’t resurrect globalisation. But it does something important: It gives Europe a credible growth diversification lever. It channels capital into sectors that still matter. It offers India exposure without paying India prices.

In a world where trade blocs are hardening and growth is scarce, that’s enough to matter. Not a miracle. But not nothing either.

The art of the deal: Fear

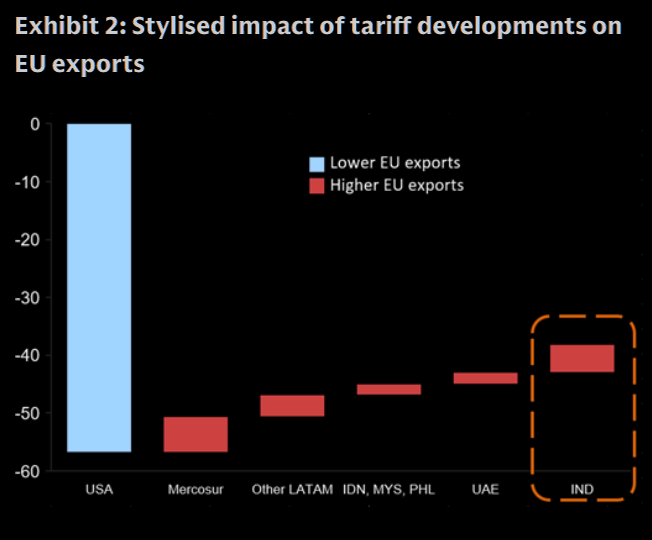

The backdrop is of course that US tariffs on India jumped to 50% in 2025, renewed tariff risk for Europe, China competition intensifying and global supply chains fragmenting. Europe and India didn’t choose each other, they were pushed together. This deal helps, but it doesn’t fix Europe’s external demand problem.

Source: Comtrade

Macro impact: Small, but real

Goldman is blunt: even in the best case, EU gross exports rise by <€20bn (~0.1% of GDP). That won’t move GDP prints. But markets don’t trade GDP levels; they trade marginal change.

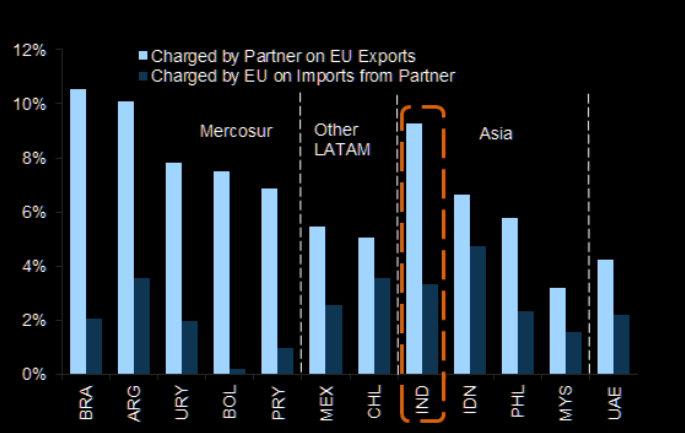

India stands out as one of the most tariff-protected major markets, meaning cuts actually matter.

Source: Haver

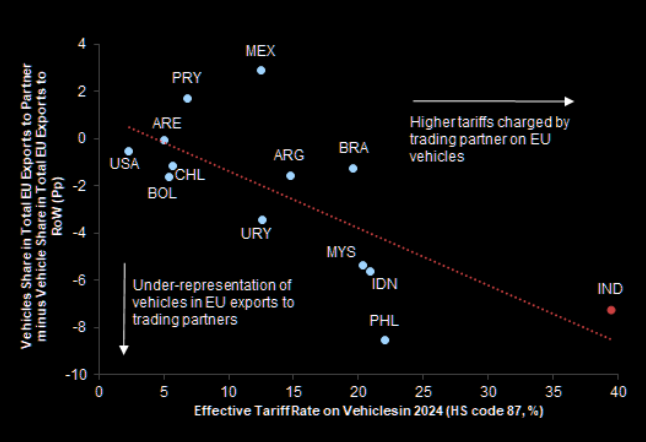

Sectorial winners: Industrials, Autos, Machinery

This is where macro investors lose interest and where equity investors should start paying attention.

India is eliminating or sharply reducing tariffs on 96.6% of EU goods exports. For example, in autos tariffs fall from 110% → 10% (quota-based).

Source: haver

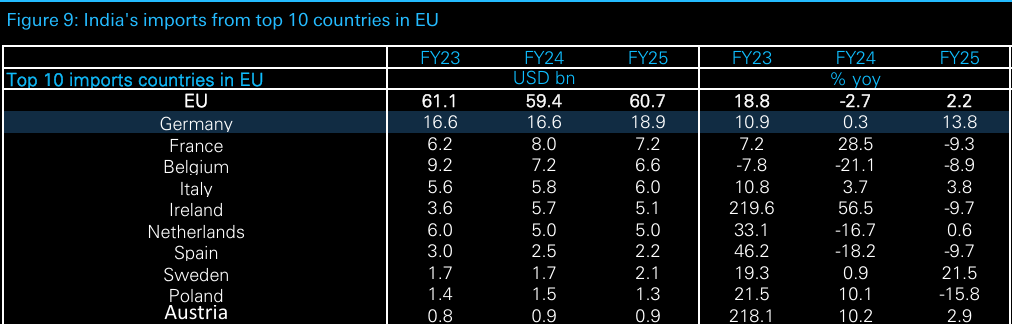

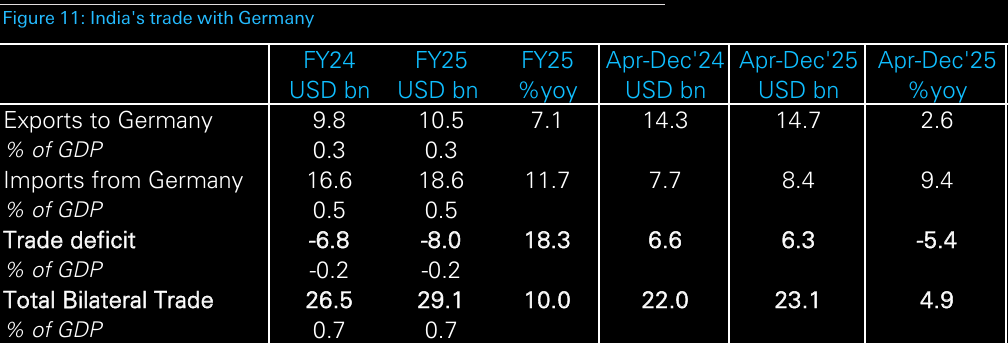

Germany: the quiet beneficiary

Deutsche Bank’s take is even clearer. Here are some stats on Germany:

1. India’s largest EU trade partner.

2. Deep FDI ties.

3. Heavy exposure to machinery, autos, industrials.

4. 78% of German firms plan to increase India investment.

If Europe is going to plug into India’s growth, Germany is the adapter.

Source: Deutsche Bank

Source: Deutsche

Source: DB

Scaling an existing relationship

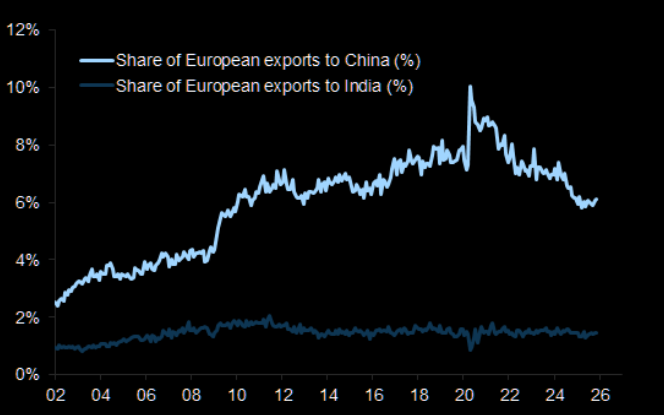

The EU is already India’s largest trading partner, with bilateral trade reaching $136.5bn in India’s fiscal year through March 2025, accounting for >17% of India’s total exports. EU goods exports to India are concentrated in machinery, transport equipment and chemicals, while services integration has deepened materially

GS: "Taking China as a precedent, we see scope for European companies to increase their customer base in India."

Source: Goldman

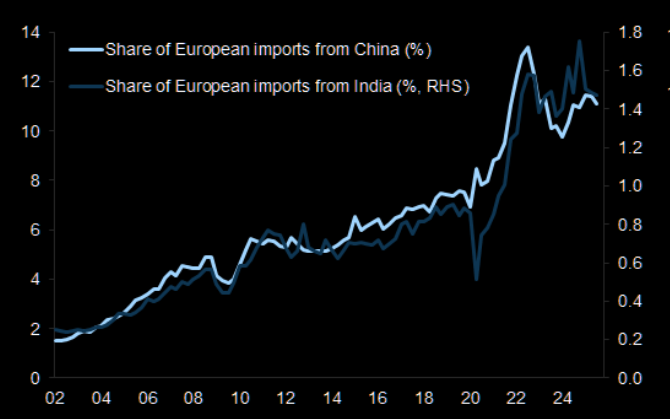

Similar trajectory

Even though the magnitude of Europe's imports from India are much lower currently, they follow a similar trend as that of China.

Source: Haver

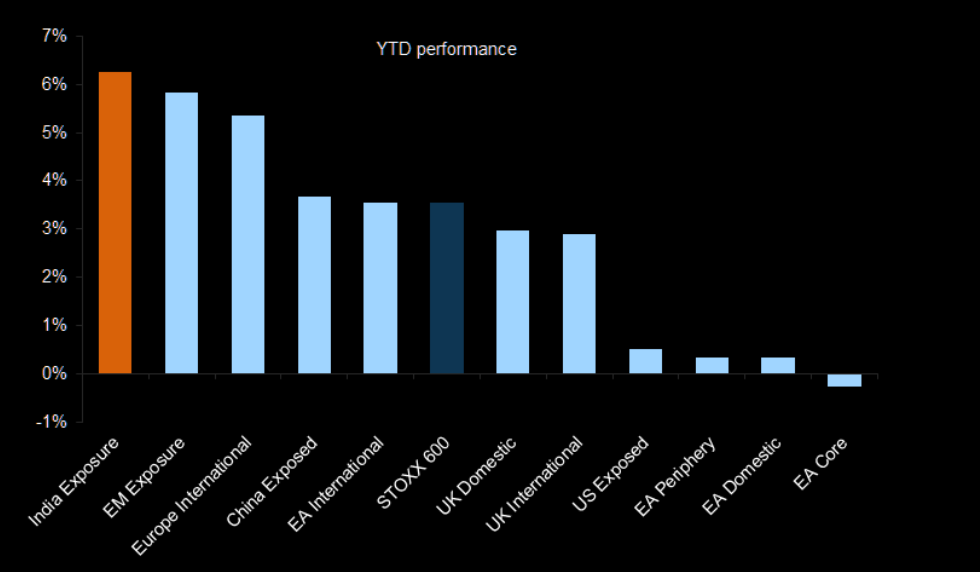

Get India exposure without paying India valuations

Here’s where it gets interesting.

Goldman’s GSSTINDI basket (European companies exposed to India):

1. Best-performing regional exposure YTD (+6.2%).

2. Trades at 15x P/E, in line with history.

3. MSCI India trades at 21x P/E (80th percentile).

4. 10–15% earnings CAGR expected.

Source: Goldman

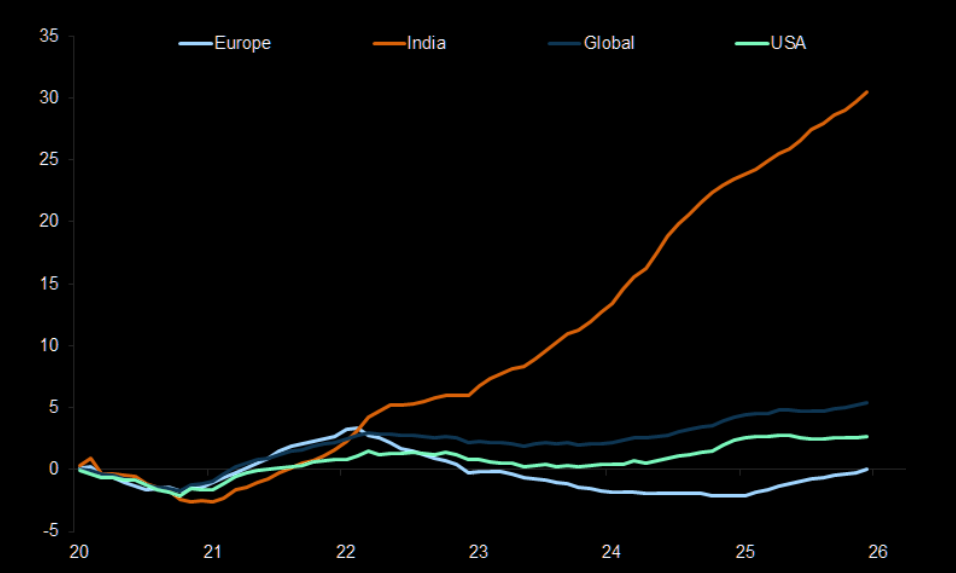

Flows don't lie

Since 2020, Indian equities have attracted significant inflows while other parts of the world have seen outflows.