VIX Is Too Quiet At The Wrong Time

What if?

What if SPX rolls over at range highs again? In prior reversals, VIX moved sharply higher. With sentiment still bullish and limited downside left in VIX (a natural floor sits only slightly lower), using VIX for portfolio protection here makes sense. Waiting for “Christmas VIX lows” risks being too stingy.

Source: LSEG Workspace

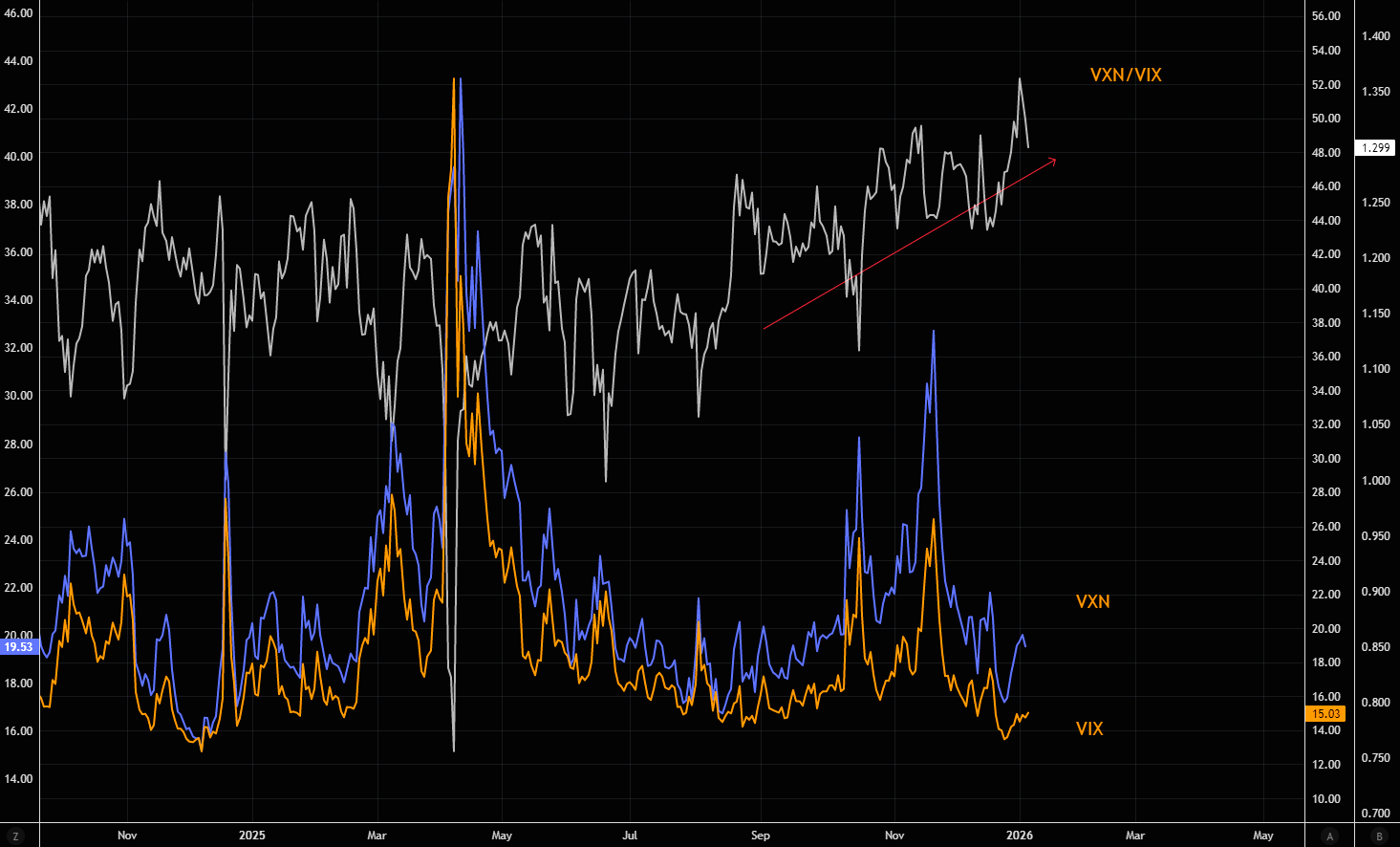

Stressed tech

Relative NASDAQ "stress" has continued to stay well bid. The gap between VXN and VIX continues to stay wide and the VXN/VIX ratio has trended higher since this autumn.

Source: LSEG Workspace

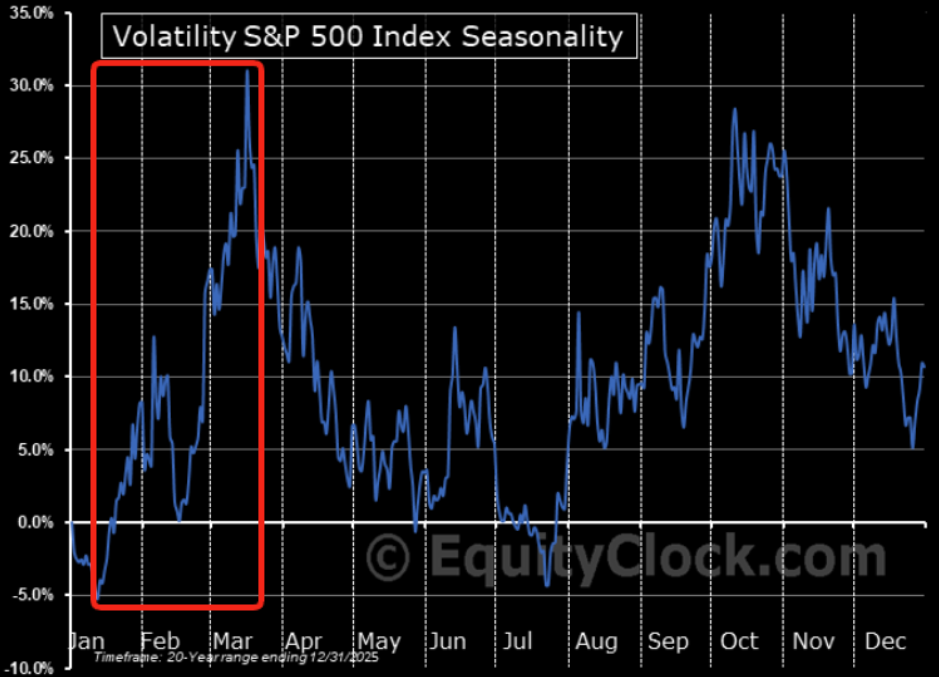

Time for VIX

VIX seasonality is about to kick in right here...

Source: Equity Clock

The skew reset

SPX has done little over the past months, while skew has reset sharply.

Source: LSEG Workspace

Whos' dead?

Skew is dead. Downside protection via the skew lens is starting to look attractive again, now trading in the 3rd percentile.

Source: Nomura

Got VIX?

Asset managers don't... Long VIX is contrarian here.

Source: Nomura

Source: Nomura

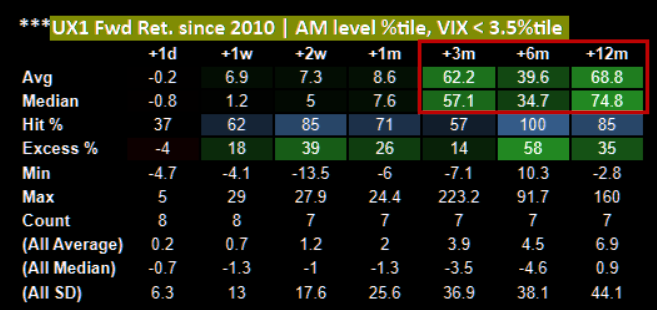

Yikes

A backtest of Asset Manager VIX futures positioning shows that when the 1-month change sits at similarly extreme low percentiles, and is net short, outcomes have historically been ugly. Across the prior seven instances, forward 3-, 6-, and 12-month average and median returns all point to materially higher VIX.

Source: Nomura

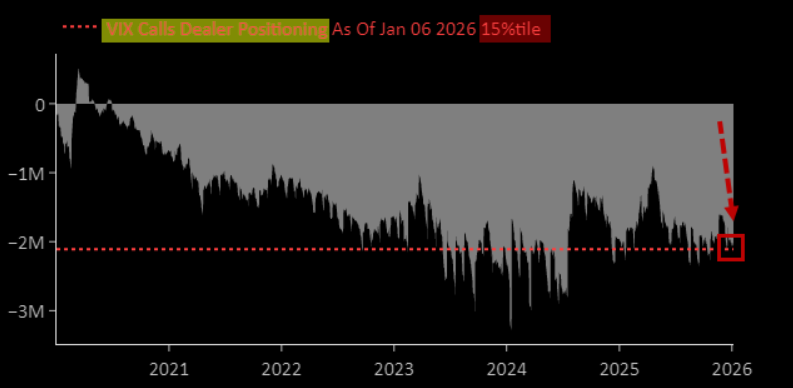

VIX shorty

Dealers running rather big VIX shorts here.

Source: Nomura

VIX call spreads

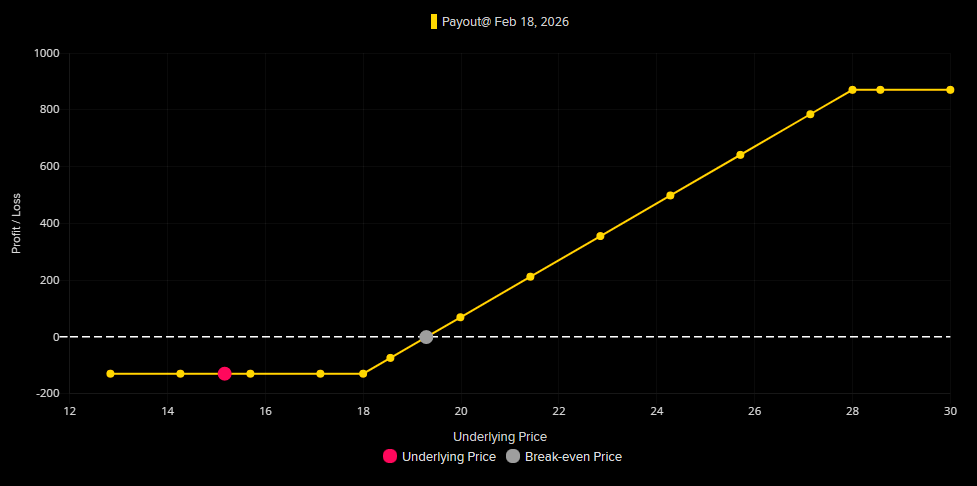

Well bid upside in VIX calls offers relatively attractive VIX call spreads. Chart 2 shows the VIX Feb 18/28 call spread, around 8x.

Source: Nomura

Source: LSEG Workspace

Busy calendar

Consumer Electronics Show (CES) Conference – January 6-9

Non-Farm Payrolls – January 9.

ICR Consumer Conference – January 12-14.

JPM Healthcare Conference – January 12-15.

December CPI, Earnings Kickoff – January 13.

November PPI, Retail Sales – January 14.

FOMC Rate Decision, TSLA earnings – January 28.

META, MSFT, AAPL earnings – estimated January 29-30.

December PPI – January 30.

45% of SPX, 36% of NDX, and 19% of RTY by weight reporting by the end of the month.

New FOMC Chair announcement expected by Feb 1.

(Courtesy Scott Rubner)