Vol Is Calm on the Surface — Tech Stress Isn’t, and Skew Knows It

Mostly tech related

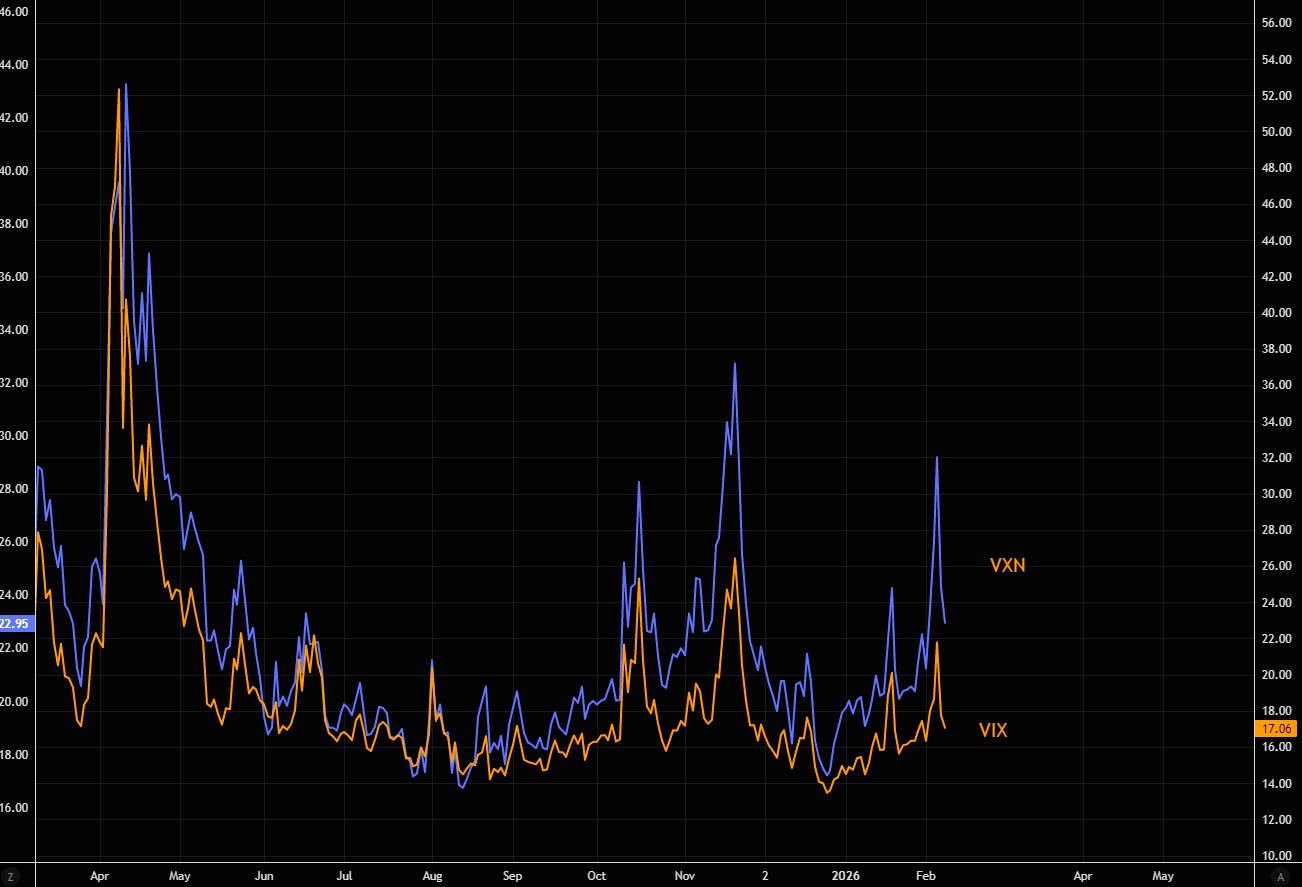

The VXN vs VIX overshoot has been rather "impressive". Chart 2 shows the VXN vs VIX ratio.

Source: LSEG Workspace

Source: LSEG Workspace

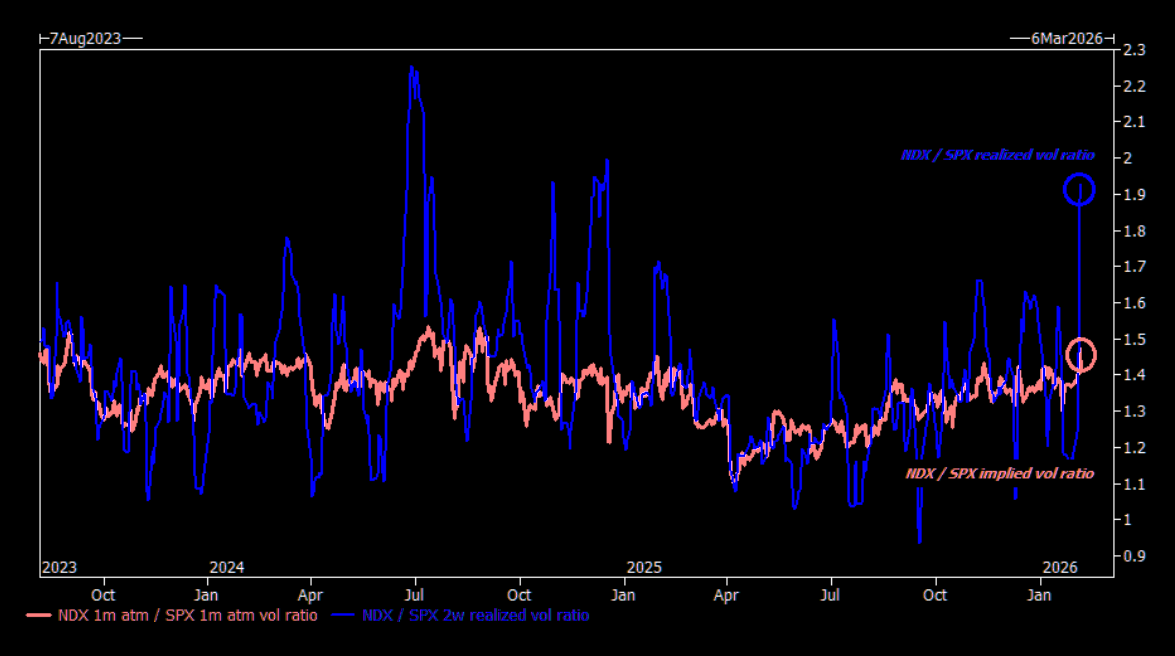

That tech stress

As we pointed out last week, this is mostly a tech thing. NDX vs SPX volatility has exploded to the upside.

Source: GS

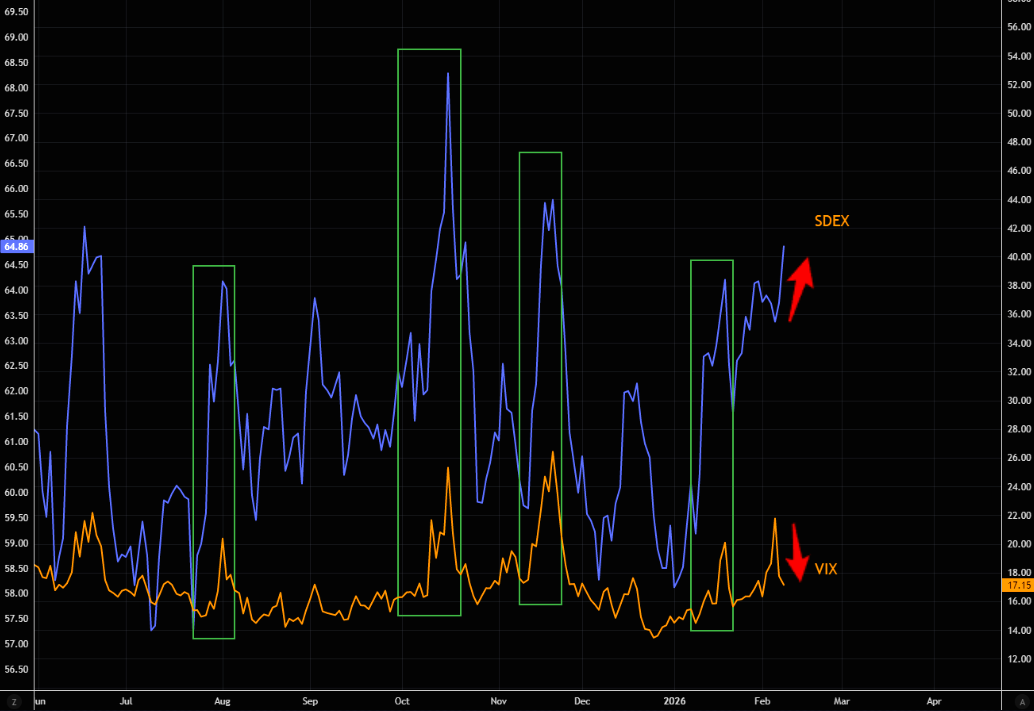

That bid for downside protection

SPX remains stuck inside the range that’s held for months, while skew continues to get aggressively bid. The SDEX index has had an impressive run so far this year and is now printing fresh recent highs. Rising skew is a clear signal of a crowded long, with investors increasingly paying up for downside protection.

Source: LSEG Workspace

Rare

VIX falling (on a Monday as well) and skew very well bid. This is rare.

Source: LSEG Workspace

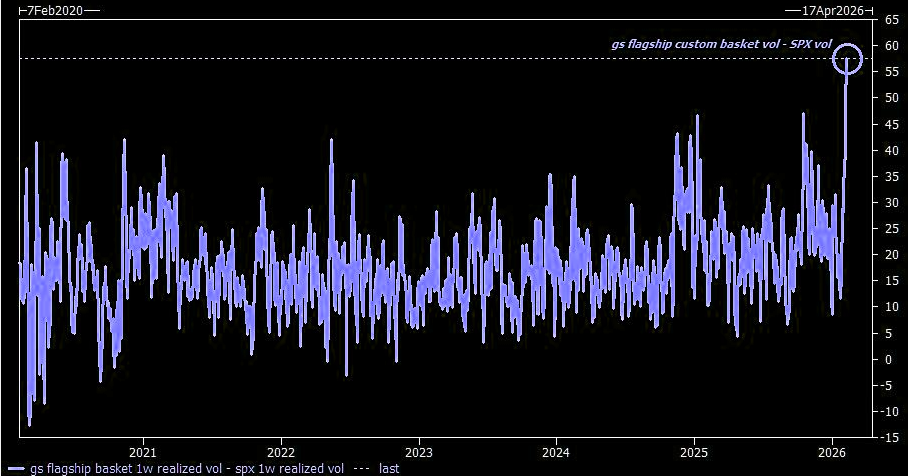

Vol blow-out

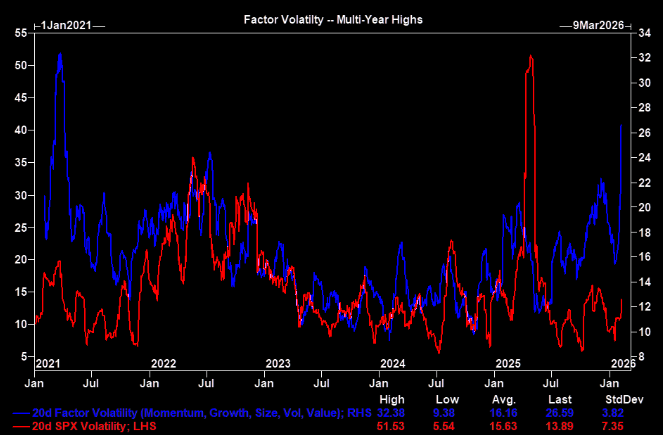

"Sectors getting disrupted, stocks moving 10% to 20% and themes/factors having 3x to 6x standard deviation moves" (Bobby Molavi)

Source: GS

Violent

The change wasn’t price, it was the violence underneath. 20-day factor volatility has exploded to the highest level since 2021, signaling a fast, disorderly unwind of leadership. This is what active de-positioning looks like. Single-stock stress was real. (GS, Coppersmith)

Source: GS

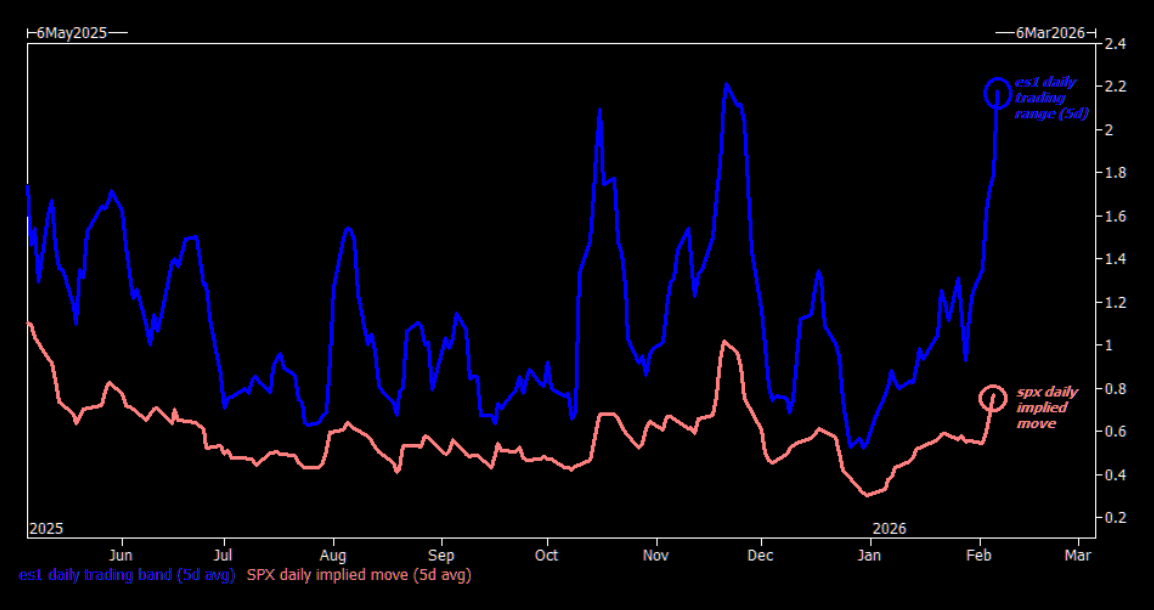

Got gamma?

Gamma is “cheap” given that the SPX implied straddle trades ~80 basis points vs the daily trading band at 220 basis points. (GS)

Source: GS

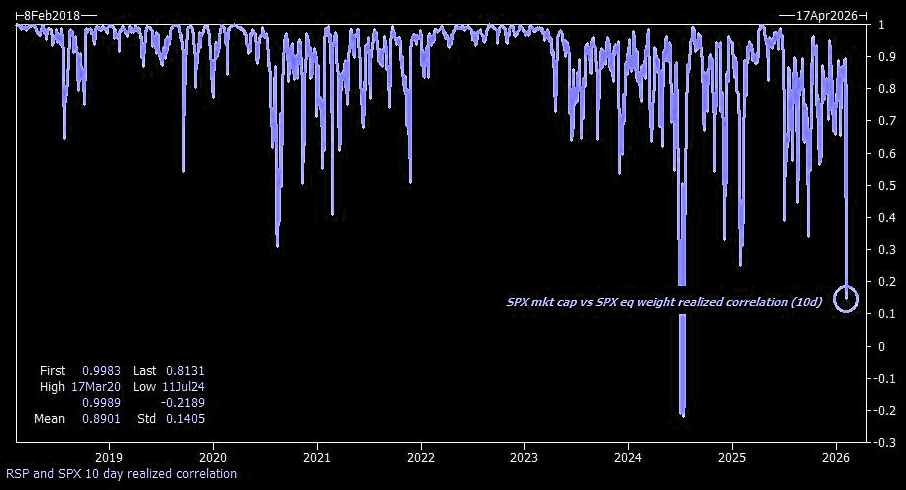

Even possible?

"...the correlation between SPX and RSP collapsed over the last two weeks, at the lows the two had almost 0.0 correlation with each other … recall, these indices have the exact same constituents..."(GS derivs)