Warshed Out — When Parabolas Break, Nothing Else Stays Standing

For the record books

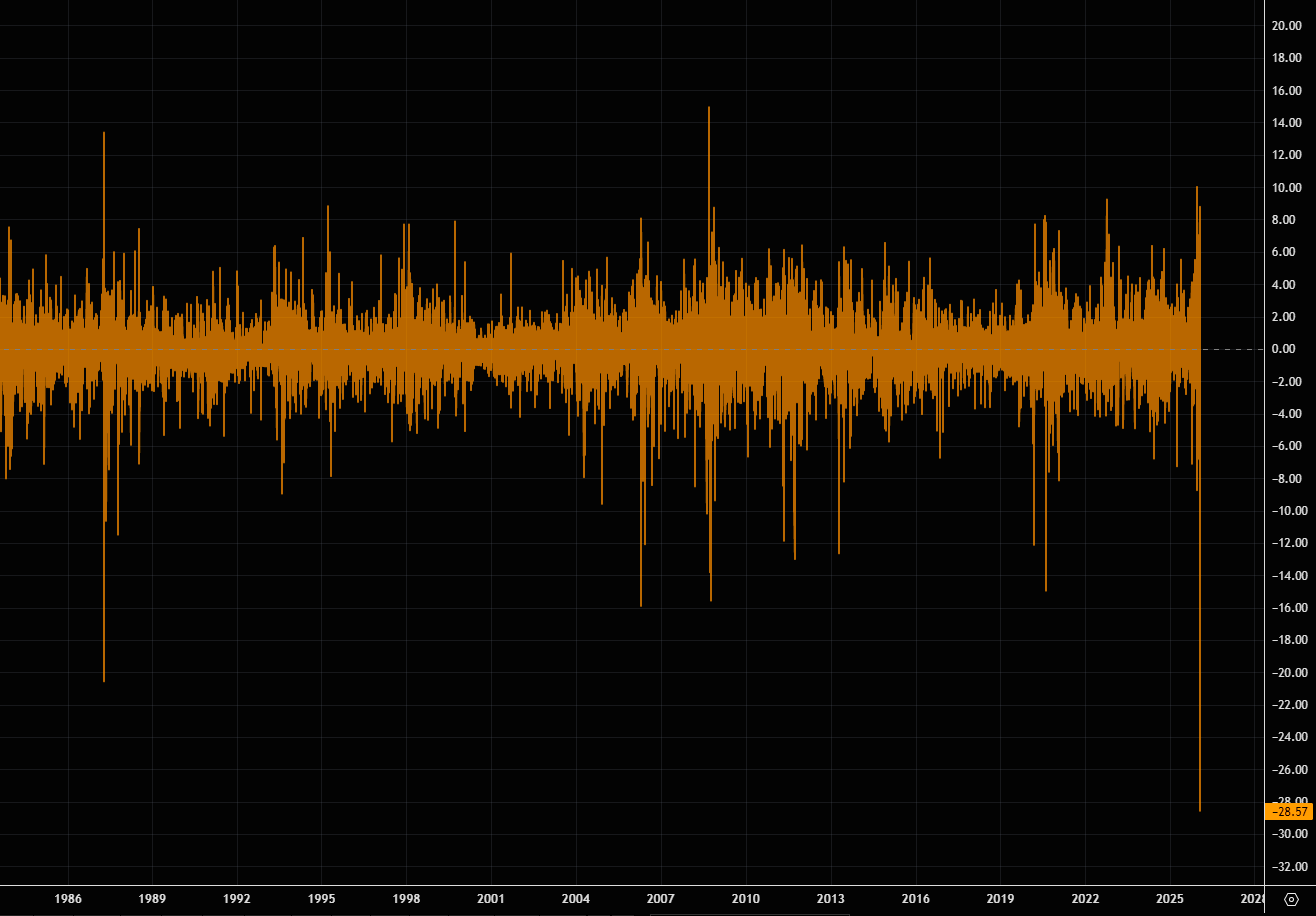

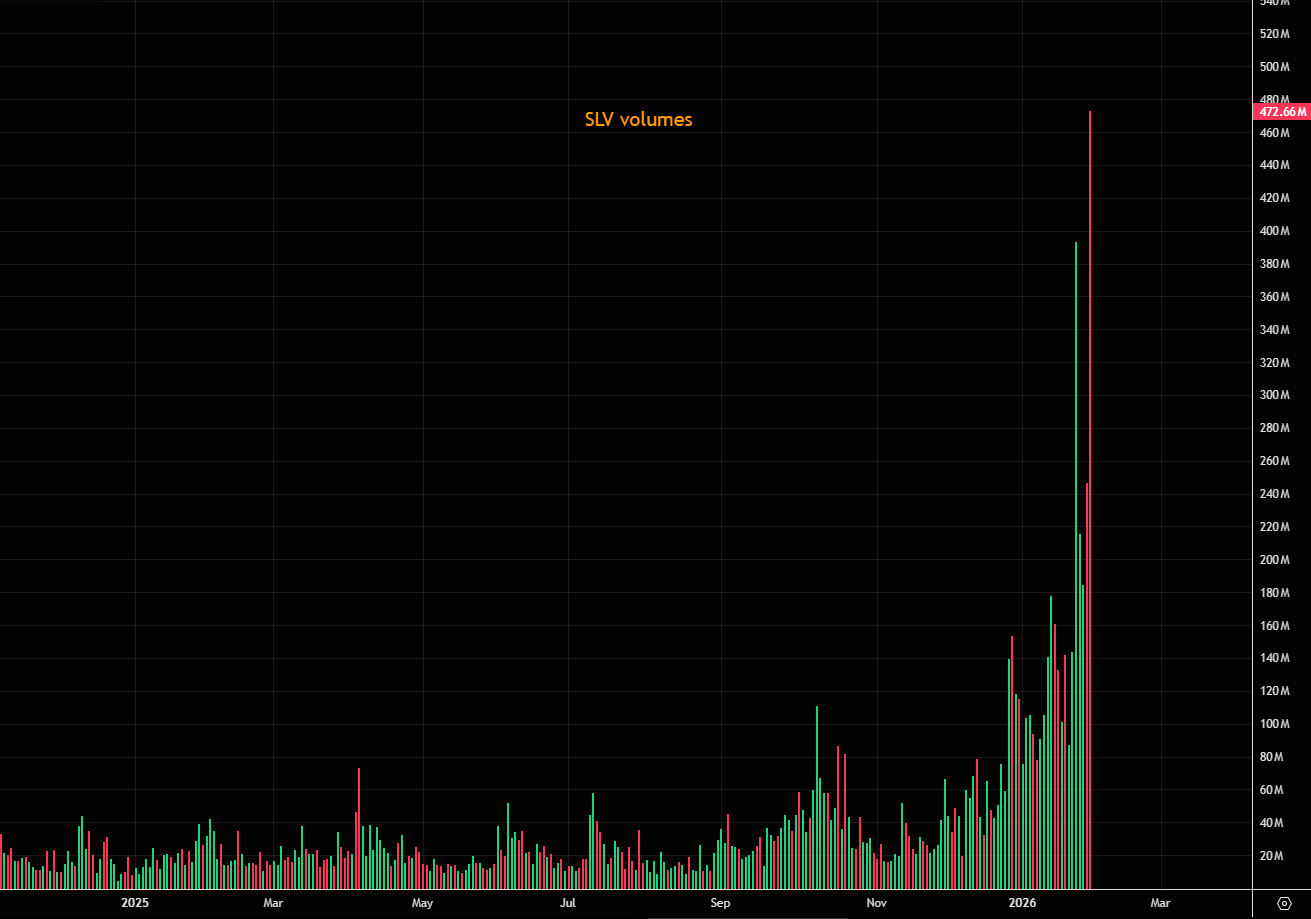

1 day rate of change and the volume bar in silver needs little commenting.

Source: LSEG Workspace

Source: LSEG Workspace

Silver levels

Earlier this week we outlined our bearsh silver logic in our note Silvergeddon. We wrote: "Some argue the move is so fundamentally driven that technicals no longer apply... it’s worth noting that we haven’t seen hard assets this stretched versus the 21-day MA, let alone the 50-day, in a very long time."

Fast forward to today and we have puked below the 21 day, but are still trading above the 50 day, not to mention the 200 day (down below $50).

Source: LSEG Workspace

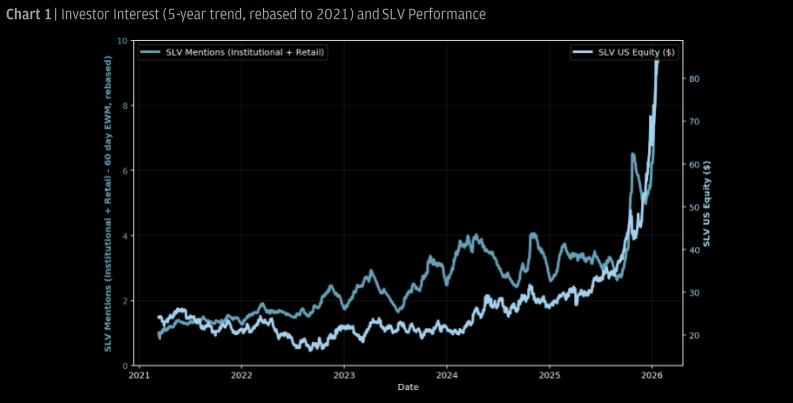

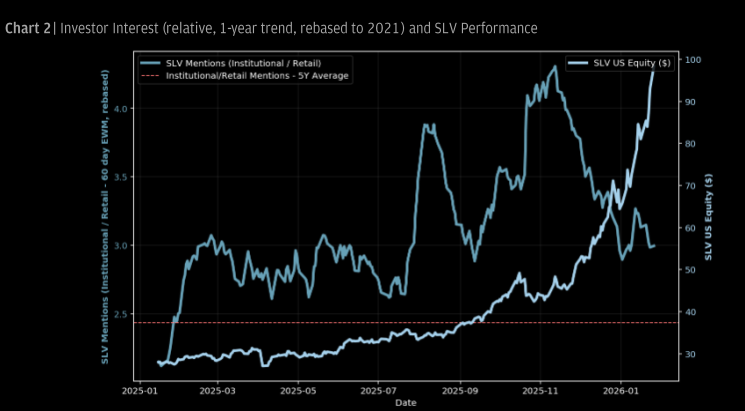

Retail and silver

Investor interest in silver has grown sharply over the past five years. While institutional participation stayed broadly stable through 2025, retail interest accelerated into Q4 as silver exploded to the upside, with ETF volumes and social activity surging. The data and online chatter reinforce that retail flows have become a key driver of recent price action, and an important factor to watch as volatility rises, writes JPM's great data asset team. Our note on silver from earlier today, before the puke here.

Source: JPM

Source: JPM

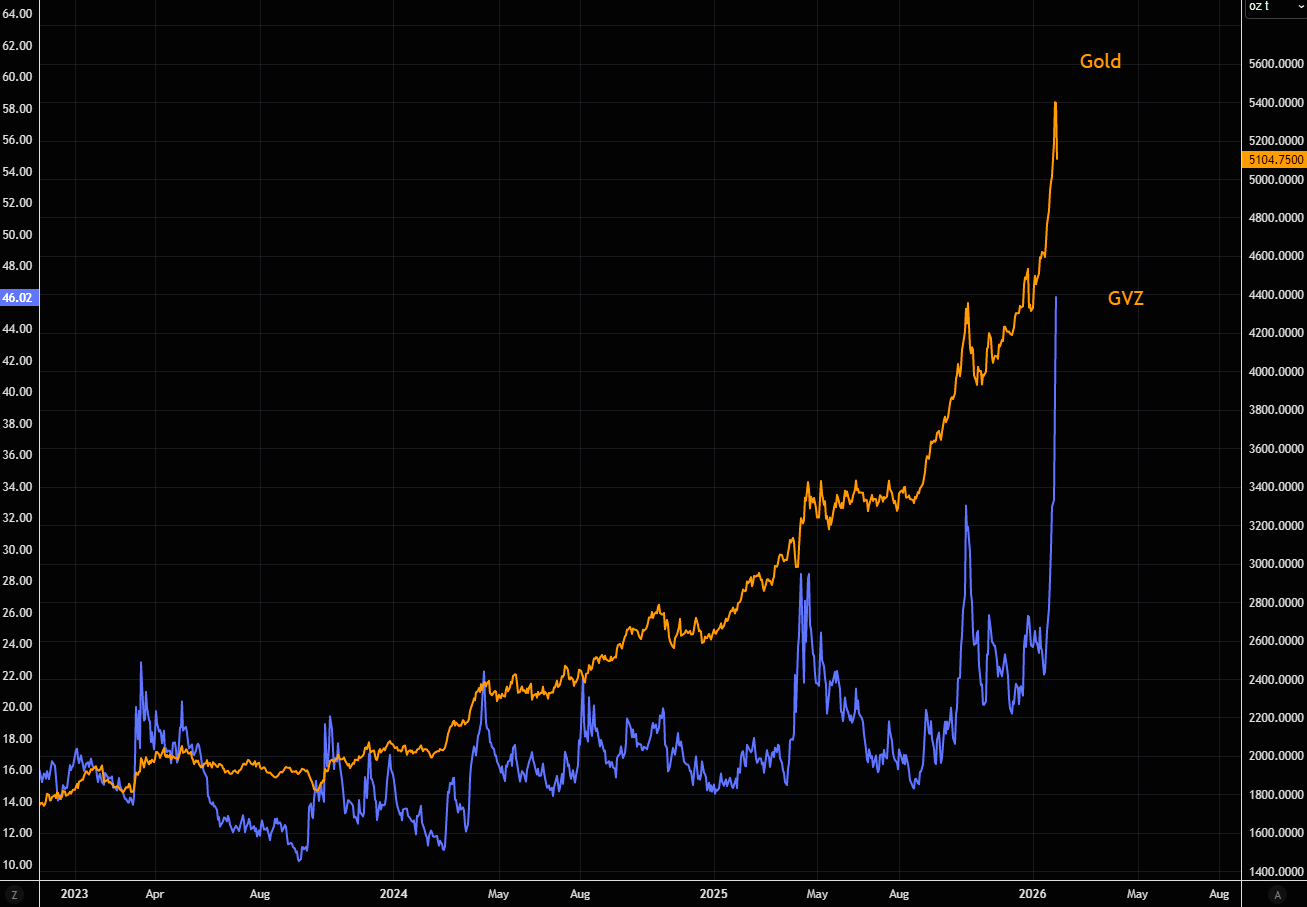

Gold - all about technicals

Gold still above the steep trendline that has been in place since the September break out. Note we touched the 21 day at lows of the day basically. 50 day just below the trend line. 200 day down around $3800.

Source: LSEG Workspace

Remember resonance from physics class?

When a system is driven at just the right frequency, small inputs get amplified into big moves, but once that frequency slips, the amplification collapses fast. Gold has been in that resonance phase, and the recent volatility explosion is the tell: flows and momentum were perfectly aligned, but as that alignment breaks, volatility rises and the same feedback loop starts damping price back toward trend. We didn't think it would break this fast, but here is the full note from earlier today.

Source: LSEG Workspace

Shorts giving up

Short interest in SPY and QQQ has collapsed lately. No shorts, no cash, no protection note here.

Source: JPM

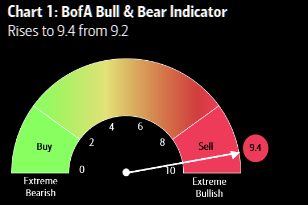

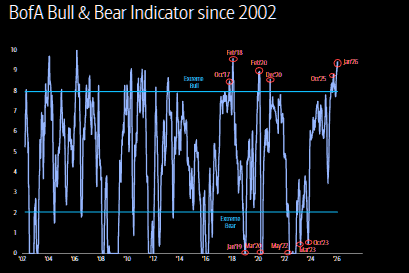

The contrarian sell

BofA's bull/bear indicator moving into even more red, extreme contrarian sell zone. Add to this "89% of MSCI global stock indices trading above both 50- day & 200-day moving averages this week…stocks in “overbought” territory (rule is >88% = “sell signal” for risk assets)."

Source: BofA

Source: BofA

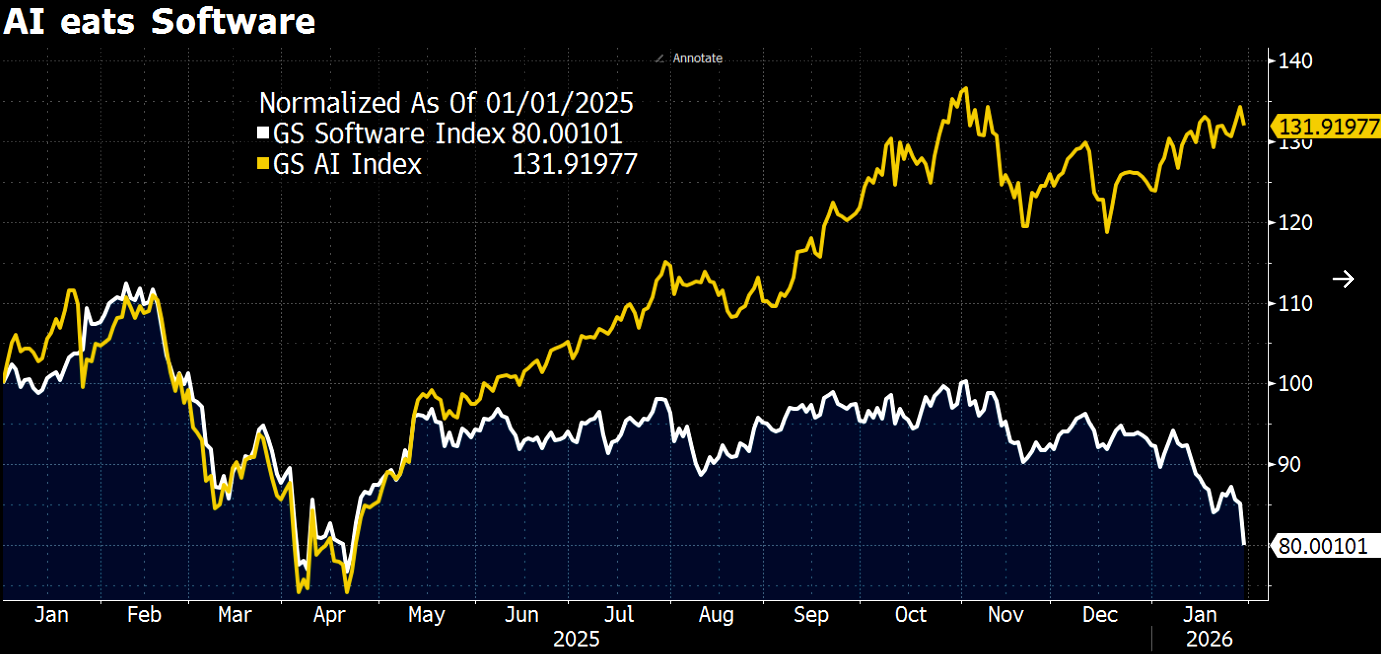

Alligator eating

You cannot spell neither alligator nor eating without A & I. More on this theme here.

Source: Bloomberg

Still see the break down?

DXY back above the huge trend line. Out latest, contrarian, dollar note here.

Source: LSEG Workspace

Policy is not in a “Good Place.”

Powell’s claim echoes last summer’s mistake: he said policy was fine, then cut 75bp. This new “plateau” is just as unrealistic. Either the employment slowdown bleeds into a broader recession (forcing big cuts), or growth re-accelerates and inflation resurges, setting up much tighter policy later. There is no stable middle ground.

Markets Are Pricing The Comfortable Middle,That’s The Problem. Fixed income is leaning into a soft-landing compromise because there’s no immediate data forcing repricing. That’s benchmark-safe, not outcome-right. History says forwards rarely win when tail risks are this wide.

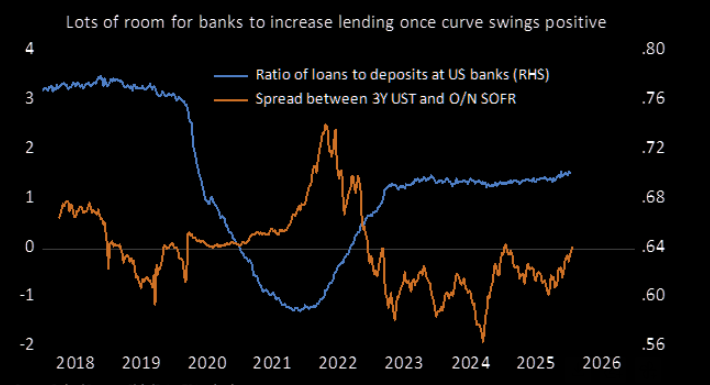

Tail Risks Are Exploding, Not Shrinking. If Powell is wrong on growth, cuts are coming and equities will trigger them. If he’s right, inflation math gets ugly fast: strong real growth, rising forward rates, curve steepening, and excess deposits turning into inflation fuel, without a Fed willing (or able) to slam the brakes. Either way, markets tighten for the Fed. The claim that the inflation–employment tension has eased is wishful thinking. (Steve Blitz, TS Lombard)