What If That Second Wave of Inflation Is Upon Us?

2% target - 3% reality

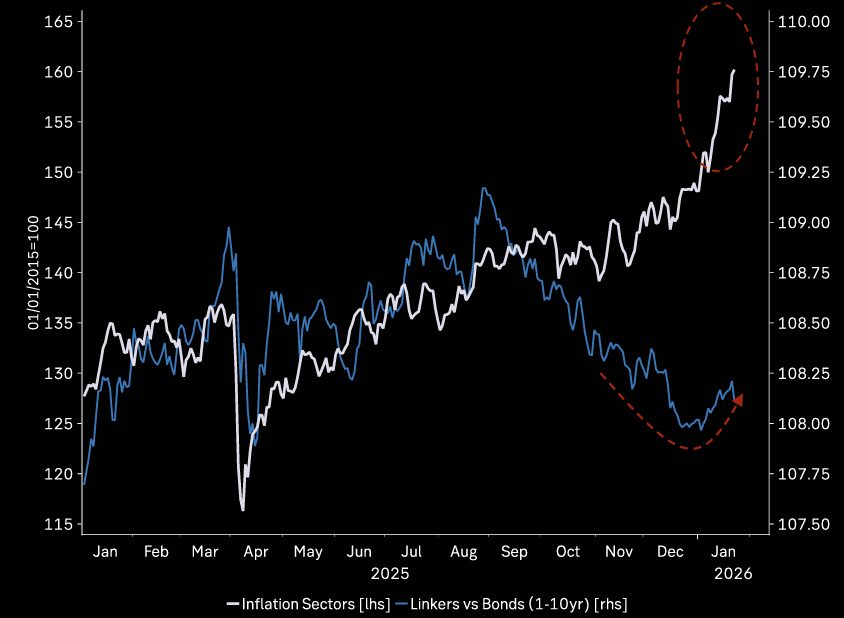

After easing from its peak, U.S. inflation has remained stuck near 3% for more than two years. Recent moves in breakevens, commodities, and growth-sensitive sectors suggest inflation risks may be drifting higher again, even as markets continue to price stability rather than stress.

Is inflation risk creeping back in?

Chart shows Linkers vs. bonds and inflation sectors.

Source: Macrobond

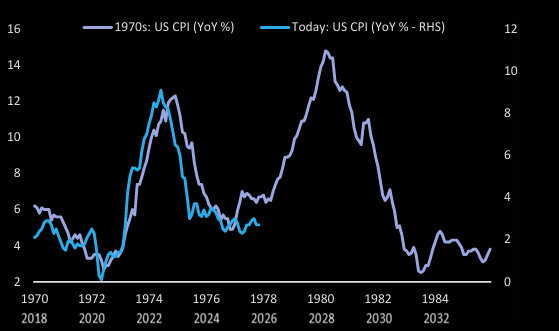

2nd wave

She moves in mysterious ways / waves. Hartnett says 2nd wave of inflation future possibility. This chart for sure is something special...

Source: BofA

Perhaps understandable

Perhaps it is understandable that FOMC members remain worried about inflation.

Source: Macrobond

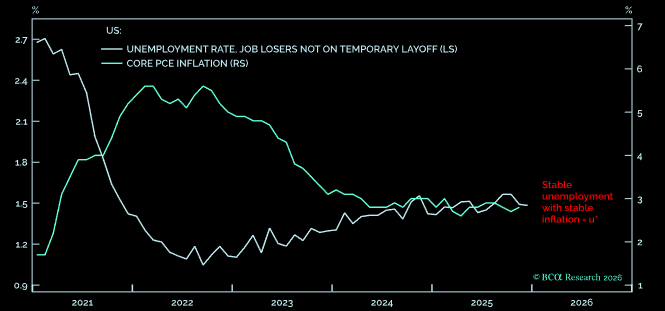

3%

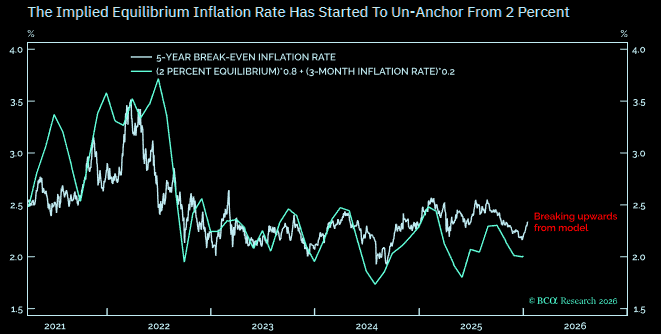

US inflation has hovered around 3% for more than two years, while long-term inflation break-evens remain near 2%. The longer inflation stays stuck at 3%, the greater the risk that expectations reset higher writes Dhaval Joshi. With both inflation and unemployment stable, the economy appears to be operating at a new u-star, and the kicker is that this equilibrium implies inflation closer to 3%, not 2%.

Source: BCA

Source: LSEG Workspace

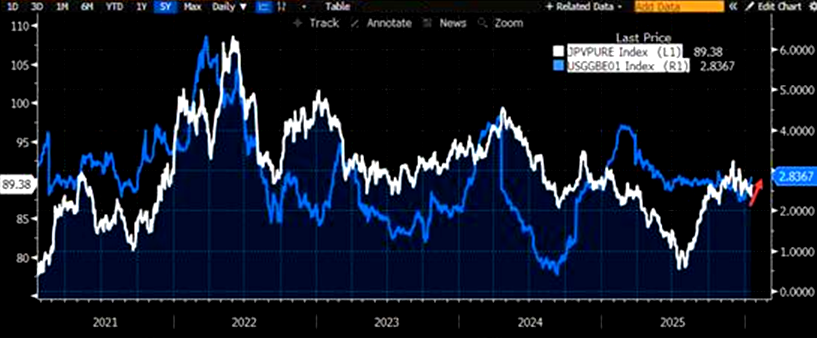

Breakevens

US 10 year breakevens moving higher lately...

Source: LSEG Workspace

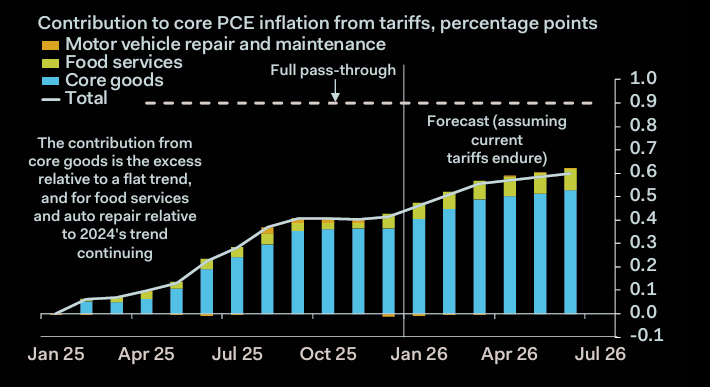

Tariff pass-through

Is there more pass-through from tariffs coming?

Source: Pantheon

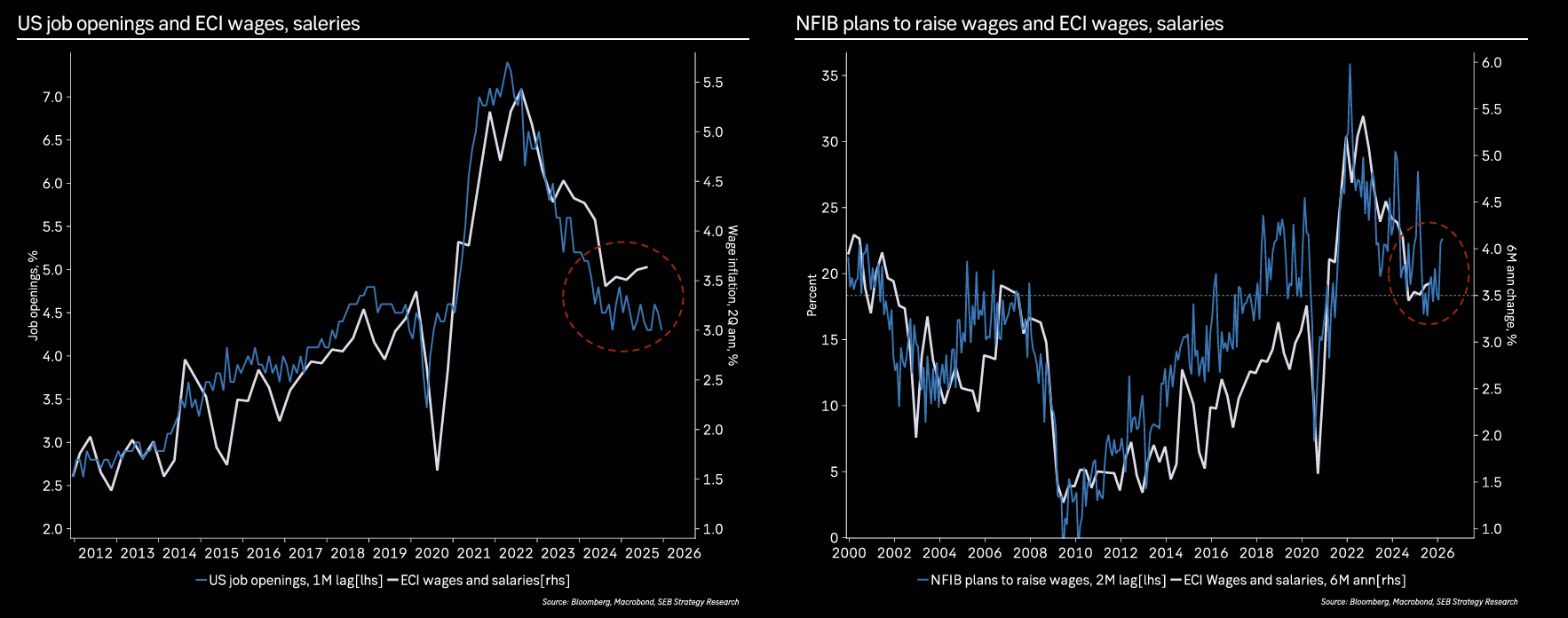

Accelerating economic growth

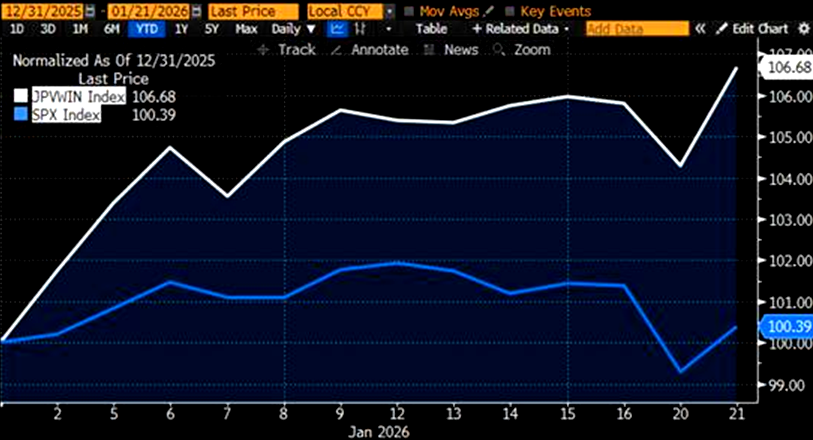

Accelerating economic growth and a strong labor market, combined with policy uncertainty around tariffs, point to a potential rise in inflation. One-year breakeven inflation is up 60 bps YTD and could break out further with upcoming inflationary data.

JPM trading desk: "To capture or hedge against this inflation risk, favor long positions in Value (JPVPURE) or Value Winners (JPVWIN), which have outperformed the SPX by 6% YTD. o Key sector beneficiaries of rising inflation include Homebuilding, Regional Banks and Autos."

Source: JPM

Source: JPM

100%

"I read recently that US CPI has risen by 93% since January of 2000, which struck me. if you’re curious when that should reach an even 100%, circle your calendar for October of next year." (Tony P)

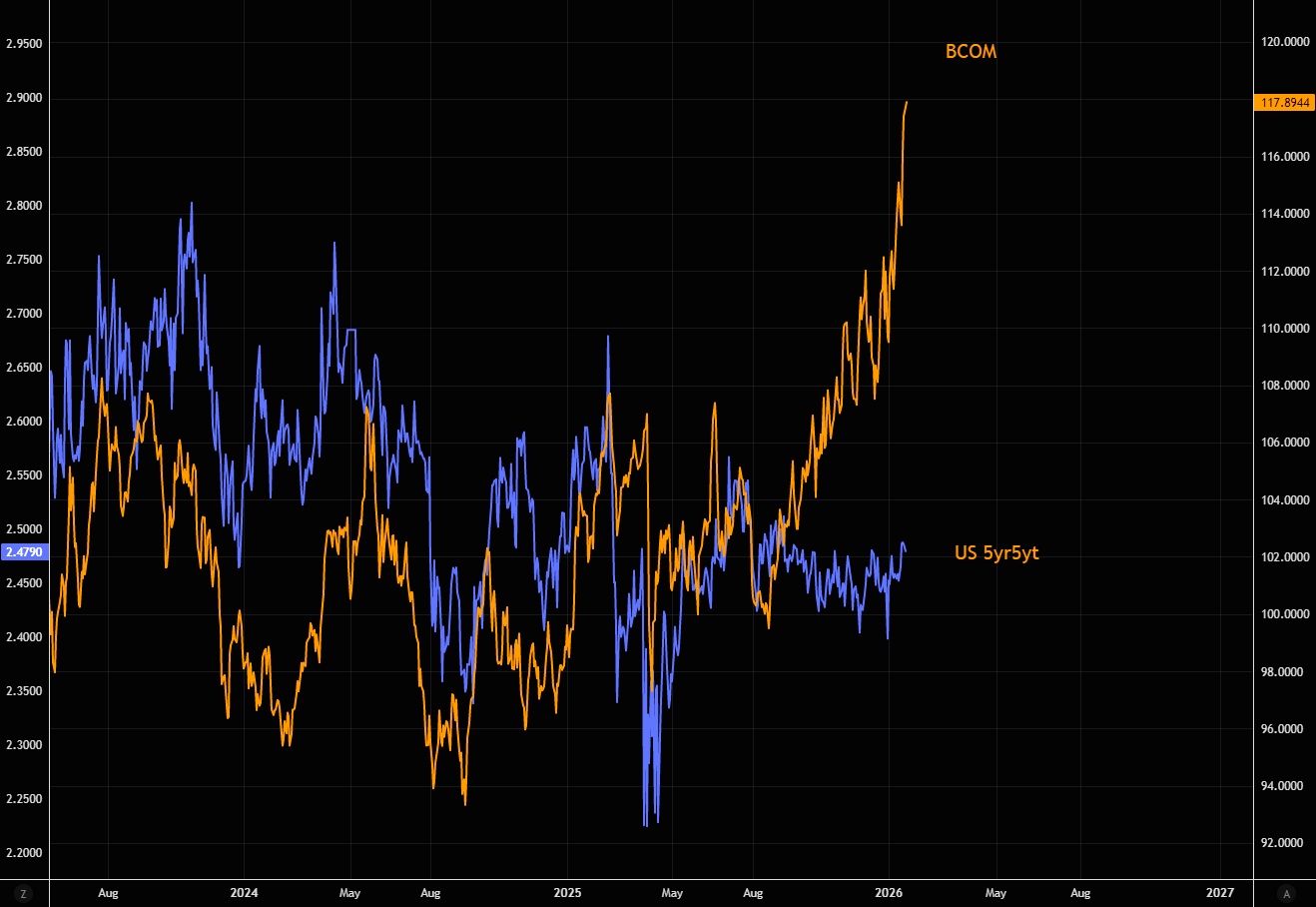

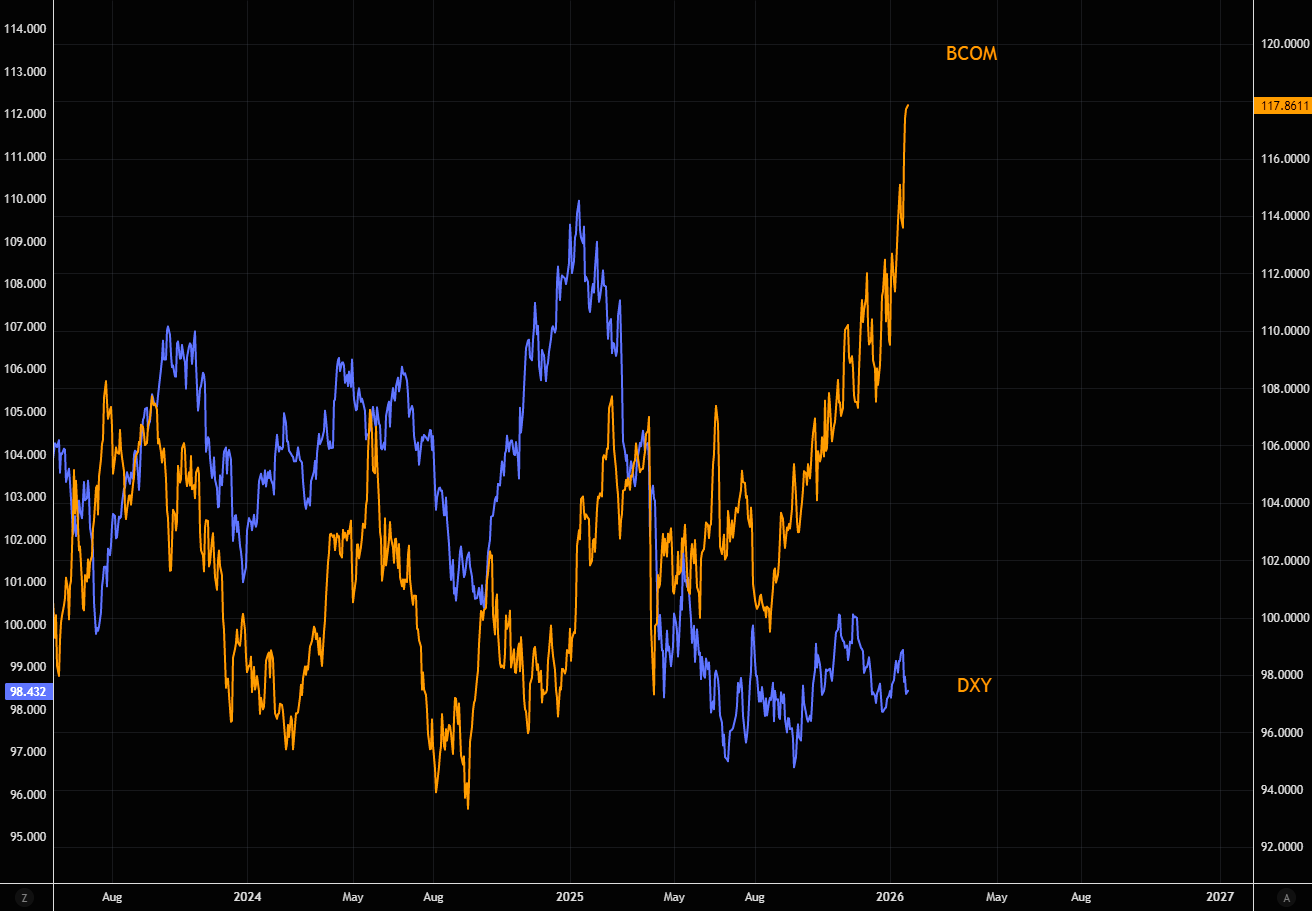

BCOM

The surge in BCOM is starting to raise the question of whether we’re in the early stages of reflation. As Goldman’s Privorotsky noted a few weeks ago, moves like this tend to signal either a broad dollar devaluation or a rapid re-acceleration in global growth. Chart 1 shows BCOM vs. US 5y5y inflation expectations, while Chart 2 compares BCOM to the DXY. The dollar has gone essentially nowhere since April, even as commodities have surged.

Source: LSEG Workspace

Source: LSEG Workspace

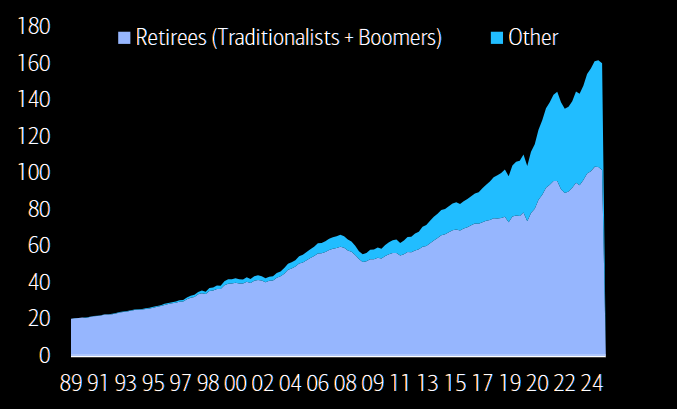

Retirees need inflation protection + income

Chart shows household net worth ($tn; 1989-2Q25).

Source: BofA Quant

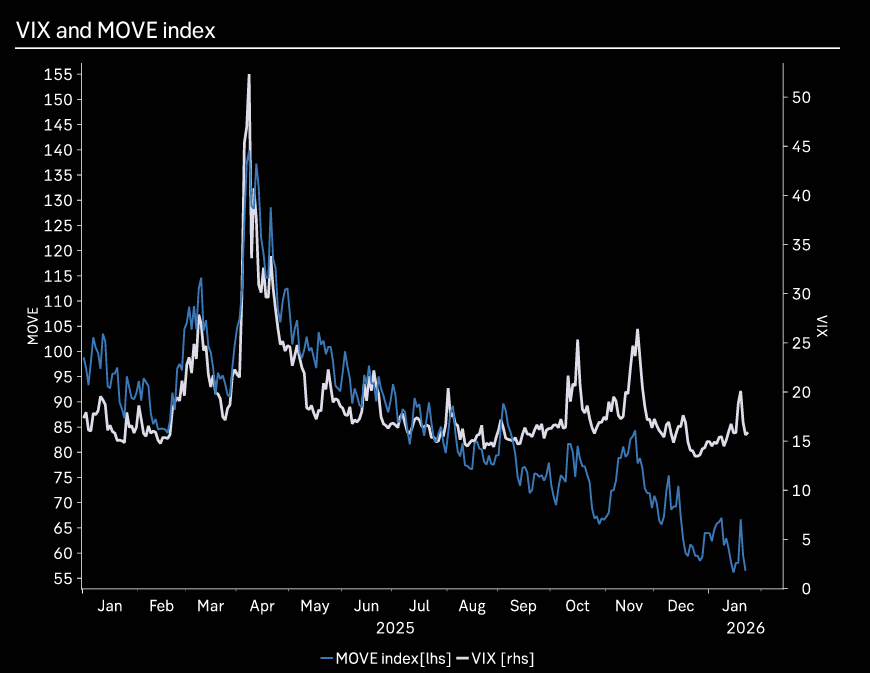

If bond markets have a problem...

…why is it not showing up in implied volatility indices like MOVE?