The Wrap: Rotations Heat Up - and Volatility Sleeps… For Now

Well ahead

Russell well ahead of NDX over the past 6 months.

Source: LSEG Workspace

Small cap tech as well

Small cap tech beating NDX by a huge margin over the past 10 days.

Source: LSEG Workspace

That's new

Trannies leaving tech behind...Chart 2 shows the two since 2023 in %.

Source: LSEG Workspace

Source: LSEG Workspace

That NVDA gap

Can we even do this without NVDA? More "disturbing" charts here.

Source: LSEG Workspace

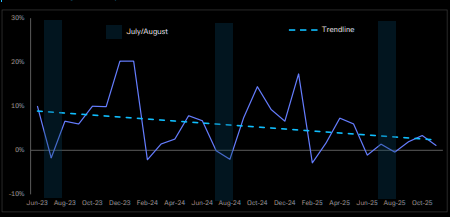

Let the trend be your friend

"Monthly growth in spending on OpenAI subscriptions has slowed down in major European markets."

Source: DB

What's up bros?

MEME and NDX moved in perfect tandem during the sell off, but MEME momos haven't been able to keep up with the bounce in stocks. Crap trying to tell us something about the psychology of the market?

Source: LSEG Workspace

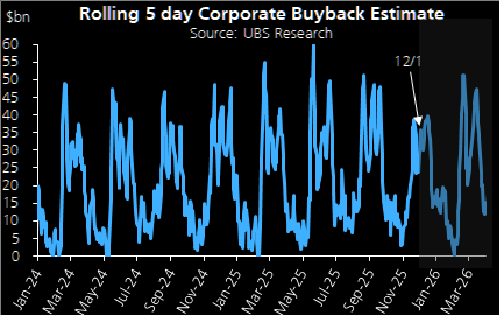

The Bid

The corporate buyback is strong, but make sure to not forget the "roll over" coming up.

Source: UBS

Unstoppable?

Japan 30 year putting in another new big up candle, trading at 3.43% as of writing. We took out a huge consolidation when the long end broke above the 3.3% level. Still a lot of vacuum to the upside, should we aim for the upper part of the trend channel. Full note here.

Source: LSEG Workspace

XLV

On November 26 (here) we outlined our logic on healthcare and the fact the entire sector had gotten ahead of itself "XLV daily RSI at most overbought levels since 2018...". Fast forward to today and hot XLV has come down substantially since recent highs. The steep trend line is still lower, coming in around $152 (21 day). 50 day all the way down at $147.

Source: LSEG Workspace

Not yet...

…but soon. VIX seasonality becomes very strong in a few weeks. Latest note on volatility and hedging here.