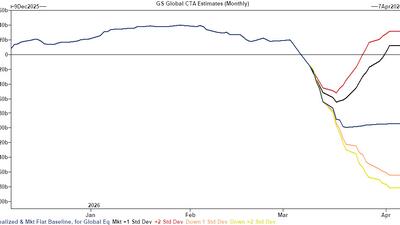

"Sell estimates over the next week are some of the largest we have seen" - Goldman

Trump refuses to say if new Ayatollah has a target on his back when pressed by reporter...

We can see clearly that AI is shaping our future whether we like it or not...

China's allowing the two vessels to depart... during a war in which they have called for restraint would be extremely notable.

Luxury timepieces are one of the most effective mediums to move illicit funds around the globe and a tool to integrate those ill-gotten gains into the financial system...

"For too long, the runway has been both an enabler and a tether..."

"Let the sh*t hit the fan ... let dog eat dog."

Trump has claimed of the national team "they will most likely be killed" upon return.

The subpoena indicates a broader scope of the investigation into irregularities in the 2020 election...

"While the schedule is tight, security is also a top concern..."

The economic and political impact of this technological revolution will constitute one of the greatest challenges to our Republic on the 250th anniversary of our independence...

Yesterday, I listened for several hours to three United States presidents who do not know Jesse Jackson...

Rural electric cooperatives may face disruption from cheaper on-site renewables...

"Are we the baddies?"

Chicago’s transit chaos shows the cost of a grievance-driven politics: when enforcement is always racist, everyone else just gets less safe...

DOWN WITH AMERIC-AAAAAAAHHHH

This has resulted in “missed flights and massive delays during peak travel"...